Cosmos

Cosmos Delegators

Cosmos Hub

On-Chain Analysis

Restake Atom

Stakers

ATOM Staking Report: Cosmos On-chain Data Analysis 2024, INTERCHAIN GROWTH & INNOVATIONS

Get the latest insights from the Cosmos Staking Annual Report for 2024, featuring staking and delegator metrics, rewards, and more from the ATOM ecosystem—prepared by Everstake validator.

JAN 16, 2025

Table of Contents

Key Findings and Takeaways

ATOM Stake and Delegators Stabilized by Late 2024

Retail Stakers Gain Dominance Over Whales

Redelegating Addresses Grew by 300%

The Volume of Restaked ATOM Rewards Hit the Year’s Peak in November

APR in Cosmos Hub Peaked in December

Interchain Security 2.0

New Leadership

The Launch of Hydro as a Stepping Stone to Broader ATOM Adoption

Most-Voted Proposals in 2024

IBC Reached New Heights in Transaction Volume

ATOM Prospects for 2025

Share with your network

Key Findings and Takeaways

-

The number of Cosmos Hub delegators surged by 26% YOY.

-

The dominant position of whale stakers, who had over 100k ATOM in stake, dropped below 50% of the total stake, while the share of retail stakers grew by 5%.

-

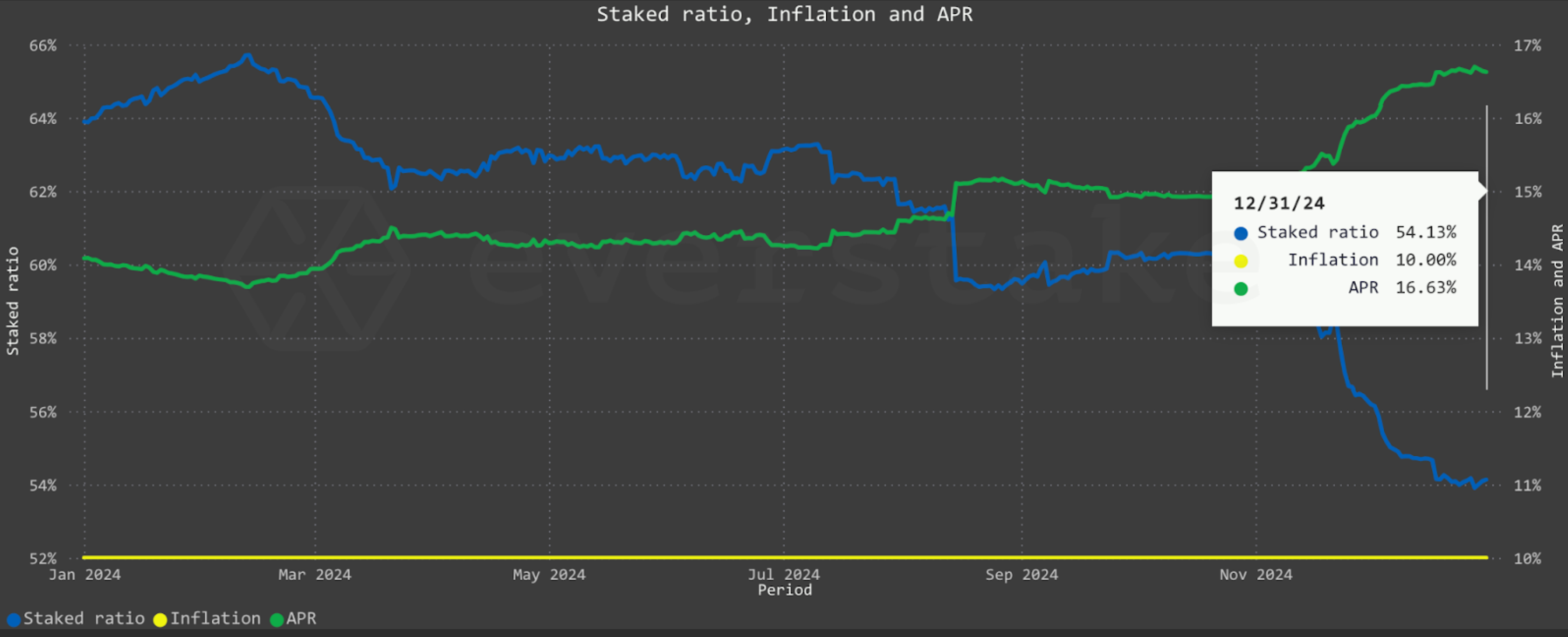

In December 2024, the staking APR reached a yearly record of 16.69% per annum, reflecting a staked ratio of 54.1%, which stabilized during the final days of the year.

-

In November 2024, rewards restaking reached a new high, climbing to a 416k ATOM.

-

Governance consolidation strengthened as only 10% of proposals were rejected, the majority of which were successfully revised and approved upon resubmission.

-

Interchain Security 2.0 (Partial Set Security) has officially launched, marking a milestone with the onboarding of three new consumer chains secured with staked ATOM.

-

The Hydro ATOM liquidity exports platform is making waves with its pilot rounds. The first round kicked off with a distribution of 200,000 ATOM among participants and concluded successfully, delivering approximately 10% APR for ATOM stakers.

-

Interchain Inc. will spearhead the Cosmos Hub roadmap, anticipated in early 2025. It aims to drive active development around the Cosmos Hub, solidifying its role as a true hub and a vital resource for the entire Cosmos ecosystem.

-

The Interblockchain Communication Protocol (IBC) is poised for significant growth in 2025 with the release of IBC V2, known as Eurica. This upgrade simplifies IBC implementation on non-Cosmos virtual machines, beginning with Ethereum, paving the way for broader adoption.

In 2024, Cosmos Hub demonstrated commendable resilience, maintaining consistent progress amid the continuing bear market. Despite dips and fluctuations, the Hub kept pushing forward to set the stage for a strong performance in the bull cycle expected in 2025.

The year concluded on a high note with the official announcement of the Skip team as the leading force behind the Cosmos Hub. They have taken charge of its development, growth, and community engagement.

Additionally, seven successful blockchain software upgrades were completed throughout the year, including enhancements to the CometBFT consensus mechanism, updates to the Cosmos SDK, implementation of a minimum validator commission rate of 5%, major updates to Interchain Security, and more.

The successful delivery of Interchain Security 2.0, the Forge launchpad for Cosmos chains, and the Hydro liquidity exports platform have become the foundation for optimistic expectations in the broader Cosmos community.

ATOM Stake and Delegators Stabilized by Late 2024

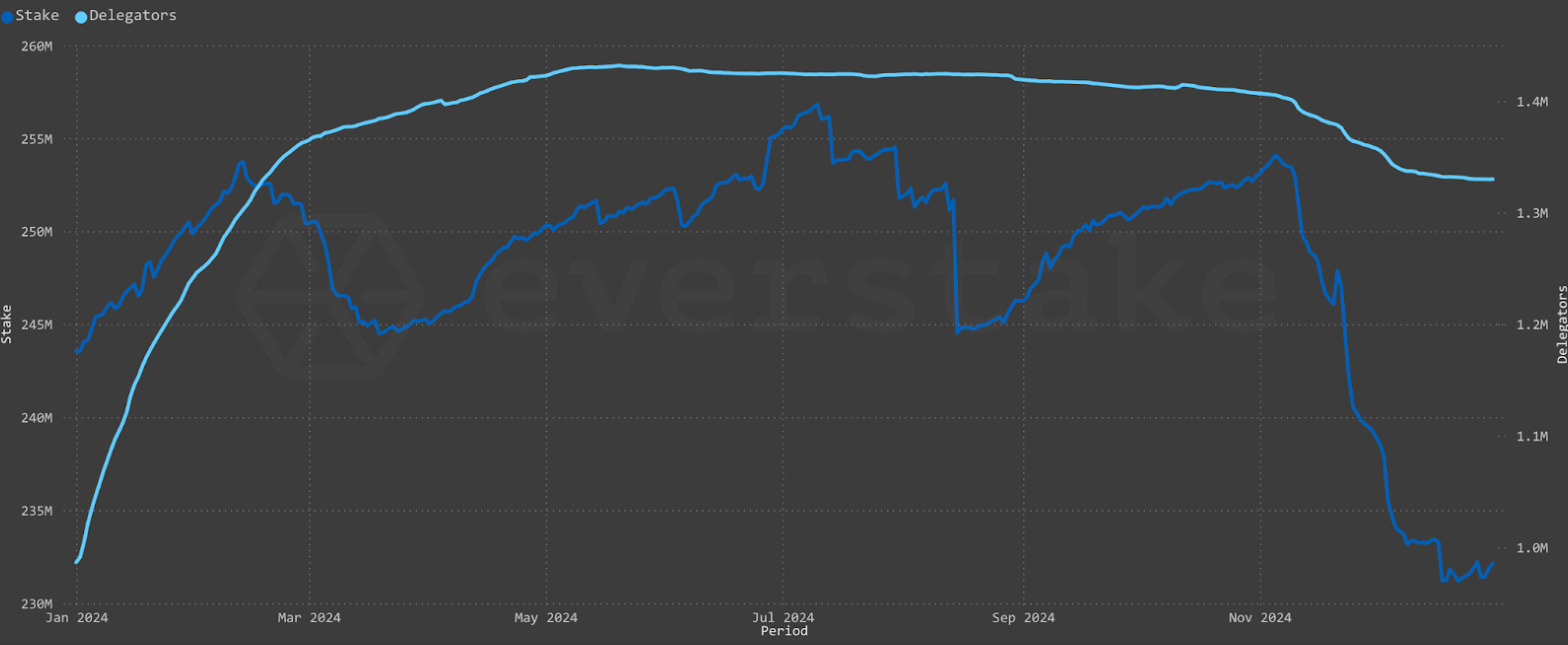

The staking scene in Cosmos experienced notable volatility, with a 5% YOY change marked by four significant dips and three comparable recoveries.

The staked ratio fluctuated significantly throughout the year.

-

The peak was at 65.71%, and the year’s lowest was at 54.1%

-

The year ended with 232.16M ATOM of total stake.

-

ATOM's market capitalization ranged between $1.43 billion and $5.5 billion. By year-end, it settled at $2.43 billion, which may suggest a potential for future recovery.

Despite the sharpest stake and delegators decrease in Q4, signs of recovery emerged by the end of 2024. This may signify growing optimism within the community that can be further reinforced by the ICF's December 2024 acquisition of Skip, now rebranded as Interchain Inc., which is set to take Cosmos Hub development and community engagement into the next phase.

-

The Cosmos Hub experienced a record-breaking surge in delegators during H1 2024, onboarding an impressive 500,000 new participants—a 60% increase compared to 2023.

-

This growth was followed by a serious correction in H2 2024, with a reduction of 90,000 delegators, most notably in November.

This shift, along with big unstakes, aligned with bullish market trends, sparked by Bitcoin surpassing the $100K milestone after a prolonged bear market and subsequent concerns about the rally's sustainability. Yet, by the end of the year, the outflow of stake and delegators significantly slowed, resulting in a total of 1.3 million stakers—accounting for a 26% year-over-year increase.

Retail Stakers Gain Dominance Over Whales

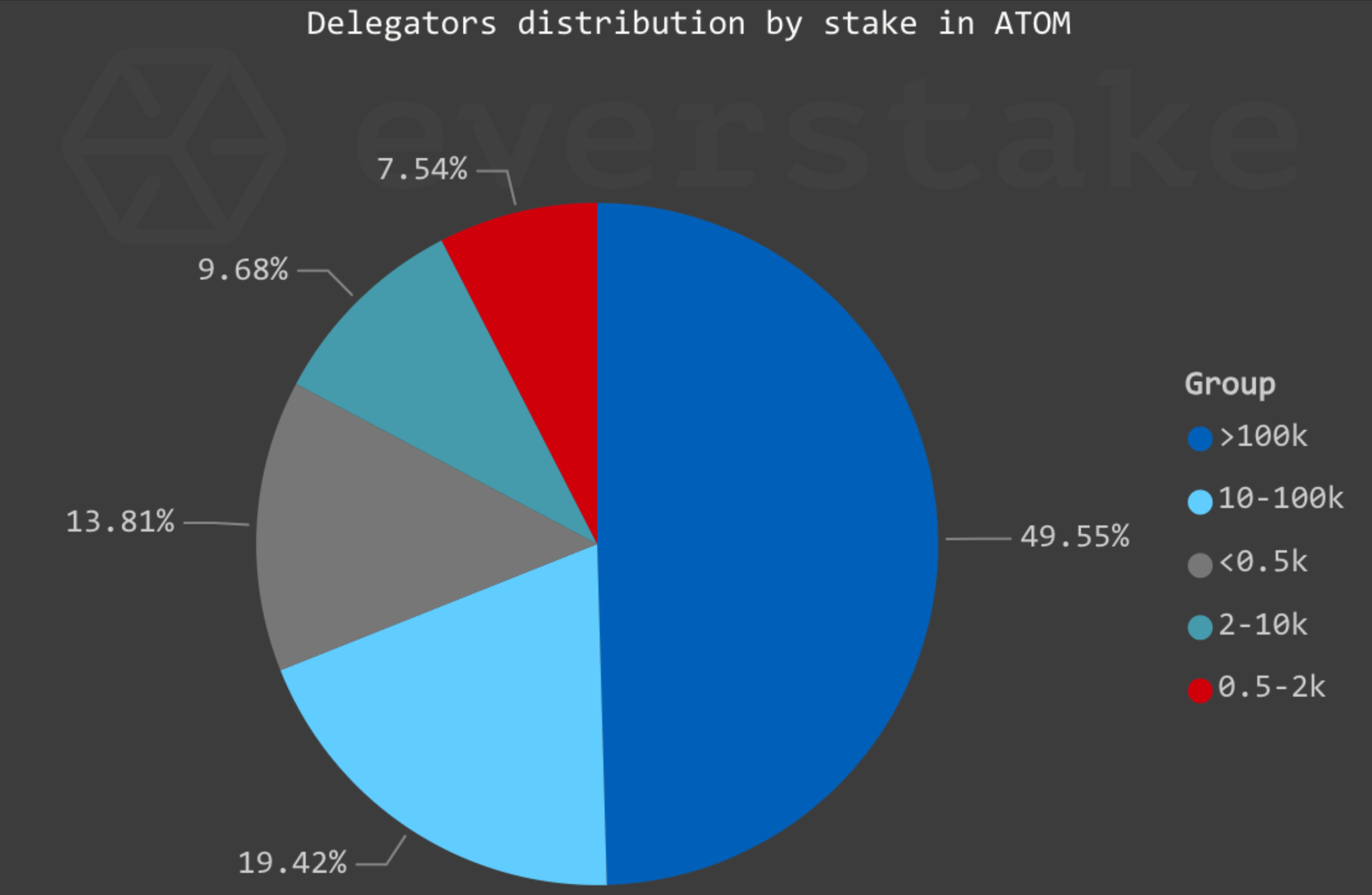

The trend toward decentralizing ATOM staking, which began in the first half of 2024, continued steadily through the end of the year.

-

For the first time, retail stakers holding 0.1-100k ATOM surpassed major delegators with over 100k ATOM.

-

The whales’ share dropped by 4.3%, decreasing to 49.55% with a total stake of 119M ATOM.

-

This decline corresponds to a reduction of five whale delegators in this group, bringing their total number to 187.

-

Among smaller stakers, the group holding 10-100k ATOM experienced a modest 1.02% rise

-

The segment staking up to 500 ATOM showed the most significant growth, increasing by 2.87% year-over-year.

The small retail segment in the Cosmos Hub seems to have started a more prominent role, which signifies an improvement in decentralization.

Redelegating Addresses Grew by 300%

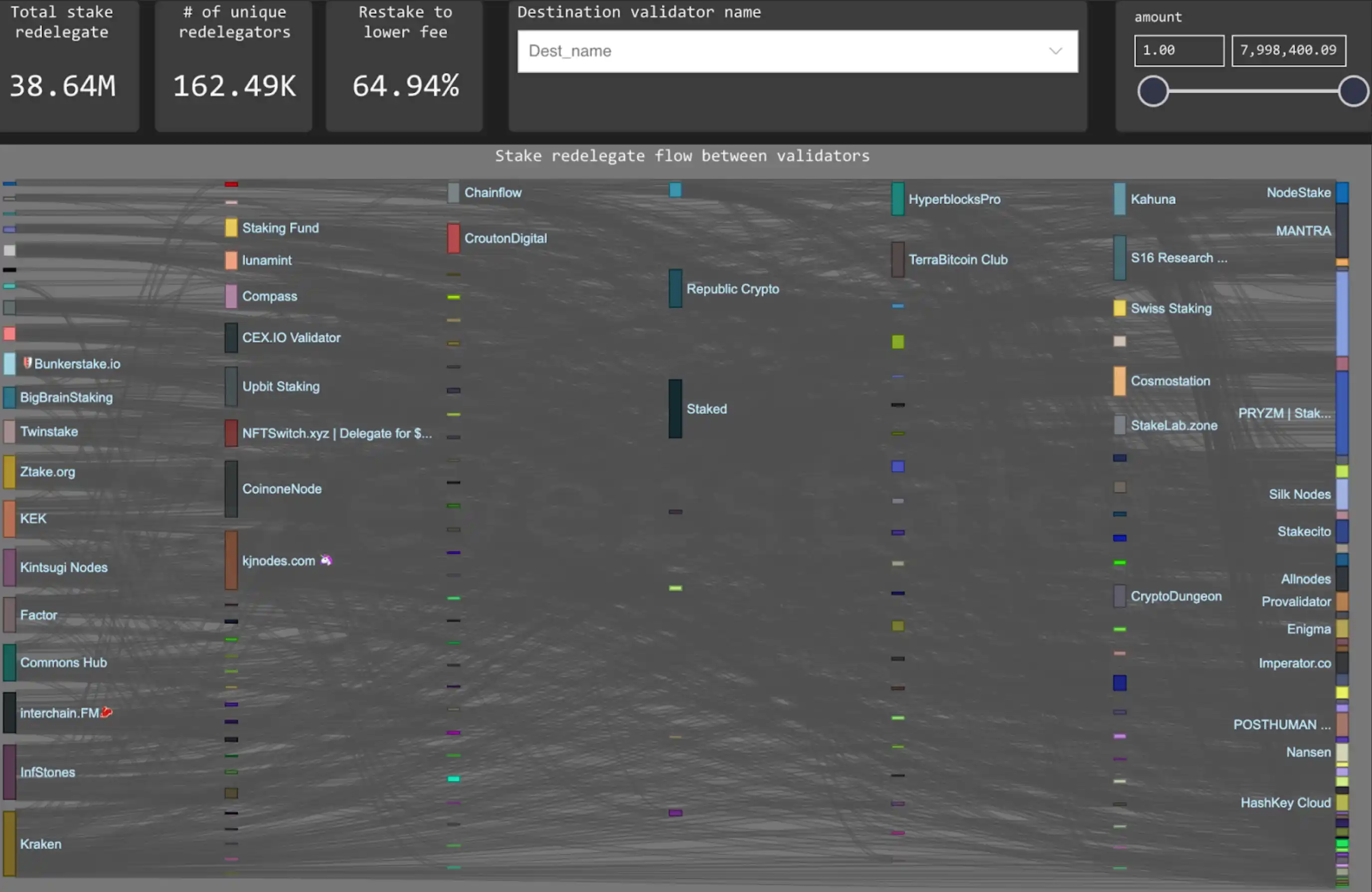

The redelegation rate decreased compared to 2023, yet more users seem to have engaged in this type of activity.

-

Redelegations in 2024 totaled 38.64M ATOM

-

It represents 16.6% of the total staked ATOM

-

This corresponds to a 7.34% year-over-year decrease in redelegation volume

-

At the same time, the number of unique addresses engaging in redelegation surged by approximately 300%, reaching 161.5k delegators.

This significant increase in the number of redelegating stakers suggests a growing focus on maximizing yields and increased awareness of staking management. Validators offering additional rewards on top of staking APR experienced notable inflows following such announcements, with reverse flows observed once the promotions ended.

This behavior model may suggest a prevalence of a strategy to actively optimize their returns in an increasingly competitive staking environment while demonstrating a long-term preference for staking with familiar and battle-tested validators.

The Volume of Restaked ATOM Rewards Hit the Year’s Peak in November

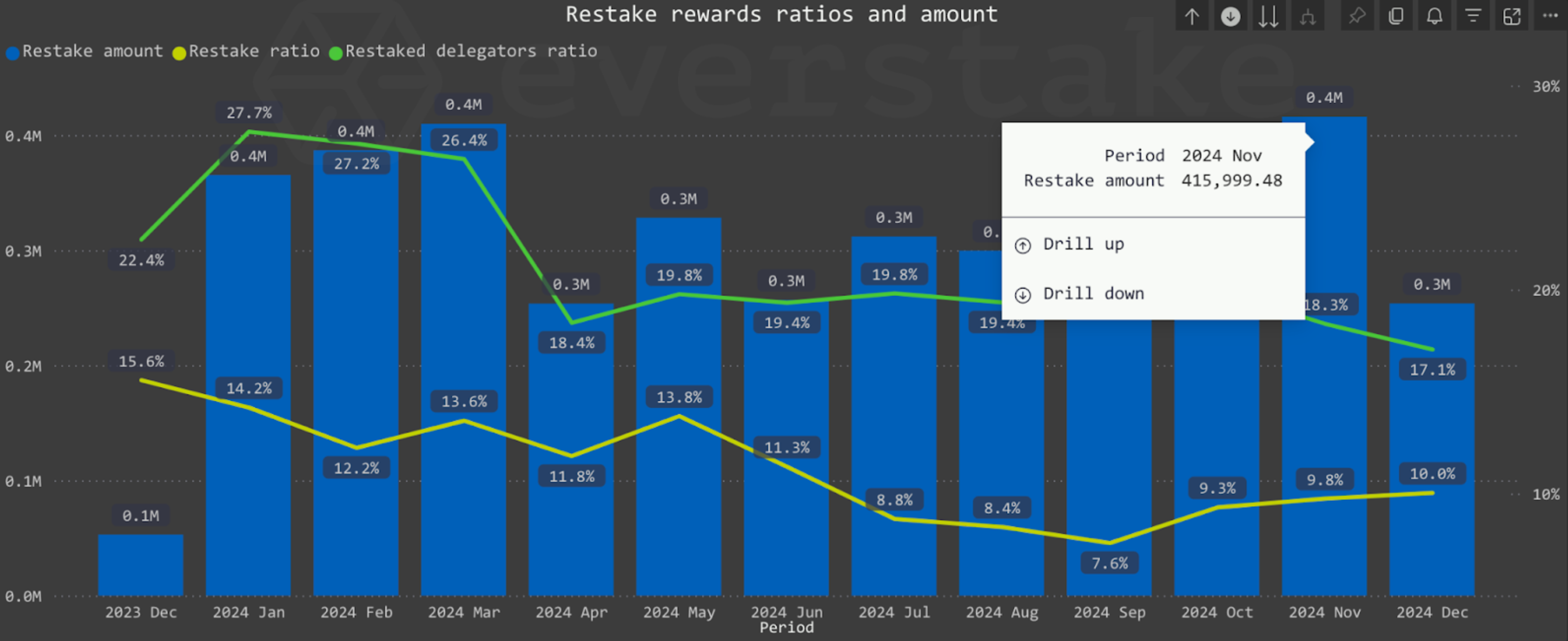

The restake ratio metric (the proportion of staking rewards reinvested into staking upon claiming) experienced a decline during the first half of 2024 but demonstrated steady recovery and growth starting in September. It peaked with a notable 10% restake ratio (a share of restaked rewards against the total amount).

This upward trend suggests the Cosmos community has sustained interest in staking ATOM. November 2024 set a record with a 415k ATOM being restaked.

APR in Cosmos Hub Peaked in December

In 2024, the staking APR ranged between 13.7% and 16.69% annually. While inflation in the Hub secured its maximum value of 10% during the year, the fluctuation of the total stake directly affected the APR.

A significant decrease in the total stake at the end of the year drove staking profitability to a record high of 16.69% in late December, with a slight adjustment to 16.63% by December 31. This marked the most favorable conditions for staking ATOM in 2024.

At the same time, the staking ratio can rebound unexpectedly and significantly, leading to a rapid decrease in profitability, as has occurred multiple times in the Hub's history.

According to the Cosmos documentation, APR is calculated as follows:

APR = inflation/Staking Ratio - 10% (Community Pool tax), where Community Pool tax stands for deductions made in favor of the Cosmos Community Pool.

Interchain Security 2.0

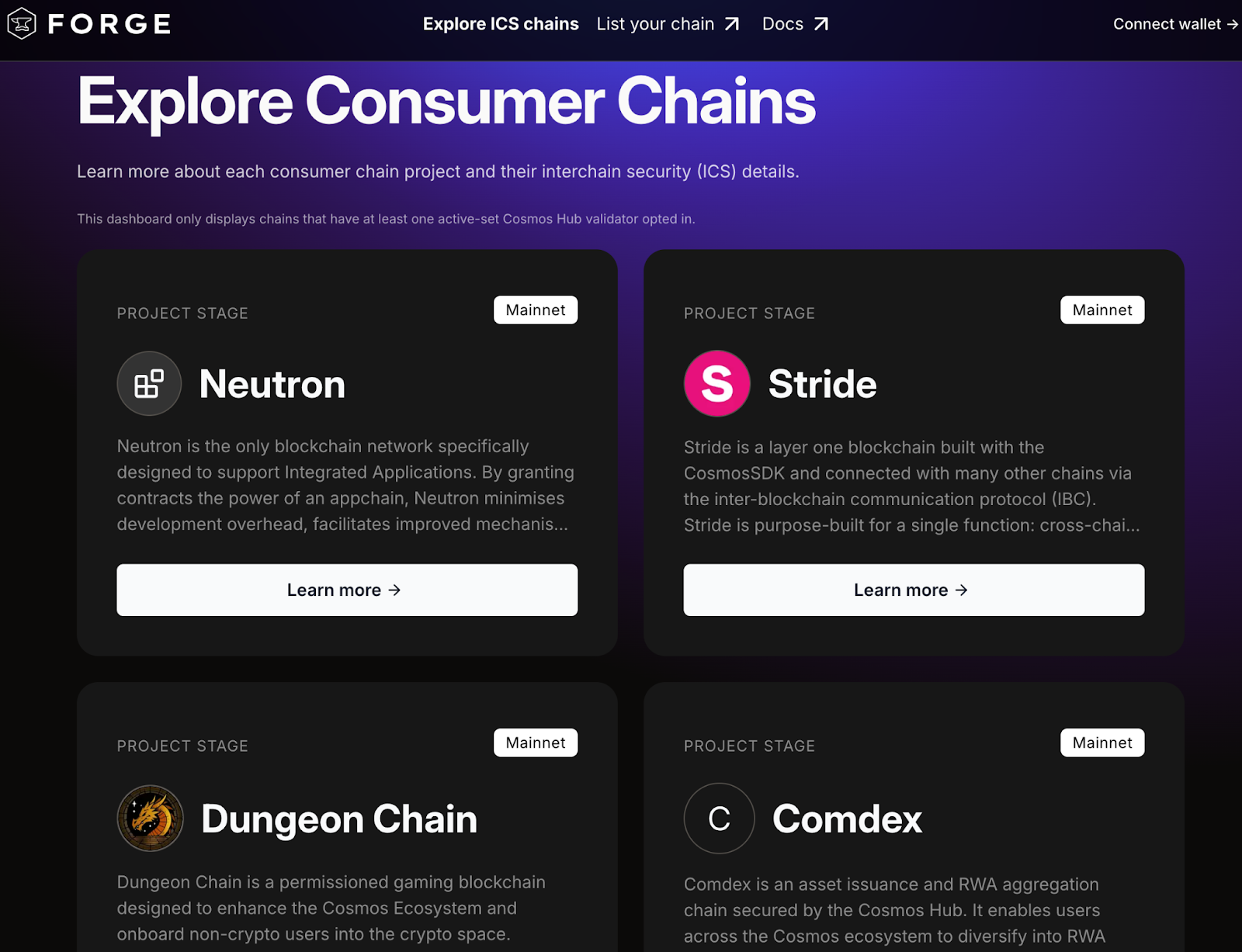

In 2024, the second iteration of Interchain Security (ICS 2.0), known as Partial Set Security, went live, advancing the Cosmos Hub's role as a security provider for consumer chains and increasing the number of consumer chains to five. ICS 2.0 addressed issues in the ICS 1.0 (Replicated Security) model by eliminating the strict requirement to involve the entire active set of ATOM validators for supporting new consumer chains. While ICS 1.0 permitted smaller validators with 5% of the Hub's voting power to optionally support consumer chains, it turned out to be less viable.

Original ICS

Originally, ICS aimed to strengthen the ATOM token by creating additional revenue streams from participating consumer chains, but adoption has been slower than expected. Two chains—Neutron and Stride—integrated ICS 1.0, but neither has yet reached the scale required to cover validator costs or deliver significant yields to ATOM stakers while being quite successful in terms of TVL and development.

In terms of numbers, Stride contributed $373K to the Hub, while Neutron added $53.4K, collectively tripling their shared YOY revenue, as seen on Datalenses.zone.

Source: Lenses

ICS 2.0 Reshaped the Model

ICS 2.0 addresses the issues mentioned above by allowing consumer chains to onboard only a selected set of active and approved inactive validators to participate rather than requiring the entire set of active validators. Besides, Partial Set Security is permissionless, meaning new chains can launch without a governance phase.

It simplified the process and reduced the number of beneficiaries of the consumer chain’s revenue—both validators and delegators—making the model potentially more feasible.

By the end of the year, three consumer chains started to utilize ICS 2.0. These are Dungeon Chain (a GameFi chain for interchain games), Elys Network (an all-in-one DeFi platform), and Comdex (an RWA aggregation chain).

Forge

Forge, a comprehensive ICS front end, provides all the details and links on the consumer chains.

Source: Forge

The key functionality of Forge is as follows.

-

Forge streamlines the interaction between validators, delegators, and consumer chains.

-

Once fully implemented, it will serve as a launchpad for new chains, guiding them through each step of their development and connecting them with validators.

-

Currently, Forge enables users to explore existing chains, providing essential information and a list of validators supporting them.

Users can connect their wallets and stake ATOM with a selected validator.

Thus, by staking ATOM with Everstake in Stride or Neutron sections on Forge, users can earn additional benefits from these chains alongside regular ATOM rewards. Still, it doesn't matter whether you stake ATOM directly from a wallet or on Forge. Forge simply highlights the exact validators set for each consumer chain.

New Leadership

The Interchain Foundation's acquisition of Skip in December 2024 has become one of the most crucial moments for Cosmos and set very ambitious goals for the ecosystem's growth and innovation. Skip, the leading team within the ecosystem, will spearhead Cosmos' expansion through top-tier engineering and strategic product development.

Renamed Interchain Inc., the new subsidiary will drive Cosmos' product vision and go-to-market initiatives.

This acquisition marked a substantial paradigm shift from the ICF's distributed product development model (the “stewards”) to an in-house development.

The new leadership is expected to bring about a growth-driven approach, focusing on strengthening the Cosmos Hub and ATOM, advancing the Interchain Stack, and boosting user adoption and liquidity across the ecosystem. Informal Systems, which stewarded the Hub in 2024, has stepped back to concentrate on its own products.

Source: Medium

The Skip Team announced its goals for the next 6 to 9 months:

-

Optimize the CometBFT consensus mechanism to achieve shorter block times.

-

Advance Cosmos SDK by transitioning to SDK V2, allowing developers to avoid multiple forks when building app chains.

-

Expand Interblockachain Communication Protocol capabilities beyond the Cosmos ecosystem, with an initial focus on integrating with Solana, Ethereum, and Move.

-

Through the open-sourcing SkipGo platform, support and improve cross-chain transferring between Cosmos chains and beyond. This would lead to simpler integrations for Cosmos onboarding and better adoption by DEXs, thus generating new opportunities for liquidity streams into the Interchain ecosystem. Skip currently handles up to 80% of IBC transaction volume, a figure expected to grow even more.

-

Build Open source EVM on Cosmos to reach seamless interoperability between Cosmos SDK and EVM.

While achieving these milestones, the Skip team is committed to advancing Cosmos Hub by developing innovative products and ensuring deeper integration with the broader Cosmos ecosystem.

Their vision is to transform the Hub into a true center for Cosmos chains, offering valuable tools and services that drive utility and growth. To this end, a dedicated Cosmos Hub roadmap is set to launch in January 2025, partially based on feedback from the community.

The Launch of Hydro as a Stepping Stone to Broader ATOM Adoption

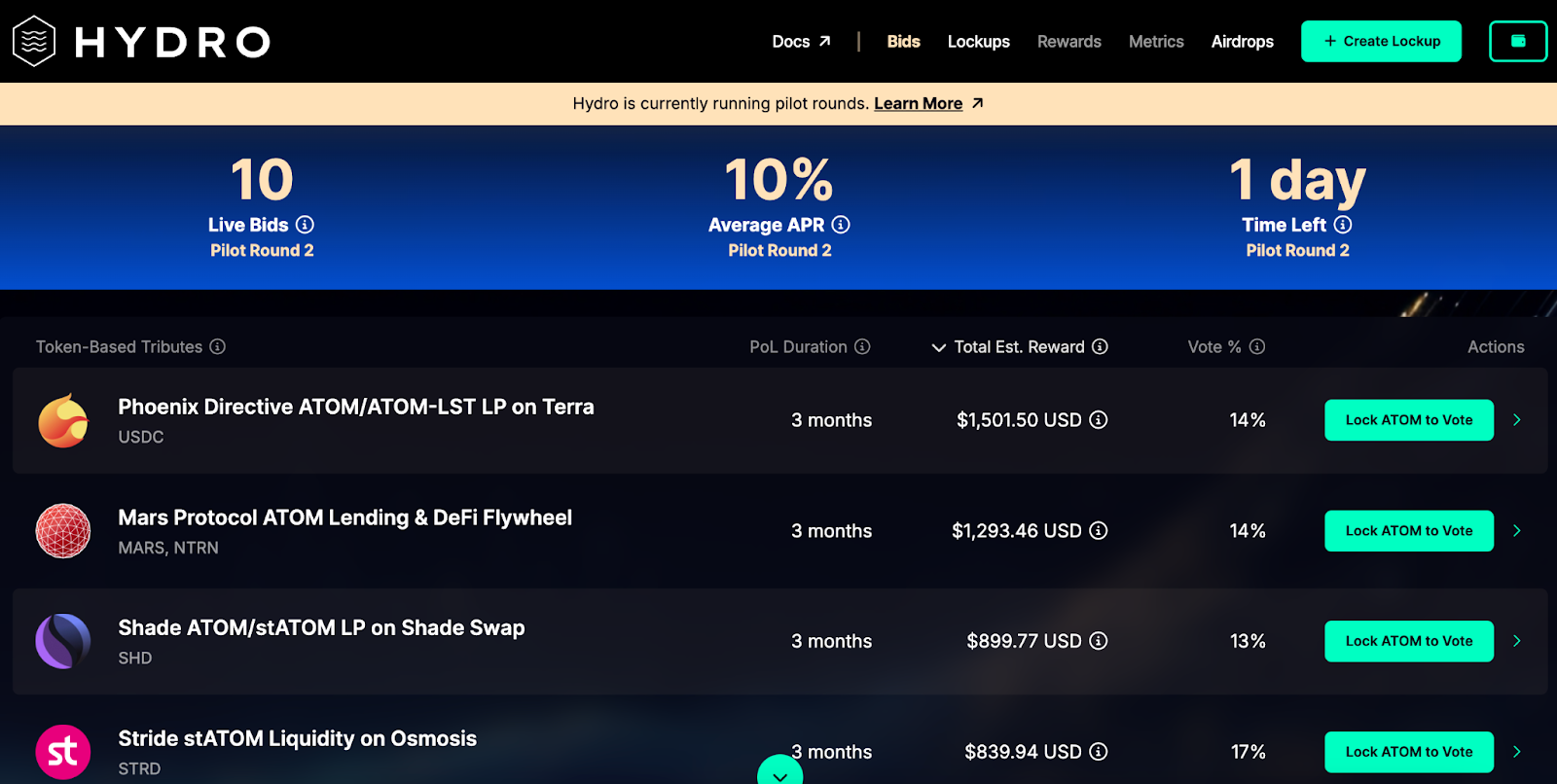

After introducing the concept of structured and automated protocol-owned ATOM liquidity management in Q2 2024, the Hydro platform launched in October with pilot rounds. In essence, Hydro participants include Cosmos projects competing for ATOM liquidity and ATOM stakers seeking additional yields beyond standard staking rewards. By year-end, the second round was underway, running smoothly and engaging 10 participating projects and 364 voters.

Hydro in a Nutshell

Each Hydro round comes with strict limitations, including a Liquidity Cap to be allocated among projects and a Cap on staked ATOM lock-ups, where stakers receive LST shares in return. For instance, in the second round, these caps were set at 300,000 and 30,000 ATOM, respectively.

-

Once a round begins, stakers should lock up their stake promptly, as Hydro follows an FCFS approach, with the cap often filled rapidly—last time, it was reached in just 4 minutes. Locking up staked ATOM into Hydro gives ATOM holders voting power to decide which projects will receive liquidity.

-

After locking their stake and casting a vote for one of the bidding projects, Hydro voters are free to switch their vote to any other project until the end of the round.

-

Whitelisted projects can join at any time, submitting bids for an amount of liquidity, and offering any amount of tokens or points as incentives (called tributes) for voters which will be distributed among stakers who vote for them at the end of the round.

At the end of the round, projects receive their allocated share of ATOM for a set POL duration. For now, the maximum duration is 3 months, but in the future this will expand up to 12 months. The amount of liquidity they will receive is determined by the proportion of votes they receive during the round, with a minimum of 5% of the total votes required to complete the liquidity transfer.

At the end of the round, projects receive their allocated share of ATOM for a set POL duration (1-3 months). This share is determined by the proportion of votes they receive, with a minimum of 5% of the total votes required to complete the liquidity transfer.

Source: Hydro

Users voting for successful bidders get a part of the tributes according to their voting power, which is higher with the longer lock-up period. At the same time, the Lock-up period can’t be shorter than the PoL Duration set for the bidder.

Using Hydro: an Example

Bob staked 100 ATOM with Everstake and wanted to support the Mars Protocol in the second round, as shown above. His course of action may look as follows.

-

To participate in Hydro, a validator must have sufficient LSM capacity. Bob verifies this by checking the validator’s LSM capacity on the Smartstake explorer.

-

He locks some of his staked ATOM for three months and gets 1.5 multiplier for the three-month lock-up period.

-

Then he votes for Mars, and now his vote is included in the total of 14% of votes.

-

Concluding the round, Bob would get 2.38% (100/ (30,000*14%)) of the tribute, which is around $30.8, while Mars would get liquidity of 42k ATOM for three months.

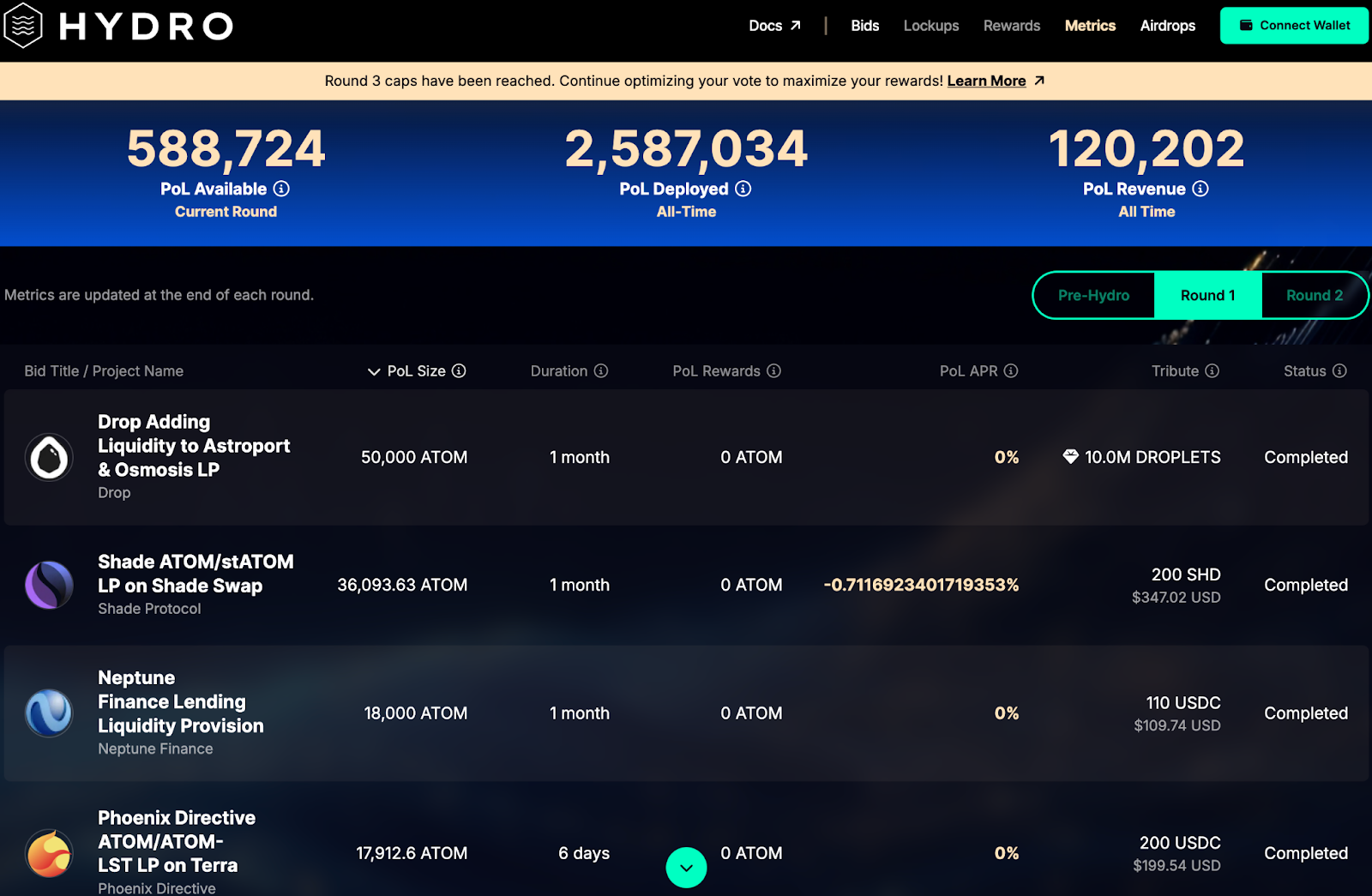

Once the round concludes and PoL is distributed among eligible bidders, its terms can be tracked on the Hydro Metrics Page. Having completed one round in 2024, Hydro distributed 155,707 ATOM to eight bidders, as shown on the dashboard below.

Source: Hydro

Future Plans

The Hydro team has set ambitious goals for 2025, focusing on enhancing the user experience through better automation and providing greater flexibility for bidders in setting their PoL duration and targets.

Hydro’s roadmap includes the deployment of vote optimizers, automated hedging, and insurance contracts provided by third parties. The integration of Valence Protocol will further enhance security and efficiency by automating committee operations. Additionally, the revenue-sharing and penalty system is designed to promote responsible voting, ensuring bidders are selected more thoughtfully.

With a request for 180k ATOM from the Hub’s Community Pool to support a six-month development roadmap (the proposal is supposed to go live in January 2025), the team is set on achieving self-sustainability by the end of this period.

The project's future vision includes significant scaling, particularly by incorporating additional tokens and expanding its services to other chains beyond the Cosmos ecosystem.

Most-Voted Proposals in 2024

In 2024, the total number of governance proposals, excluding spam, was 46—14 fewer than in 2023. Yet only five proposals were rejected—there were nine in the previous year. Notably, revised versions of four previously rejected proposals were approved once revised.

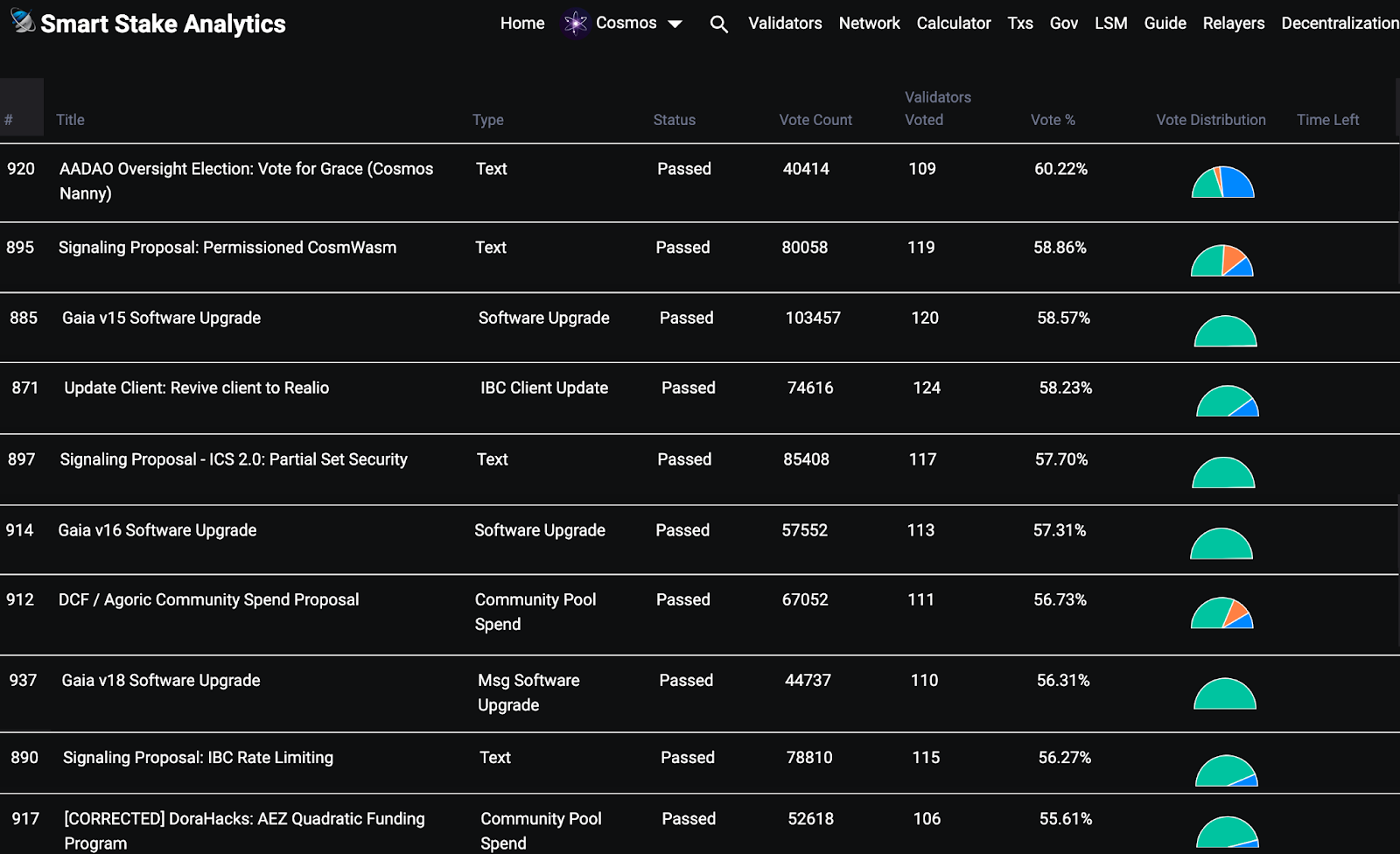

The proposals that garnered over 55% are shown below.

Source: Smart Stake Analytics

-

As shown in the picture above, three proposals concerning Cosmos Hub Software upgrades and Proposal #897, which advocated for Partial Set Security, received unanimous support with 100% YES votes.

-

Proposal #920, garnered the most votes, focused on the Oversight election within the Atom Accelerator DAO. It aimed to increase transparency in the DAO’s operations, an initiative that strongly resonated with the community.

Other highly supported proposals addressed initiatives designed to advance Cosmos Hub development and enhance ATOM’s value, garnering significant backing from delegators.

IBC Reached New Heights in Transaction Volume

The Inter-Blockchain Communication Protocol (IBC), an open-source solution enabling seamless cross-chain data transfers, is one of Cosmos’s cornerstones.

As of December 2024, IBC connects 119 chains, including 14 newcomers joining over the year. Collectively, they account for a total market cap of approximately $45 billion.

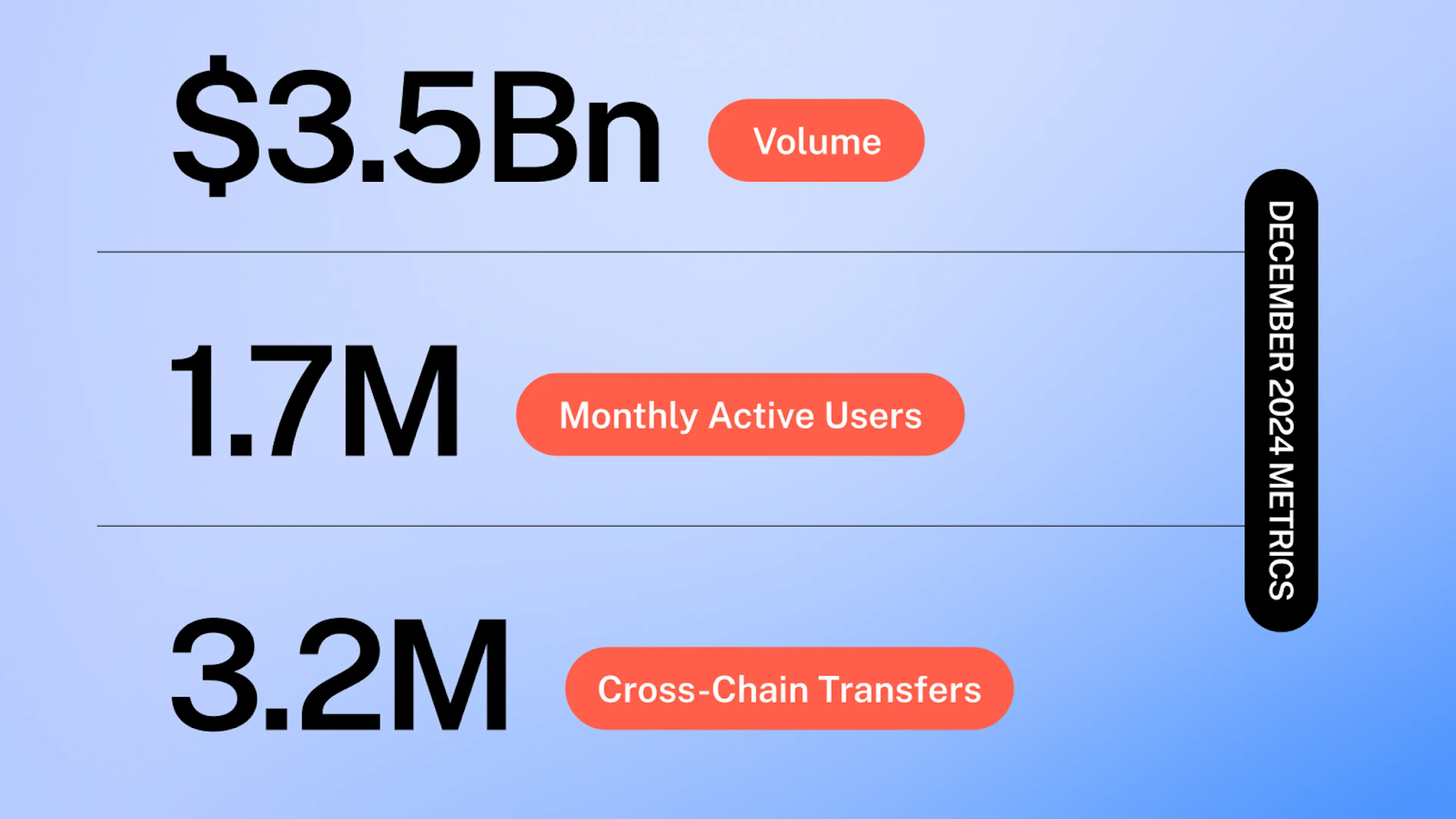

With a monthly transfer volume of over one billion, IBC ended 2024 at $3.5B with 3.2M IBC transfers, while Cosmos Hub's yearly average value stood at $150M.

Source: IBC

Since August 2024, IBC metrics have been available on DeFiLlama, including its current volume compared to other bridges and historical transaction data spanning the past six months. Consistently ranking among the top ten bridges out of 64 listed on DeFiLlama, IBC is one of the most popular and reliable cross-chain solutions.

In 2024, the IBC protocol made significant progress following four major upgrades of its ibc-go software.

Key improvements included:

-

empowering Interchain Accounts with tooling for querying modules and fetching data

-

seamless IBC channel upgradability

-

multi-token transfers within a single IBC packet in one transaction

Notable steps have also been taken to connect Solana, Ripple’s sidechain, and Cardano to the IBC network. These connections are expected to come to full capacity with the upcoming release of IBC V2, known as the IBC Eurica, planned for early 2025.

Eureka

IBC Eureka, the next evolution of the IBC protocol, is designed to be 10x easier to implement on non-Cosmos SDK virtual machines. It eliminates complexities such as connections, handshake protocols, and encoding limitations while preserving IBC’s reliable light-client-backed transaction verification.

At launch, Eureka will debut on Ethereum, enabling seamless asset transfers between Ethereum and Cosmos chains that upgrade to Eureka.

ATOM Prospects for 2025

Concluding 2024 ATOM demonstrated substantial growth potential driven by new products, attracting liquidity to Cosmos Hub. Other important developments that are at the foundation of ATOM’s progress in 2025 include the expanding Interchain Security and connections with the leading blockchain ecosystems through IBC-Eureka.

The trend of prevailing retail staking over whales may continue into 2025, which would likely increase the decentralization and minimize shocks following single-address unstakes.

An increase in the redelegating addresses and restaking rewards, along with governance awareness and consolidation, indicate the community’s growing interest in ATOM staking and Cosmos Hub development. The continued success of Hydro, which offers additional yields on top of staking, holds significant potential to further enhance ATOM staking and bring about greater participation.

Thus, 2025 holds great promise for ATOM and the Cosmos ecosystem in general.

Disclaimer

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.

Sign Up for

Our Newsletter

By submitting this form, you are acknowledging that you have read and agree to our Privacy Notice, which details how we collect and use your information.