INTRODUCTION

Throughout 2024, Sui achieved remarkable advancements, particularly in scalability and ecosystem expansion.

This report highlights the key milestones, including a surge in daily active users, a noteworthy increase in the Total Value Locked (TVL), and significant developments in liquid staking. The analysis offers insights into the dynamic trends shaping the Sui ecosystem over the past year.

KEY 2024 MILESTONES AND TAKEAWAYS

-

Active Accounts Growth: Sui experienced a significant rise in daily active accounts, peaking at 2.5 million in May 2024.

-

Transaction Trends: Nearly 68 million transactions were processed in a single day in 2024, totaling 8 billion by year-end.

-

Total Value Locked (TVL): Base TVL surged by 770%, increasing from $212 million on January 1st, 2024, to a peak of $1.84 billion in December 2024, marking the highest point of the year.

-

Liquid Staking: TVL in liquid staking saw sharp growth, driven by projects like SpringSUI and Haedal Protocol. Over the past year, TVL surged to $648 million as of December 31, 2024.

-

Latency Reduction: The introduction of the Mysticeti consensus mechanism in August 2024 reduced latency by 80%, improving transaction speeds to about 370-390 milliseconds.

-

Walrus Decentralized Storage: Mysten Labs launched Walrus testnet in October 2024. Walrus is a decentralized storage solution that allows any application to publish, read, and program any data type onchain.

-

Stablecoin Expansion: In 2024, Sui integrated four major stablecoins (USDC, AUSD, FDUSD, USDY), strengthening its financial ecosystem and supporting DeFi growth.

METHODOLOGY

This report examines the performance of Sui through a structured approach that includes:

-

On-Chain Data: Collection of raw transaction records and key metrics such as staking activity, transaction volume, and inflation rates.

-

Data Preparation: Using Python and Power BI, we processed and formatted the data, ensuring a thorough analysis from multiple including third-party sources.

-

Data Analysis: Charts and statistical techniques were applied to uncover meaningful trends and insights.

DEFINITIONS

Key terms referenced in this report include:

-

Sui: The layer-1 blockchain protocol that was built for mass adoption.

-

SUI: The native token of Sui.

-

Total Stake: The total amount of SUI locked for staking.

-

Validators: Node operators responsible for validating transactions, securing Sui, and producing new blocks.

-

Delegators: Participants who delegate their SUI to Validators to support Sui’s security and operations.

-

TVL (Total Value Locked): The total value of assets locked within the Sui’s DeFi protocols.

-

Devnet: A private environment for developers to test and debug blockchain applications without impacting the main network.

-

Testnet: A public test environment where developers can trial applications and smart contracts without risking real assets or compromising the main blockchain’s security.

UNIQUE ACTIVE ACCOUNTS GROWTH

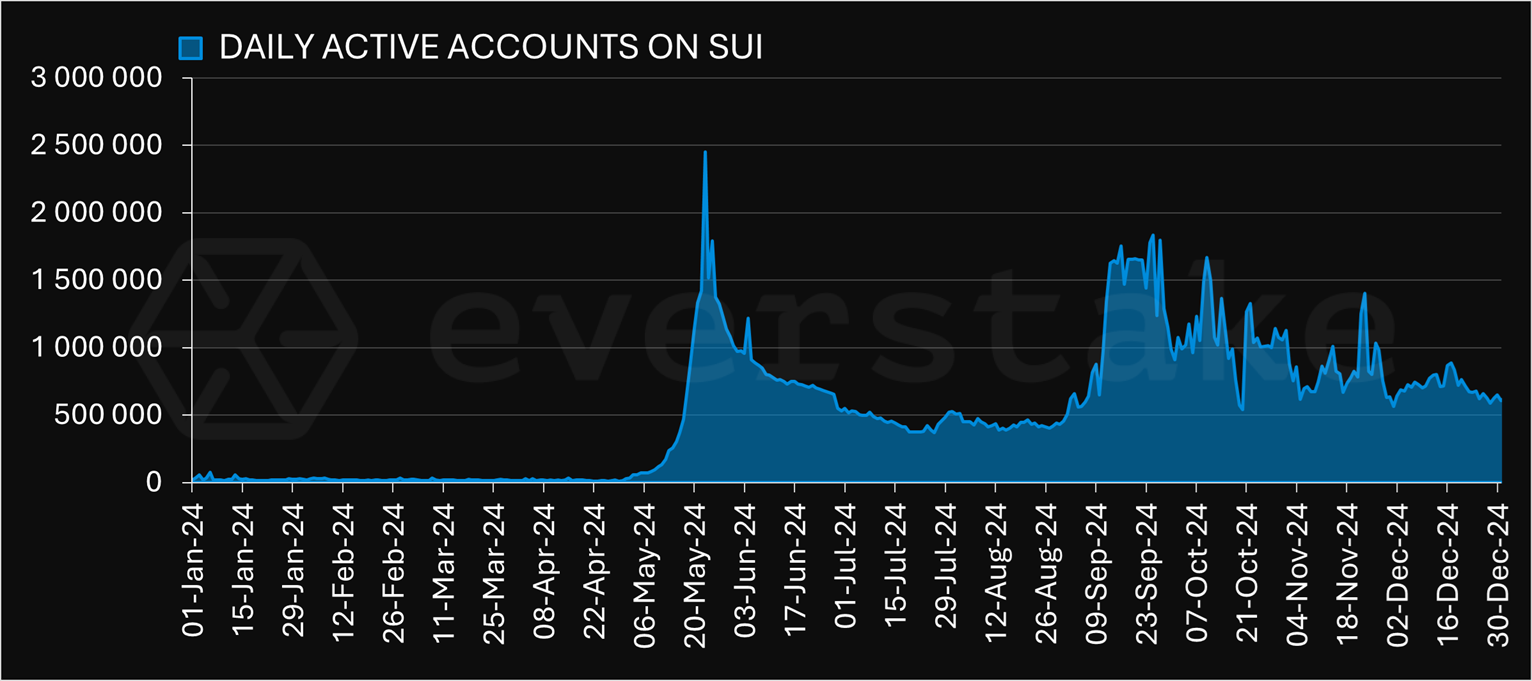

User activity on Sui experienced significant expansion in 2024.

As shown in Figure 1, daily active accounts substantially grew, starting modestly at a few tens of thousands at the beginning of the year before surging to 2.5 million on May 23rd. This peak coincided with key ecosystem events and heightened user interest in decentralized finance (DeFi) and NFTs. Following this spike, daily active accounts settled at lower levels but remained robust, with consistent fluctuations reflecting periodic ecosystem milestones.

FIGURE 1. SUI DAILY ACTIVE ACCOUNTS

FIGURE 1. SUI DAILY ACTIVE ACCOUNTS

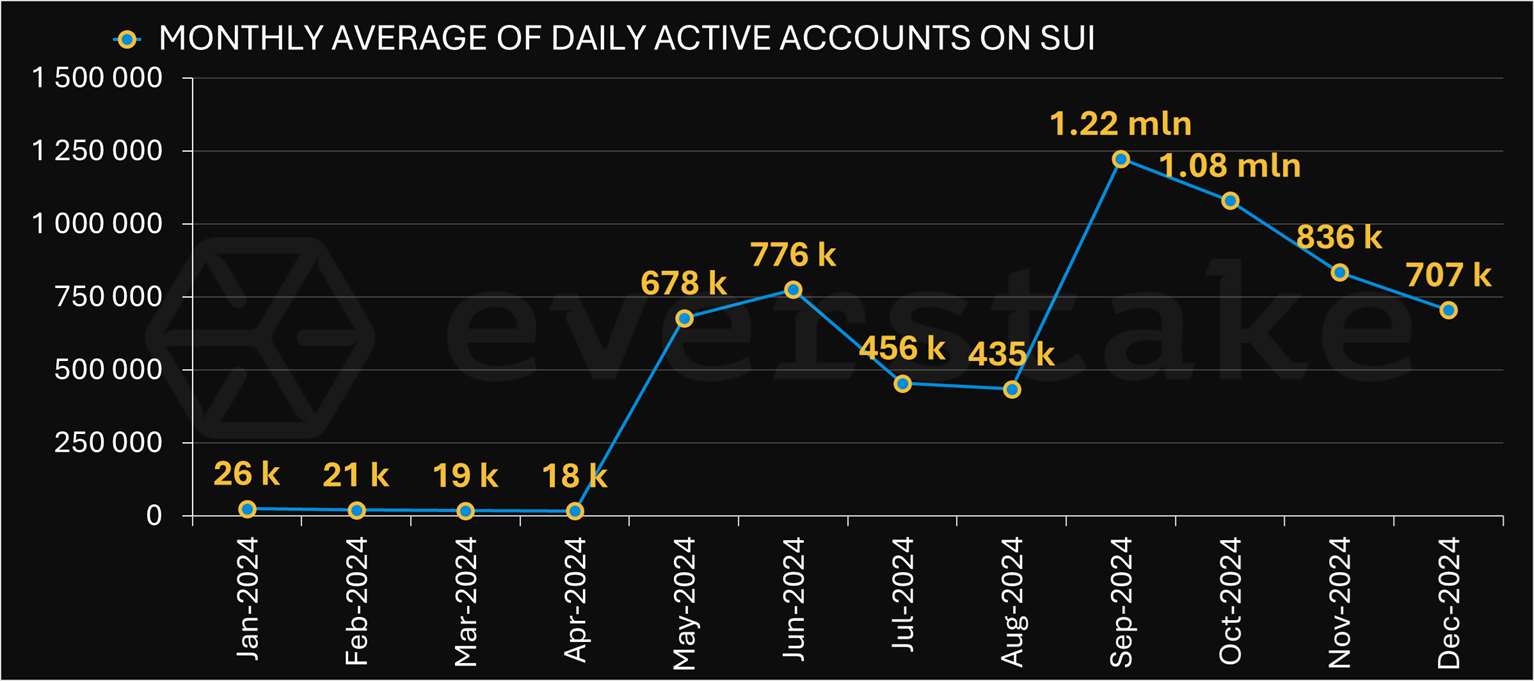

The monthly average of daily active accounts, presented in Figure 2, highlights trends in user engagement. Beginning with just 26,000 in January, the average climbed sharply, peaking at 1.22 million in September. While the average declined slightly in the subsequent months, December still recorded a strong 707,000 average daily active accounts, underscoring the sustained adoption of Sui’s blockchain ecosystem even as the year ended.

FIGURE 2. MONTHLY AVERAGE OF DAILY ACTIVE ACCOUNTS

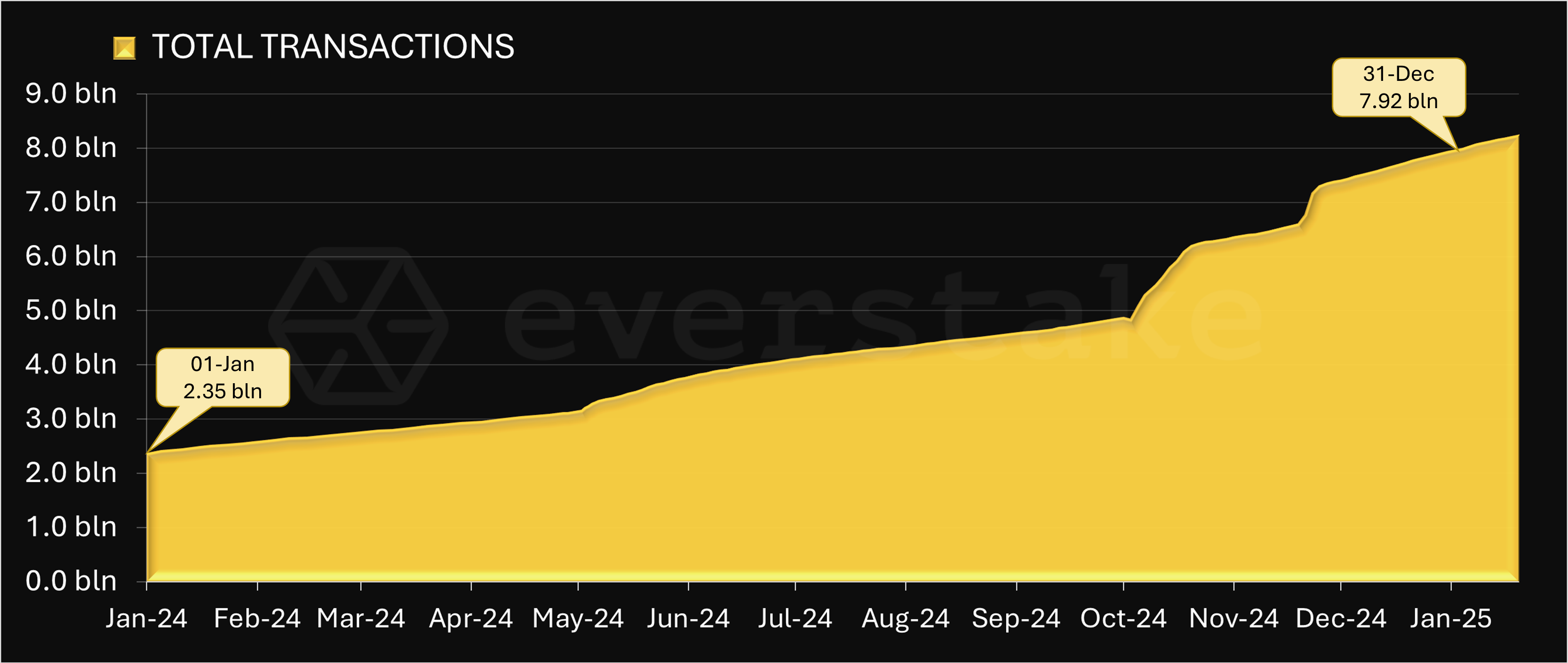

TRANSACTION TRENDS

Transaction volume on Sui continued its upward trajectory, reflecting increased engagement and usability. Figure 3 showcases the total transactions processed over time, reflecting how network activity scaled alongside ecosystem growth.

FIGURE 3. TOTAL TRANSACTIONS COUNT

FIGURE 3. TOTAL TRANSACTIONS COUNT

In November 2024, Sui processed over 1 billion transactions in a single month, including executing 65.8 million transactions in a single day.

This performance underscored Sui’s scalability and efficiency, bringing the network's total cumulative transaction count to 8 billion, - evidence of Sui’s strong growth and adoption.

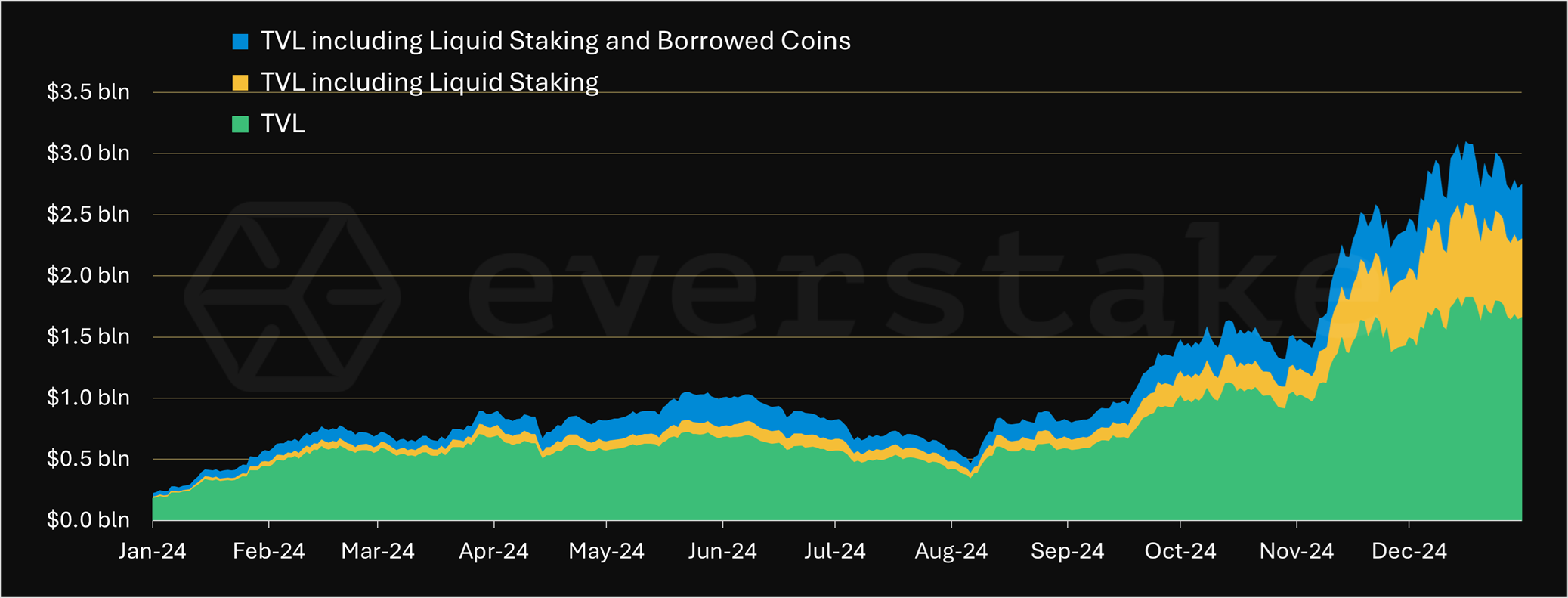

TOTAL VALUE LOCKED (TVL)

TVL is a critical indicator of blockchain growth and DeFi activity. Figure 4 illustrates the trends in TVL throughout the year, with separate charts for three key metrics: Base TVL, TVL including Liquid Staking, and TVL including both Liquid Staking and Borrowed Coins.

FIGURE 4. TRENDS IN SUI TVL

FIGURE 4. TRENDS IN SUI TVL

Sui’s TVL grew extraordinarily over 2024, peaking on December 16 and marking the highest point of the year:

-

Base TVL grew from $212 million on January 1st, 2024 to a peak of $1.84 billion on December 16th, 2024 (+770%)

-

TVL including Liquid Staking expanded from $227 million on January 1st, 2024 to $2.61 billion on December 16th, 2024 (+1050%)

-

TVL Including Liquid Staking and Borrowed Coins skyrocketed from $257 million on January 1st, 2024 to $3.12 billion on December 16th, 2024 (+1110%)

This growth illustrates the position of Sui as one of the fastest-growing ecosystems.

STAKING STATS

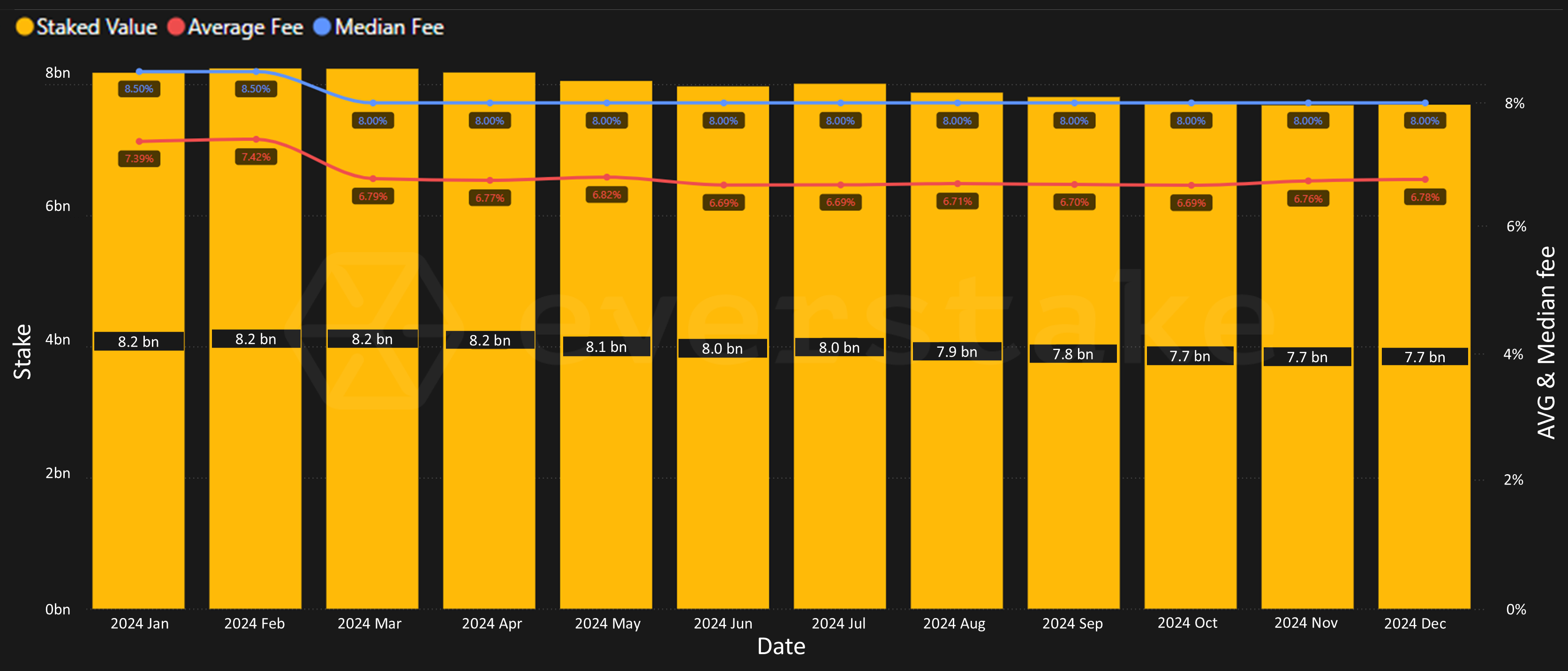

The total stake on Sui stood at 7.69 billion SUI at the end of 2024.

Validator fees stabilized around 6.8%, and the number of delegators surpassed 160,000, indicating sustained participation. The stake allocation among Validators varied based on fee rates, with some attracting more Delegators due to competitive fee structures.

Figure 5 shows trends in total staked SUI, average Validator fees, and median Validator fees throughout the year.

FIGURE 5. TRENDS IN STAKE AND AVERAGE/MEDIAN FEES

FIGURE 5. TRENDS IN STAKE AND AVERAGE/MEDIAN FEES

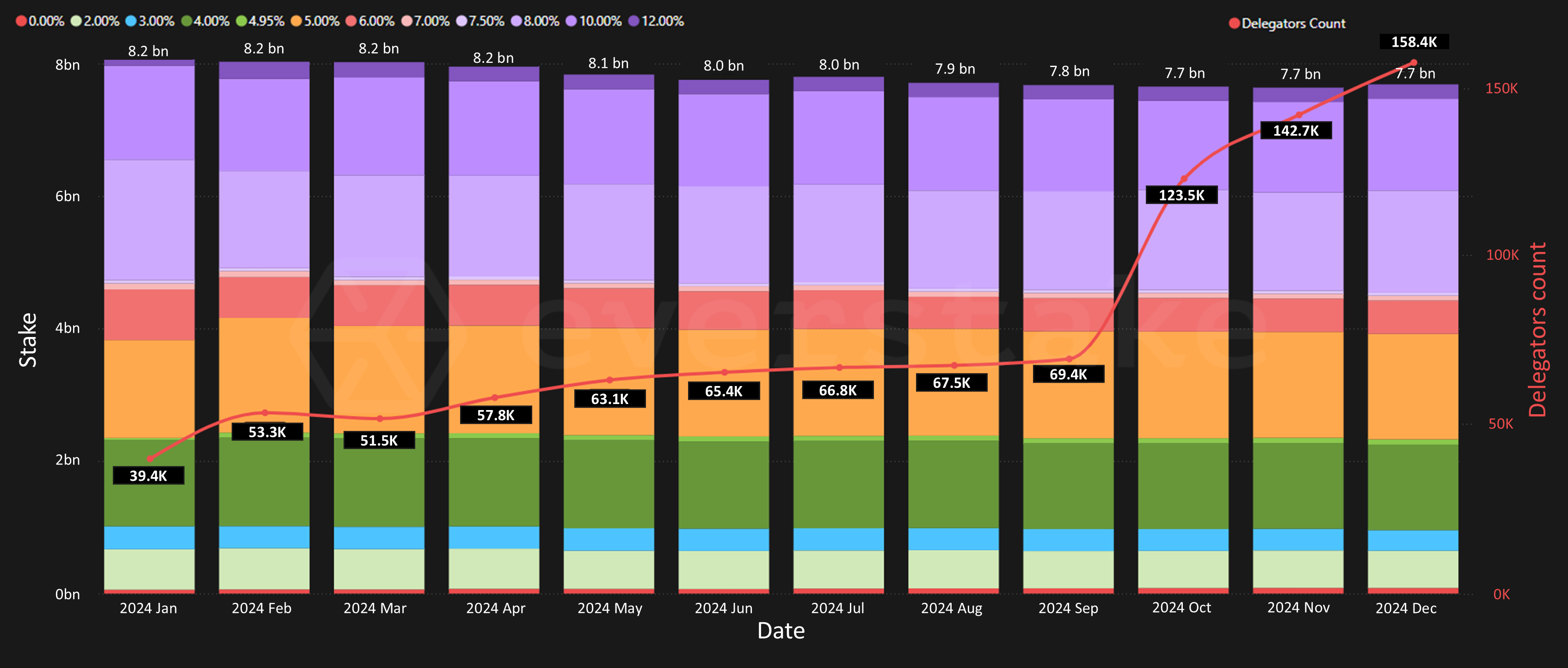

The staked bar chart in Figure 6 depicts the stake allocation across Validators, categorized by their fee percentages (e.g., 0%, 2%, 10%, etc.). Also, this chart highlights changes in the number of Delegators over time.

FIGURE 6. STAKE DISTRIBUTION AMONG VALIDATORS, CATEGORIZED BY THEIR FEES

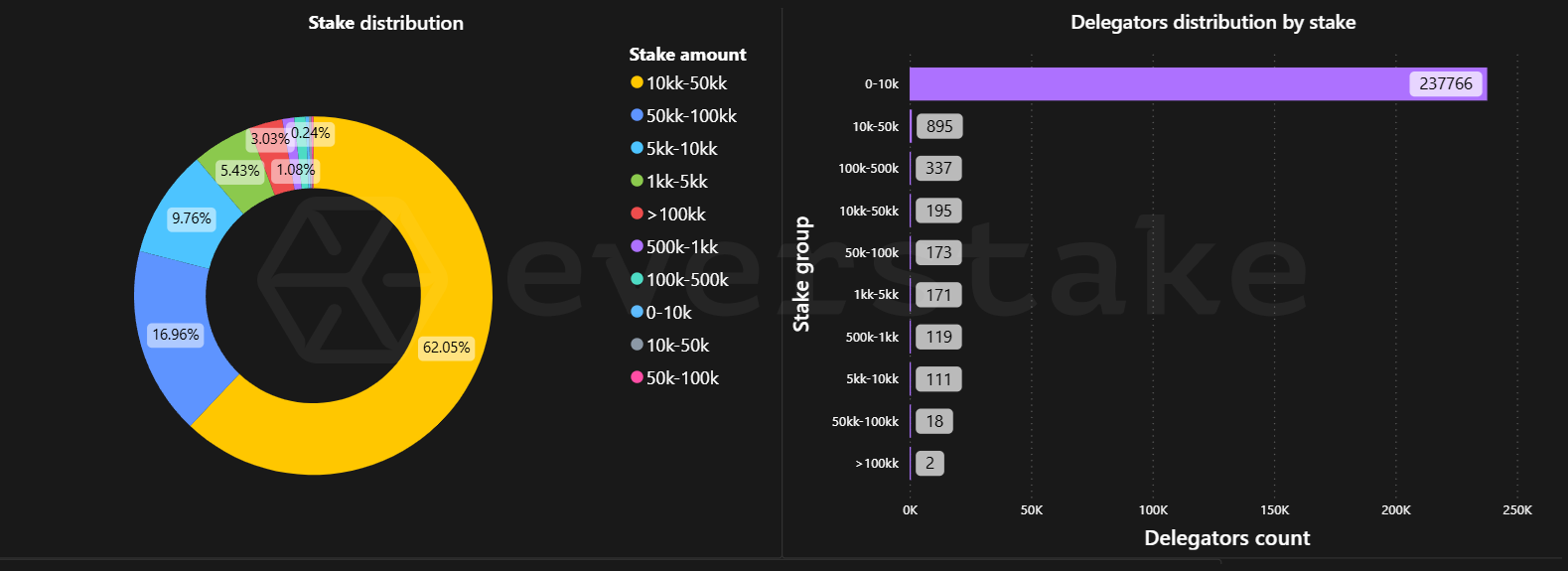

Additionally, Figure 7 presents the breakdown of stake distribution by Delegator size.

The left side of the figure shows that a substantial portion of the total stake (4.717 billion SUI) is held by Delegators staking between 10 million and 50 million SUI. Meanwhile, the right side indicates that the majority of Delegators (237,000) are in the 0–10k stake range, demonstrating widespread participation at smaller staking levels.

FIGURE 7. DISTRIBUTION OF STAKE (LEFT) AND DELEGATOR COUNT (RIGHT) BY STAKE SIZE

FIGURE 7. DISTRIBUTION OF STAKE (LEFT) AND DELEGATOR COUNT (RIGHT) BY STAKE SIZE

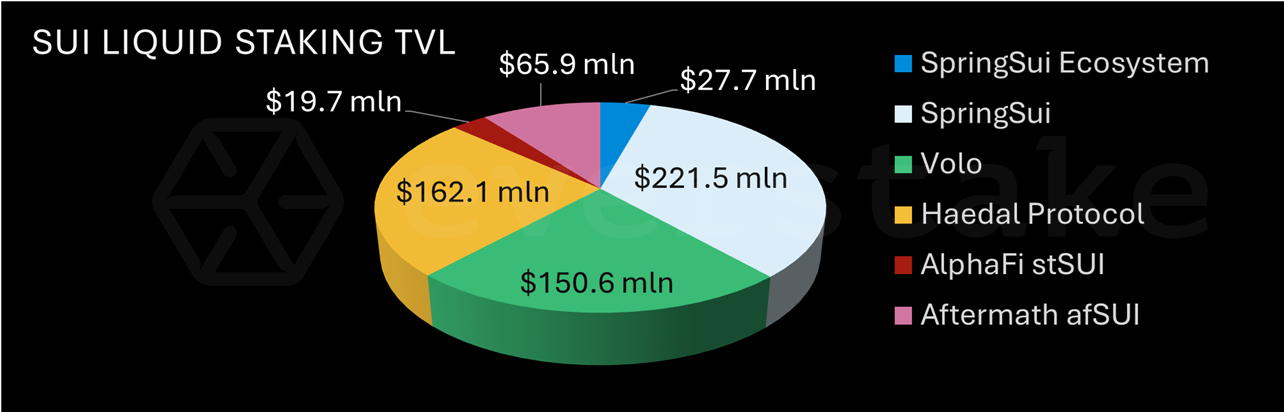

LIQUID STAKING

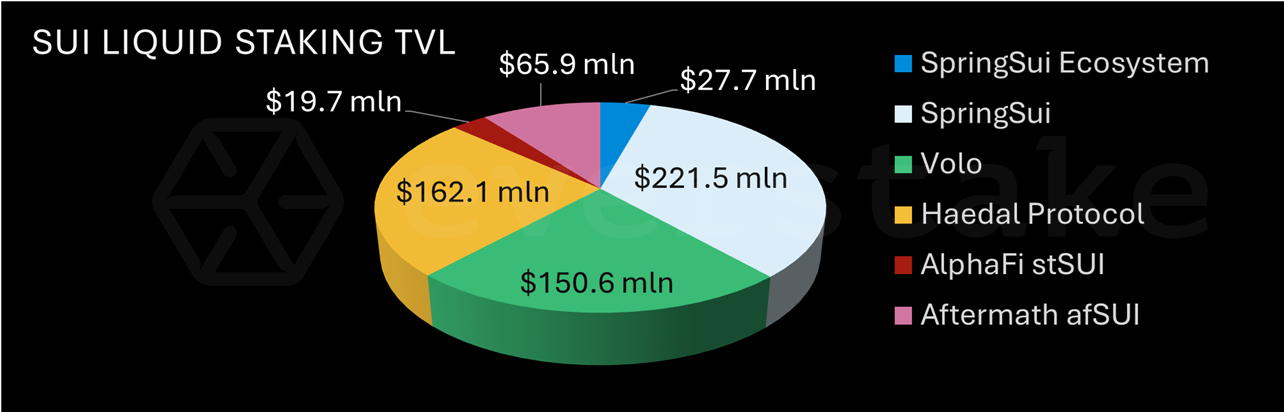

Liquid staking saw significant traction, with TVL for liquid staking increasing sharply in the final quarter of 2024. The TVL for key contributors (as of December 31, 2024) included:

-

SpringSUI: $221.5 million and SpringSUI Ecosystem: $27.7 million

-

Haedal Protocol: $162.1 million

-

Volo: $150.6 million

-

Aftermath: $65.9 million

-

AlphaFi: $19.7 million

Figure 8 illustrates the growth in TVL for liquid staking on Sui, with steady progress throughout 2024 and a sharp increase in the final quarter. This surge points to a period of rapid adoption and heightened activity within the ecosystem and signals a significant influx of liquidity and growing interest in liquid staking on the platform.

FIGURE 8. SUI LIQUID STAKING TVL

FIGURE 8. SUI LIQUID STAKING TVL

Figure 9 provides a detailed breakdown of contributions by individual protocols.

FIGURE 9. SUI LIQUID STAKING TVL (as of 31st December 2024)

FIGURE 9. SUI LIQUID STAKING TVL (as of 31st December 2024)

SpringSUI and its ecosystem make up a large share of the total TVL, showing their popularity and consistent growth. Haedal Protocol and Volo are also key contributors, adding substantial value to the network. Meanwhile, Aftermath and AlphaFi bring variety and depth, enriching the overall liquid staking ecosystem on Sui. The steady upward trend highlights how all these protocols, together, drive the network's growth and success.

LATENCY REDUCTION

In 2024, Sui introduced the Mysticeti consensus mechanism which dramatically reduced consensus latency by approximately 80%. This update allowed for transaction finality in about 370-390 milliseconds, positioning Sui among the fastest blockchains for transaction processing.

The upgrade was critical for supporting more real-time applications, especially in gaming and high-frequency trading environments.

SUI BRIDGE

The launch of the Sui Bridge in September 2024 significantly enhanced blockchain interoperability, allowing seamless asset transfers between Sui and Ethereum. This bridge was designed to provide a secure, efficient, and trustless solution for cross-chain transactions.

In less than three months since the Sui Bridge launched, over 25,000 ETH were transferred to Sui, showcasing a strong demand for secure, native connections between ecosystems and signaling a growing interest in Sui.

Security was a key focus in the bridge's development. To bolster confidence among users and developers, an incentive program was introduced, encouraging the community to report vulnerabilities and test the system. Additionally, the bridge supports popular assets such as ETH, wBTC, USDC, and USDT, ensuring fast and reliable transfers.

In addition, the integration of Circle’s Cross-Chain Transfer Protocol (CCTP) made transferring USDC between Sui and other blockchains even more efficient, increasing the bridge's overall utility.

With these developments, the Sui Bridge is positioning Sui for increased institutional interest, driving liquidity, and expanding its role in DeFi through enhanced cross-chain interactions.

WALRUS

Walrus, launched on Testnet by Mysten Labs in October 2024, is an advanced decentralized storage solution powered by Sui. It introduces a novel approach to data management by utilizing Reed-Solomon encoding and a unique 2D coding algorithm named "RedStuff," designed for Byzantine Fault Tolerance (BFT).

This protocol allows for the efficient handling and storage of large datasets, including multimedia files, offering both full replication and erasure coding benefits. In addition to providing safe, reliable, and robust storage, Walrus’ highly programmable nature means that storage can be integrated and adapted to specific use cases.

Following the launch of Walrus on Sui in 2025, Walrus is expected to not only amplify Sui's utility via its management of programmable data but also support the development of applications that require robust, decentralized storage solutions.

Walrus’s Devnet and Testnet launch have already fostered a vibrant community of developers and users, particularly through community initiatives and hackathons, significantly contributing to Sui's reputation as a platform for innovative blockchain applications.

NATIVE STABLECOINS

In 2024, there was a significant expansion in Sui's stablecoin offerings with the integration of four major stablecoins: USDC, AUSD, FDUSD, and USDY.

This move was crucial for enhancing liquidity on Sui, providing users with stable value storage options, and supporting the growth of DeFi applications. The introduction of these stablecoins helped Sui to become a more robust ecosystem for financial transactions and lending protocols.

INSTITUTIONAL ADOPTION

Sui witnessed a surge in institutional interest and adoption in 2024:

-

VanEck introduced a regulated financial product backed by SUI

-

Franklin Templeton collaborated with Sui to explore blockchain solutions

-

Grayscale Investments launched the Grayscale SUI Trust, giving accredited investors direct exposure to Sui's growth

This institutional backing underscored the network's credibility and potential in the financial sector.

SUI BASECAMP 2024 EVENTS

Sui Basecamp 2024, held in Paris, was one of the largest blockchain events focused on a single network, attracting over 1,100 attendees from 65 countries. It showcased Sui's latest technological innovations and ecosystem projects, such as the Mysticeti consensus mechanism and SuiPlay0x1.

With 100 speakers and exciting announcements, the event served as a vibrant platform for developers, investors, and enthusiasts to collaborate, discuss, and celebrate Sui's growth and future. Looking ahead, next year's Sui Basecamp will be hosted in Dubai on May 1-2, 2025.

The Sui Overflow Hackathon saw impressive participation from over 2,000 developers across 75 countries, resulting in 352 submissions and 32 winning projects, further highlighting the ecosystem's growing talent pool.

Another key event, the Builder House in Singapore, provided valuable insights into new initiatives like the Walrus Whitepaper and the announcement of USDC on Sui. The event culminated in a celebration attended by over 2,400 people, further strengthening Sui’s developer community.

FINAL THOUGHTS

Sui made remarkable progress in 2024, strengthening its position as a leading blockchain ecosystem. With rapid growth in active accounts, massive TVL expansion, and significant staking advancements, Sui continues to innovate and evolve. The successful launch of the Sui Bridge, institutional interest, and vibrant community engagement through events like Sui Basecamp 2024 further highlight Sui’s upward trajectory.

Entering 2025, Sui’s momentum remains strong, for example the TVL reached a new record of $2.065 billion on January 7, 2025 and the number of Delegators surpassing 200,000 by early February 2025—reinforcing a promising trend for continued growth and adoption in the blockchain space.