Core Dual Staking combines the strength of Bitcoin with the flexibility of the Core blockchain. By locking BTC and staking CORE together, you can get higher rewards and keep full control of your assets.

This guide will show you the full process from start to finish, including an introduction to Core, how dual staking works, what you need to participate and how to use supported wallets.

What Is the Core Blockchain?

Core is a Layer-1 blockchain that brings together the best of Bitcoin and Ethereum by combining Bitcoin’s security model with EVM-compatible smart contracts. At its core, the network is built to offer decentralization, scalability, and interoperability, all while staying deeply connected to Bitcoin’s ecosystem.

Key features of Core

- Bitcoin-aligned security through hash power delegation;

- EVM compatibility, allowing developers to deploy Ethereum-based smart contracts with no modifications;

- Low fees and high throughput, optimized for user and developer experience;

- Decentralized validator selection, secured by CORE token staking.

The network’s native asset, CORE, serves three main purposes:

- It’s used for paying gas fees

- It’s staked to secure the network and participate in governance

- It’s paired with BTC for dual staking, enabling rewards and helping anchor Bitcoin into Core’s architecture

The total supply of CORE is capped at 2.1 billion tokens. This fixed supply, combined with real economic utility, makes CORE a foundational element of the Core ecosystem, not just as a currency, but as a governance and security mechanism.

Understanding Tiered Dual Staking

Core’s Dual Staking uses a tier system to reward users based on how much CORE they stake relative to their BTC — the higher the ratio, the better the rewards.

Maximum tier ratios (CORE:BTC):

- Satoshi Tier (Highest Rate): 34,000:1

- Super Tier: 12,750:1

- Boost Tier: 4,250:1

The more CORE you stake per BTC, the higher your tier, and the more rewards you get. You can see your tier and estimated yield directly in the staking dashboard before confirming the stake. These thresholds adjust over time to keep the system fair and balanced.

What Is Dual Staking?

Dual staking lets you stake both BTC and CORE together to get rewards in CORE. Here’s how it works: your BTC gets locked on the Bitcoin network for a set period, and your CORE is delegated to a validator on the Core blockchain like Everstake. You keep full control over both assets, while they stay in your wallets.

The more CORE you stake per BTC, the higher your reward tier. Higher tiers (like Super or Satoshi) give you a better reward. For example, staking 1 BTC with 12,750 CORE puts you in the Super Tier, getting more than just staking BTC alone.

This system rewards long-term holders, supports the network, and makes it easy to get with your BTC without moving it to another chain. Stake both, and your rewards scale up.

How to Dual Stake on Core

Step 1: Visit the Staking Dashboard

Go to the Core DAO page and click Stake Now.

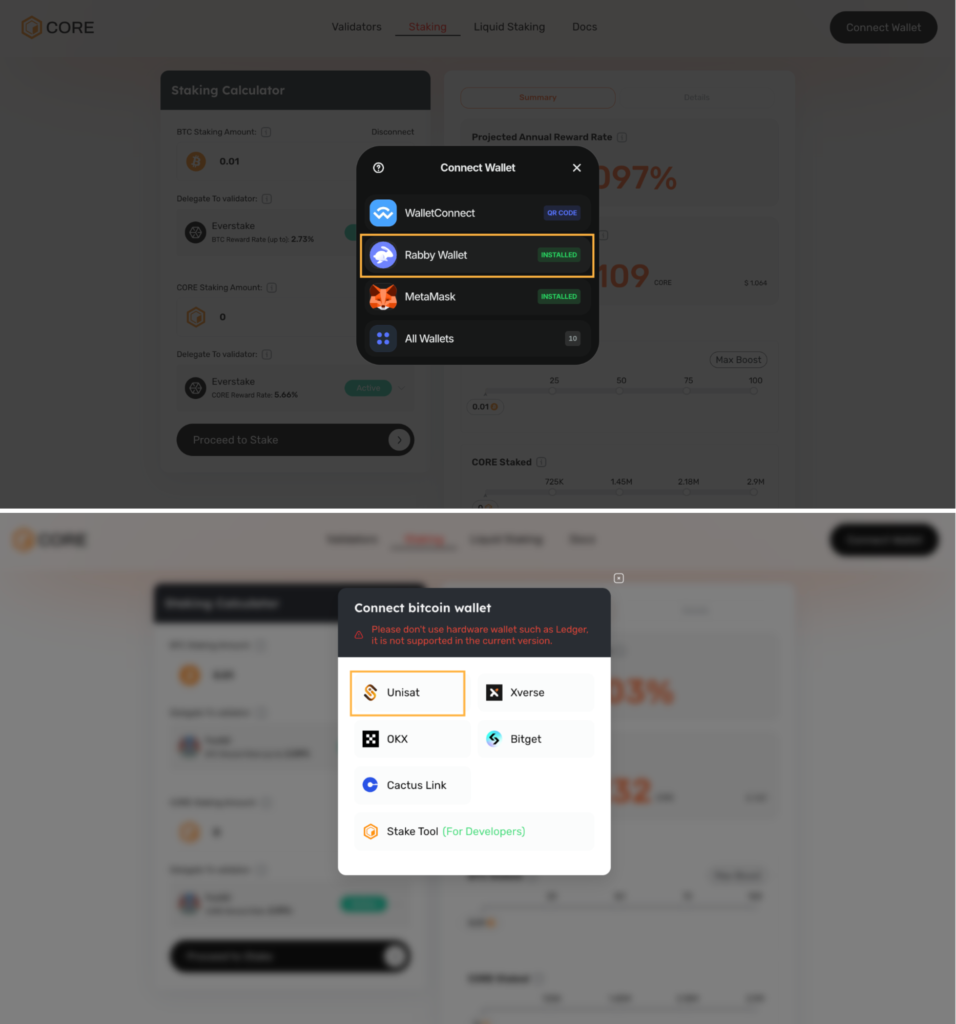

Step 2: Connect Your Wallets

Click on the Connect Wallet button.

To start staking, you need two wallets. In this guide, we will proceed with these two:

- Rabby Wallet for CORE;

- Unisat Wallet for BTC.

Choose them from the list and approve the connection.

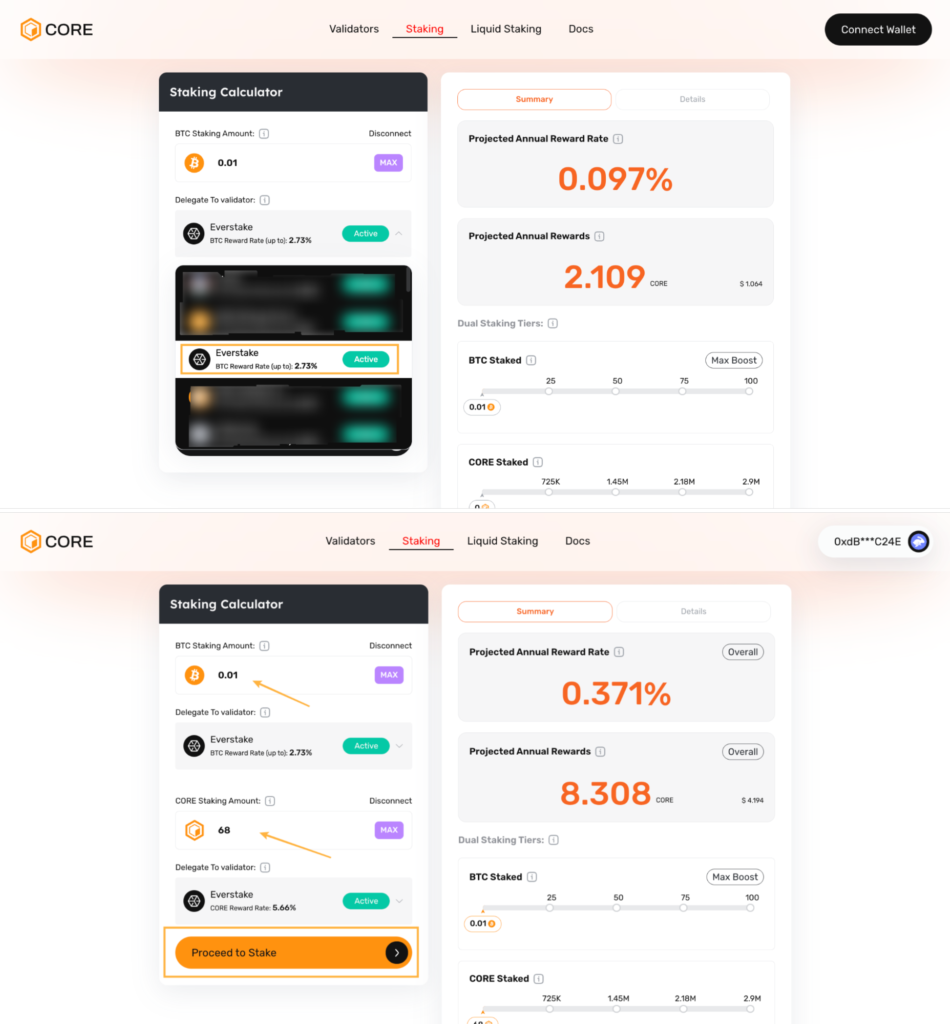

Step 3: Choose a Validator and Enter Stake Amounts

Select Everstake from the validator list.

Enter the amount of:

- BTC (minimum 0.01 BTC)

- CORE (minimum 1 CORE)

Make sure you have a bit extra to cover network and transaction fees.

Click Proceed to Stake.

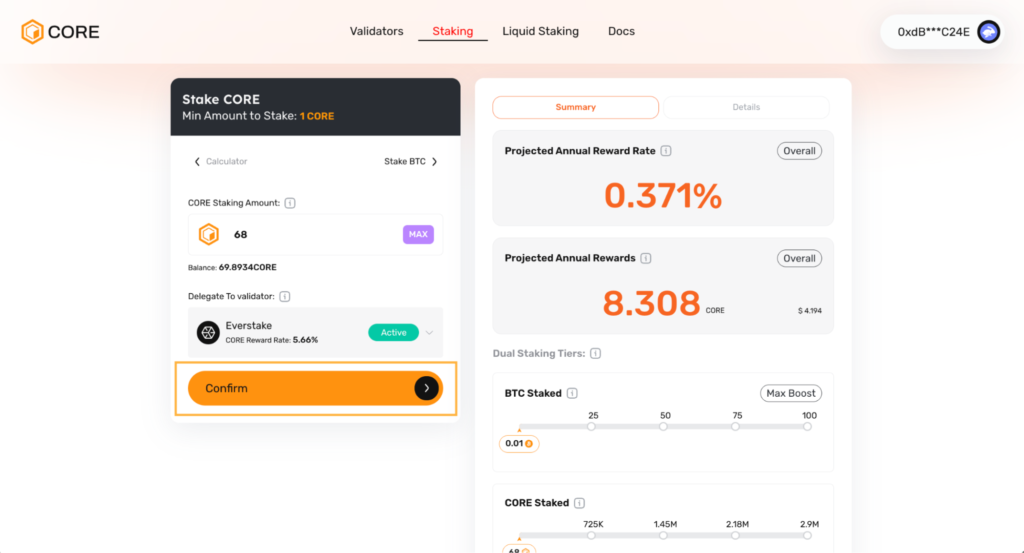

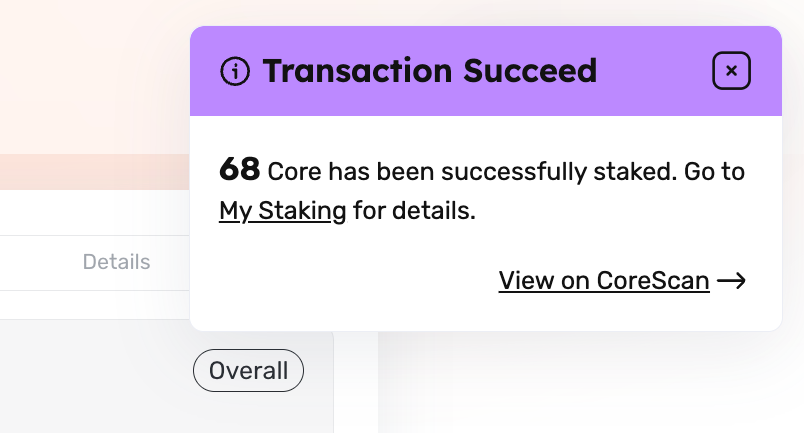

Step 4: Stake CORE

You’ll first confirm CORE staking.

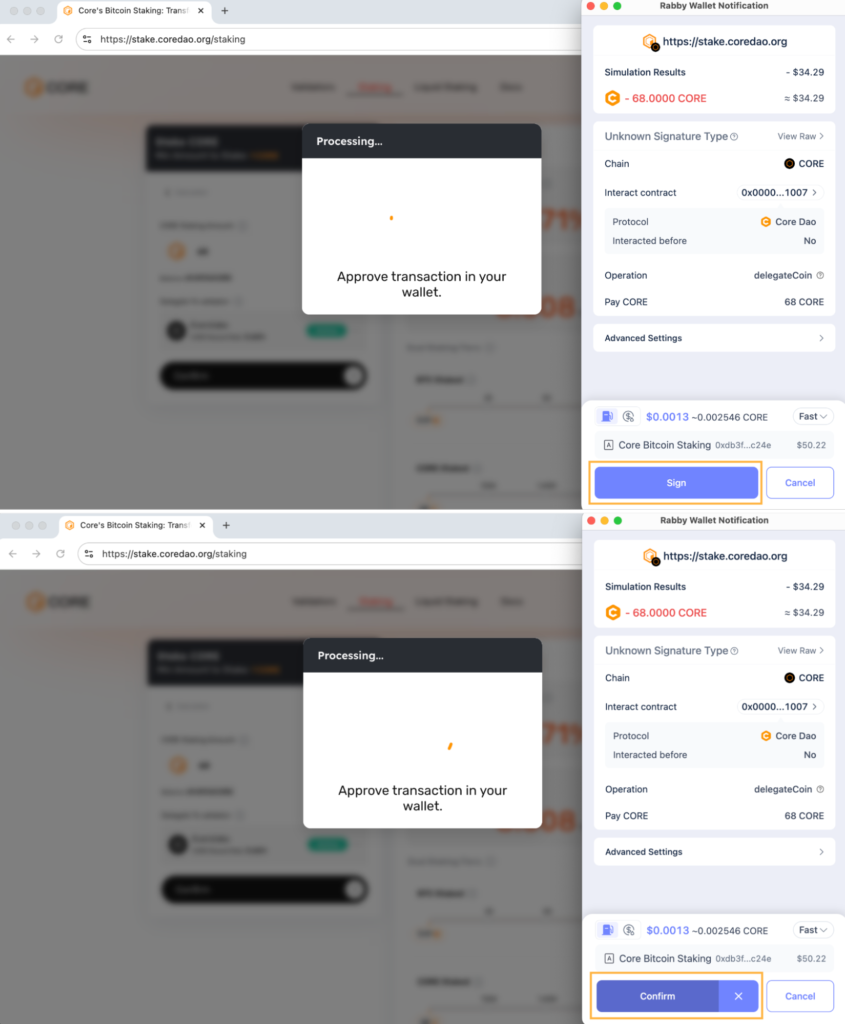

Sign the transaction in your Rabby wallet.

You’ve successfully staked CORE! You can view your transaction on CoreScan.

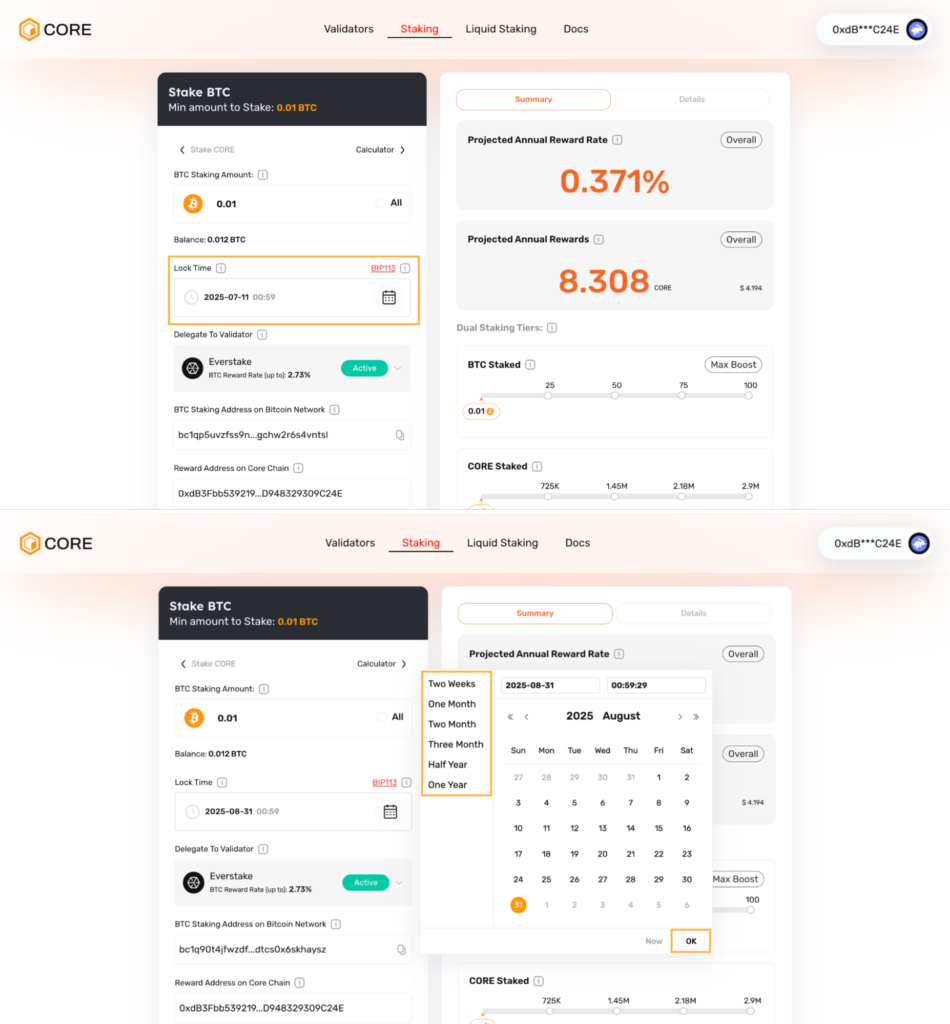

Step 5: Stake BTC

Set your BTC staking amount and choose the Lock Time (minimum 5 days).

Lock Time is the duration after which your staked BTC will be available for withdrawal again.

Confirm it by clicking OK.

Choose your transaction speed: Slow, Normal, Fast, or Custom. Then tap Confirm.

Note: Your BTC staking address and your original Bitcoin address are linked by the same private key, meaning you remain in full control.

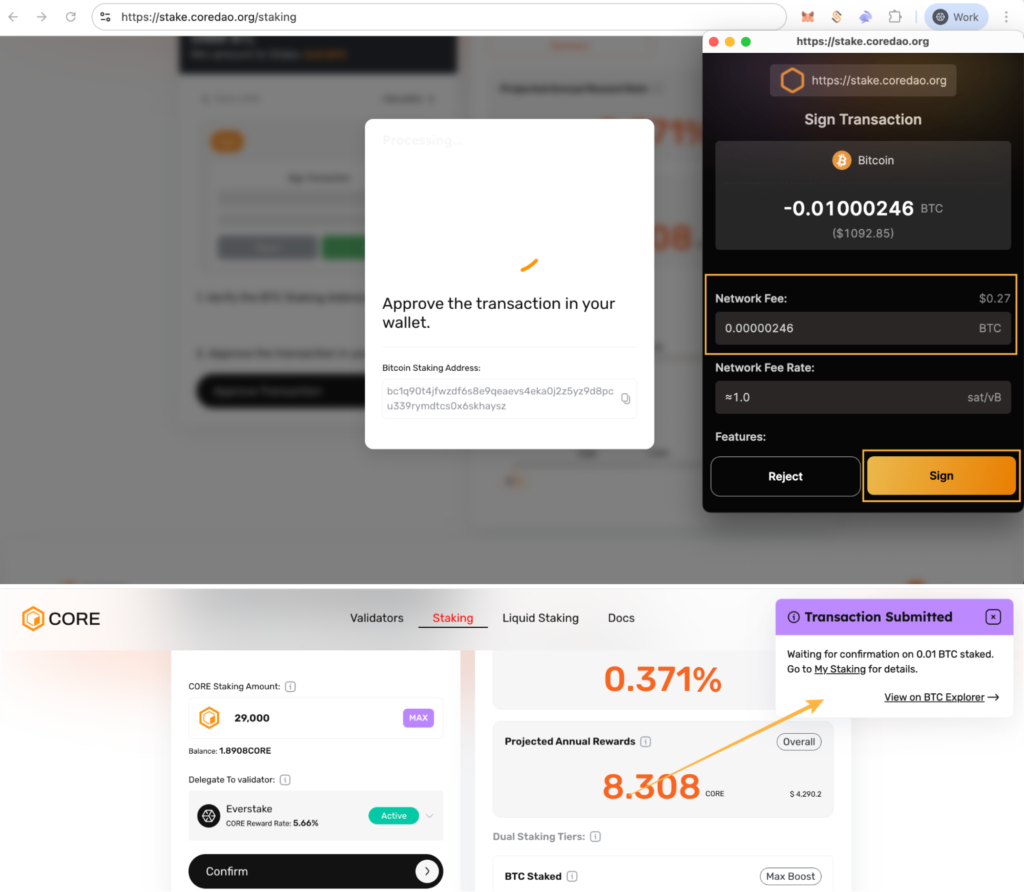

Click Approve Transaction.

If you want to know details about address verification, watch this guide video.

Sign the transaction in your BTC Wallet.

Done! You can check the transaction on a Bitcoin explorer.

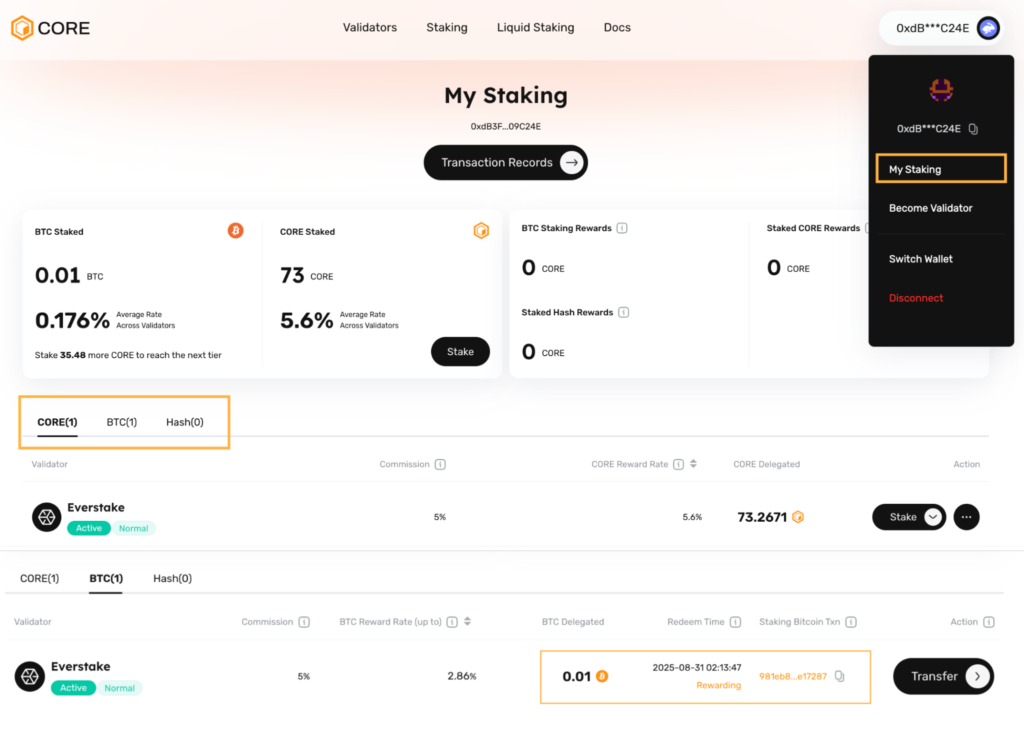

Check Your Staking Activity

Go to the My Staking section in the dashboard. From here, you can:

- Claim CORE rewards after the lockup ends;

- Unstake or transfer your CORE/BTC;

- Redelegate BTC to another lock period;

- Track all your active stakes.

Conclusion

Core’s dual staking system brings together the best of two worlds: the stability of Bitcoin and the innovation of the Core blockchain. Dual staking gives you the opportunity to get rewards in a secure and decentralized way. Just follow the steps, pick a trusted validator like Everstake, and put your assets to work.

Stake with Everstake | Follow us on X | Connect with us on Discord

FAQs

Do I need to move my BTC to another network for staking?

No. Your BTC stays on the Bitcoin blockchain and is locked using a native time-lock (CLTV). You don’t bridge or wrap your BTC.

Who controls my BTC after I stake it?

You do. You keep full control. Your BTC never leaves your wallet, and no one else can access it. The private key that controls your Bitcoin wallet also controls the BTC staking address.

How is Bitcoin staking in Core secure if assets stay in your wallet?

Core’s self-custodial staking model lets you lock BTC directly on the Bitcoin blockchain, no bridges, smart contracts, or third parties. Since your funds never leave your wallet, you rely entirely on Bitcoin’s native security.

Does Core hold or move my BTC during staking?

No. Your BTC stays locked on the Bitcoin network under your full control. Core validators don’t hold your funds, they only read Bitcoin transactions through relayers and confirm valid staking actions to issue CORE rewards.

What if the Core blockchain or validators go offline?

Your Bitcoin remains untouched. Since BTC stays on the Bitcoin network, not on Core, any network issues won’t affect your ability to access funds after the lock period ends.

Why are short BTC lock times risky or less reliable?

If you pick a short lock period (like 10 minutes), your transaction might not get confirmed in time due to Bitcoin’s block intervals and congestion. To avoid failed staking, it’s safer to choose a longer lock duration (at least 5 days).

Can I cancel or withdraw my BTC before the Lock Time ends?

No. Once you lock your BTC for staking, it cannot be moved or spent until the Lock Time expires. Select your locking period thoughtfully, considering your investment objectives and risk tolerance. Starting with shorter locking periods can help you become familiar with the process before committing to longer durations.

What happens after the Lock Time ends?

You can redeem your BTC, or redelegate it for a new lock period. You can also claim any accumulated CORE rewards.

How do I check my staking status and rewards?Go to the My Staking section on Core DAO to view active stakes, claim rewards, and manage your delegations.

***

Everstake is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services, or take custody of, or otherwise hold or manage, customer assets. Everstake does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency, or associated funds. Everstake’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.