The ABCs of Crypto

Crypto Validators Explained in Depth: The Core of Proof-of-Stake Networks

Validators are the core operators of Proof-of-Stake blockchains. This guide explains how they work, how they differ from delegators, and why they are critical to network security.

DEC 05, 2025

Table of Contents

TL;DR

The Backbone of PoS Networks

What Is a Validator in Crypto?

How Validators Work in Proof-of-Stake

The Role of Validators in Blockchain Security

Validator vs Delegator: What’s the Difference?

Requirements to Become a Validator

Rewards and Risks of Running a Validator

Why Validators Matter for Decentralization

Everstake as a Trusted Validator Example

Conclusion

Share with your network

TL;DR

A validator is a network operator in a Proof-of-Stake blockchain that verifies transactions, produces blocks, and enforces consensus rules. Validators secure the network through staked collateral, where correct behavior is incentivized, and violations are penalized through slashing.

Blockchain networks can’t function on trust alone; they rely on participants who verify every transaction and keep the system honest. In Proof-of-Stake (PoS) ecosystems, these participants are known as validators. They’re the ones who confirm blocks, maintain consensus, and make sure no one cheats the network. Without them, even the most advanced blockchain would be nothing more than a collection of unverified data.

In this article, we’ll break down what validators actually do, how they’re chosen, and why they’re central to the security and decentralization of PoS systems. You’ll also learn how validators differ from delegators, what it takes to run a node, and what risks and rewards come with it. By the end, you’ll have a clear picture of what “being a validator” really means.

The Backbone of PoS Networks

The shift from Proof-of-Work (PoW) to Proof-of-Stake was a rethinking of how blockchains achieve consensus. PoS networks replaced energy-intensive mining with a system built on trust, stake, and responsibility. Instead of solving puzzles, participants lock up tokens to prove their commitment to the network’s integrity.

At the heart of this model are validators: the entities responsible for verifying transactions, proposing new blocks, and ensuring that every entry in the ledger is legitimate. In practical terms, validators are participants who secure the network by validating transactions and creating new blocks. They are both the backbone and the safeguard of PoS systems, making decentralization possible without the wastefulness of traditional mining.

What Is a Validator in Crypto?

A validator in crypto is a node that participates in consensus by verifying transactions and proposing new blocks in a Proof-of-Stake blockchain. In other words, it’s a network participant responsible for maintaining the ledger’s accuracy and up-to-date status. Validators don’t compete with each other through computational power; they get the right to create and confirm blocks based on the amount of tokens they’ve staked.

This is where the primary difference between validators and miners becomes apparent. In Proof-of-Work systems, such as Bitcoin, miners utilize specialized hardware to solve complex mathematical puzzles, consuming vast amounts of energy. In Proof-of-Stake, validators replace that process with economic commitment: they lock up tokens as collateral to prove their honesty. If they act maliciously or fail to perform their duties, a portion of their stake can be reduced as a penalty.

Staking, therefore, is what enables users to become validators. By depositing a certain amount of tokens, they can participate directly in securing the network. In most cases, the more tokens staked, the higher the chance of being selected to validate the next block. However, randomness is built into the system to ensure fairness and decentralization.

How Validators Work in Proof-of-Stake

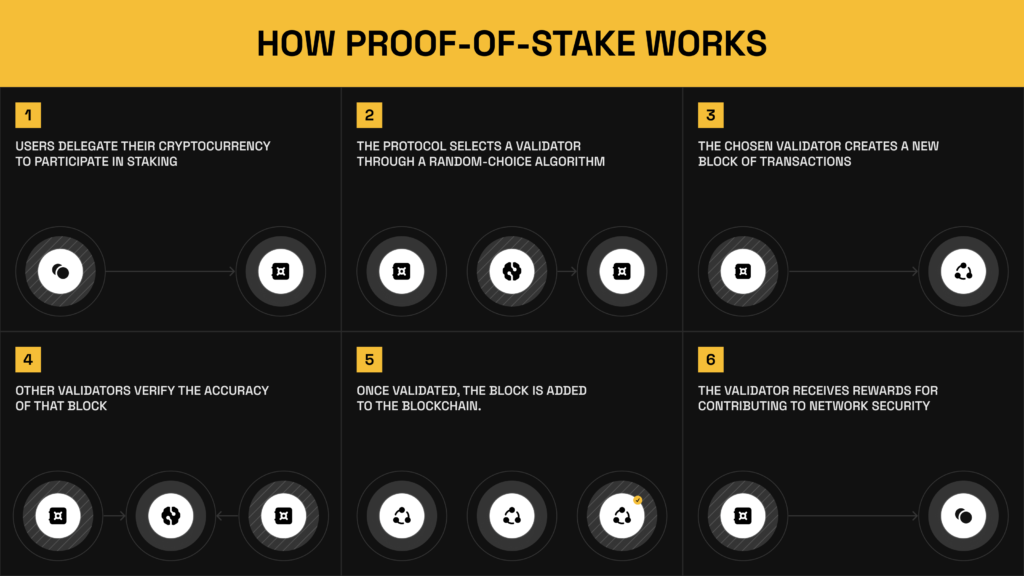

Proof-of-Stake replaces the energy-heavy competition of mining with a more elegant mechanism, one that relies on economic trust and randomized selection. Instead of solving cryptographic puzzles, validators are chosen to propose and confirm new blocks based on how much they’ve staked and how consistently they perform their duties.

When a validator is selected, it proposes a new block of transactions to be added to the blockchain. Other validators then verify that block, voting on its validity through digital signatures. Once a supermajority is reached, the block is finalized and becomes part of the chain. This multi-party verification process ensures that no single validator can unilaterally control consensus outcomes.

The exact mechanics differ across ecosystems:

- In Ethereum, validators are randomly selected from those who have staked 32 ETH, with others confirming their work through attestations.

- In Solana, a rotating schedule allows validators to take turns producing blocks at high speed.

- In Cosmos, validators are ranked by the size of their stake and reputation, ensuring that only reliable participants secure the hub.

Across all these and other systems, the core principle remains the same: validators don’t just add blocks, they embody the network’s integrity.

The Role of Validators in Blockchain Security

Validators are the first and last line of defense in Proof-of-Stake networks. Every time they confirm a transaction or approve a block, they reinforce the network’s trust layer, ensuring that no one can rewrite history, double-spend tokens, or manipulate the ledger. They keep the blockchain fair, transparent, and consistent for all participants.

When validators perform correctly, the network reaches consensus smoothly. However, when they act dishonestly or go offline for too long, penalties are imposed. Most PoS systems include a slashing mechanism—a built-in safeguard that deducts part of a validator’s staked assets if they attempt to validate conflicting blocks or ignore protocol rules. This creates strong economic incentives to behave responsibly and maintain high uptime.

In short, validators maintain the network’s trustworthiness. Their work replaces the brute-force security of Proof-of-Work with economic alignment, where honesty and reliability are rewarded, and negligence comes at a cost.

Validator vs Delegator: What’s the Difference?

Not everyone in a Proof-of-Stake network needs to run a validator node. Many users choose to delegate their tokens instead. Both validators and delegators contribute to network security, but they do it in different ways.

Validators are the technical operators. They run full nodes, keep their infrastructure online 24/7, and actively participate in block production and validation. Their performance directly affects the network’s reliability, and their reputation grows with consistent uptime, accuracy, and community trust.

Delegators, on the other hand, are token holders who support validators by staking their assets with them. In return, they share a portion of the rewards got by that validator. Delegation allows users to participate in staking without handling the operational complexity or risk of running hardware themselves.

The relationship is mutually beneficial: validators gain more stake and therefore higher chances of being selected to produce blocks, while delegators get passive income for helping secure the chain. If a validator misbehaves, both sides share the risk, a reminder that choosing a reliable validator matters just as much as the amount staked.

In networks like Ethereum, delegation is typically done through staking pools such as Lido or Rocket Pool. In Cosmos or Solana, users can delegate directly from their wallets to validators like Everstake, with full control over which node they trust.

Requirements to Become a Validator

Becoming a validator isn’t as simple as clicking “stake.” It requires both a financial and technical commitment. Each network sets its own criteria, balancing accessibility with security, and those rules shape who can actually participate in consensus.

The first and most obvious requirement is the minimum stake.

For instance, Ethereum requires 32 ETH to activate a validator, whereas networks like Solana and Cosmos allow users to start with much smaller amounts. The logic is simple: a higher stake means more responsibility, since validators risk losing part of it if they break the rules.

At the same time, infrastructure providers have introduced solutions that lower technical entry barriers. For instance, Everstake enables Ethereum staking starting from 0.1 ETH through its non-custodial staking dashboard.

The second layer is technical readiness.

Validators must operate reliable hardware, typically a dedicated server with robust uptime, stable internet connectivity, and effective security measures. Even short downtimes can lead to missed rewards or minor penalties. Many validators run nodes on specialized infrastructure or partner with trusted providers to maintain near-perfect availability.

Finally, there’s operational discipline.

Validators need to keep their software up to date, monitor performance, and follow protocol upgrades closely. In decentralized systems, being a good validator means staying aligned with the network’s rules and reacting quickly to changes.

Running a validator is, in essence, a mix of responsibility and precision. It’s open to anyone in theory, but only those who treat it seriously can sustain it in practice.

Rewards and Risks of Running a Validator

Validators are rewarded for keeping their nodes online, validating blocks accurately, and following network rules. In most Proof-of-Stake systems, these rewards come from two main sources: newly issued tokens (inflation) and transaction fees paid by users. Over time, some networks also introduce extra incentives, such as priority fees or MEV (maximal extractable value) opportunities for high-performing validators.

However, staking rewards are never “free money”. Each validator operates under a clear trade-off between potential profit and operational risk. The most common threat is slashing, when a validator’s stake is partially confiscated for double-signing blocks, going offline too often, or violating consensus rules. While such penalties are rare, they exist to ensure accountability.

There are also infrastructure risks, like downtime from hardware failure, security breaches, or poor maintenance, that can reduce rewards or even cause losses. Running a validator means maintaining reliable uptime and constant monitoring.

Reliable validators balance these factors carefully, optimizing for consistent performance and transparency rather than chasing the highest rewards.

Why Validators Matter for Decentralization

Decentralization depends on how distributed the validators are. When block production and verification are handled by many independent participants instead of a few large entities, the network becomes more resilient, censorship-resistant, and transparent.

Each validator adds redundancy and trust to the system, verifying transactions, maintaining uptime, and ensuring no single actor can manipulate the chain. That’s why networks like Ethereum encourage client diversity, and ecosystems such as Solana or Cosmos promote staking across many validators.

Simply put, decentralization isn’t automatic. It’s built through the choices of those who run validators and those who delegate to them, keeping control of the network in the hands of its community.

Everstake as a Trusted Validator Example

Everstake is one of the largest global non-custodial staking providers, trusted by more than 1.6M users across 130+ Proof-of-Stake networks to date. Founded in 2018 by blockchain engineers, it has supported over $7 billion in staked assets for both institutional and retail clients.

The company operates with 99.98% uptime and has maintained zero material slashing events since inception. Its infrastructure meets the highest industry standards, holding SOC 2 Type II, ISO 27001:2022, and NIST CSF certifications, along with GDPR and CCPA compliance.

Through API-first architecture, distributed node deployments, and continuous infrastructure monitoring, Everstake provides staking infrastructure for wallets, custodians, exchanges, asset managers, and protocol ecosystems globally.

Conclusion

Validators are the quiet backbone of every Proof-of-Stake network. They keep transactions accurate, ensure consensus, and protect the system from manipulation, all without the energy costs of traditional mining. Their reliability defines how secure, efficient, and decentralized a blockchain truly is.

As staking grows and more networks adopt PoS, validators will remain central to this evolution. They don’t just confirm blocks; they sustain trust in a trustless environment. Whether run by individuals or large providers like Everstake, validators are what make decentralized finance possible, one block at a time.

***

All metrics displayed on the website, including without limitations value of staked assets, total number of active users, rewards rates, and networks supported, are historical figures and may not represent the actual real-time data.

Share with your network

Related Articles

The ABCs of Crypto

Infrastructure is Trust: Validators in Agent-Native Economies

The digital economy is entering the era of agent-centric operations where autonomous AI agents manage assets, execute transactions, and coordinate workflows on-chain, making network reliability and validator uptime critical. In this emerging environment, enterprise-grade validator infrastructure becomes the foundational layer that supports secure, high-volume machine-to-machine commerce and agentic blockchain activity.

MAR 02, 2026

The ABCs of Crypto

web3 infrastructure

Enterprise Staking-as-a-Service: Secure, Non-Custodial Infrastructure for Institutions

Institutional Staking-as-a-Service is a non-custodial infrastructure solution that allows organizations to participate in Proof-of-Stake (PoS) consensus and earn protocol-native rewards while offloading the technical burden of validator management.

FEB 26, 2026

The ABCs of Crypto

Institutional vs Retail Staking: Key Differences

A clear breakdown of how institutions and individual users approach staking, and why their risks, requirements, and responsibilities differ.

DEC 01, 2025

Disclaimer

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users, but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services, or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency, or associated funds. Everstake, Inc., or any of its affiliates, providing technology services that allow a user to stake digital assets, does not endorse or recommend any digital assets. Users are fully and solely responsible for evaluating whether to stake digital assets.

Sign Up for

Our Newsletter

By submitting this form, you are acknowledging that you have read and agree to our Privacy Notice, which details how we collect and use your information.