Mitosis is an L1 blockchain that makes liquidity programmable by tokenizing LP positions and enabling composable liquidity markets via its EOL and Matrix VLFs. Mitosis serves as a seamless distribution channel for on-chain capital deployment.

In this guide, you will learn Mitosis and MITO, why staking matters, and how to delegate MITO tokens step-by-step using Everstake as your validator.

What is Mitosis and MITO?

Mitosis is a network for Programmable Liquidity that makes liquidity programmable and interoperable across different networks. Instead of locking deposits and making them inactive, Mitosis allows users to place assets into Vaults and receive Hub Assets on the Mitosis chain.

These Hub Assets can then be used in community-driven liquidity allocation through Ecosystem-Owned Liquidity (EOL) or in predefined liquidity campaigns known as Matrix, making liquidity flexible, transparent, and reusable across ecosystems.

MITO, its native token, plays a central role in this design. It is used to pay transaction fees, participate in governance decisions, and secure the protocol by being delegated to validators. In this way, MITO supports both the technical operations and the coordination of the Mitosis ecosystem, ensuring that its liquidity and governance mechanisms work together sustainably.

Why Stake MITO?

Staking MITO strengthens the Mitosis network by supporting validator operations. Delegating tokens helps maintain decentralization, ensures network reliability, and allows participants to contribute to the protocol’s growth actively.

By choosing a validator such as Everstake, users benefit from professional infrastructure and transparent participation in securing the blockchain.

Step-by-Step Guide to Staking MITO

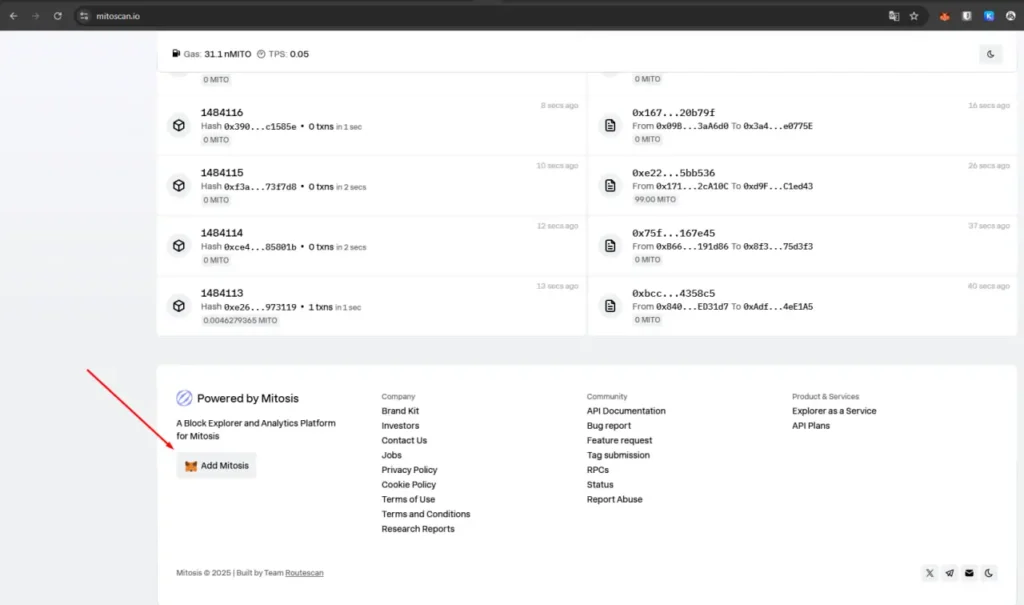

Step 1. Visit Mitoscan and use the available button to add the Mitosis network directly to your MetaMask wallet.

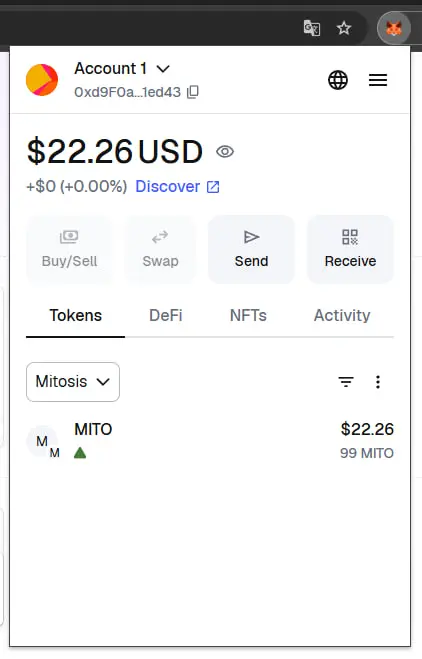

Step 2. Acquire MITO (or tMITO) tokens on supported platforms or transfer them into your MetaMask wallet.

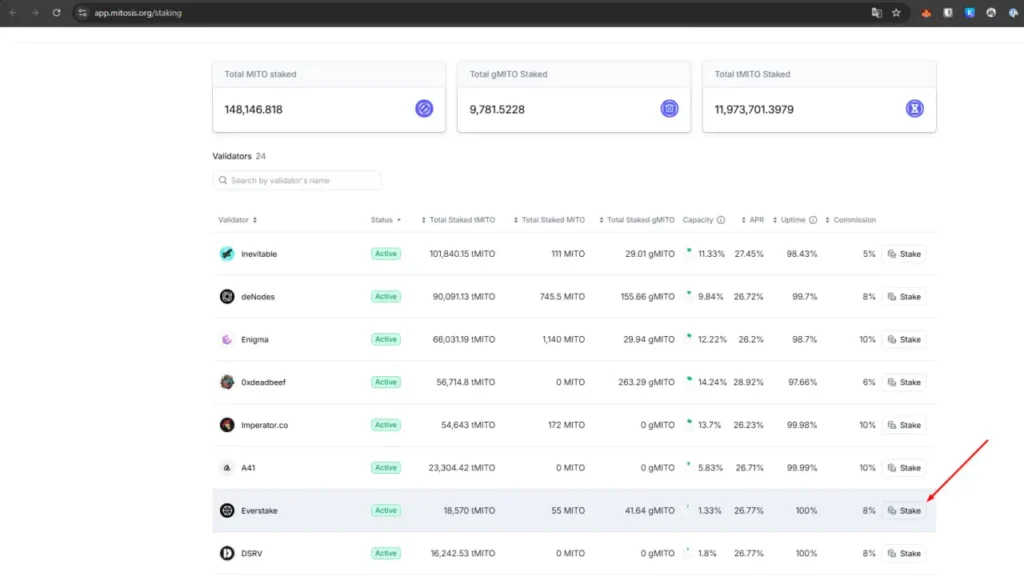

Step 3. Go to the Mitosis staking app, browse the validator list, find Everstake, and click Stake.

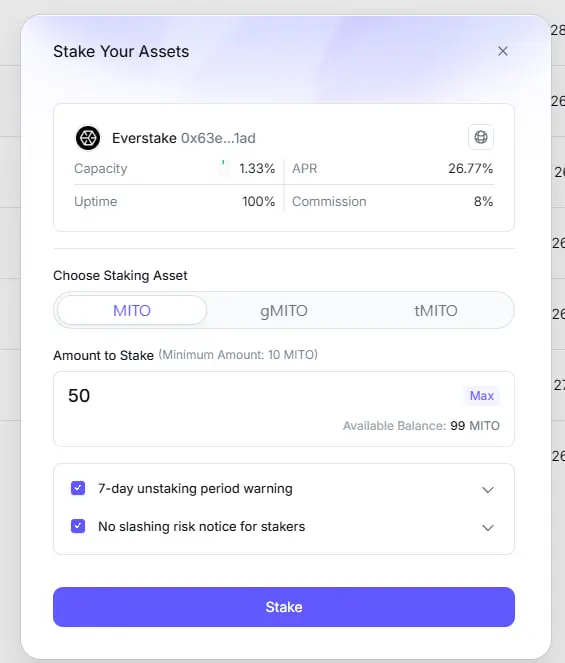

Step 4. Connect your MetaMask wallet, enter the number of MITO (or tMITO) tokens you want to delegate, and click on Stake.

Step 5. Once the delegation is confirmed, your MITO (or tMITO) starts contributing to the network’s security. You can check your staking details on the Staking Dashboard.

How to Claim Staking Rewards

Staking rewards on Mitosis are distributed on an epoch basis. Each epoch lasts 7 days, and rewards are normally calculated and distributed within several days after an epoch ends.

To receive your rewards, you need to manually claim gMITO on the My Staking page. The claimed gMITO can then be used according to the protocol’s design or managed from your wallet.

Key Staking Parameters:

- Unstaking Period: 7 Days

- gMITO Reward Distribution: Per Epoch

- gMITO → MITO Convert Period: 7 Days

- Epoch Period: 1 Epoch = 7 Days

- Minimum Staking/Unstaking Amount: 10 MITO (or tMITO)

- Redelegation Cooldown: 1 Day

Conclusion

Mitosis is an innovative protocol that focuses on interoperability, modularity, and scalability, with MITO as its native token powering governance, security, and utility. Staking MITO is a straightforward way to participate in the network’s stability and development. With Everstake, you can delegate to a trusted validator and support the ecosystem with confidence.

Stake with Everstake | Follow us on X | Connect with us on Discord

***

Everstake is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services, or take custody of, or otherwise hold or manage, customer assets. Everstake does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency, or associated funds. Everstake’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.