To understand how SWQoS works, imagine a subway platform at rush hour. The system runs efficiently, but when demand surges, everyone tries to board at once, and not every train can take everyone immediately. That’s similar to how public RPCs in Solana operate during peak activity: a sudden influx of requests competing for limited throughput.

SWQoS introduces order to that process. By prioritizing requests based on validator stake, it ensures the network remains predictable and responsive even under heavy load.

In this article, we’ll explore what makes SWQoS the best approach to Solana RPC access, how it works, and how Everstake scales this technology across the Solana ecosystem.

What Is SWQoS?

Stake-Weighted Quality of Service (SWQoS) is a mechanism that organizes how Solana prioritizes network traffic. In simple terms, it assigns priority to RPC requests based on the stake of the validator sending them. Validators with more stake, and therefore a higher contribution to network security, receive proportionally greater bandwidth and reliability.

This system replaces the previous “first-come, first-served” approach, where all requests competed equally regardless of their importance. With SWQoS, transactions are no longer part of a single congested flow. Instead, they’re processed in clear, weighted lanes, keeping the network fair, efficient, and stable even during heavy load.

As a result, SWQoS has quickly become recognized as the best Stake-Weighted QoS solution for maintaining consistent RPC performance on Solana.

Why Solana Needs Quality-of-Service RPC

Solana has a reputation for speed, but even the quickest elevator will lag if all buttons are pressed at once. This is what happens during token launches or NFT drops: transaction flow spikes, and public RPCs cannot handle the demand. The outcome—failed transactions, delays, and uncertainty—is particularly risky for institutional users, as even short-term network instability can disrupt automated operations, settlement workflows, or compliance reporting.

SWQoS eliminates this unpredictability. It distributes bandwidth proportionally to stake weight, ensuring that essential operations are processed first and mission-critical workloads maintain stability. This marks a major step toward a more predictable, scalable, and institutional-ready Solana experience.

Congestion on Solana RPCs

To understand the value of the best SWQoS models, it is necessary to take a closer look at the problem of network congestion. Solana’s high throughput is impressive, but public RPCs often become the weakest link when network activity spikes.

Public RPC bottlenecks and failed transactions

Public RPCs are a shared resource. They work well under normal conditions, but under load, they quickly become unreliable. This leads to:

- High failure rates (transactions do not reach confirmation).

- Unpredictable performance (from fast responses to critical delays).

- Lack of guarantees (important requests compete with any others).

For institutional or large applications, such uncertainty is no longer a minor inconvenience but a risk that blocks operations and makes it impossible to adhere to standards.

How SWQoS Solana RPC Works

SWQoS makes Solana’s RPC access predictable and transparent. The logic is simple: priority is determined by stake weight, and infrastructure enforces that rule.

Direct RPC connection

Clients are directly connected to the RPC infrastructure SWQoS provides, which uses a stake-based prioritization approach. Since requests are regularly delayed or dropped as traffic increases, this avoids the unpredictability of public endpoints.

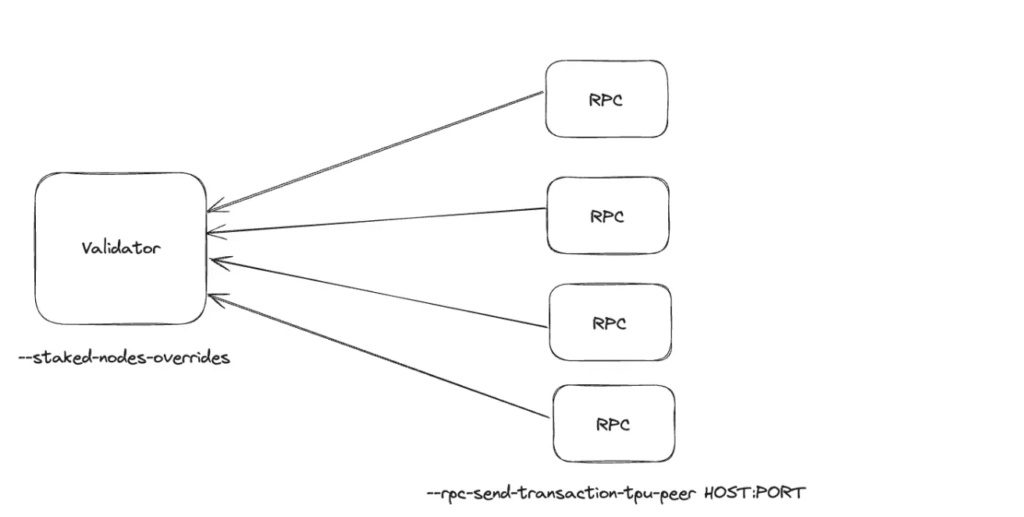

The diagram below shows how RPC nodes peer with a validator in the SWQoS model. Rather than simply competing on public endpoints, every RPC connection is established with clear stake-weight rules, and each request is routed with predictable priority.

Virtual stake assignment

A central feature of SWQoS is virtual stake. Institutions aren’t required to run their own validator to enjoy stake-weighted access. Rather, they can be assigned a virtual stake value that determines their position in the queue. This makes the system accessible, while keeping the rules transparent.

Priority routing & deterministic execution

Requests are routed according to their stake weight. That means critical operations don’t get stuck competing on equal terms with every other transaction on the network. That makes the order of execution clear and consistent, an important aspect to have for teams that require reliability.

SLA-backed throughput and uptime

Unlike public RPCs, which work on a best-effort basis, SWQoS provides measurable guarantees. Institutions are given defined service levels for throughput and uptime, supported by monitoring and reporting. This assures teams that their RPC performance will hold steady even when the network is under heavy load.

Pricing Models & Access Tiers

SWQoS makes Solana’s RPC access predictable and transparent. The logic is simple: priority is determined by stake weight, and infrastructure enforces that rule.

Pay-as-you-go

The pay-as-you-go model provides flexibility for teams that wish to test SWQoS in the market without long-term commitments. Each transaction is billed one-off, beginning at 0.0005 SOL. As such, it’s most practical for pilots or low-volume use.

Base SWQoS

This tier guarantees stable access to a system by smaller banks and applications who need to perform on a reliable basis. Clients are guaranteed predictable throughput at a 100k SOL stake weight under most network scenarios.

Advanced SWQoS

At the 300k SOL level, the advanced ones secure higher priority routing and allocation of throughput for institutions. This level is for projects running at scale where you need to avoid interrupting during heavy traffic congestion.

Pro SWQoS

This pro tier is meant for big businesses and mission-critical services. It gives you maximum priority and capacity. By applying a 1M SOL stake weight, clients get access to the highest guarantees.

Custom enterprise packages

For institutions with unique needs — for greater throughput, compliance-related reporting, or bespoke SLAs — Everstake provides tailored package offerings. These are developed in partnership with enterprise teams to accomplish precise operational needs.

SWQoS vs Alternatives

Different RPC access models come with trade-offs. The best SWQoS solutions distinguish themselves through transparency, SLA-backed reliability, and fairness.

Public RPC: congestion & no guarantees

Public RPC is free and widely available but unpredictable. During peak days, congestion leads to failed transactions, long confirmation times, and no service guarantees. It can work for hobby projects, but in institutions, the risks of downtime are high.

Private RPC: limited & opaque

Private RPCs provide a measure of reliability as opposed to public endpoints but tend to be less transparent. While institutions sometimes pay for access, they are still left with no insight into how requests are prioritized or what service level guarantees they have.

SWQoS: SLA-backed stake-weighted fast lane

Combines accessibility with performance transparency. Requests are prioritized by stake weight, backed by SLAs, and monitored for uptime, creating the best Stake-Weighted QoS system for Solana institutions.

Helius SWQoS vs Everstake SWQoS

Helius also implemented SWQoS, showing how fast the model is gaining adoption. Everstake’s SWQoS, however, extends the concept with enterprise-grade reliability, certifications, and support.

This makes Everstake’s infrastructure one of the best SWQoS implementations available today—optimized for businesses requiring compliance, uptime, and scalability

Why Everstake

Deciding on an RPC provider isn’t just a question of access; it’s a matter of trust in the infrastructure behind it. Everstake brings years of experience as one of the industry’s largest validators, along with an integrated approach that combines technical expertise with compliance-grade standards.

Proven validator infrastructure

Everstake has operated Solana validators since the early days of the network and runs over 40,000 nodes across 80+ protocols. The infrastructure is built for scale, redundancy, and near-constant uptime, with over $7B staked across ecosystems. Companies collaborating with Everstake can now utilize the same backbone to protect some of the world’s largest PoS networks.

Enterprise certifications

Recognized standards support reliability. Everstake provides enterprise-grade certifications, including SOC 2 Type II, ISO 27001, NIST CSF & CPPA, which means the company’s operational processes and security practices adhere to global compliance standards. For institutions, this means they can rest assured that RPC services are high-speed and also backed by audited safeguards.

FAQ: SWQoS Explained

What is a virtual stake?

Virtual stake is a mechanism that assigns a stake weight to an institution even if it doesn’t operate its own validator. This allows organizations to benefit from prioritized RPC access without running complex infrastructure.

How does SWQoS compare to private RPC?

Private RPCs offer dedicated access, but they rarely come with transparency or guaranteed performance. SWQoS provides both clear rules based on stake weight and SLA-backed guarantees that define throughput and uptime.

What’s the SLA coverage?

Everstake’s SWQoS includes service-level agreements that cover both throughput and validator uptime. This ensures that performance metrics are not just promises, but measurable commitments.

Can institutions test before committing?

Yes. SWQoS supports flexible access models, including pay-as-you-go, so institutions can evaluate the system before moving to higher tiers or custom enterprise packages.

Why are “swqos solana” queries rising?

Searches for “swqos solana” are growing steadily, reflecting a trend where teams and companies are no longer satisfied with public RPC. The main benefits that SWQoS provides are the consistent throughput, transparent service-level expectations, and protection against congestion during network peaks. In other words, the market needs predictable access to RPC, and SWQoS provides the right solution.

***

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.