Key Insights & Takeaways

- 2025–2026 marks a transition to crypto maturity: Growth is now driven by institutions, real-world use cases, and regulated infrastructure rather than speculation.

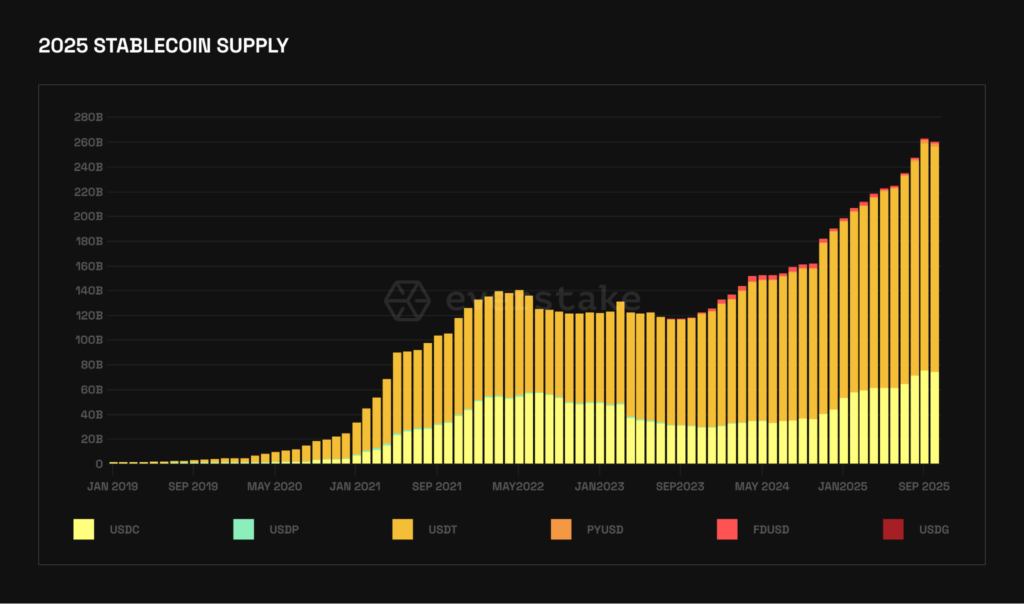

- Stablecoins have become the backbone of the ecosystem: An aggregate supply of over $280 billion, dominated by USDT and USDC, is now integrated into payments, trading, and institutional settlement.

- Tokenization has moved into active deployment: RWAs (bonds, credit, real estate) are now used by major regulated institutions, not just experimented with.

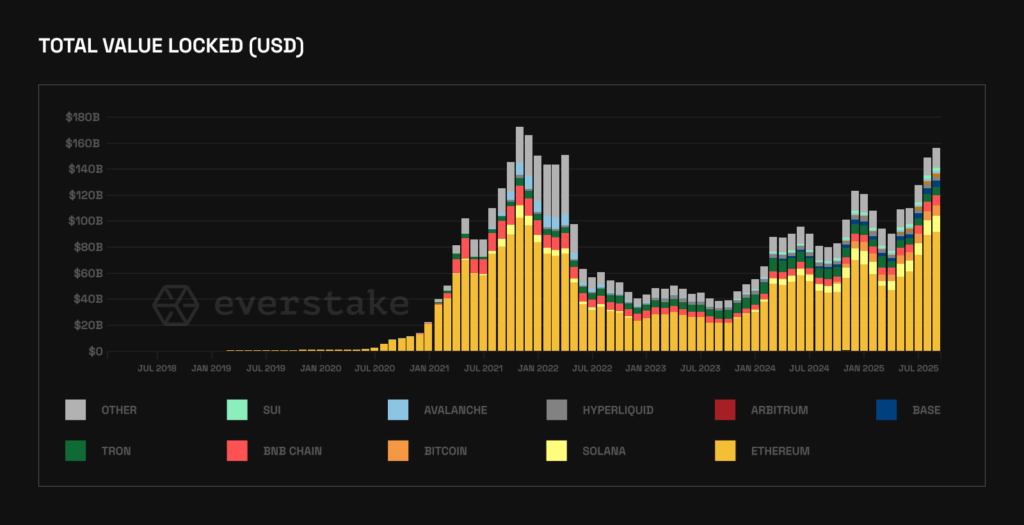

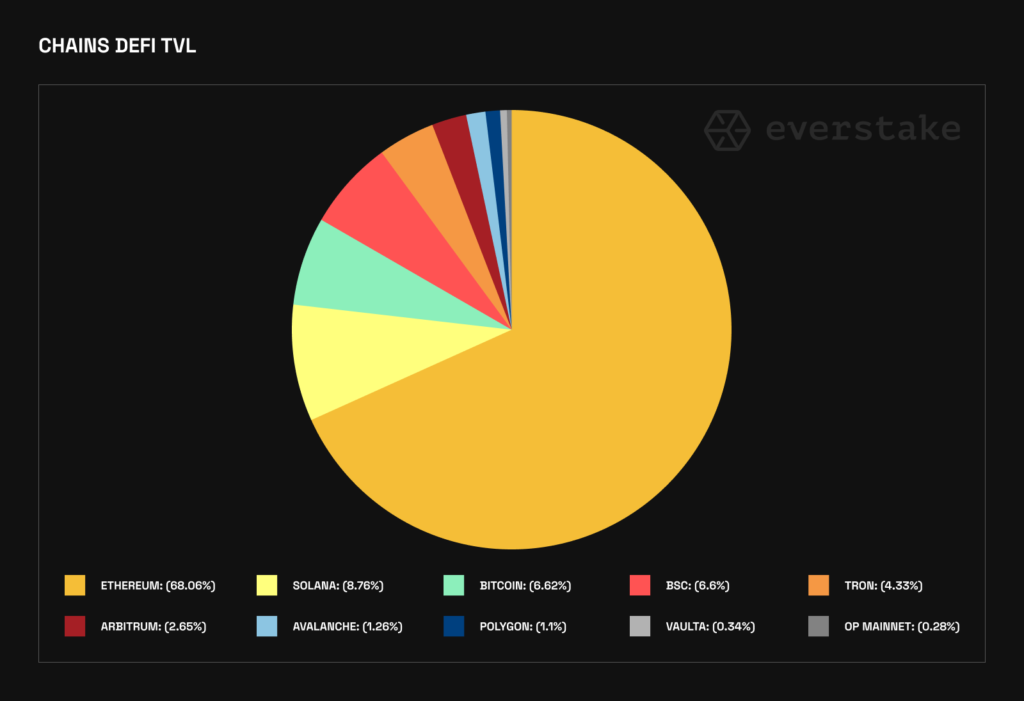

- Ethereum remains the DeFi center of gravity: ~68% of the total DeFi TVL, with liquid staking eliminating the trade-off between staking and DeFi participation.

- Solana is the fastest-growing alternative DeFi ecosystem: ~$9.19B TVL with strong activity in trading, staking, and liquid staking.

- Restaking hype collapsed due to weak economics: Sub-1% incremental rewards, excessive AVS proliferation, and unsustainable operator costs.

- Layer 2 ecosystems are consolidating around Ethereum: Former standalone chains are becoming L2s, and specialization is replacing raw scaling competition.

- Global adoption is shifting to the Global South: APAC, Latin America, and Africa show the fastest growth via payments and remittances.

- The staking market exceeds $245B with ~34.4% global staking ratio: Solana and Cardano lead in participation, while Ethereum and BNB face DeFi competition for capital.

The year 2025 proved to be a turning point for the crypto industry in many regards. The industry’s drift from speculation toward infrastructure, real-world use cases, and integration with traditional finance has become undeniable and is likely to gain even more steam in the coming year. In this feature, we take a look back at the most crucial trends of 2025 and look into what 2026 may have in store for the entire crypto industry.

What 2025 Brought

For most of 2025, the cryptocurrency market was in a mature bull phase, driven largely by institutional investors. Altcoins continued to trail, with capital flowing selectively rather than broadly.

Stablecoins

Stablecoins have become a core driver of this cycle. Clearer regulation in the U.S. and EU has boosted confidence, with frameworks like MiCA and proposed U.S. legislation accelerating institutional interest. As of October 2025, the stablecoin supply exceeded $280 billion, with over 99% pegged to the USD, and nearly the entire market is controlled by Tether and Circle.

A 2025 survey of institutional investors revealed that the vast majority already hold or plan to allocate to digital assets this year, with most expecting to increase their exposure. Over half intend to commit more than 5% of their portfolios to these assets. Stablecoins are also becoming a key institutional tool for liquidity and settlement, suggesting that digital assets are increasingly viewed as a strategic extension of traditional portfolios rather than a niche allocation.

Adoption

Public companies now hold a growing share of Bitcoin, with holdings surpassing one million BTC and expanding swiftly quarter over quarter. Ethereum has experienced an even sharper surge in institutional adoption, with most corporate ETH accumulation occurring within a single quarter. Staking rewards, ETF access, and the search for on-chain income are driving companies toward Ethereum, DeFi lending, and tokenized fixed-income products as traditional proceeds come under pressure.

Geography of Crypto

According to the global adoption report by Chainalysis, the growth of cryptocurrency is shifting toward emerging markets. The Asia-Pacific region has become the fastest-growing area, led by countries such as India, Vietnam, and Pakistan, with on-chain activity surging year over year.

Latin America and Sub-Saharan Africa are also expanding at a fast rate as crypto is increasingly used for remittances, payments, and everyday financial needs. While North America and Europe still dominate total transaction volume, their recent growth is being driven primarily by institutional adoption and regulatory clarity.

The Middle East and North Africa continue to expand at a steadier pace, with growth of around one-third and total crypto volumes exceeding $500 billion.

On a per-capita basis, Eastern Europe stands out as one of the most active crypto regions globally. Countries such as Ukraine, Moldova, and Georgia rank among the highest in user engagement, driven by economic instability, low trust in traditional banks, and a strong technical talent base. In these markets, crypto functions less as a speculative asset and more as a practical tool for savings, remittances, and cross-border transfers.

Infrastructure

At the infrastructure level, 2025 was defined by both concentration and specialization. Ethereum, Solana, and Bitcoin continue to dominate total value locked, but the Layer 1 scene is shifting away from one-size-fits-all designs. New networks are now increasingly built for specific use cases such as stablecoins, fintech infrastructure, and data availability. At the same time, Layer 2 adoption continues to grow as the primary scaling path for major ecosystems.

The most dynamic area of development is now stablecoin-focused Layer 1 blockchains. These networks are being purpose-built for regulated, high-volume financial activity, prioritizing low costs, fast settlement, and embedded compliance. Projects such as Circle’s Arc, Tempo developed jointly by Stripe and Paradigm, and Google’s GCUL illustrate this shift, each targeting payments, foreign exchange, enterprise settlement, and interoperability rather than full DeFi ecosystems from the outset.

This trend is driven by rising global demand for digital dollars, the need for large-scale, low-cost transaction infrastructure, and the growing importance of trust through audits, reserves, and regulatory integration. Success in this space is less about raw transaction speed and more about merchant adoption, banking connectivity, and seamless on- and off-ramps for fiat.

L2 Blockchains

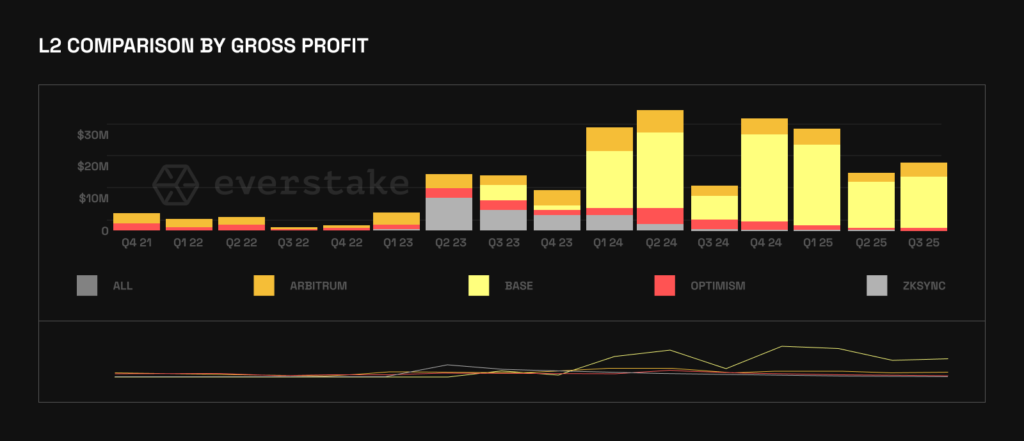

Layer 2 development is consolidating around Ethereum as projects increasingly prioritize stability over independence. Several networks that once operated as standalone chains, including Celo and Ronin transitioned to Ethereum-based Layer 2s (L2s) to benefit from shared security, deeper liquidity, and lower operational complexity.

At the same time, Layer 2s are moving toward functional specialization. Instead of competing solely on speed and fees, different networks started to offer clear focuses on payments, gaming, DeFi, and cross-chain interoperability. The result is a more connected, Ethereum-centered ecosystem in which L2s serve as practical scaling extensions for real-world use.

Among established leaders, Base, Arbitrum, and Optimism are the dominant players in the sector. Since early 2024, Base has consistently led in both revenue and transaction volume, outperforming its competitors significantly. Its growth was fueled by strong DeFi activity, an efficient fee structure, and deep integration with Coinbase’s ecosystem, which continues to drive user adoption and on-chain engagement.

Technological Challenges

One of the most notable shifts of the year has been the downfall of the restaking narrative. The core issue was a poor risk-reward balance: additional rewards remained below 1%, far too low to compensate for the added technical and economic risks. At the same time, the swift proliferation of AVSs and secondary networks proved excessive, with many lacking sustainable business models or real product-market fit. High operating costs and weak user demand ultimately pushed restaking from a major market theme into a niche experiment.

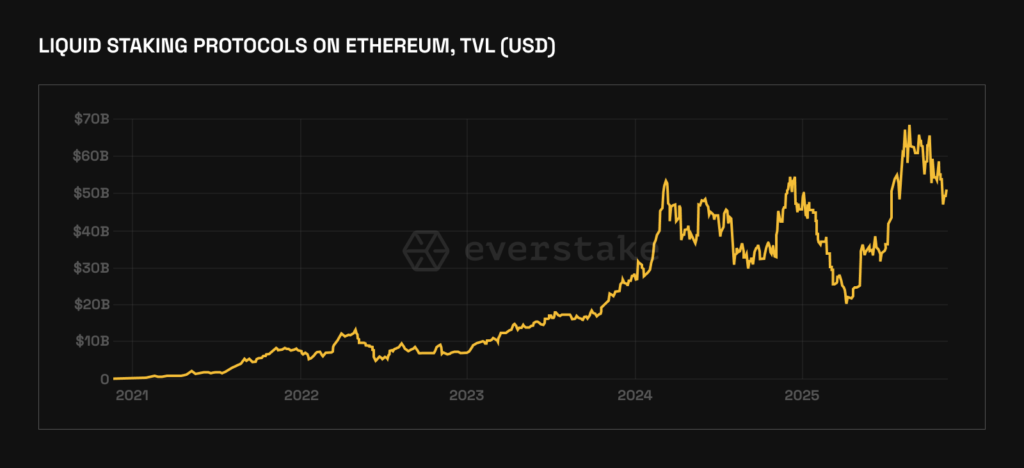

On the other hand, liquid staking has continued to expand and has consolidated itself as a foundational component of DeFi, supported by strong demand and clear utility. Zero-knowledge technology has also advanced, but it remains in its early stages of adoption. Despite its promise for scalability and privacy, high infrastructure costs and fragile economics mean zk systems still require further optimization before reaching mass use.

Meanwhile, real-world asset tokenization has become one of the strongest structural trends of the year. Government bonds, real estate, and institutional debt are increasingly moving on-chain, thus further strengthening the link between traditional finance and decentralized infrastructure.

What Went On in the Markets

As of December 2025, the leading Layer 1 networks by market capitalization were:

- Ethereum ($387 billion)

- BNB ($125 billion)

- Solana ($80 billion)

- Cardano ($16 billion)

BNB showed particularly strong recent growth. The global staking market across these and other chains now totals approximately $245 billion out of a circulating supply of $711 billion, representing a global staking ratio of about 34.4%. Everstake represents around 1.8% of the total global staking market.

Staking participation varies significantly by ecosystem. Solana and Cardano lead with the highest staking ratios. Ethereum and BNB, on the other hand, exhibit more moderate staking levels, largely because DeFi opportunities on these networks compete directly with native staking rewards. The gap between total and staked market capitalization indicates differences in user behavior, economic incentives, and the protocol’s maturity.

Chain | ETH | BNB | SOL | ADA |

| Total Market Cap | $387b | $125b | $80b | $16b |

| Staking Market Cap | $109b | $23,6b | $59b | $8,7b |

| Staked MC, % | 28.2% | 18,8% | 73% | 59% |

| Staking APR, % | ~3.1% | ~1% | ~6,2% | ~2,17% |

Overall, the data suggests the swift expansion of staking as a core element of proof-of-stake networks. User participation is shaped by a balance between reward opportunities, liquidity demands, and confidence in each ecosystem’s long-term outlook.

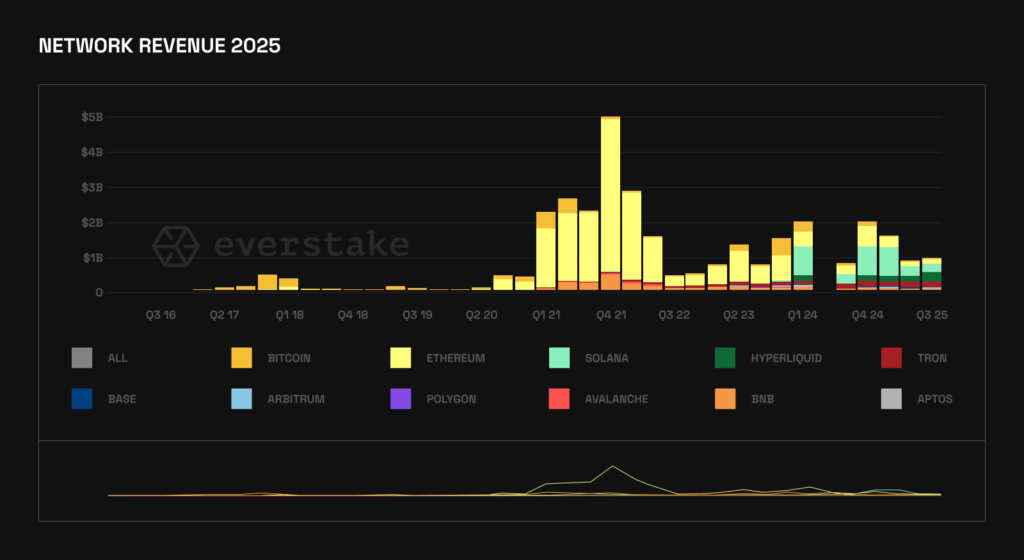

Over 2025, lending remained a foundational element of on-chain finance, while decentralized derivatives have become the fastest-growing segment of DeFi.

- In the second quarter of 2025, trading volumes in decentralized derivatives surged.

- Features such as 24/7 market access, transparency, and non-custodial execution are now standard expectations.

- At the same time, tokenization has moved decisively from experimentation to real-world deployment.

- The tokenized asset market has surpassed $33 billion in value, with the majority of new growth driven by regulated financial institutions rather than purely DeFi-native projects.

- Stablecoins continue to serve as the backbone of DeFi liquidity while expanding swiftly into traditional finance. Current innovations focus on programmability and regulatory alignment.

Ethereum vs Solana

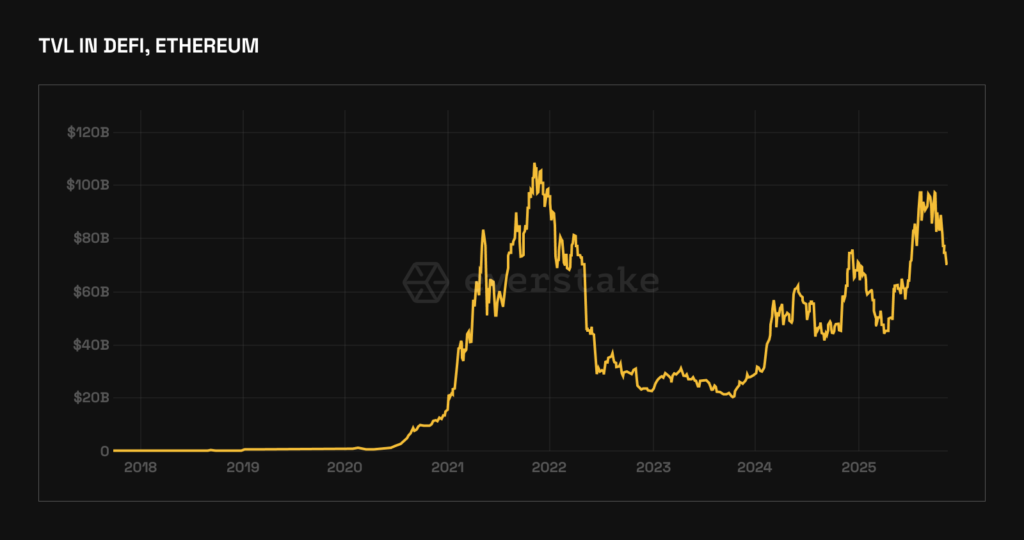

As of early December 2025, Ethereum remained the undisputed leader in DeFi, accounting for over two-thirds of total DeFi TVL with roughly $71 billion. The rise of liquid staking has removed the traditional trade-off between staking and DeFi participation, allowing ETH holders to receive staking rewards while maintaining full access to on-chain liquidity and financial opportunities. Among protocols, Lido led with $27.5 billion in TVL, followed closely by Aave at $27 billion. In comparison, EigenLayer ranked third with $13 billion.

The Solana DeFi ecosystem now holds nearly $9.19 billion in total value locked, with strong growth momentum that began in 2024 and has continued through 2025 (with some fluctuations driven by market corrections). Leading platforms such as Jupiter, Kamino, Jito, Sanctum, and Raydium account for the majority of activity.

Liquid staking remains one of the most important and resilient segments of DeFi across both Ethereum and Solana. On Ethereum, liquid staking TVL has reached approximately $44.8 billion. It is highly consolidated, with a small group of dominant protocols, including Lido, Binance Staked ETH, Rocket Pool, Liquid Collective, and StakeWise, controlling nearly 94% of the market. Since the start of 2025, the overall liquid staking market has grown by about 4%, with peak growth of up to 33% observed in August and September 2025.

On Solana, the liquid staking TVL comprised roughly $9.94 billion, exhibiting a similar concentration trend. The top protocols (Jito, Sanctum, Jupiter, and Binance Staked SOL) collectively control approximately 78% of the total liquid staking liquidity. Across both ecosystems, liquid staking has decisively become a core layer of DeFi.

Blockchain Economy and Governance

Over the past year, a trend toward economic policy adjustments has become apparent across several established blockchains, primarily focused on reducing inflation to improve market dynamics, limit selling pressure, and enhance token scarcity.

NEAR, for instance, lowered its inflation from 5% to 2.5%, while Tezos introduced adaptive issuance through its Quebec upgrade, linking inflation directly to the percentage of supply staked. As a result, the issuance of its native token XTZ has begun to contract under the new mechanism.

Solana’s SIMD-0228, SIMD-0411 proposals, aimed at significantly reducing and dynamizing inflation, sparked extensive debate within its ecosystem. Celestia similarly cut its inflation in half through successive governance proposals, bringing it down from 5% to 2.5%.

On the other hand, MultiversX proposed a shift from a capped-supply model to a tail-inflation framework of 9.47% annually, paired with burns and reinvestment. This move marked a substantial departure from its earlier deflationary vision.

While such bold economic reforms suggest the growing maturity of these ecosystems, reduced issuance does not consistently deliver the intended outcomes: lower inflation can materially weaken staking rewards for validators and stakers, potentially driving liquidity to more attractive networks and forcing validators to exit if price appreciation fails to offset the cuts.

Challenges for Emerging Projects

At the same time, weaknesses in tokenomics have become especially visible among emerging projects. A widening gap between economic theory and real-world implementation has produced poorly structured models that fail to support price stability or long-term staking incentives.

As mentioned earlier, in several restaking ecosystems, rewards have fallen below 1%, thus becoming clearly insufficient to attract either validators or liquidity providers. This deterioration is partly driven by market fatigue and an increasing tendency for teams to prioritize marketing narratives, such as “restaking” or “AI-driven consensus,” over well-thought-out economic design.

In many cases, token models are disclosed only after the token generation event or mainnet launch, leaving the early participants without a clear understanding of the project’s economic foundations.

Rather than applying lessons from earlier failures, teams often replicate known structural flaws. To compensate, weaker projects increasingly rely on buyback schemes or artificial reward boosts, producing short-lived liquidity inflows followed by sharp corrections.

Retail vs Institutional Players: A Difference in Behavior

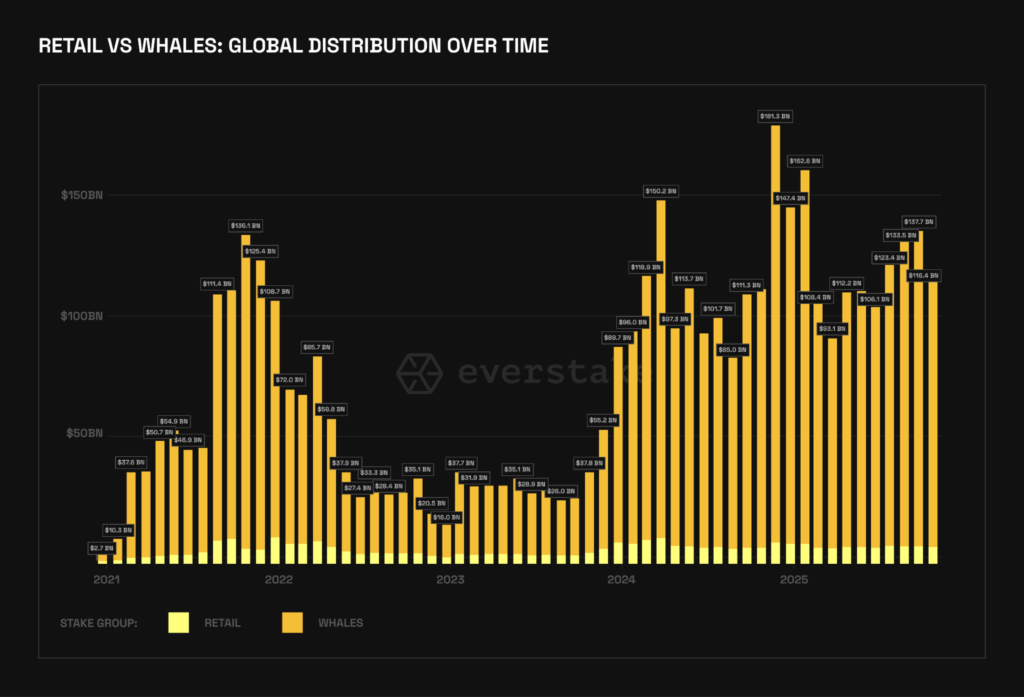

In 2025, the crypto market settled into a distinctly bi-fractured shape characteristic of traditional finance. On one side, unprecedented waves of institutional capital poured in through regulated, highly structured investment vehicles. On the other, retail players continued to energize the more speculative corners of the ecosystem.

Comparison of capital flows in 2025

| Segment | Retail | Institutions |

| Inflow channels | Direct purchase through CEXs, DEXs, Wallets, and P2P platforms | ETPs (dominant channel), Custodies, OTC desks |

| Scale | Stable, high inflow. Retail investors are steadily increasing the share of digital assets in their portfolios (on average, 5-20%) | Explosive growth. Total assets in crypto ETPs surpassed $ 175 billion. BlackRock’s IBIT alone accumulated tens of billions of AUM, demonstrating the most successful launch in history. |

| Preferred assets | Around 70% of retail investors hold cryptocurrencies beyond BTC and ETH, but mostly only 2-3 others (e.g., XRP, SOL, ADA) (source – Chainalysis: The 2025 Global Crypto Adoption Index) | Absolute dominance of BTC and ETH through spot ETFs. Growing interest in stablecoins and Real-World Assets. |

Retail participants adopted a diverse range of strategies: from buy-and-hold to day trading and savings plans. At the same time, they maintained a remarkable emotional resilience in the face of market swings. Their optimism remained unshaken, with many continuing to “buy the dip” and actively seek higher returns through on-chain experimentation.

Institutions, on the other hand, approached digital assets with long-term strategic intent. A large majority had already allocated or planned to allocate a portion of their portfolios to crypto in 2025, with many committing more than five percent of their assets under management.

This divide extended into trading behaviour. Institutional players have increasingly migrated to OTC venues, where trading volumes have grown more than twice as fast as on centralized exchanges.

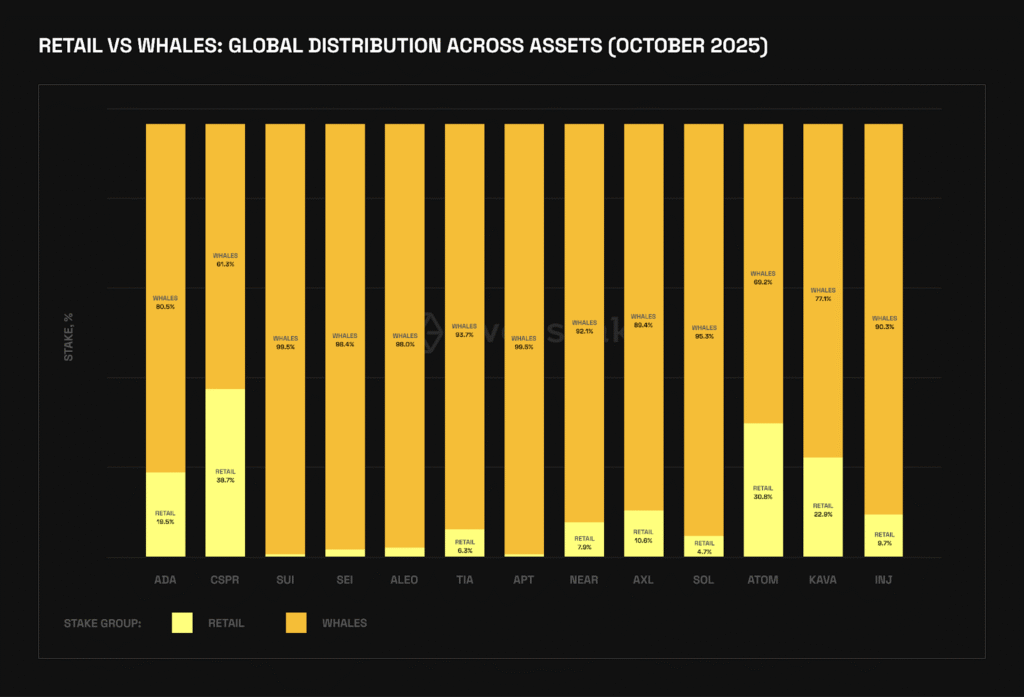

Even in staking, this contrast persisted. Whales continued to dominate the total amount staked across major blockchains, while retail users contributed only a modest share. The result was a market defined not by conflict, but by coexistence, with each side shaping the ecosystem through its own motives, tools, and risk appetites.

What Would 2026 Bring to Staking

General Trends

The staking industry is entering a phase of structural transformation shaped by macroeconomic pressure, rising competition, and protocol-level changes, which essentially makes it the biggest potential challenge of 2026. A central trend is reward compression, as staking returns decline across many ecosystems due to lower validator commissions, intensified competition, and reduced protocol inflation.

Many networks are reducing token inflation to strengthen long-term token economics and limit sell pressure, but this often results in lower rewards for validators and stakers. Without compensating mechanisms such as higher fee revenue or stronger on-chain demand, these policies can weaken validator profitability and, over time, increase centralization and security risks.

At the same time, competition among staking providers is intensifying, particularly as institutional participation grows. Validators are aggressively cutting commissions to capture market share and secure strategic partnerships. While this benefits delegators in the short term, it creates sustainability risks for the broader validator set, especially during periods of falling prices or reduced network activity. In a potential bear market, declining revenues could pressure infrastructure quality and network security.

Despite these challenges, competitive pressure is also accelerating efficiency and innovation. Validators are increasingly focused on automation, cost optimization, and service differentiation to remain viable in a low-rewards environment. In the long run, the strongest players will be those able to balance technical efficiency, sustainable economics, and trusted relationships with both protocols and delegators.

Moving Waves of the Economy

The blockchain industry is moving into a new stage of economic maturity. Its early phase was driven by experimentation, where launching a new Layer 1 with a staking model was often enough to attract users and capital. By 2026, however, this dynamic has shifted. Core infrastructure challenges, such as speed, scalability, and cost efficiency, have largely been addressed by established ecosystems, making it increasingly difficult for new Layer 1s (L1s) to offer truly differentiated value. At the same time, the proliferation of new chains continues to fragment liquidity and user activity, especially where reliable cross-chain infrastructure is lacking.

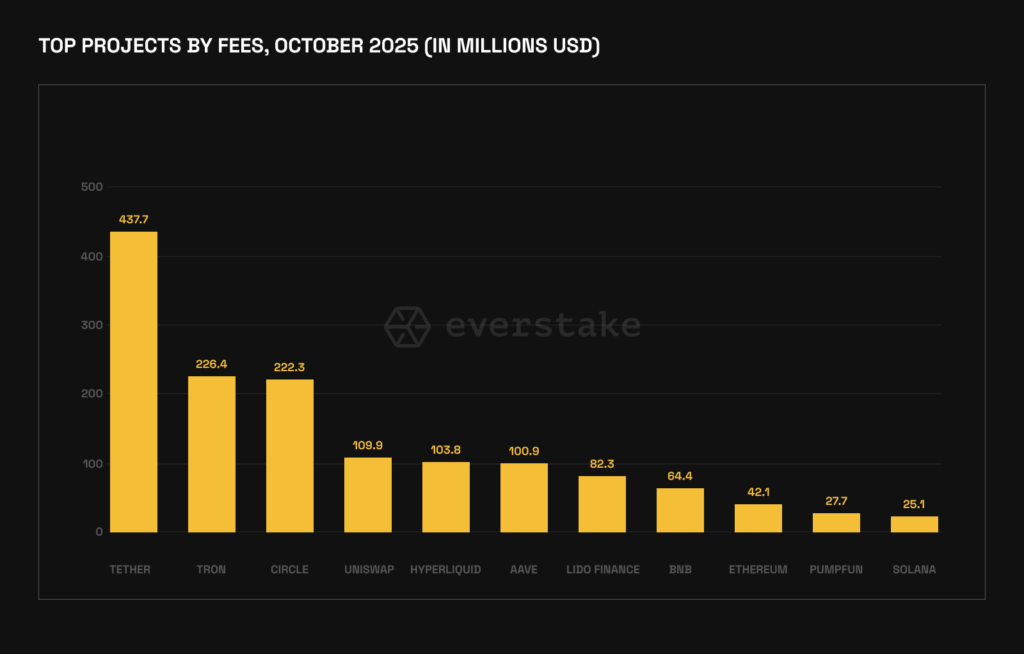

Economic value is now steadily migrating away from base layers toward applications and protocols built on top of them. In many cases, apps generate more revenue than the underlying chains, which suggests a structural reallocation of profitability within the blockchain stack. The chain itself is no longer the end product but the tooling layer for building services with real-world utility.

As a result, teams are shifting focus from launching new blockchains to developing products within existing ecosystems. Differentiation now comes from user experience, interoperability, and integration with traditional finance and real-world assets. A shift like this marks the beginning of a new blockchain phase, where sustainable success is driven by practical implementation, ecosystem collaboration, and real economic impact rather than by infrastructure novelty alone.

Final Thoughts

In 2026, the defining theme of the market is likely to be convergence: between DeFi and traditional finance, between blockchains and payment networks, and between institutional and retail participation. In this next phase, crypto’s success will be measured less by market cycles and more by how deeply it is embedded into the everyday mechanics of the global financial system.

Tokenized real-world assets are expected to expand well beyond treasuries into credit, funds, and private markets, turning blockchains into programmable financial rails rather than speculative venues. At the same time, Ethereum will remain the gravity center of DeFi, with Layer 2s continuing to absorb most user activity as specialization increases across payments, trading, and on-chain capital markets.

On the infrastructure side, competition will intensify through enhanced operational efficiency, improved interoperability, and increased regulatory readiness. The staking industry will have to adopt greater automation, consolidation, and institutional-grade service standards.

Only operators that can combine scale, cost efficiency, and trust will remain competitive.

Stake with Everstake | Follow us on X | Connect with us on Discord

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.