Sei Network is the fastest Layer-1 blockchain in the industry, delivering 400ms transaction finality, a parallelized EVM, and a robust infrastructure purpose-built for global digital asset markets. By combining Web2-level user experience with the security and trust guarantees of a decentralized network, Sei enables applications to operate at the scale and speed modern finance requires. With its high-throughput architecture and proven reliability, Sei is emerging as a preferred settlement layer for high-frequency trading, global payments, large consumer applications, and the evolving agentic economy.

In this article, we explore what Sei is and how it works, the Sei Giga upgrade and its multi-proposer architecture, the network’s role as high-performance rails, and the broader ecosystem that has grown around Sei. You will also learn what real-world use cases Sei unlocks, and how users can participate in the network through staking.

Why Sei Matters in Modern Digital Finance

The digital asset landscape increasingly requires the speed, reliability, and throughput associated with traditional financial systems. Applications such as trading engines, global payments, and agentic systems depend on infrastructure that can process large transaction volumes without congestion or latency fluctuations, requirements that many Layer-1 blockchains were not originally designed to meet.

Sei addresses these limitations with sub-400ms finality, a parallelized EVM for simultaneous execution, and an architecture built for high-frequency workloads. This enables deterministic, low-latency performance, allowing Sei to operate as a modern settlement layer for real-time financial applications, large consumer systems, and emerging automation use cases while maintaining decentralization and security.

Sei Network and How it Works?

Sei’s design is centred around delivering predictable, low-latency performance for applications that rely on fast execution and high throughput. Instead of optimizing for general-purpose workloads, Sei focuses on the requirements of markets, large-scale financial systems, and global consumer products operating at internet scale. Several foundational principles define how the network achieves this level of performance.

Instant Finality (400ms)

Sei achieves transaction finality in approximately 400 milliseconds, making it the fastest EVM Layer-1 blockchain currently available. This predictable finality ensures that once a transaction is confirmed, it is irrevocably settled, reducing settlement risk and enabling use cases that depend on immediate state updates. For users, this creates a Web2-like experience with consistent responsiveness even during periods of high network activity.

Parallelized EVM Execution

Unlike sequential EVM architectures, Sei processes transactions simultaneously through a parallelized execution engine. This approach eliminates traditional execution bottlenecks, allowing the network to scale throughput as demand increases. Parallel execution is essential for applications that generate high transaction volume, such as trading platforms, payment systems, and agentic applications, where delays or congestion can degrade user experience and limit operational capacity.

High Performance for Global Markets

Sei’s architecture is optimized to meet the performance expectations of modern financial markets and large consumer ecosystems. The network supports high-frequency workloads, sustained throughput under load, and deterministic execution times. This combination enables a wide range of applications, from trading infrastructure and global settlements to AI-driven automation and high-volume consumer interactions, all within a decentralized environment designed for reliability and long-term scalability.

Sei Giga: The Multi-Proposer Upgrade

The Sei Giga upgrade introduces a redesigned execution model that significantly increases the network’s throughput and efficiency. Its core innovation is a multi-proposer architecture, which allows multiple validators to generate execution traces in parallel, rather than relying on a single proposer. This approach removes traditional bottlenecks and enables Sei to scale for high-frequency transaction loads.

Multi-Proposer Architecture

Multiple validators can propose blocks simultaneously, and their execution traces are aggregated into a single block. This parallelism reduces contention, accelerates block production, and ensures consistent performance under increased network demand.

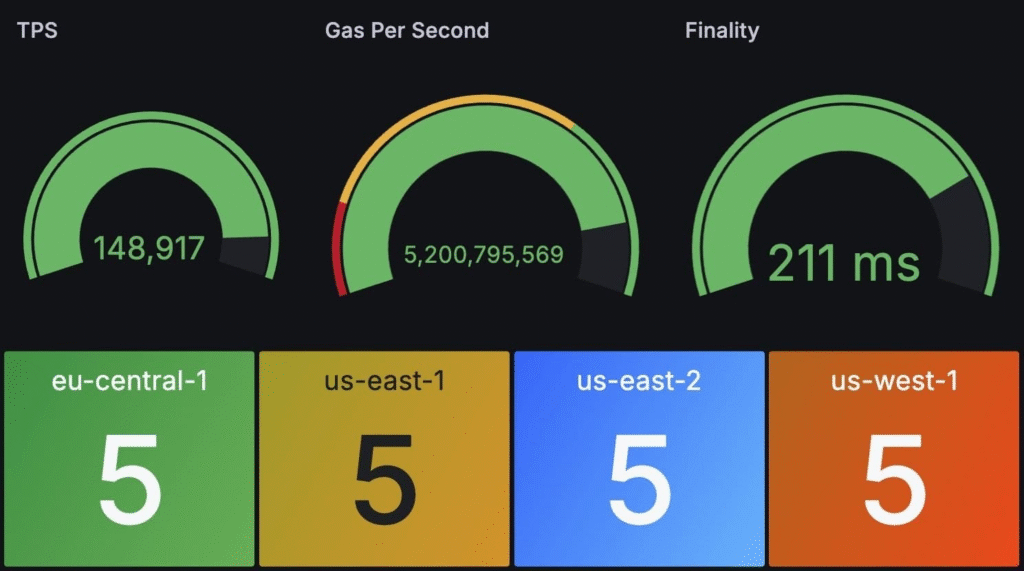

5 Gigagas per Second

Sei Giga supports up to 5 gigagas per second, enabling throughput levels of roughly 200,000 transactions per seconddepending on transaction type. This capacity reflects Sei’s ability to handle global-scale workloads without congestion.

Sub-400ms Finality at Scale

Despite the increased throughput, Sei maintains its defining feature: sub-400ms finality. This ensures deterministic settlement times for applications where speed and reliability are essential.

Sei’s Modular Architecture

Sei’s architecture separates execution, consensus, and storage into distinct layers, allowing each component to be optimized independently. This modular design improves system efficiency, enhances fault isolation, and enables the network to evolve without disrupting application performance.

Separation of Responsibilities

By decoupling execution, consensus, and storage, Sei can upgrade or refine one layer without affecting the others. This reduces complexity and supports targeted performance improvements as the ecosystem grows.

Efficient Protocol Upgrades

Modularity enables seamless, in-place protocol upgrades, critical for networks that support high-volume financial applications. Developers and users benefit from continuous improvements without downtime or disruptive migrations.

Long-Term Scalability

The layered design ensures Sei can incorporate new technologies, optimize performance, and support emerging use cases over time, providing a future-proof foundation for high-performance digital markets.

Twin-Turbo Consensus and Proven Network Reliability

Sei’s performance is reinforced by its Twin-Turbo consensus mechanism, designed to deliver low-latency finality and stable performance across a globally distributed validator set. This architecture ensures that the network remains responsive and secure, even as transaction volumes scale.

Global Validator Set with High Uptime

Sei’s validators have maintained 99.9% uptime since the mainnet launch, supporting continuous network availability and preventing disruptions. The distributed nature of the validator set enhances resilience against localized failures.

Consistent, Irreversible Finality

Once a block is finalized on Sei, it becomes irreversible. This deterministic settlement model is essential for applications involving financial transactions, risk-sensitive operations, or real-time execution environments.

Optimized for Low-Latency Workloads

Twin-Turbo consensus minimizes communication overhead and accelerates block propagation, contributing to Sei’s sub-400ms finality and ensuring predictable performance for high-frequency applications.

The Sei Ecosystem

The Sei ecosystem brings together applications, developers, and users operating on a high-performance Layer-1 optimized for instant settlement and large-scale transaction workloads. Its combination of EVM compatibility, fast finality, and parallel execution has supported rapid ecosystem growth and adoption.

#1 EVM Blockchain by Active Users

Sei hosts more than 80 million wallets and 200+ live applications, making it one of the most active EVM environments. Developers can deploy without modifying existing Ethereum-based code, significantly reducing integration time.

EVM Tooling with High-Performance Execution

Sei combines familiar Ethereum tooling with the execution speed typically associated with high-throughput chains. This enables developers to build or migrate applications without compromising on performance or user experience.

Applications Enabled by Sei

Sei’s architecture supports a wide range of use cases that rely on fast, reliable execution, including:

- market and execution platforms

- global payment networks

- agentic and automated systems

- consumer-scale applications requiring consistent low latency

By delivering predictable performance at scale, Sei provides a foundation for applications that must handle real-time workloads in decentralized environments.

Built for Global Finance, Trusted by Industry Leaders

Sei provides the performance and reliability required for modern financial infrastructure. Its consistent low-latency execution, modular design, and proven uptime make it suitable for systems where predictable settlement and operational continuity are critical. These characteristics have contributed to growing interest from organizations building large-scale financial and transactional applications.

High-Performance Infrastructure for Financial Markets

Sei’s sub-400ms finality and parallelized EVM execution support workloads such as high-frequency trading, real-time settlement, and global payments. The network is engineered to operate under sustained load while maintaining stable performance.

Backed by Leading Industry Participants

Organizations including Circle, Jump, and Coinbase Ventures support the development of Sei. Their involvement reflects the network’s focus on meeting the requirements of enterprise-level systems and the broader digital asset economy.

Deterministic Performance for Mission-Critical Applications

Consistent execution times, a resilient validator set, and a modular architecture contribute to a predictable operational environment. This reliability is essential for institutions and developers building financial products that rely on fast, irreversible settlement.

How to Stake SEI

Staking enables users to contribute to securing the Sei Network by delegating SEI tokens to validators. In return, delegators receive rewards that reflect validator performance and their share of the overall staked amount. The process is straightforward and can be completed using a compatible wallet.

Step 1. Obtain SEI Tokens

SEI can be acquired on cryptocurrency exchanges that list the asset. Once purchased, tokens should be transferred to a wallet that supports staking on Sei.

Step 2. Choose a Compatible Wallet

Select a wallet that enables delegation to Sei validators. After setting up the wallet, connect it to the staking interface provided by the network or supported dashboards.

Step 3. Select a Validator

Review the available validators, considering factors such as uptime, commission rates, and overall performance. Choosing a reliable validator is important for getting consistent rewards.

Step 4. Delegate SEI Tokens

Enter the amount of SEI you wish to delegate and confirm the transaction through your wallet. Once processed, your tokens will be staked with the selected validator.

Step 5. Get Staking Rewards

Rewards begin accruing based on network parameters and validator activity. Users can typically claim or compound their rewards through the staking dashboard.

Conclusion

Sei Network provides a high-performance Layer 1 infrastructure tailored to meet the demands of modern digital asset markets. With sub-400ms finality, a parallelized EVM, a multi-proposer execution model introduced through the Sei Giga upgrade, and a modular architecture that supports continuous optimization, Sei provides deterministic performance at scale. These capabilities enable a wide range of applications, from trading platforms and global payments to consumer-facing services and agentic systems, to operate reliably in decentralized environments.

As the ecosystem continues to expand, Sei’s combination of speed, resilience, and compatibility with established EVM tooling positions it as a foundational settlement layer for next-generation financial and transactional applications. The network’s focus on performance and long-term scalability supports ongoing innovation and broad adoption across the digital economy.

Stake with Everstake | Follow us on X | Connect with us on Discord

***

Everstake is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services, or take custody of, or otherwise hold or manage, customer assets. Everstake does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency, or associated funds. Everstake’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.