In 2024, Aptos grew remarkably, reaching key milestones that cemented its status as one of the industry's leading blockchains. With sub-second transaction speeds, expanding DeFi opportunities, and a thriving ecosystem, Aptos continues to offer a powerful platform for developers and users alike.

This report highlights a year of significant progress, from a surge in daily active users and transactions to groundbreaking advancements in staking and decentralization.

KEY INSIGHTS AND TAKEAWAYS

-

Unique active accounts climbed from 1.6 million in January to 10.1 million in December, with daily activity jumping from 96,000 to 891,000.

-

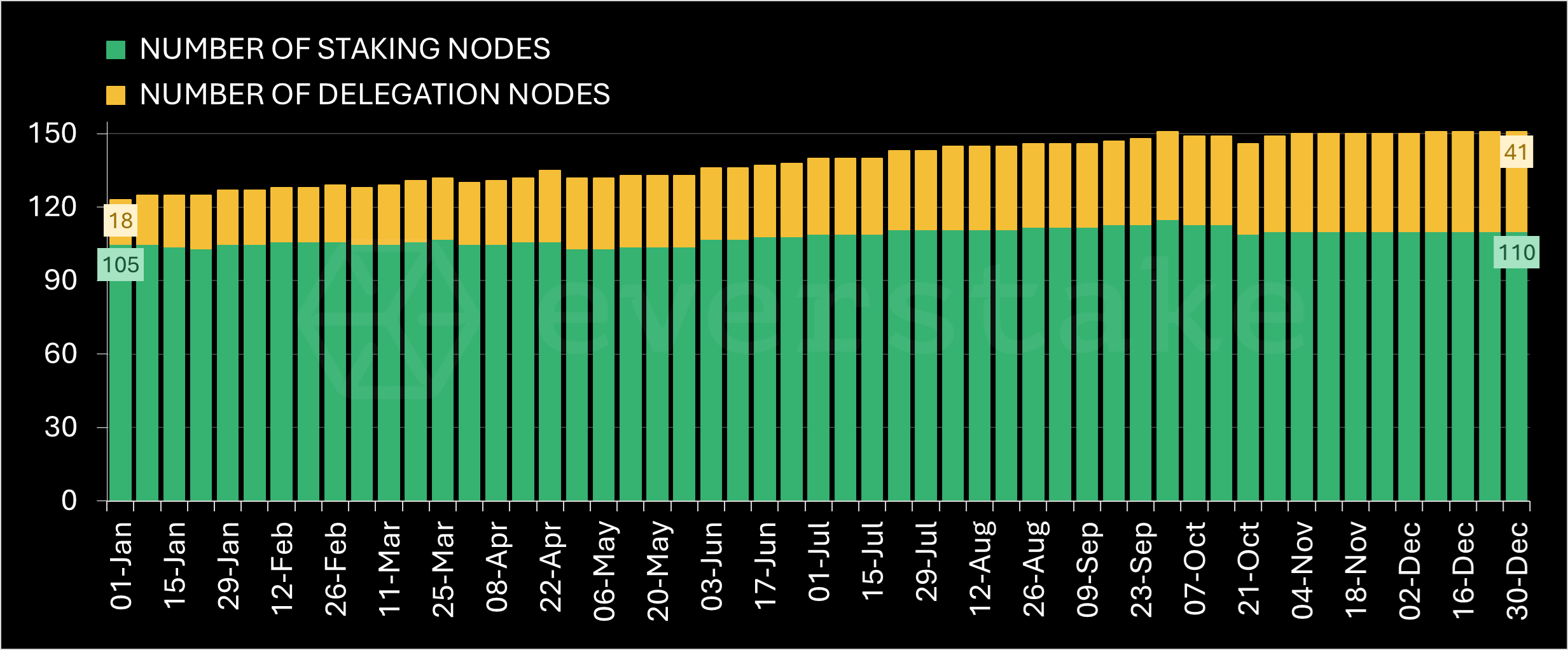

The number of delegation pools increased from 18 to 41, boosting the total node count from 123 to 151 by December.

-

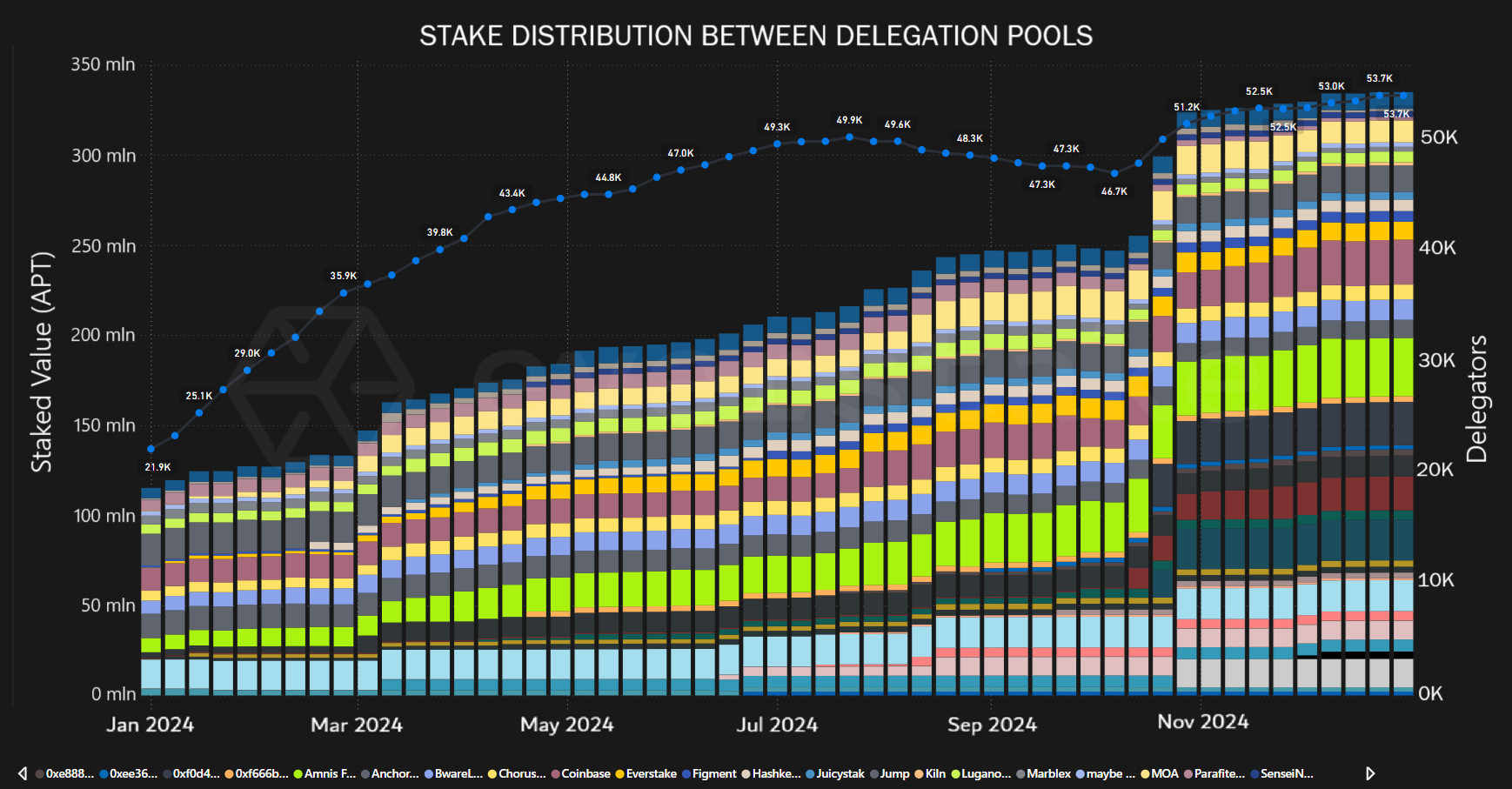

Delegated stake surged from 118 million APT in January (12.9% of total stake) to 339 million APT by December (37.7% of total stake). The number of delegators more than doubled, increasing from 21.9k in January to 53.5k in December.

-

Base TVL grew from $117 million at the beginning of the year to $1 billion by the end of December, reflecting a 750% increase

-

TVL with Liquid Staking increased from $170 million to $1.5 billion, showing a 780% growth.

-

Including borrowed coins, TVL skyrocketed from $175M to $2.1B, marking a staggering 1100% increase.

-

Liquid staking grew from $56.8 million to $417.6 million (+246%) across five major projects, including Amnis Finance and Thala Liquid Staking.

-

Aptos achieved the lowest latency in the industry, reaching sub-second levels.

-

The August Tapos event processed 533 million transactions in just three days, peaking at 12,000 TPS.

-

Aptos gained new ecosystem projects, integrated several stablecoins, and introduced more user-friendly features, among other things.

METHODOLOGY

This report explores Aptos blockchain’s performance using a structured approach that includes:

-

On-Chain Data: We gathered comprehensive data directly from the Aptos blockchain, including raw transaction records and key metrics such as staking activity, transaction volume, and inflation rates.

-

Data Preparation: We meticulously cleaned and formatted the data using Python and Power BI. We also carefully integrated inputs from various sources to enable a thorough and cohesive analysis.

-

Data Analysis: Charts and statistical insights were applied to uncover meaningful patterns.

DEFINITIONS

Key terms referenced in this report include:

-

Total Stake: The total APT tokens locked for staking.

-

Validators: Node operators that validate transactions, secure the network, and produce new blocks.

-

Delegators: Token holders who delegate their tokens to specific nodes in exchange for staking rewards and the opportunity to participate in Aptos governance.

-

TVL (Total Value Locked): The value of assets secured within Aptos.

UNIQUE ACTIVE ACCOUNTS GROWTH

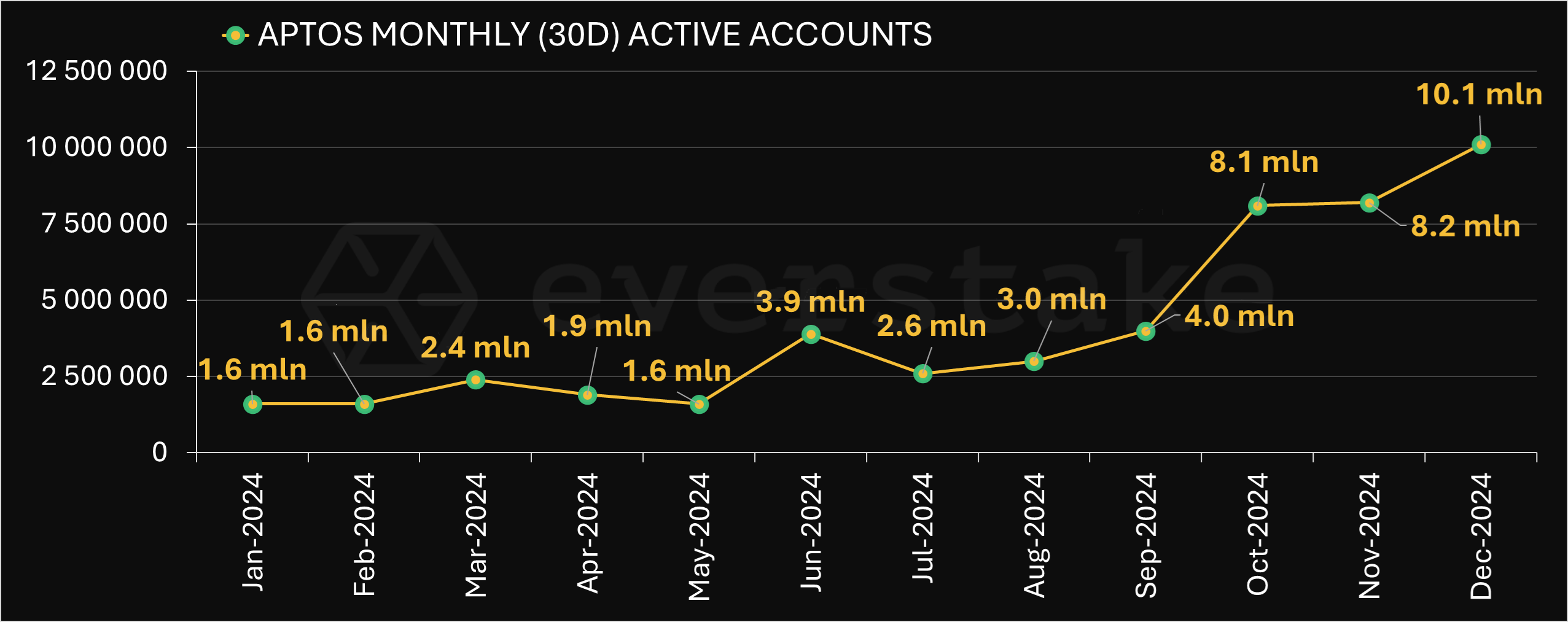

In 2024, Aptos experienced consistent growth in active accounts, reflecting increasing network adoption. Unique active accounts rose from 1.6 million in January to 10.1 million by December, with significant growth occurring in Q4.

As seen in Figure 1, monthly active accounts rose rapidly, rising from 1.6 million in January to an impressive 10.1 million by December. The sharp increase from September onward signals a surge in user adoption during the year’s latter half.

FIGURE 1. APTOS MONTHLY ACTIVE ACCOUNTS

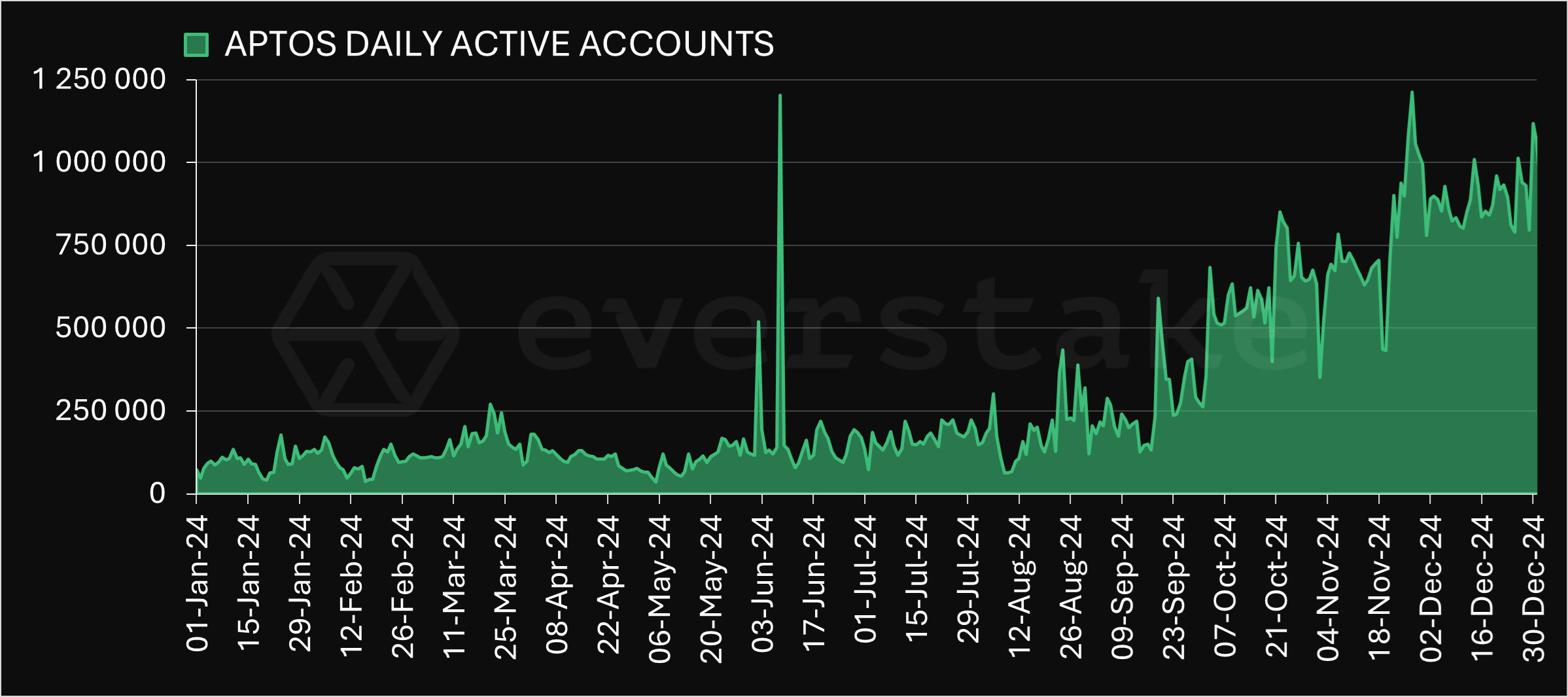

Daily active users, highlighted in Figure 2, spiked significantly in June, reaching 1.2 million on June 8, further emphasizing Aptos’ growing appeal.

FIGURE 2. APTOS DAILY ACTIVE ACCOUNTS

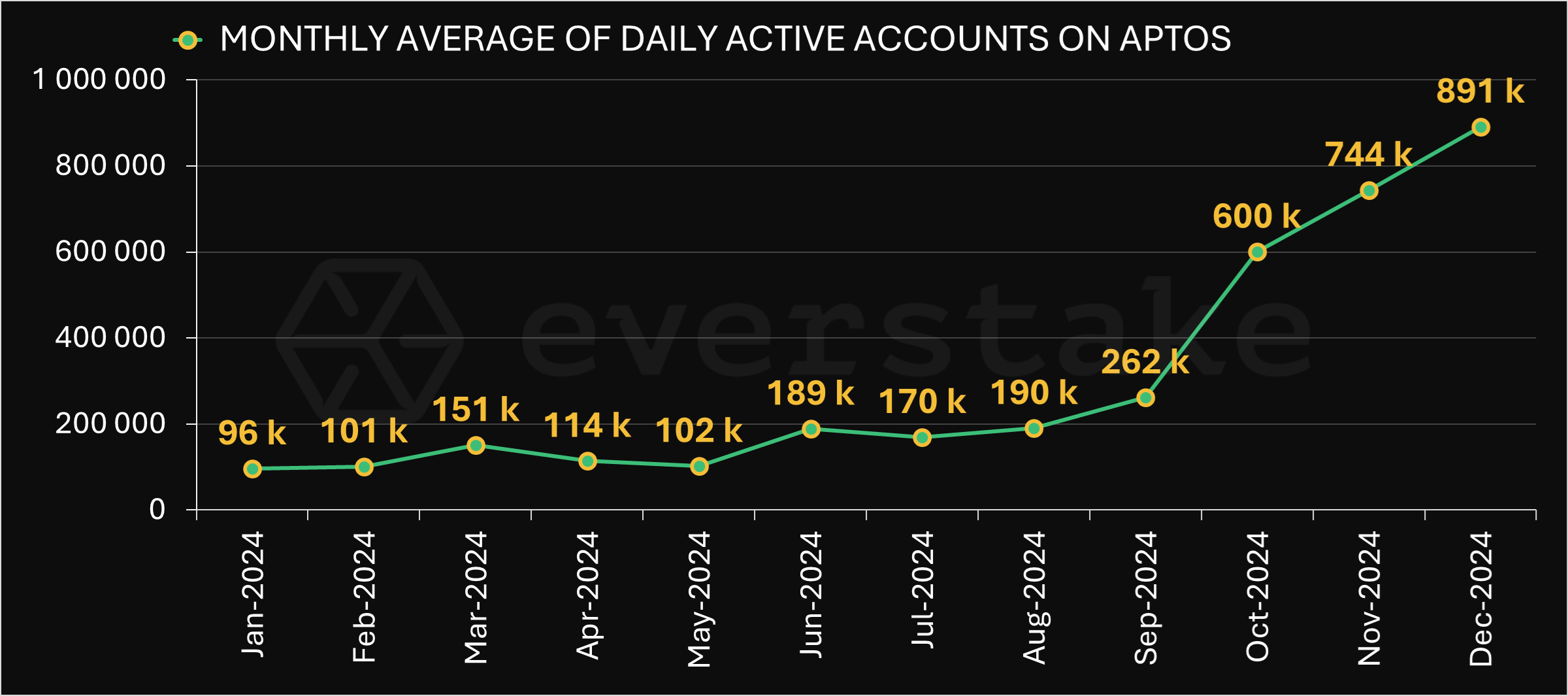

The average daily activity for each month, illustrated in Figure 3, demonstrates consistent growth, climbing from 96,000 in January to 600,000 by October, 744,000 in November, and an impressive 891,000 in December.

FIGURE 3. MONTHLY AVERAGE OF DAILY ACTIVE ACCOUNTS ON APTOS

The growth in Q4 underscores Aptos' ability to onboard diverse users while sustaining scalability and resilience.

TRANSACTION TRENDS

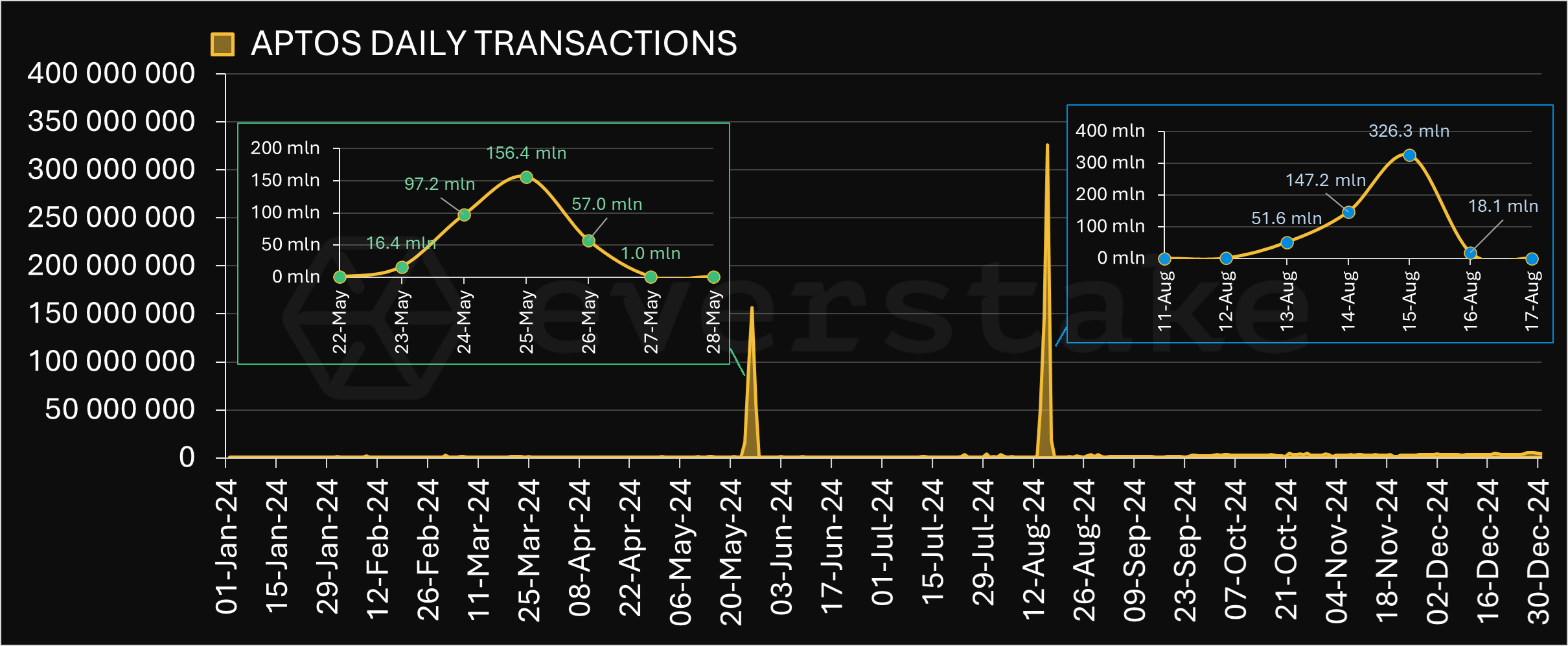

The daily user transaction count is a key metric that reflects activity and engagement on the platform—an important indicator of the platform's usability, performance, and user satisfaction.

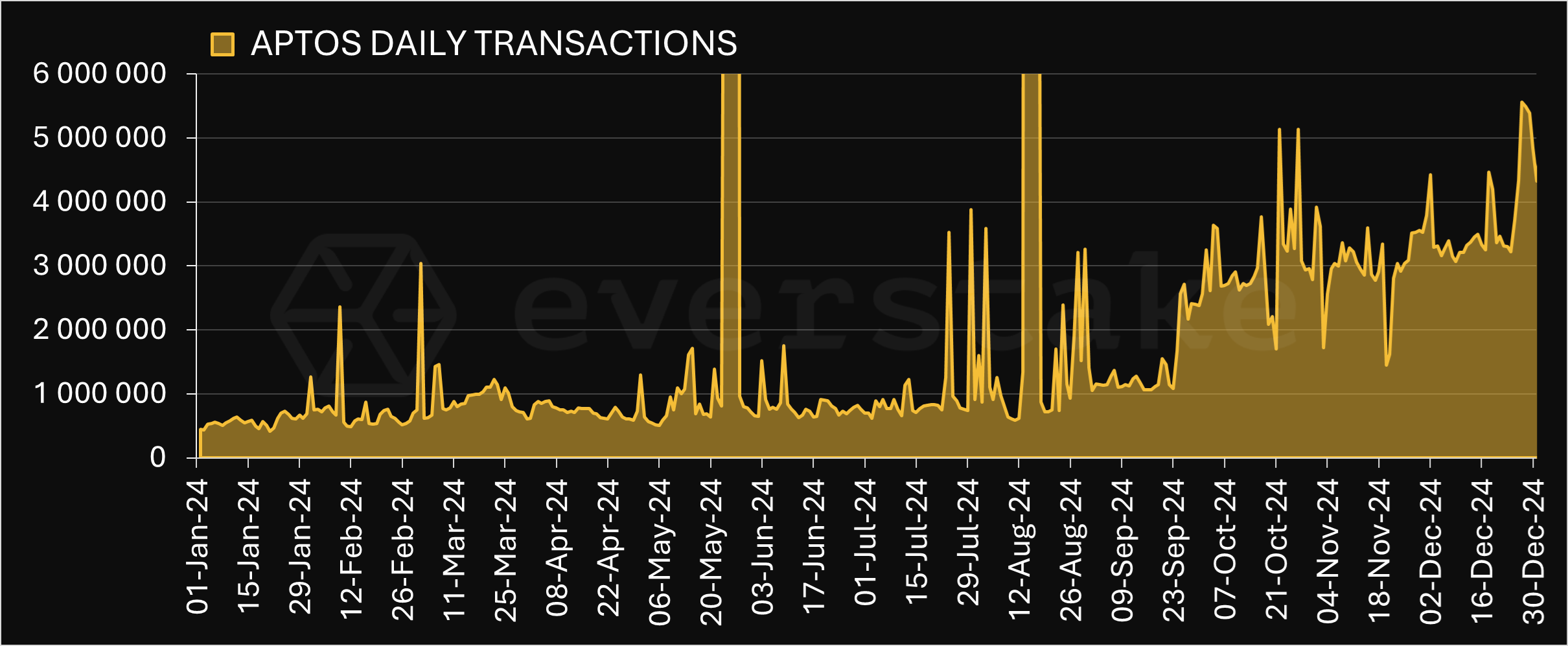

FIGURE

4. APTOS DAILY TRANSACTIONS

FIGURE

4. APTOS DAILY TRANSACTIONS

Figure 4 illustrates the daily successful transaction count on Aptos throughout the year, highlighting two significant spikes during Tapos game events:

-

During the May 2024 Tapos event, transactions surged to 97 million on May 24 and 156 million on May 25, showcasing the platform’s capability.

-

The August 2024 event surpassed this, with total transactions exceeding 533 million in three days, peaking at 326 million transactions on August 15.

FIGURE

5. APTOS DAILY TRANSACTIONS (Excluding Tapos Game Events)

FIGURE

5. APTOS DAILY TRANSACTIONS (Excluding Tapos Game Events)

As Figure 5 shows, even outside these high-traffic periods, transaction activity remained strong and steadily increased.

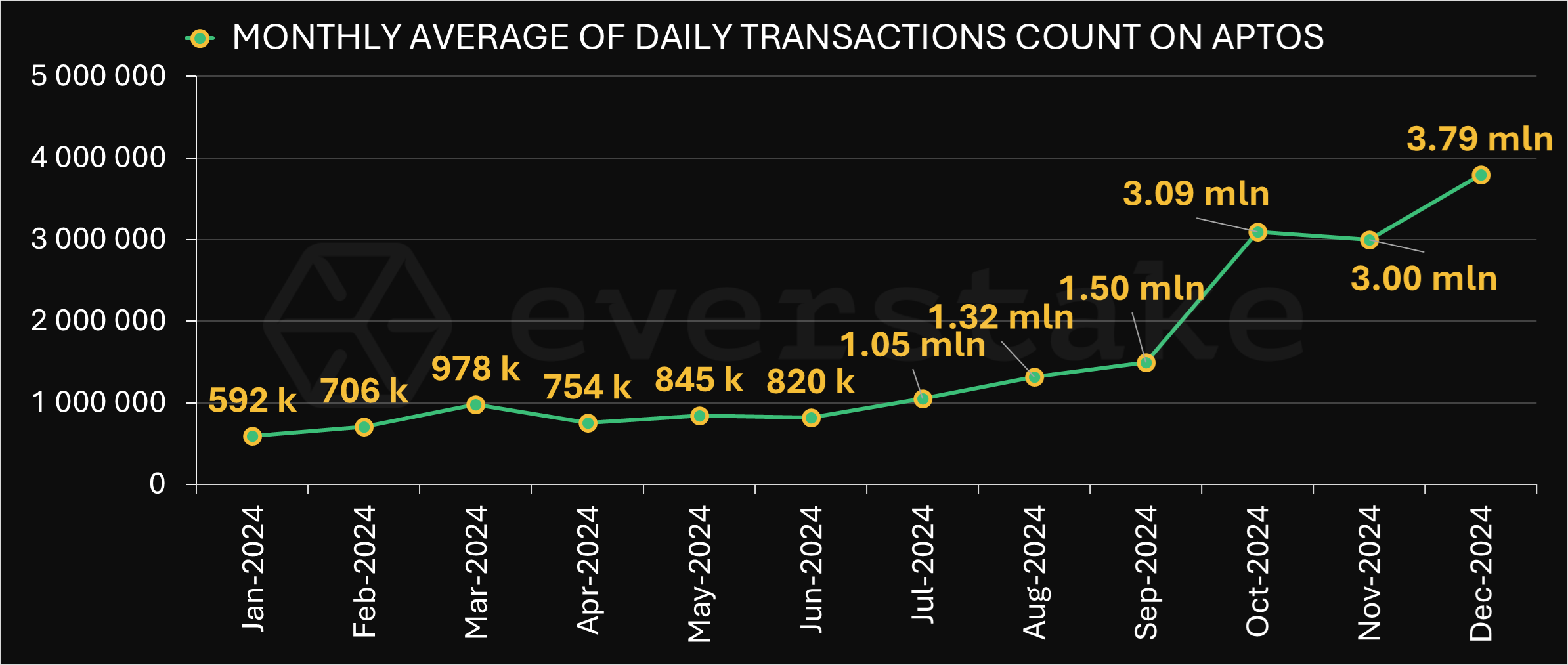

FIGURE

6. MONTHLY AVERAGE OF DAILY TRANSACTIONS ON APTOS

FIGURE

6. MONTHLY AVERAGE OF DAILY TRANSACTIONS ON APTOS

Figure 6 highlights the monthly average of daily transactions on Aptos, excluding Tapos game events (May 23-26 and August 13-16). The data reveals a clear upward trend—by December, the average daily transactions exceeded 3.7 million. As a result, the transaction count for December alone surpassed 118 million, and for the entire year of 2024, it exceeded 1.4 billion.

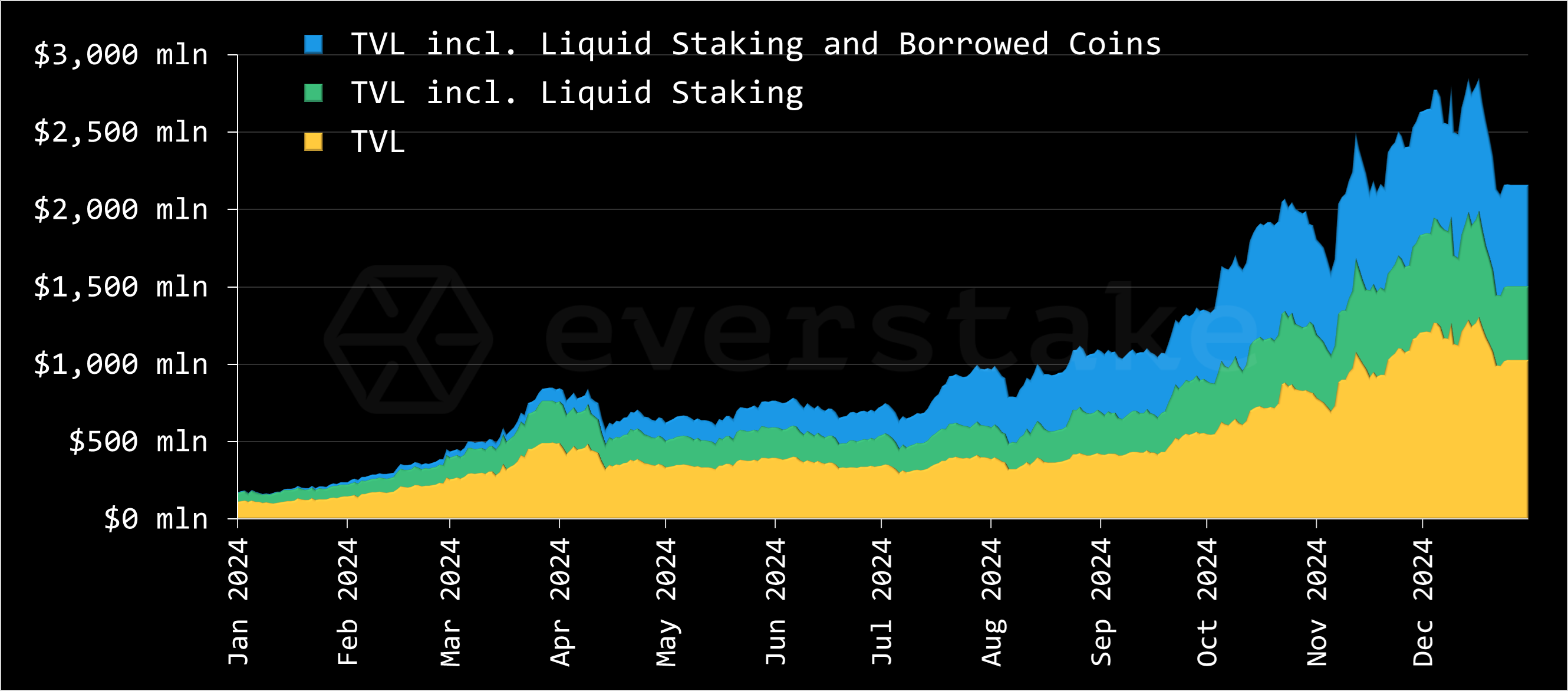

TOTAL VALUE LOCKED (TVL)

TVL is a crucial indicator of DeFi adoption and overall blockchain growth. This report evaluates the Aptos chain's TVL through three key metrics: Base TVL, TVL including Liquid Staking, and TVL including both Liquid Staking and Borrowed Coins.

FIGURE

7. TRENDS IN APTOS CHAIN TVL

FIGURE

7. TRENDS IN APTOS CHAIN TVL

Aptos saw incredible TVL growth:

-

Base TVL grew from $117 million to $1 billion, a 750% surge.

-

TVL including Liquid Staking expanded from $170 million to $1.5 billion, up by 780%.

-

TVL Including Liquid Staking and Borrowed Coins skyrocketed from $175 million to an impressive $2.1 billion, an 1100% increase.

The top 10 Aptos ecosystem projects by TVL including Liquid Staking and Borrowed Coins include Aries Markets, Echo Lending, and Amnis Finance.

|

1 |

Aries Markets |

$670.9 mln |

|

2 |

Echo Lending |

$262.4 mln |

|

3 |

Amnis Finance |

$238.1 mln |

|

4 |

Echelon Market |

$218.3 mln |

|

5 |

Thala |

$115.1 mln |

|

6 |

Meso Finance |

$97.4 mln |

|

7 |

TruStake |

$91.9 mln |

|

8 |

Cellana Finance |

$68.6 mln |

|

9 |

Superposition |

$58.0 mln |

|

10 |

LiquidSwap |

$46,5 mln |

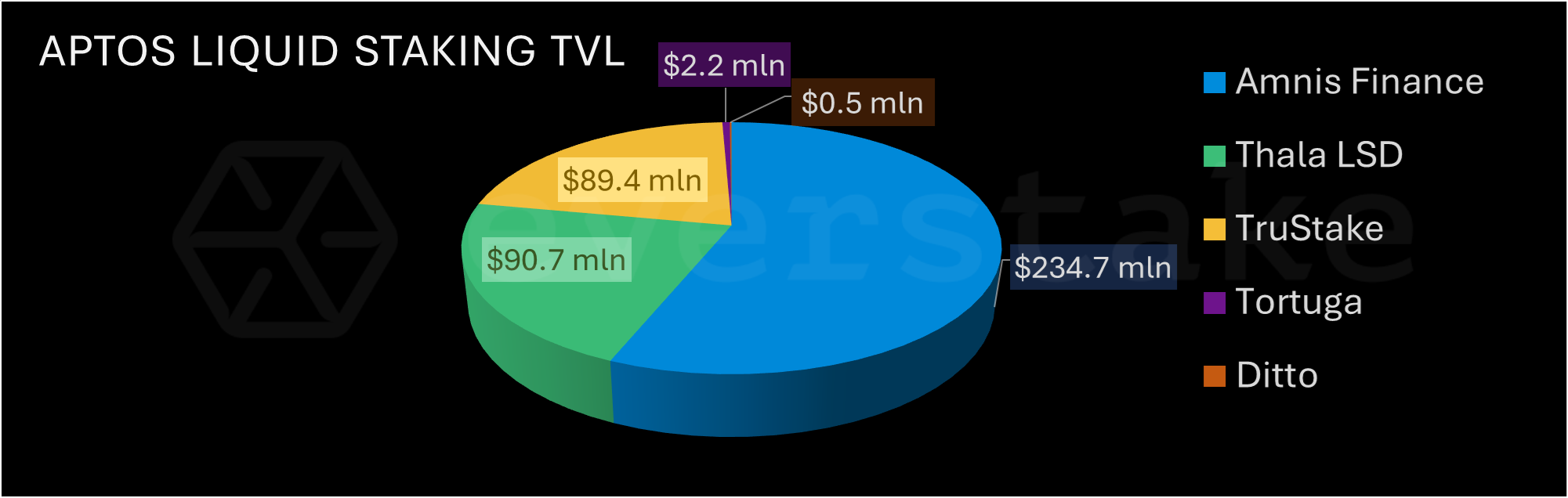

LIQUID STAKING

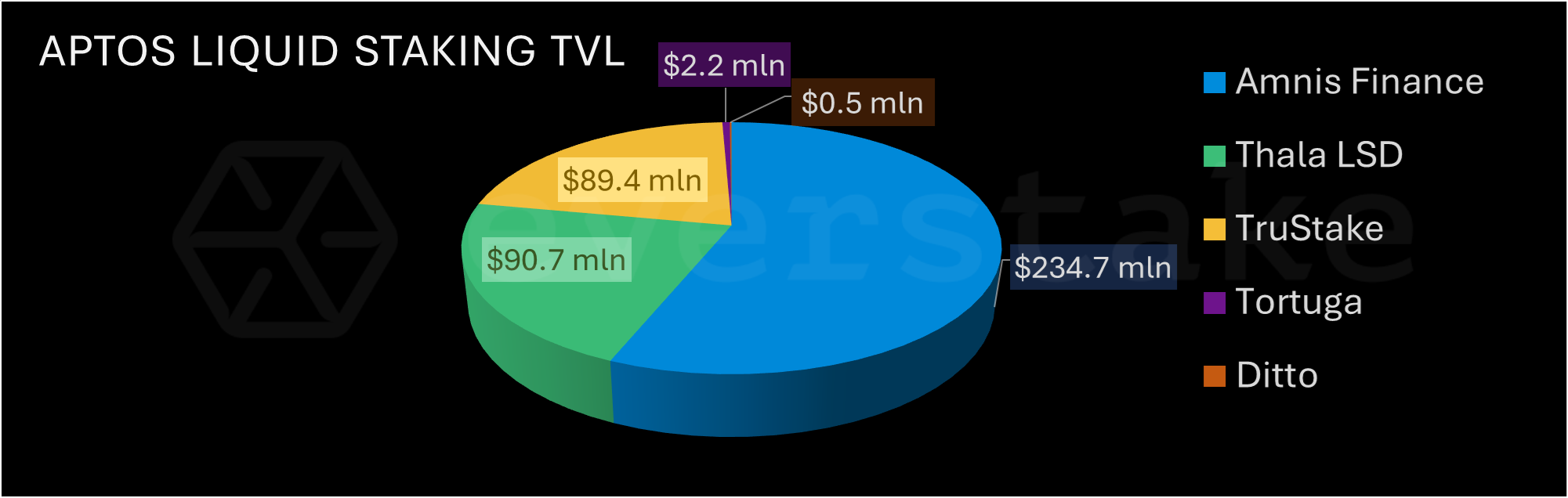

Liquid staking saw significant traction throughout the year, with Total Value Locked increasing from $56.8 million to $417.6 million, marking a 246% growth across five major projects

FIGURE

8. APTOS LIQUID STAKING TVL

FIGURE

8. APTOS LIQUID STAKING TVL

As of January 1, 2025, the five leading liquid staking projects include:

-

Amnis Finance Liquid Staking—$234.7 million TVL

-

Thala Liquid Staking—$90.7 million TVL

-

TruFin (TruStake)—$89.4 million TVL

-

Tortuga Financ—$2.2 million TVL

-

Ditto—$0.5 million TVL

FIGURE

9. APTOS LIQUID STAKING TVL (AS OF 1/1/2025)

FIGURE

9. APTOS LIQUID STAKING TVL (AS OF 1/1/2025)

NUMBER OF NODES

In 2024, the Aptos network achieved greater decentralization, with the number of delegation pools more than doubling, from 18 to 41.

This growth directly strengthened the network by increasing the total number of nodes from 123 to 151. It also highlights the network's commitment to improving security, resilience, and trust by distributing control among a larger and more diverse group of participants, ultimately fostering a healthier and more robust decentralized ecosystem.

FIGURE

10. NUMBER OF NODES ON APTOS

FIGURE

10. NUMBER OF NODES ON APTOS

STAKING STATS

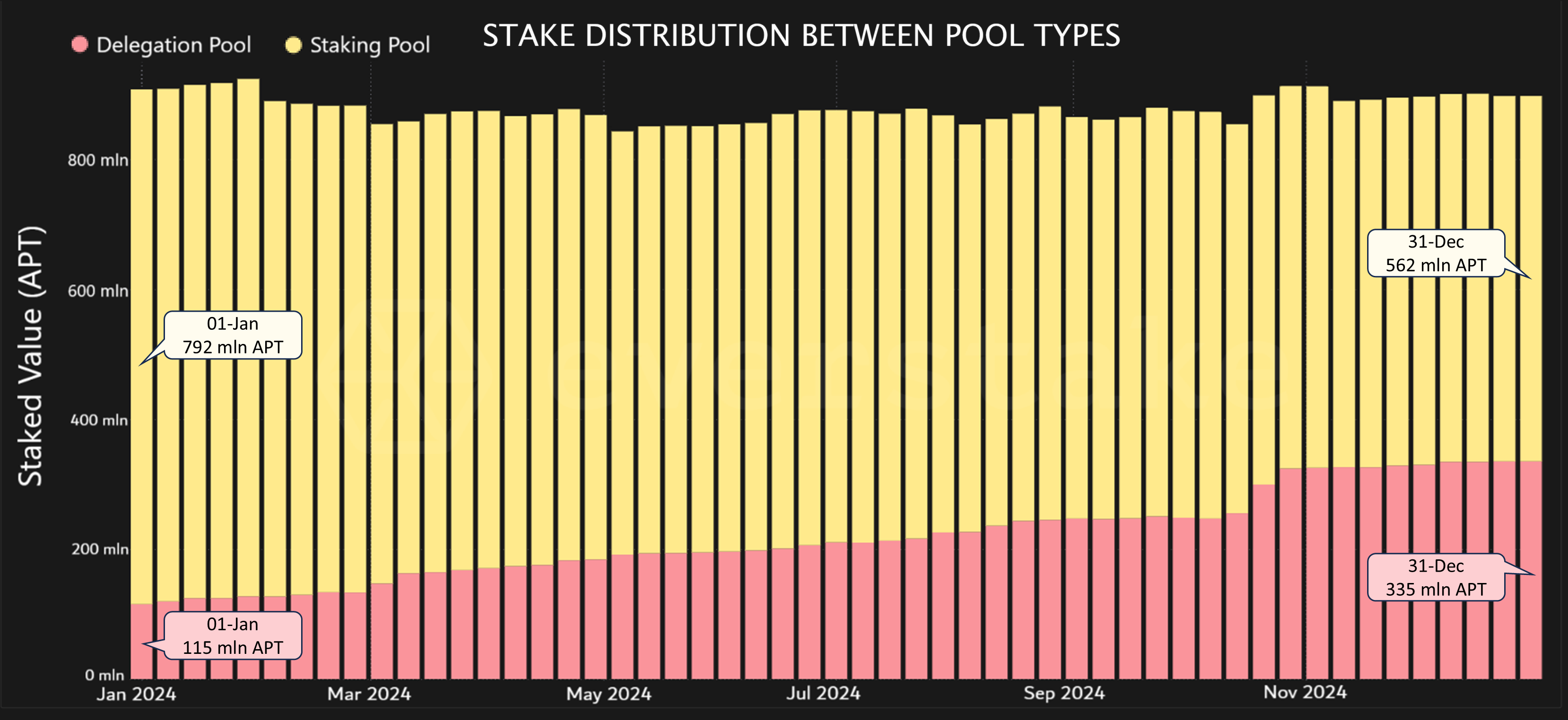

At the beginning of 2024, the total stake on delegation nodes stood at 118 million APT, accounting for 12.9% of the total stake, while the majority—791 million APT (87.1%)—was held in staking pools. However, by the end of the year, there was a significant shift in staking preferences. Delegated stake surged to 339 million APT, representing 37.7% of the total stake, marking an impressive 187.3% increase over the year.

At the same time, the stake within staking pools declined, dropping to 561 million APT, now accounting for 62.3% of the total. This steady migration from staking pools to delegation nodes underscores a clear trend—more users are opting to delegate their tokens, promoting a wider distribution of influence and reinforcing the network’s decentralized structure.

The chart below visually represents the stake distribution between staking and delegation nodes throughout 2024.

FIGURE 11. STAKE DISTRIBUTION BETWEEN POOL TYPES

Additionally, the growth in delegated stake was accompanied by a substantial rise in the number of delegators. Over the year, their numbers increased from 21.9 thousand in January to 53.5 thousand by December, reflecting an expansion of over 144%. This data highlights the growing trust and participation in Aptos’ staking ecosystem.

Figure 12 provides insights into how the delegation landscape evolved, showcasing the increasing number of delegators and the growing diversity of validators, which rose to 41 by the end of 2024. This diversification strengthens network resilience and decentralization, ensuring a robust and secure blockchain environment.

FIGURE 12. STAKE DISTRIBUTION AND NUMBER OF DELEGATORS ON DELEGATION NODES

DELEGATION NODE COMMISSION RATES

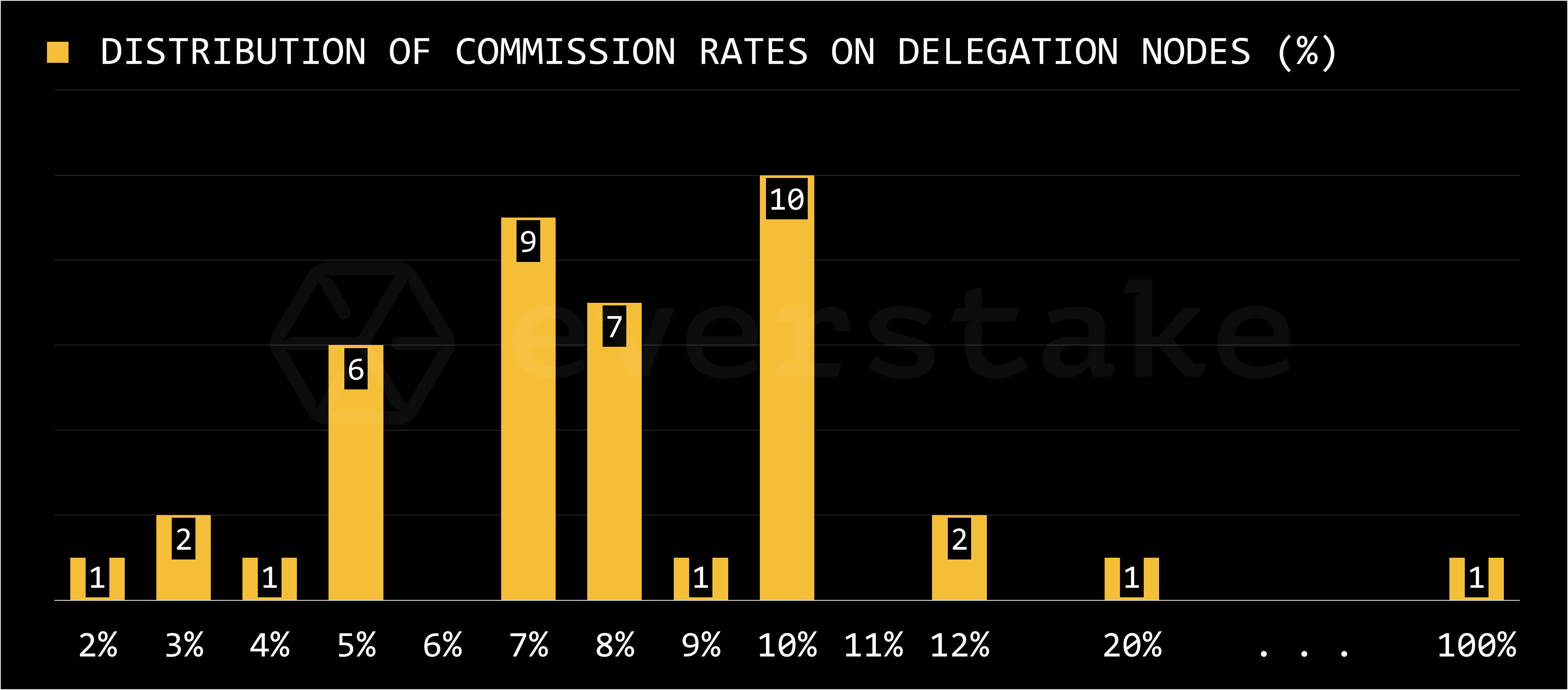

The commission rates of delegation nodes on the Aptos network vary significantly, reflecting different strategies adopted by operators. As of December 31, 2024, the distribution of commission rates is illustrated in the chart below.

FIGURE

13. DISTRIBUTION OF COMMISSION RATES ON DELEGATION NODES

FIGURE

13. DISTRIBUTION OF COMMISSION RATES ON DELEGATION NODES

-

2% to 4% Commission: Lower commission rates have minimal representation. One node operates with a 2% commission rate, two nodes at 3% (including Everstake), and one node at 3.5%. These rates offer higher rewards to delegators, though only a few operators adopt such low commissions.

-

5% Commission: A moderate presence is observed at this level, with six delegation nodes operating with a 5% commission rate. However, there is no representation at 6%, indicating a possible gap in operator strategies at this level.

-

7% to 10% Commission: This range shows the highest concentration of delegation nodes. Specifically, nine nodes operate at a 7% commission rate, seven nodes at 8%, and ten nodes at 10%. This cluster suggests that rates between 7% and 10% are the most popular among operators, balancing profitability with attractiveness to delegators.

-

11% to 12% Commission: Two nodes operate with a 12% commission rate, demonstrating some operator preference for slightly higher commissions.

-

20% Commission and Beyond: Higher commission rates are rare, with just one node at 20% and another at 100%. These rates likely reflect operators employing unique strategies or forgoing delegator engagement entirely.

PERFORMANCE MILESTONES

Aptos achieved consistent sub-second end-to-end (E2E) latency for all transaction types, ensuring transactions are confirmed almost instantly.

E2E latency measures the time from transaction submission to confirmation back to the user, focusing on the overall user experience. Aptos ensures irrevocable transaction finality, meaning confirmed transactions cannot be reverted.

To achieve this, Aptos optimized several components of its architecture, including:

-

Upgraded mempool for faster transaction propagation.

-

Advanced Byzantine Fault Tolerance (BFT) consensus protocol for improved speed.

-

Adaptive block proposals to speed up transaction inclusion.

Further details can be found in the article.

THROUGHPUT AND SCALABILITY

Throughput, measured in transactions per second (TPS), is a key indicator of a blockchain's performance.

As mentioned earlier, Aptos set records in transaction throughput, with the Tapos game events demonstrating the platform’s capabilities:

-

August 2024 Tapos event achieved a peak of 12,000 transactions per second (TPS).

-

Aptos now holds four of the top daily transaction records across all blockchains.

1,000,000 NFTs

On May 14, 2024, Aptos successfully minted a collection of 1 million NFTs in four hours, marking the fastest and largest NFT minting event to date.

This accomplishment showcased the power of Aptos Aggregators, a feature designed to enable parallel execution of smart contracts on the Aptos Blockchain, even in scenarios with significant read-write conflicts.

GOVERNANCE

The Aptos on-chain governance process allows community members to create and vote on proposals. Members must stake to participate in proposing or voting, but running a validator node is not required.

Aptos Improvement Proposals (AIPs) are suggestions created by the Aptos community or the Aptos Labs team to enhance the chain's operations and development.

Notable AIPs include:

-

AIP-61: Introduces keyless accounts on the Aptos blockchain, allowing users to secure their blockchain accounts with existing Web2 identities, simplifying onboarding and reducing the risk of account loss or theft.

-

AIP-79: Implements on-chain randomness, providing Move smart contracts with instant, unbiased, and unpredictable randomness under the proof-of-stake (PoS) assumption.

-

AIP-66: Introduces Aptos Passkeys, allowing users to authenticate transactions using passkeys and WebAuthn credentials, providing a secure, phishing-resistant, and user-friendly alternative to passwords.

STABLECOINS

Aptos has integrated several stablecoins into its ecosystem:

-

Tether (USDT) was launched on the Aptos blockchain to reduce transaction costs and enhance global access to digital currencies. Further details can be found in the CoinTelegraph article.

-

Circle (USDC): Integration with Cross-Chain Transfer Protocol (CCTP) is now available on Aptos, enabling seamless cross-chain transfers.

-

Hong Kong Digital Dollar (e-HKD): The Hong Kong Monetary Authority is leveraging Aptos for the second phase of its digital currency pilot.

These stablecoin integrations are important because they can bridge traditional finance with blockchain technology, encouraging wider adoption, improving transaction efficiency, and paving the way for more sophisticated financial applications on the Aptos network.

MEMECOINS

On the Aptos blockchain, memecoins have emerged as a notable niche. Built on Aptos’s fast and scalable infrastructure, these tokens combine the cultural appeal of memecoins with the blockchain’s technical advantages. Here’s a list of some popular memecoins on Aptos and what makes them stand out:

-

GUI—A community-focused token that has gained traction through airdrops to active Aptos users.

-

CHEWY—Embraces meme culture with a light-hearted approach to community building.

-

LOON—Associated with an NFT project, offering perks to its community members.

-

UPTOS—Represents the optimism of the Aptos blockchain, engaging users to boost network activity.

-

DONK—A playful coin with a name meant to entertain without deeper utility.

-

SHRIMP—A quirky memecoin that has captured some attention in the Aptos community, focusing on fun and community engagement.

There are many more new popular Aptos memecoins such as MEOW, CHAD, MAU, etc.

LOW GAS COSTS

Aptos remains one of the most cost-efficient blockchain platforms, with transaction fees typically amounting to fractions of a cent. This affordability attracts developers and users looking for high performance without breaking the bank.

CLOSING THOUGHTS

Throughout 2024, Aptos has solidified its position as a leading blockchain platform by achieving significant milestones and setting ambitious goals for the future. In the first half of the year, the network established an efficient foundation for growth, with notable improvements in latency reduction and increased throughput, enhancing scalability and positioning the blockchain for future expansions. These advancements and user-friendly features like Keyless accounts exemplify Aptos’s commitment to making the technology accessible to a broader audience.

In the latter part of 2024, Aptos focused on expanding its ecosystem by integrating additional stablecoins, onboarding new projects, and developing features to cater to broader markets beyond existing blockchain communities. This continuous ecosystem growth has allowed Aptos to remain at the cutting edge of blockchain innovation, driving broader adoption and unlocking exciting opportunities for both developers and end users.

Aptos blockchain's future in 2025 looks promising, with increased network activity, strong scalability, and ongoing development initiatives. The ecosystem is expected to grow through partnerships and enhanced platform adoption.