KEY INSIGHTS AND TAKEAWAYS

-

Monthly active accounts remained above 10 million, with a 30‑day peak of 18 million on February 11, 2025.

-

Daily active users averaged over 1 million, more than double the second half of 2024.

-

User engagement and transaction volume remained high, with June’s daily transactions averaging 4.2 million and peaking at 5.2 million.

-

Total Value Locked (TVL) has hovered around $1 billion across ~30 DeFi protocols.

-

The delegated stake increased from 37.5% to 47.1% of the total stake in six months.

-

The number of validators rose from 41 to 75, indicating stronger network decentralization.

-

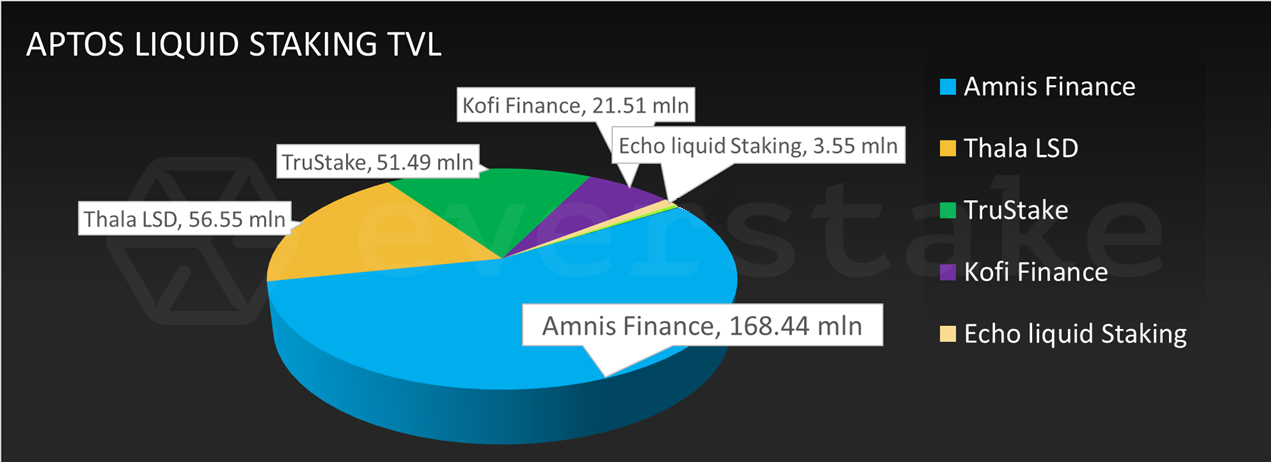

Amnis Finance leads liquid staking TVL at $168 million, followed by Thala, TruFin, and KoFi.

-

Raptr achieved 250,000 TPS with 750ms latency via Prefix Consensus.

-

The execution engine Shardines enabled over 1 million TPS by decoupling execution, storage, and consensus layers.

-

The low-latency architecture dubbed Zaptos reduced transaction confirmation time by 40%, sustaining 22,000 TPS with sub-second finality.

METHODOLOGY

This half-year report examines Aptos blockchain metrics and developments using the following methods.

-

On-Chain Data: Raw blockchain data on transactions, stake, validator activity, and token flows.

-

Data Preparation: Analysis was conducted using Python, Power BI, and custom scripts, integrating data from Aptos explorer APIs, ecosystem dashboards, and third-party analytics platforms.

-

Data Analysis: Trends were extracted using statistical methods and visualized via dynamic dashboards.

ACTIVE ACCOUNTS

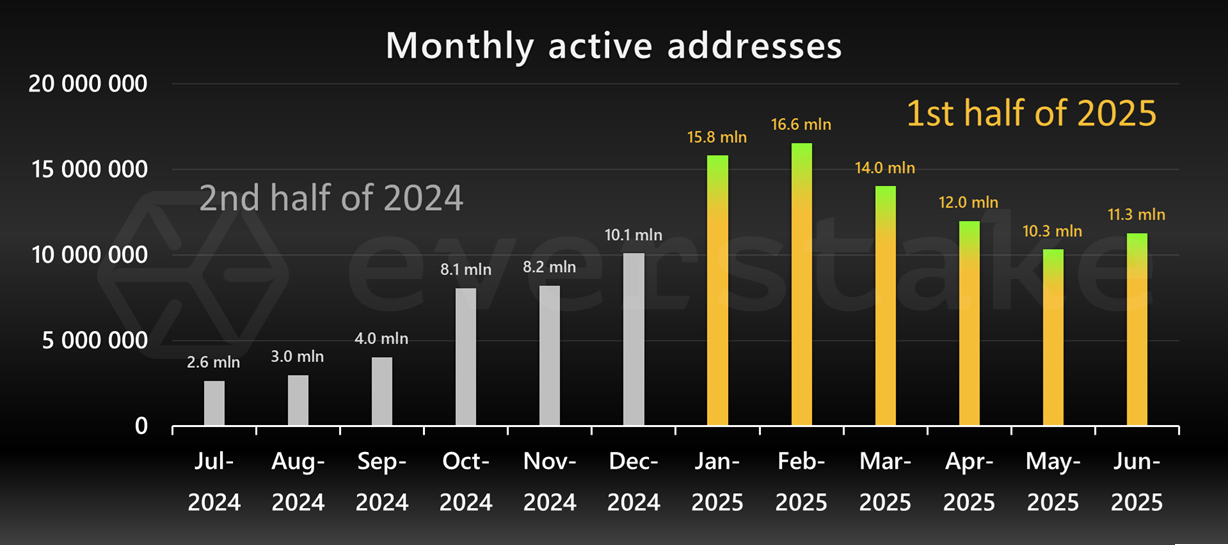

In the first half of 2025, Aptos sustained strong levels of active accounts, building on the significant growth seen in 2024 and indicating high network adoption. The number of active accounts each month never fell below 10 million. February saw a new peak, with the calendar-month total reaching 16.6 million, while the record over the prior 30 days hit 18 million on February 11. Figure 1 below compares monthly active accounts in the first half 2025 with 2024 trends. FIGURE 1. APTOS MONTHLY ACTIVE ACCOUNTS

FIGURE 1. APTOS MONTHLY ACTIVE ACCOUNTS

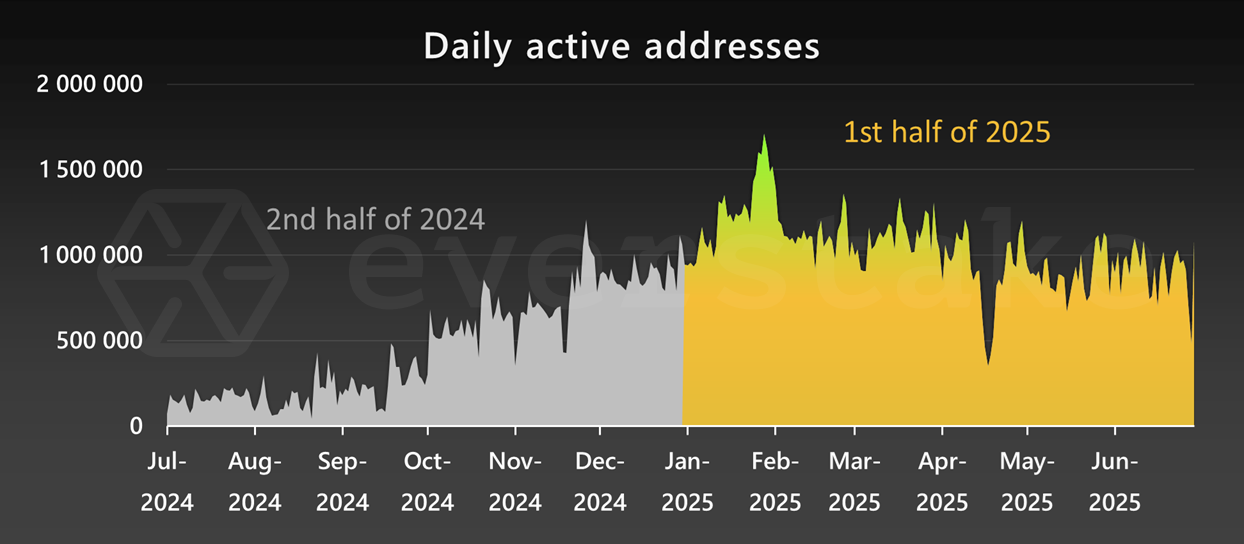

Figure 2 highlights the daily active users, who show solid numbers, reaching a peak of 1.7 million on January 29.

FIGURE 2. APTOS DAILY ACTIVE ACCOUNTS

FIGURE 2. APTOS DAILY ACTIVE ACCOUNTS

The average daily activity in the first half of 2025 was above 1 million, more than twice that of the second half of 2024, reflecting sustained user engagement across the network.

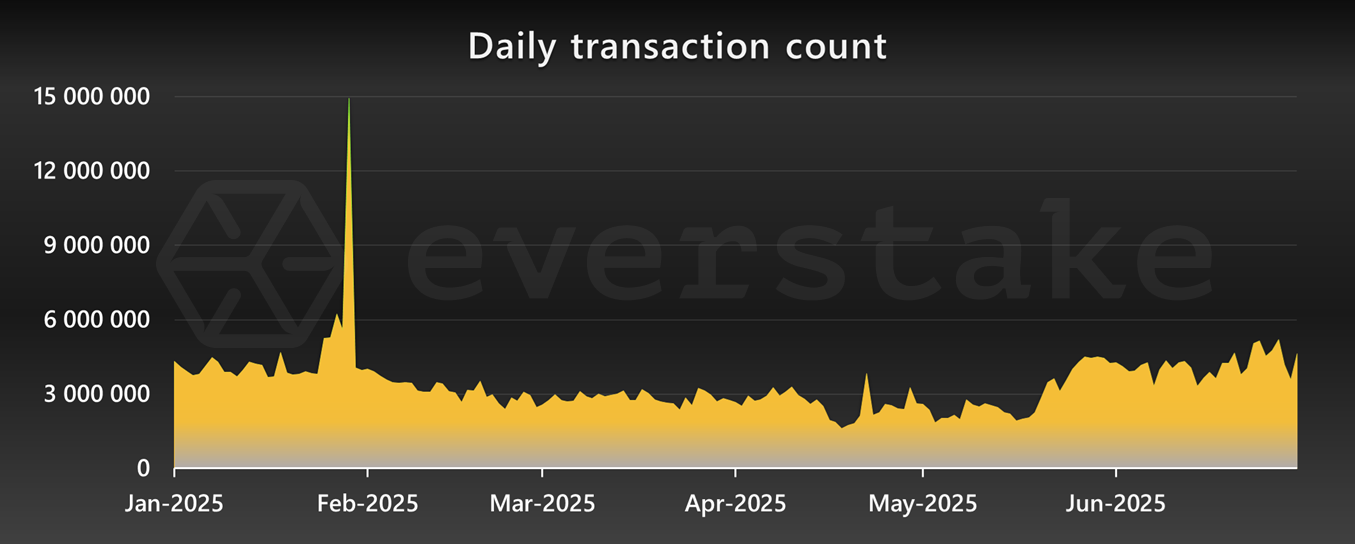

The daily user transaction count is a core metric that captures overall activity and engagement levels. It also offers valuable insights into usability, system performance, and user satisfaction.

Figure 3 shows the daily count of successful transactions on Aptos over the first half of 2025.

FIGURE 3. APTOS DAILY TRANSACTIONS

FIGURE 3. APTOS DAILY TRANSACTIONS

A pronounced spike at the end of January was followed by a period of relative stability through the following months. Activity begins to pick up again toward the end of May, with a clear rise continuing into June. The increase in June may point to growing adoption or the effect of targeted updates and campaigns.

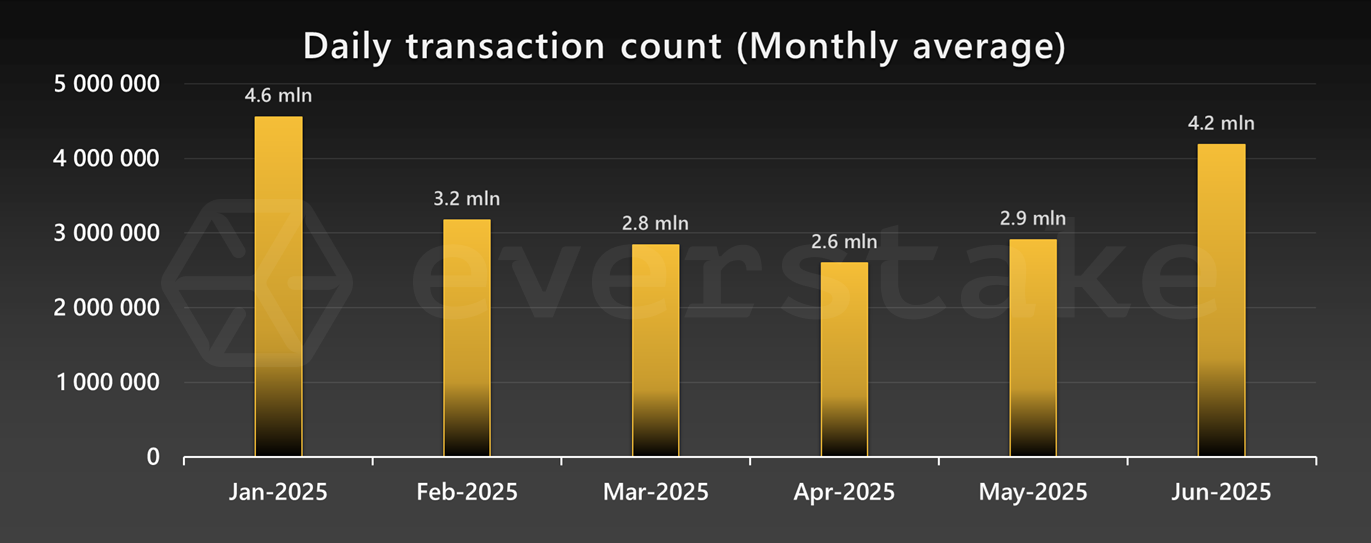

The bar chart in Figure 4 provides the monthly average of daily transactions.

FIGURE 4. MONTHLY AVERAGE OF DAILY TRANSACTIONS ON APTOS

FIGURE 4. MONTHLY AVERAGE OF DAILY TRANSACTIONS ON APTOS

February through May maintained a relatively steady range between 2.6 and 3.2 million, while June saw a rise to 4.2 million, which marks the highest average of the period.

TOTAL VALUE LOCKED (TVL)

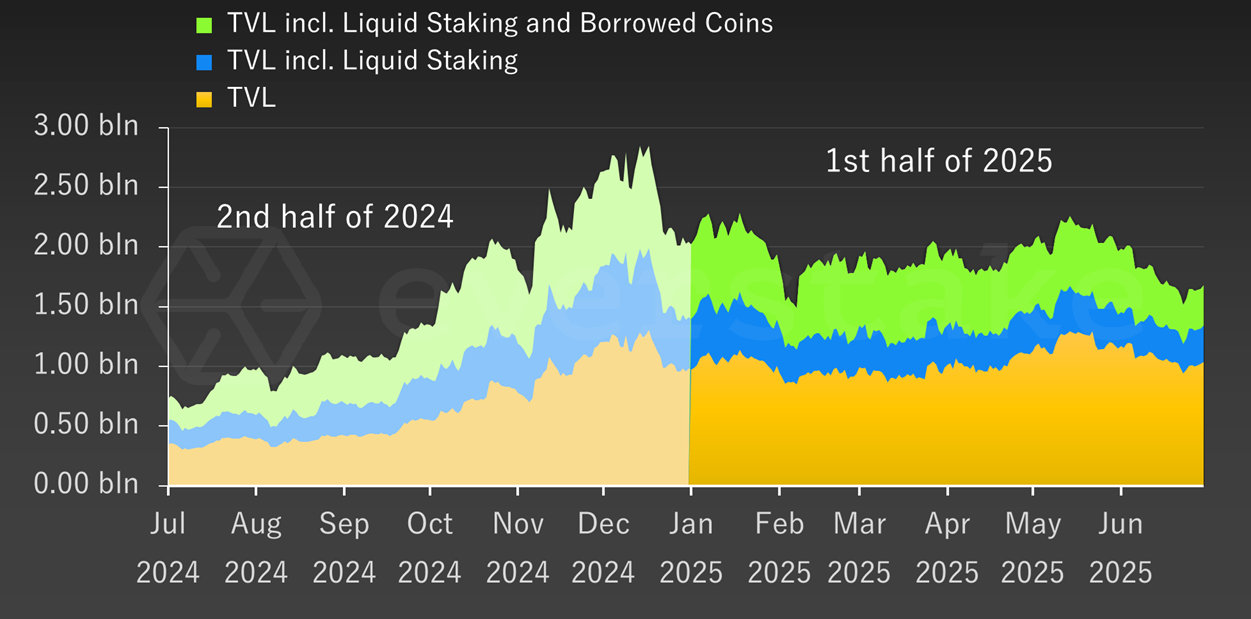

TVL is a crucial indicator of DeFi adoption and overall blockchain growth. This report evaluates the Aptos chain's TVL through three key metrics: Base TVL, TVL including Liquid Staking, and TVL including both Liquid Staking and Borrowed Coins. Figure 6 illustrates the dynamics of these three TVL components over the second half of 2024 and the first half of 2025.

FIGURE 5. TRENDS IN APTOS CHAIN TVL

FIGURE 5. TRENDS IN APTOS CHAIN TVL

-

Base TVL remained relatively stable in the first half of 2025, fluctuating between 0.9 and 1.3 billion USD. It slightly increased in May before dipping again in June.

-

TVL + Liquid Staking followed a similar path, ranging from approximately 1.1 to 1.5 billion USD, showing moderate resilience amid market fluctuations.

-

TVL + Liquid Staking and Borrowed Coins stayed within the 1.5 to 2.1 billion USD range.

These trends suggest that while growth has paused compared to late 2024, the Aptos DeFi ecosystem managed to maintain a strong and stable presence in the first half of 2025.

STATE OF STAKING

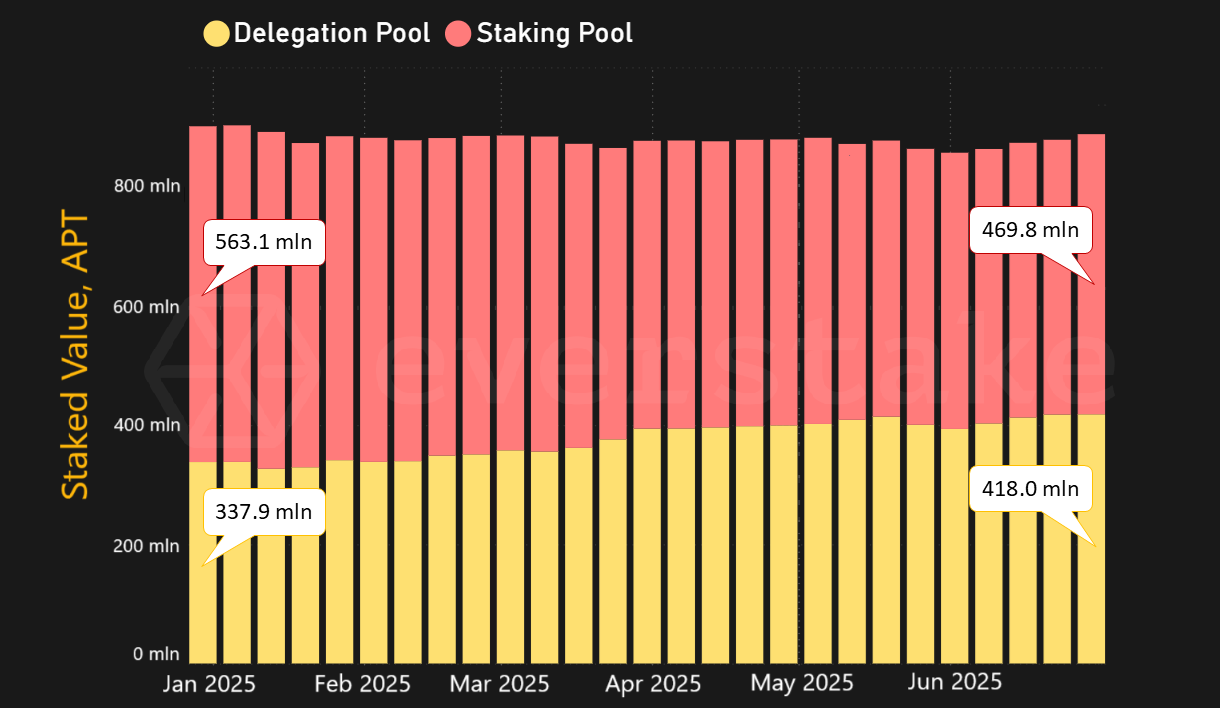

At the beginning of 2025, the total stake on delegation nodes stood at 337.9 million APT, accounting for 37.5% of the total stake, while the majority of 563.1 million APT (62.5%) was held in staking pools. By the end of June, there was a significant shift in staking preferences. Delegated stake surged to 418 million APT, representing 47.1% of the total stake.

At the same time, the stake within staking pools declined to 469.8 million APT, now accounting for 52.9% of the total. This steady migration from staking pools to delegation nodes continues the 2024 trend. It clearly suggests that more users are opting to delegate their tokens.

The chart below visually represents the stake distribution between staking pools and delegation nodes throughout the first half of 2025.

FIGURE 6. STAKE DISTRIBUTION BETWEEN POOL TYPES

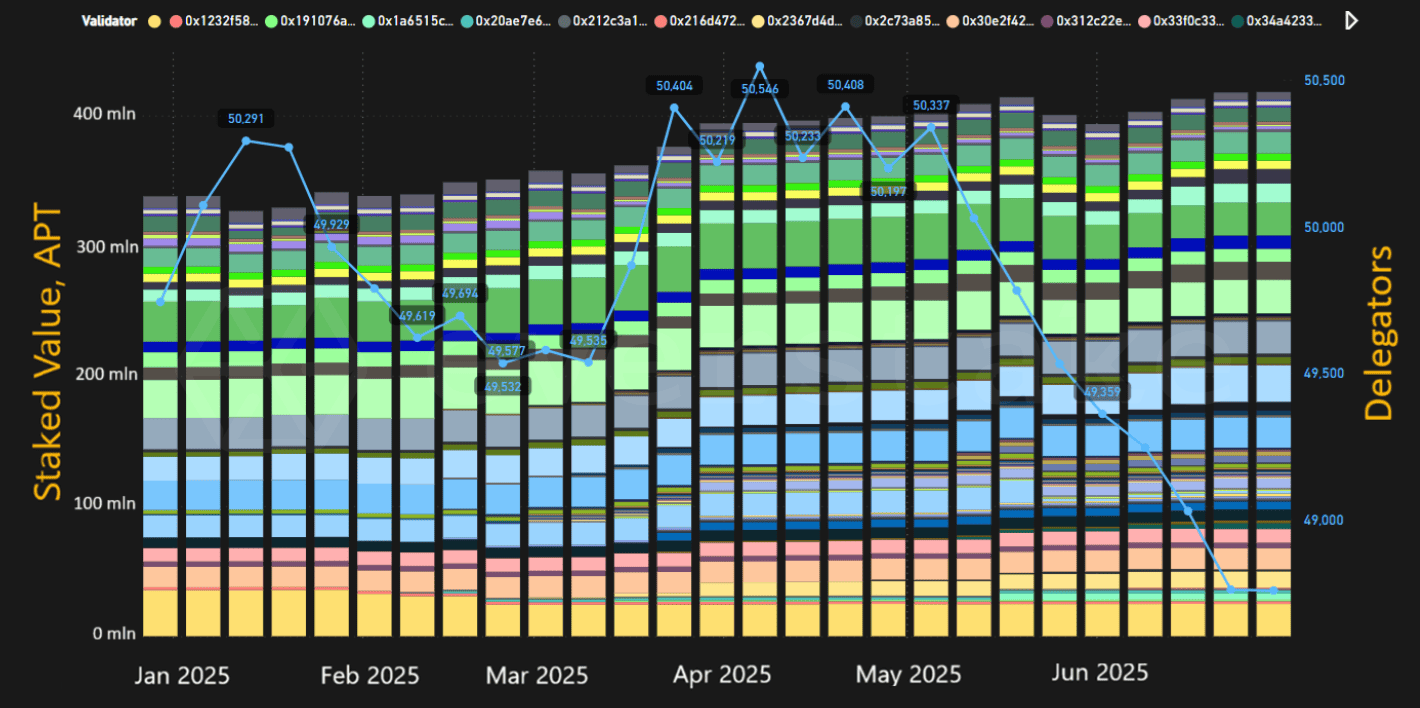

Figure 7 shows the changes in delegation trends. The number of delegators decreased slightly, yet the diversity of validators increased from 41 to 75 by the end of June 2025. This suggests an ongoing trend for higher diversification and decentralization.

FIGURE 7. STAKE DISTRIBUTION AND NUMBER OF DELEGATORS ON DELEGATION NODES

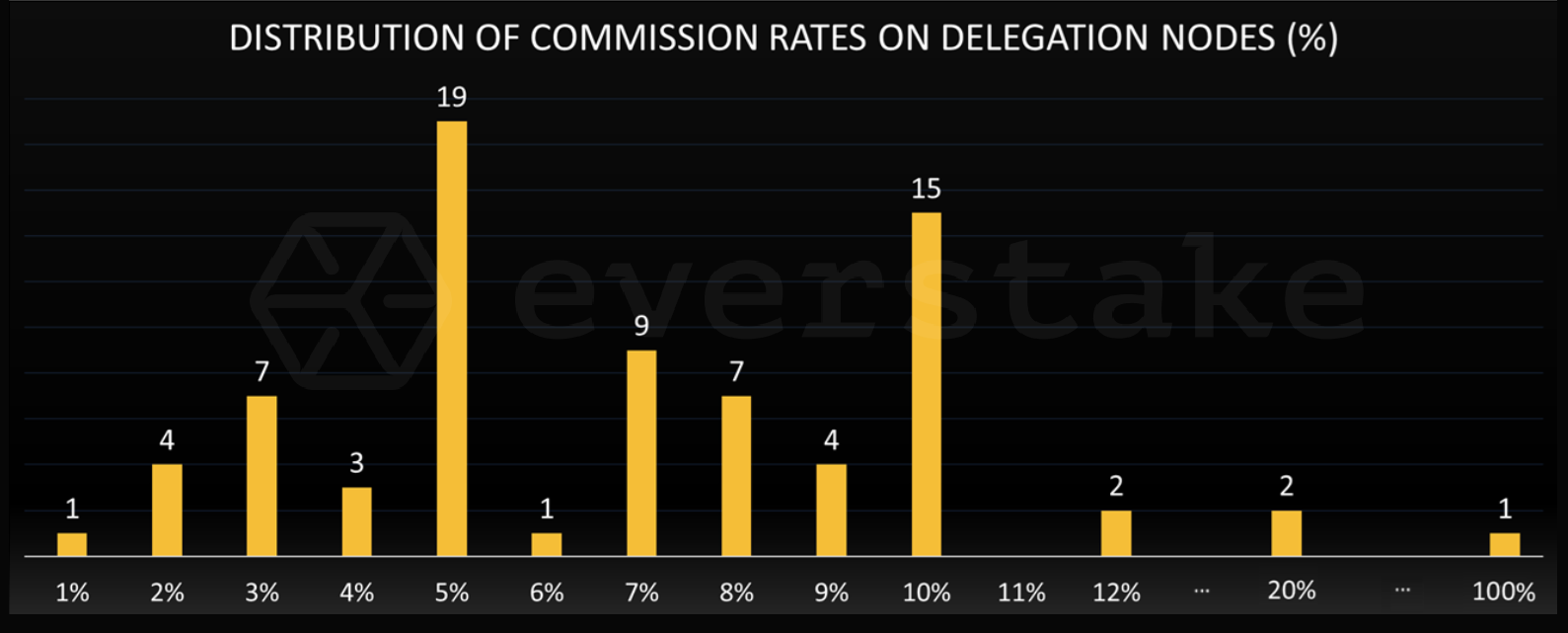

DELEGATION NODE COMMISSION RATES

The commission rates of delegation nodes on the Aptos network continued to vary widely, reflecting diverse operator strategies. The chart below illustrates the distribution of commission rates as of June 30, 2025.

FIGURE 8. DISTRIBUTION OF COMMISSION RATES ON DELEGATION NODES

-

1% to 4% Commission: Lower commission rates are relatively uncommon. Only 1 node operates with a 1% rate, 4 nodes at 2%, 7 nodes at 3% (including Everstake), and 3 nodes at 4%. These rates can offer higher rewards to delegators but are chosen by a limited number of operators.

-

5% Commission: This is the most common commission rate, with 19 nodes operating at this level. This suggests that 5% strikes a strong balance between operator revenue and delegator incentives.

-

6% to 9% Commission: This range shows a moderate but noticeable presence among delegation nodes. Specifically, 1 node operates at 6%, 9 nodes at 7%, 7 nodes at 8%, and 4 nodes at 9%.

-

10% Commission: The second most common commission level, with 15 nodes operating at this rate. While this is a popular choice among operators, a 10% fee is relatively high and may be seen as less competitive compared to lower rates.

-

11% to 12% Commission: Two nodes operate with a 12% commission rate, demonstrating some operator preference for slightly higher commissions.

-

20% Commission and Beyond: Higher commission rates are rare, with just one node at 20% and another at 100%. These rates are likely associated with operators employing unique strategies or forgoing delegator engagement entirely.

LIQUID STAKING

As of June 30, 2025, the leading liquid staking projects include the following key players.

-

Amnis Finance Liquid Staking: $168.4 million TVL

-

Thala Liquid Staking: $56.5 million TVL

-

TruFin (TruStake): $51.5 million TVL

-

Kofi Finance: $21.5 million TVL

FIGURE 9. APTOS LIQUID STAKING TVL (AS OF 30/06/2025)

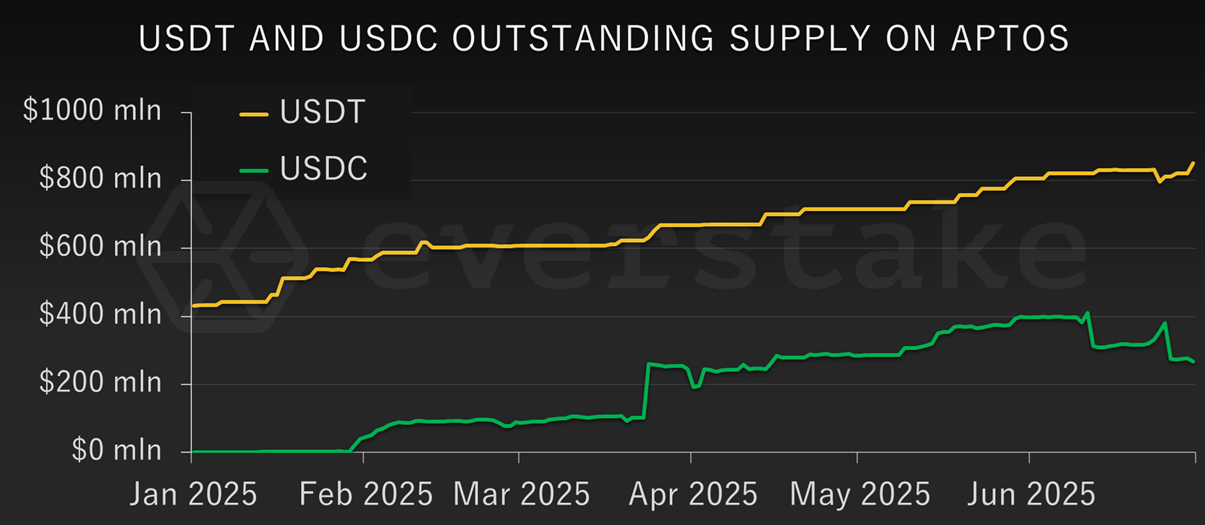

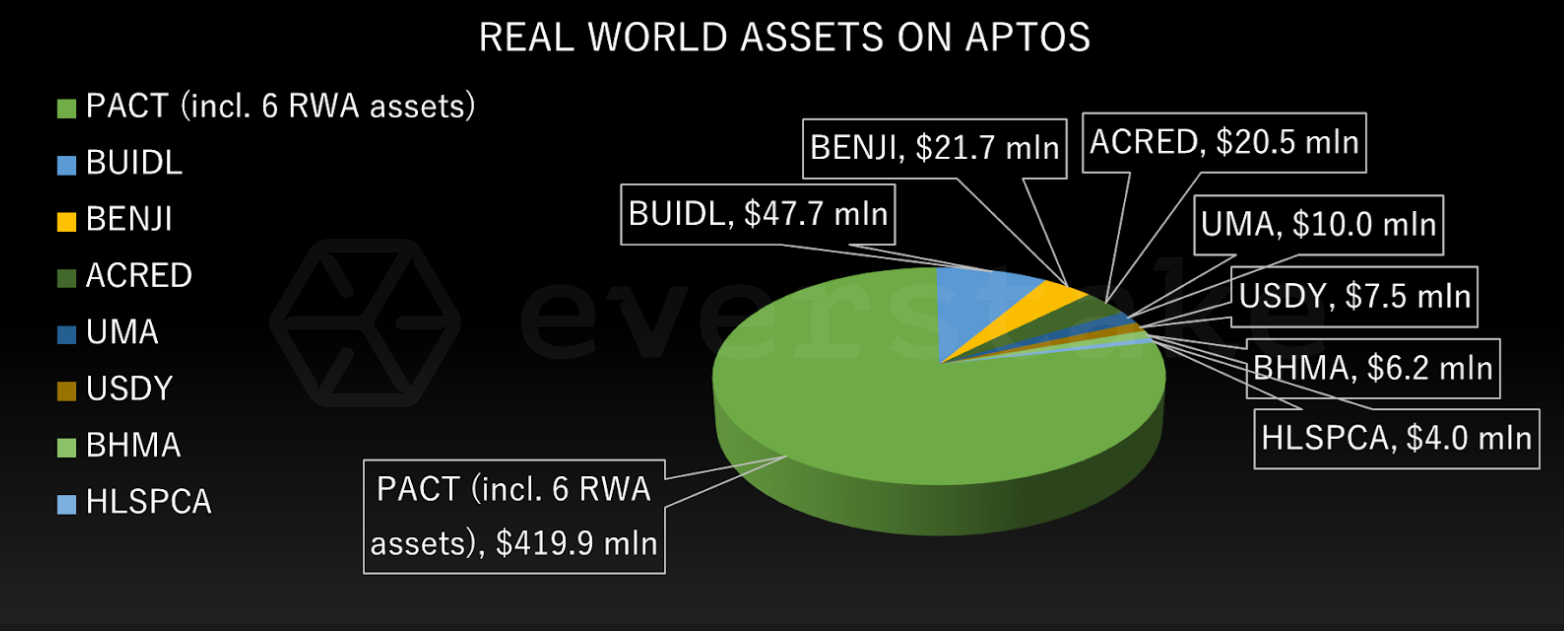

STABLECOINS AND RWAs ON APTOS

Stablecoins and Real World Assets (RWAs) are among the most critical drivers of growth on the Aptos blockchain. In the first half of 2025, they became the key element of Aptos’ increasingly utility-focused DeFi ecosystem.

USDT is the leading stablecoin on Aptos, followed by USDC. The former grew significantly from $431 million at the beginning of 2025 to $850 million by June 30, while the latter, launched natively on Aptos in January, reached $267 million by the end of June. Both supplies continue to grow. Figure 10 shows this upward trend, marking USDT and USDC as the primary drivers of on-chain liquidity and payments.

FIGURE 10. USDT AND USDC OUTSTANDING SUPPLY ON APTOS

FIGURE 10. USDT AND USDC OUTSTANDING SUPPLY ON APTOS

The third-largest stablecoin on Aptos is the Ethena-developed sUSDe / USDe, with over $45 million in circulation.

The aforementioned stablecoins benefit from Aptos’s core technological strengths, including its Block-STM parallel execution engine, which enables rapid, low-cost, and reliable transaction processing. This infrastructure ensures peg stability even during volatile market conditions, increasing trust and usability across DeFi protocols.

Simultaneously, Real World Assets (RWAs) have gained strong traction on Aptos, with the total value reaching $537 million as of June 30, 2025, up from $328 million in January. This makes Aptos the third-largest chain by RWA value. PACT was the biggest contributor, being a collective of regulated financial institutions and service providers focused on bringing real-world financial products on-chain. Six RWA tokens issued through PACT are currently live on Aptos, representing a combined value of $420 million. The second-largest RWA asset is BUIDL, BlackRock’s tokenized fund, with $47.7 million, followed by BENJI from Franklin Templeton at $21.7 million. Other tokens shown in Figure 11 include ACRED, UMA, USDY, BHMA, and HLSPCA.

FIGURE 11. REAL WORLD ASSETS ON APTOS

This suggests that Aptos has a pronounced potential to become a leading platform for both on-chain liquidity and real-world financial integration.

APTOS ECOSYSTEM AND KEY MILESTONES

AIP-119: Reduce Staking Rewards on Aptos

Throughout the first half of 2025, governance remained active and inclusive, with proposals discussed not only by core contributors but also by DeFi protocol teams, validators, large stakeholders, independent users, and the Aptos Foundation itself.

One of the most notable proposals of this period was AIP-119, which suggested reducing staking rewards. The proposal sparked widespread discussion across the ecosystem, with differing perspectives shared and debated transparently.

The original version of AIP-119 proposed reducing staking rewards by 1% per month over three months, targeting a 3.79% annual rate. Still, after receiving extensive feedback from the Aptos community, the proposer, Moon Shiesty, revised the plan.

The updated proposal scales back the reduction from 3% to 1.5%, spread over six months instead of three. This change was motivated by concerns that a rapid decrease could reduce incentives for validators, particularly smaller ones with low commission rates, and thus damage decentralization.

“I believe decreasing the rewards over a longer period of time will allow the Aptos community more time to assess the impacts, positive or negative, of the change to staking rewards.”

Moon Shiesty, Mirage Protocol

The updated proposal extended the timeline, giving the ecosystem room to adjust. It also allowed the Aptos Foundation to expand its delegated staking program, support smaller validators, and maintain a healthy, decentralized validator set.

Raptr

Raptr is a cutting-edge Byzantine Fault Tolerant (BFT) consensus protocol that sets a new standard in blockchain performance by achieving the BFT trifecta of high throughput, low latency, and efficient decentralization, which many deemed impossible.

At its core, Raptr uses a leader-based model enhanced by a pioneering concept called Prefix Consensus. This approach fuses the speed of optimistic consensus with the reliability of pessimistic safety guarantees, enabling blocks to be finalized much faster without sacrificing network integrity.

What sets Raptr apart is its real-world efficiency: it delivered an impressive 250,000 transactions per second (TPS) with a latency as low as 750 milliseconds in a simulated mainnet-like environment. Moreover, Raptr maintains consistent performance even during severe network disturbances, outperforming many top-tier protocols, including the most advanced DAG-based systems.

Shardines

Shardines is an execution engine presented by Aptos Labs to break through blockchain's biggest barrier: scaling execution without limits. While most blockchains hit a wall due to CPU constraints, Shardines removes that bottleneck entirely, achieving over 1 million transactions per second (TPS) and paving the way for infinite horizontal scalability.

Much like shifting from a single-lane road to a multi-lane expressway, Shardines enables transactions to be executed in parallel, not in competition. It does this by decoupling execution from storage and consensus so that each layer can scale independently and efficiently.

Shardines marked the beginning of infinite scalability on Aptos, which is set to make it an operating system for global finance and enable decentralized apps to scale to the level of global demand.

Zaptos

Zaptos is a low-latency blockchain architecture built on Aptos that reduces end-to-end transaction time by reordering how execution, certification, and storage happen relative to consensus. Instead of waiting for consensus to complete, Zaptos introduces optimistic shadow processing, allowing these stages to begin in parallel as soon as a block is proposed.

This redesign removes most stages from the latency-critical path. As a result, Zaptos achieves up to 40% lower latency under load, while sustaining 20,000 transactions per second with sub-second finality. It significantly improves responsiveness for real-time blockchain applications, without sacrificing throughput.

By maximizing resource utilization and parallelizing pipeline stages, Zaptos ensures faster transaction confirmations even in geo-distributed environments. This makes it highly suitable for scaling decentralized applications requiring speed and high throughput.

Move Madness

Move Madness represents a significant upgrade to the Move programming language on the Aptos blockchain, enhancing its capabilities for DeFi applications. The recent improvements introduce several powerful enhancements to the Move programming language, enabling more efficient, secure, and expressive DeFi development on the Aptos blockchain.

-

Dynamic Script Composer

This feature allows developers to build complex Aptos transactions using TypeScript without writing Move scripts directly. It chains multiple actions, like swaps, transfers, or deposits, into a single transaction, compiling them into a Move script automatically. This simplifies development, speeds up experimentation, and enables powerful multi-step transaction flows without deploying new on-chain modules.

-

Account Abstraction

Aptos now allows accounts to use customizable Move-based authentication, beyond the traditional native methods. This means users can implement more flexible and complex verification like multisig or delegated access. The result is improved security, scalability, and greater control over account access.

-

Permissioned Signers

The permissioned signer model in Aptos allows users to define fine-grained access control by associating specific permissions with signers, effectively reducing the risk of unauthorized actions in smart contracts. This mechanism enhances security by enforcing runtime checks within the Aptos Framework and supports revocable, time-limited handles for account delegation without compromising signer integrity.

-

Big Ordered Maps

This enhancement enables fast, scalable handling of large on-chain data by spreading storage across multiple resources. It improves performance, lowers gas costs, and supports parallel updates, which makes it suitable for high-throughput applications like DeFi and indexers.

-

Storable Function Values (Higher-Order Functions)

Move 2 introduces higher-order functions, allowing function values, such as lambdas and partial applications, to be passed, stored in structs, and even persisted on-chain if they meet certain conditions. This enables more modular, reusable logic, particularly useful in scenarios like DeFi where dynamic, asset-specific behavior can be registered without redeploying the main contract.

Global Trading Engine

Aptos's Global Trading Engine initiative aims to position the blockchain as a central hub for high-performance trading applications, leveraging its ability to handle substantial transaction volumes. With commitments like the $200 million in grants and investments, Aptos is aiming for an environment where innovative trading solutions can thrive, potentially attracting institutional interest and mainstream adoption.

That said, the success of this engine will hinge on its ability to maintain low gas costs and instant finality under real-world conditions. In these areas, Aptos has shown promise but still faces competition. This initiative is a bold move, but its effectiveness will be tested as it scales globally.

MEV on Aptos

The management of Maximal Extractable Value (MEV) on Aptos is being tackled through cutting-edge solutions like the Block-STM parallel execution engine, which seeks to optimize transaction processing in scenarios with access conflicts.

The KoFi Finance team plays a pivotal role in this effort, exploring the integration of MEV with Directed Acyclic Graph (DAG) structures to improve transaction ordering and mitigate exploitative risks, crucial in Aptos's high-throughput setting where MEV could otherwise compromise user experience and network stability.

Their focus on liquid staking protocols, enhanced by MEV revenue sharing and leveraged staking vaults, aims to boost staker profitability, aligning with Aptos's vision for advanced DeFi applications.

Still, this approach introduces potential risks from over-leveraging and the intricacies of MEV extraction, which could affect protocol stability. Aptos's strategy to address MEV, supported by KoFi Finance's innovative work, is promising but requires ongoing refinement to handle exploitation tactics and regulatory and technical obstacles efficiently.

BTCfi on Aptos

BTCfi on Aptos explores the intersection of Bitcoin's security with Aptos's scalability, aiming to bring Bitcoin-based financial applications to a more efficient blockchain environment. It supports aBTC, sBTC, xBTC, and WBTC, giving users access to multiple forms of tokenized Bitcoin.

This initiative could attract Bitcoin holders looking for DeFi opportunities without compromising on the underlying asset's stability, leveraging Aptos's low transaction costs and high throughput. Still, integrating Bitcoin with Aptos involves technical challenges, such as ensuring cross-chain compatibility and maintaining decentralized trust, which could limit initial adoption.

The potential for BTCfi to expand Aptos's user base is significant. Still, to stand out in a crowded market, it will require highly reliable bridging solutions and a clear value proposition. This development is a strategic move for Aptos, though its success will depend on overcoming these hurdles and demonstrating tangible benefits to users.

FUTURE PROSPECTS

Aptos continued to demonstrate strong growth and resilience in the first half of 2025. With increasing user adoption, expanding validator decentralization, and innovative technologies like Raptr, Shardines, and Zaptos pushing performance boundaries, Aptos is positioning itself for mass-market DeFi and real-world asset integration.

Stablecoins such as USDT and USDC are expanding rapidly, while real-world assets are gaining significant momentum. These trends are helping Aptos build a more liquid, practical, and mature DeFi ecosystem.

While the ecosystem maintains stable TVL and a healthy staking environment, upcoming governance decisions and technology upgrades will be crucial in sustaining momentum and balancing decentralization with incentives.

That said, Aptos’s focus on low latency, high throughput peak 22k TPS, and developer-friendly tools suggests a promising future for the ecosystem.

***

The Aptos Experience is back—this time in New York City. On October 15–16, join global innovators, bold builders, and top projects for two days of high-voltage insights, hands-on tech demos, and real talk on scaling Web3. Celebrate three years of Aptos, explore the future of the Network, and connect with the next wave of standout startups.