ATOM

Cosmos

crypto

staking

COSMOS (ATOM) STAKING INSIGHTS & ANALYSIS: H1 2025 | EVERSTAKE

Get the latest insights from the Cosmos staking report for the first half of 2025. Performance metrics, rewards, and Everstake’s role in the ATOM ecosystem.

JUL 30, 2025

Table of Contents

Key Findings and Takeaways

H1 2025: an overview

Major H1 2025 milestones

State of Staking

Proposals and Governance

Future Prospects

Share with your network

Key Findings and Takeaways

-

Staking Surge, APR Stable: Despite market volatility, ATOM staking rose 15.7% to an all-time high of 274.04M ATOM. The cosmos staking APR remained stable at 16.34%, driven by Proposal #996, which redirected 98% of inflation to stakers.

-

Slight Drop in Delegators: The total number of unique cosmos staking addresses declined by 1.38% to 1.28M, largely due to the exit of small airdrop-farming wallets. At the same time, there was a net gain of 3,680 new delegators in February.

-

Whales Gained Ground: The known 218 addresses holding over 100k ATOM grew their share to 54.63% for a 5.08% gain. Smaller delegator categories lost relative weight.

-

Steady Rewards Flow: Cosmos rewards totaled 19.26M ATOM in H1, with an average monthly distribution of 3.21M ATOM. Coinbase and Binance had the highest reward claims.

-

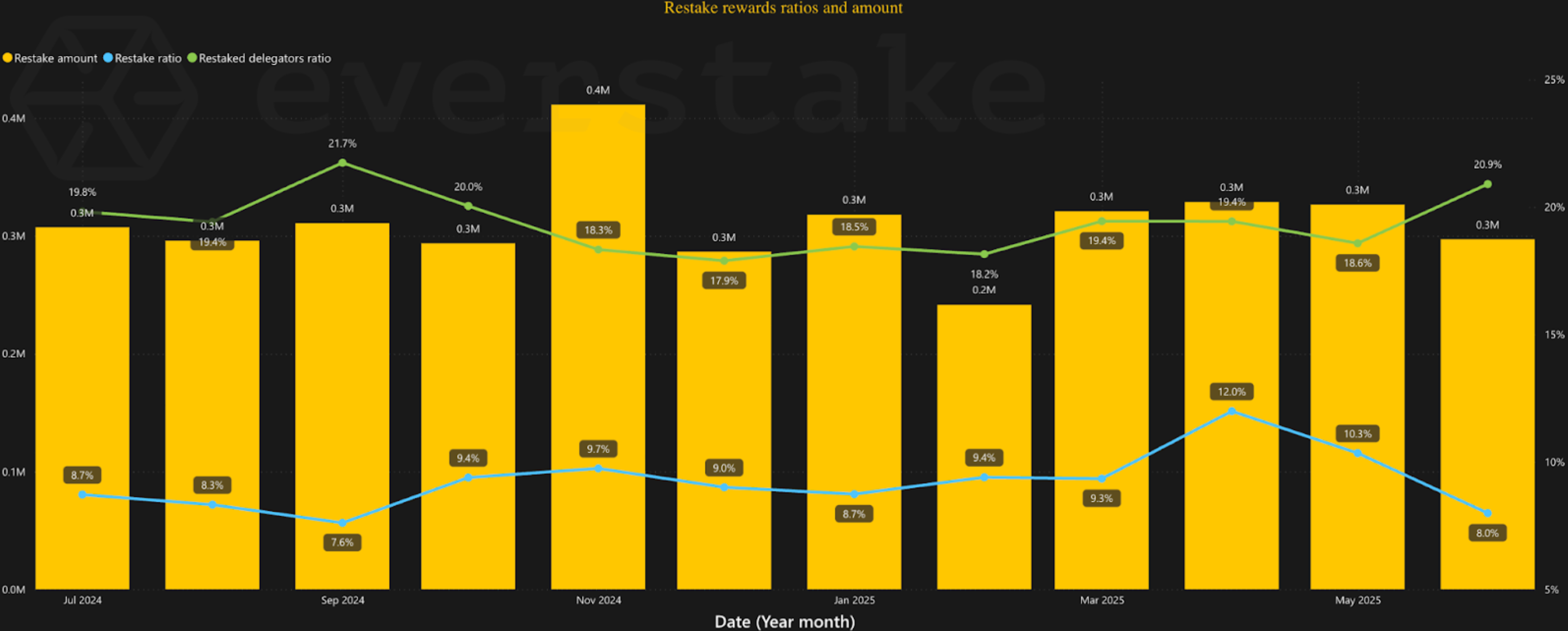

Restaking Activity: Restaking held steady around 300k ATOM/month, with a notable rise in active restakers from 18.5% to 20.7% of total delegators.

-

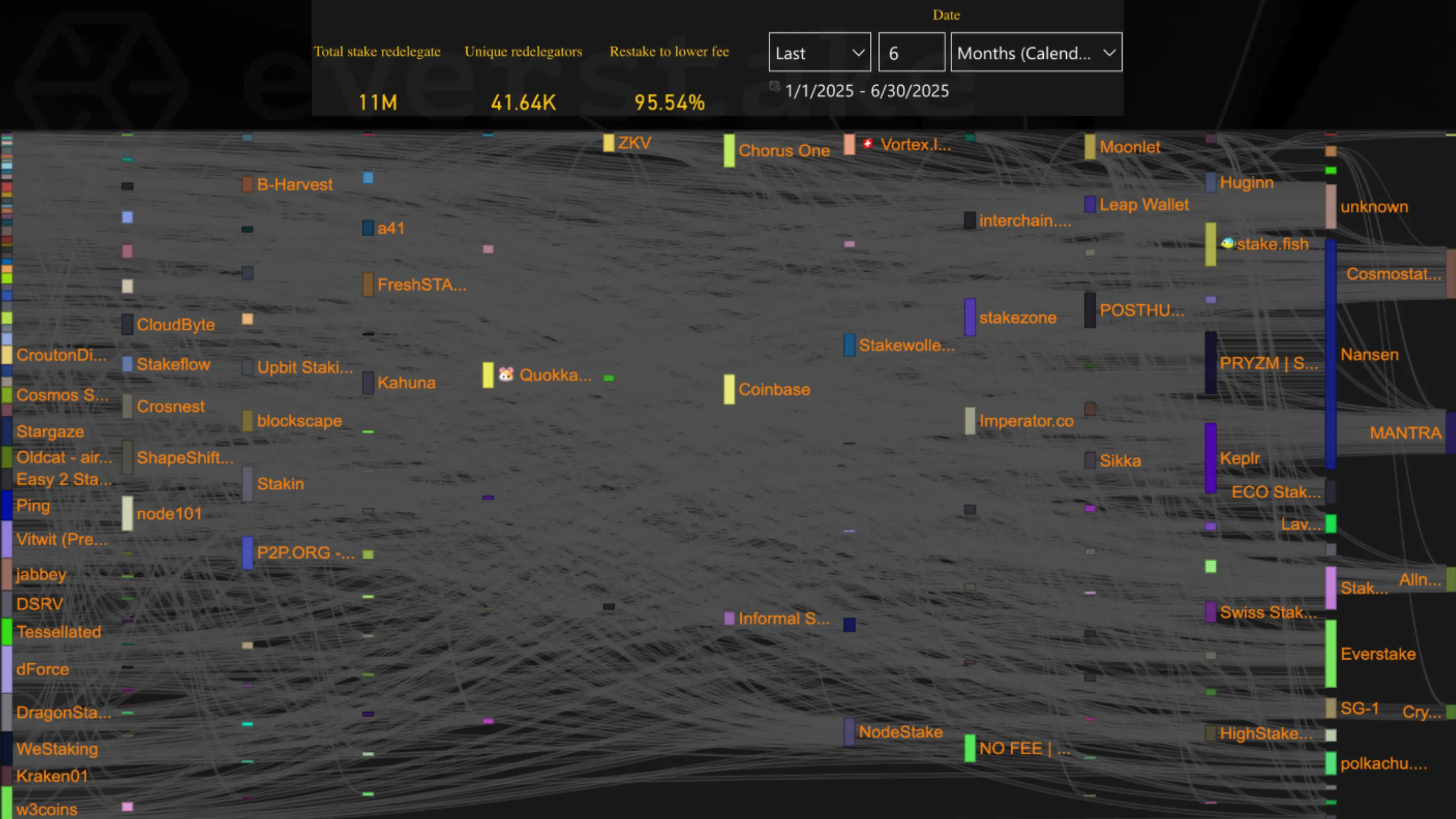

Redelegation Still Dynamic: 11M ATOM was redelegated across 41,640 addresses, marking a 15% decline in volume and increased participation compared to H2 2024.

-

Focused Governance: 15 of 19 submitted proposals passed. Due to a higher deposit threshold, no spam was observed. Seven proposals focused on core upgrades.

-

Core Upgrades Delivered: IBC v2 (Eureka) and Cosmos SDK v0.53 were launched, improving interoperability and developer experience.

-

Cosmos Stack Adoption Grew: The Cosmos EVM stack gained traction across projects like Ripple, Babylon, and Ondo.

-

Real-World Usage Expanded: RWA integration, enterprise experiments, and growing interest from TradFi signaled practical adoption of the Cosmos infrastructure.

H1 2025: an overview

The first half of 2025 was crucial for Cosmos development. It was dedicated to the revival of the Cosmos Hub and its establishment as the leading chain in the ecosystem, both as a liquidity hub and interchain connector bridging a wide range of blockchain networks.

Since its introduction, Cosmos has contributed to blockchain development through the Cosmos SDK and Tendermint BFT (now CometBFT), providing a modular framework for launching independent chains. This approach reduced the technical barriers to creating new blockchains, resulting in the deployment of numerous networks. That said, many of these chains encountered challenges during market downturns, including limited liquidity, declining token value, and reduced community engagement.

The Cosmos Hub was the first of these networks and initially implemented the concept of Internet of Blockchains, as described in the Cosmos whitepaper. Despite its foundational role, the Hub’s purpose remained loosely defined for several years.

In 2025, Interchain Labs began refocusing development efforts under the Interchain Foundation. Priorities included expanding integration beyond the Cosmos ecosystem, improving liquidity, aligning the ATOM token’s utility with network usage, and developing the Hub as a central coordination layer for interchain activity.

Major H1 2025 milestones

The first half of 2025 marked a significant period of realignment for the Cosmos ecosystem. With the establishment of Interchain Labs, development efforts shifted toward integrating the Cosmos Stack and Cosmos Hub and establishing the broader interchain ecosystem under a cohesive strategic direction.

Several key infrastructure upgrades were implemented during this period.

-

The release of IBC v2 enabled general-purpose cross-chain messaging. It facilitated the launch of IBC Eureka, a new hub-based routing mechanism now operational with connections to Ethereum, Babylon, XRP, and other networks.

-

As of mid-2025, over 150 chains support IBC, up from approximately 100 at the end of 2024. This makes Cosmos the largest interoperability network by the number of connected chains.

-

-

The Cosmos SDK v0.53 introduced enhancements to simplify module development and improve the developer experience.

-

In parallel, the Cosmos EVM stack was fully open-sourced and adopted by at least five major projects, including Ripple’s EVM Sidechain, TAC, Babylon, and Ondo Finance.

-

Although plans to deploy an EVM directly on the Cosmos Hub were paused, development continues to focus on enabling sovereign EVM chains across the interchain ecosystem, positioning the Cosmos Hub as a cross-chain coordination layer.

-

On the adoption front, Ondo Finance tokenized over $16 billion in real-world assets using the Cosmos infrastructure. Financial institutions like TAC and Ripple began piloting IBC for cross-border settlement cases. Cosmos-native projects like Stride and Neutron maintained strong engagement.

At the same time, new Cosmos chains, including Elys, Nillion, Initia, Namada, Polaris, and Fairblock, contributed to growth in areas such as rollups, privacy, and modular infrastructure.

State of Staking

The first half of 2025 presented continued difficulties for the cryptocurrency market, and ATOM was similarly affected. Nevertheless, under the direction of Interchain Labs, cosmos staking activity increased.

-

The total amount staked in ATOM rose by 15.7%, reaching a record high of 274.04 million, reversing the downward trend observed in the latter half of 2024.

-

The proportion of staked supply grew by approximately six percentage points, now accounting for about 60% of the total supply.

Unlike the volatility and decline seen in late 2024, the first half of 2025 was marked by steady and incremental growth in cosmos staking. This indicates a shift toward more stable and sustained participation within the network.

While the total number of staked ATOM increased, the number of delegators declined slightly. Most departing addresses held relatively small balances, suggesting that the reduction was driven by the exit of multi-account setups previously used for airdrop farming. Recent changes to Cosmos airdrop eligibility criteria, particularly introducing higher minimum thresholds, have reduced incentives for low-balance wallets to remain active. Consequently, many of these accounts have either consolidated or exited the network.

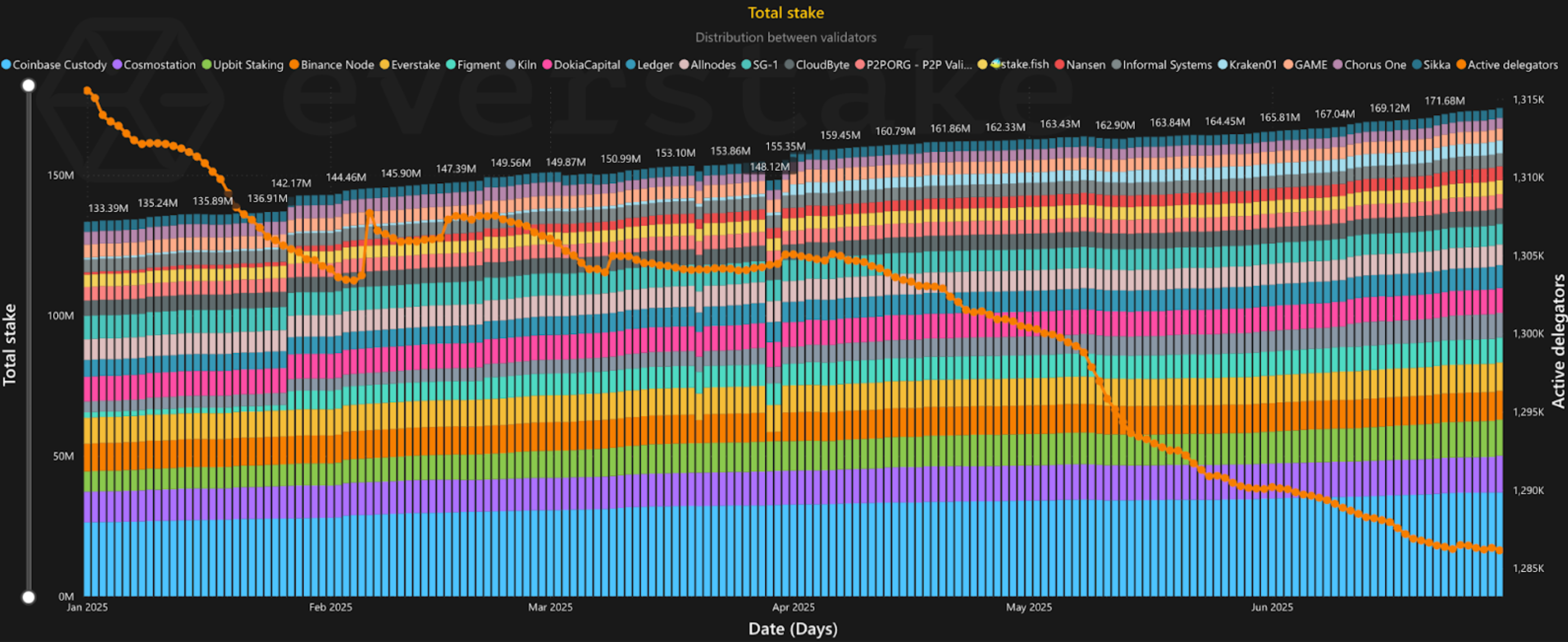

Total Delegators

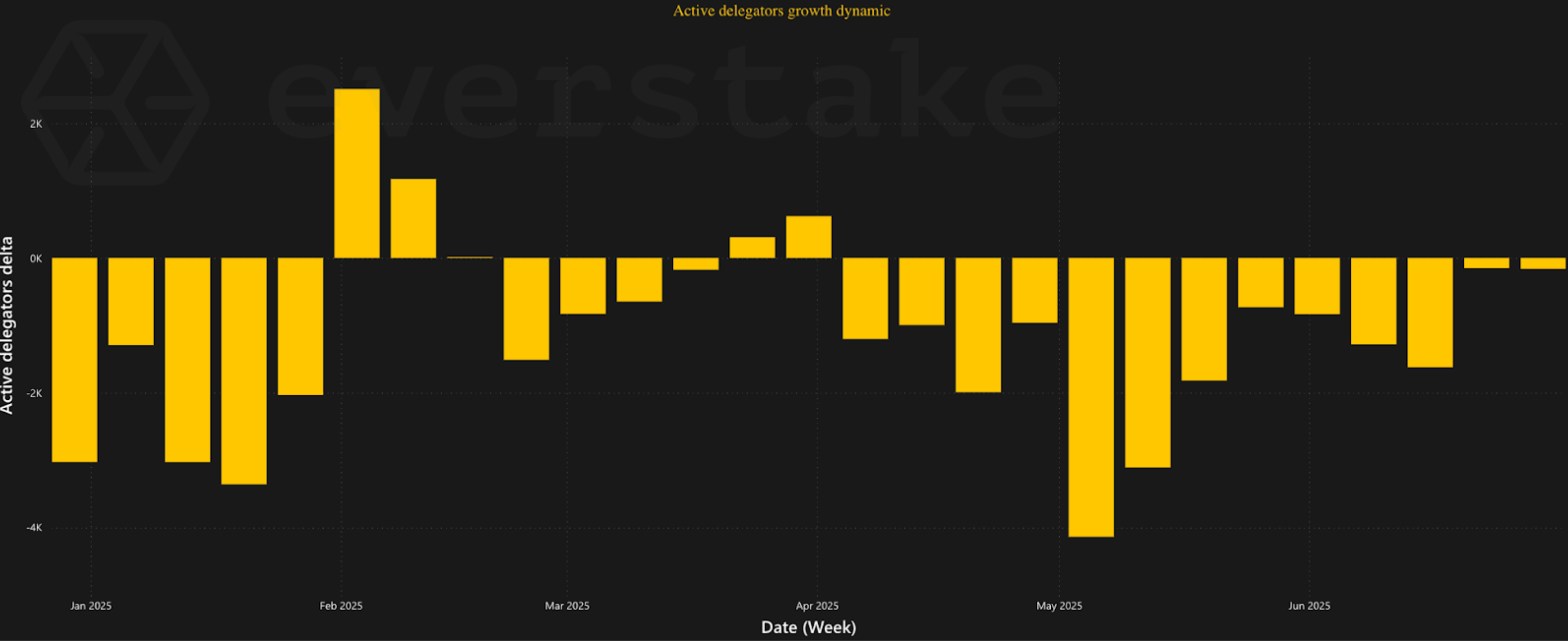

Changes in the number of delegators during the first half of 2025 were uneven, ultimately resulting in a modest net decrease of 1.38%. By the end of the period, the total number of unique ATOM staking addresses stood at approximately 1.28 million.

-

The largest net outflows occurred in January, followed by a significant rebound in February, which saw the highest monthly increase: a net gain of 3,680 new delegator addresses.

-

March experienced a temporary decline, followed by partial recovery.

-

In the remaining spring months, weekly net exits ranged between 150 and 4,000, tapering off toward the end of the season.

The chart below presents weekly net changes in delegator count. Positive values indicate a net increase in ATOM staking addresses, while negative values reflect periods where more delegators exited than joined.

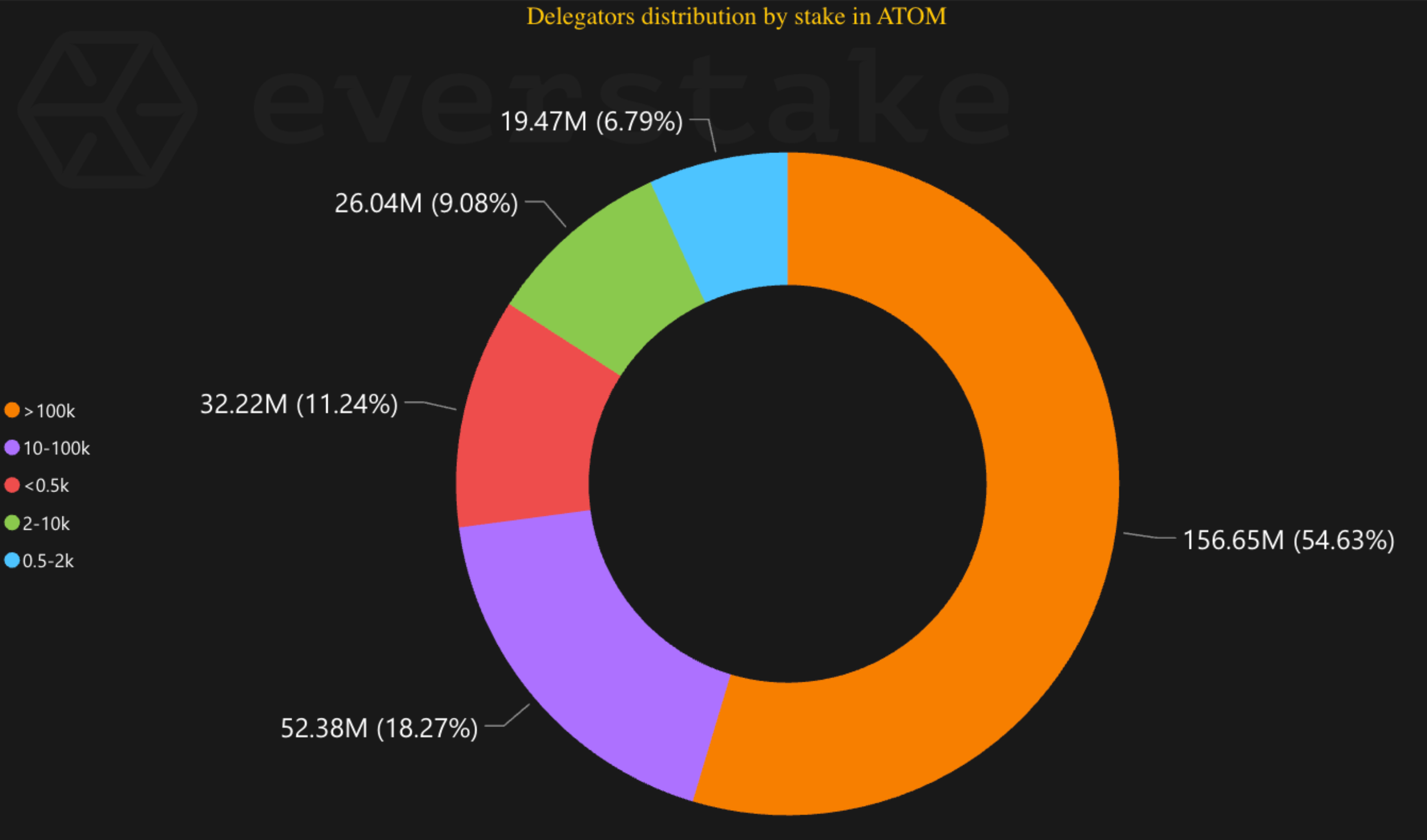

Whale Dominance

The distribution of staked ATOM by delegator size in H1 2025 showed a shift toward larger holders, reversing the retail-led trend observed in late 2024.

-

The share of delegators with balances exceeding 100,000 ATOM increased by 5.08%, reaching 54.63% of the total stake. This group comprises 218 addresses, including 31 new entrants in 2025, and now holds approximately 156.65 million ATOM.

-

The increase suggests renewed engagement from major stakeholders, such as centralized exchanges and institutional participants.

-

Delegators with balances between 10,000 and 100,000 ATOM experienced a slight share decline of 1.15%.

-

Smaller holders, with balances under 500 ATOM, saw a decrease of 2.57%, effectively offsetting their gains from the second half of 2024.

Despite the growing concentration among larger holders, the stake remains distributed across a relatively broad set of addresses. At the same time, retail delegators continue to represent 45.37% of the total staked supply, which is a substantial portion that may expand again as long-term confidence in the network increases.

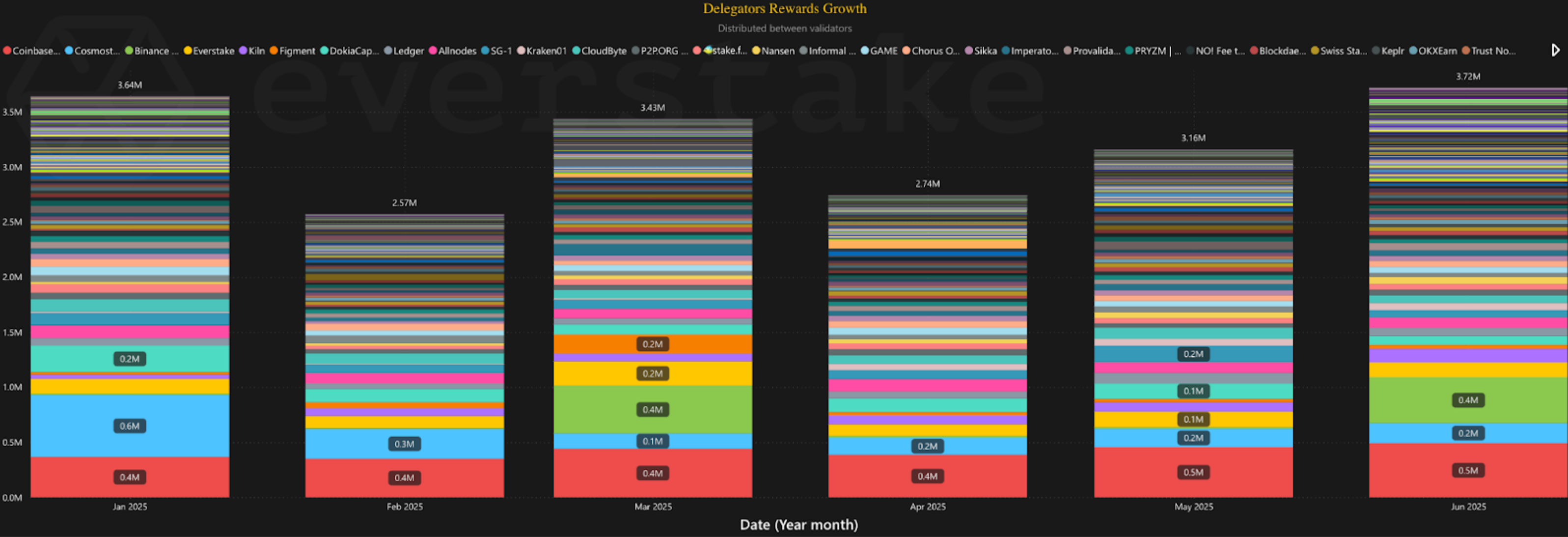

Claimed Rewards

-

In H1 2025, ATOM delegators claimed 19.26 million ATOM in staking rewards, averaging 3.21 million monthly.

-

Notable spikes occurred in January (3.64M) and March (3.43M), driven largely by substantial claims from addresses staking via Coinbase and Binance. These spikes likely came from large holders choosing to realize profits only a few times a year based on market conditions.

The May–June period showed a steady upward trend.

-

While June saw another significant claim from Binance delegators, the 13% increase from April to May passed without standout claim events.

-

This was likely due to a 3M ATOM growth in total stake, and a reduction of the Community Pool Tax from 10% to 2% in May, redirecting more emissions toward cosmos rewards as APR has grown by about 1.4% since May 15.

A notable portion of staking rewards remained unclaimed during the first half of 2025, indirectly reducing circulating supply and easing price pressure. In February, approximately 430,000 ATOM went unclaimed, followed by around 950,000 in April and 550,000 in May.

While an estimated 160,000 ATOM in deferred rewards were later claimed during March and June, roughly 1.7 million ATOM remain unclaimed as of the end of the reporting period. This unclaimed balance is a temporary supply buffer, supporting overall price stability.

Estimate your ATOM staking rewards in seconds with the ATOM staking calculator.

Restaking Activity

In addition to unclaimed rewards, restaking activity is important in supporting the Cosmos Hub’s security and influencing ATOM’s market behavior. By compounding rewards into the existing stake, restaking strengthens network security and enhances individual delegators’ returns, making it a key mechanism for protocol resilience and value accrual.

-

During the first half of 2025, restaking volumes remained stable, averaging approximately 300,000 ATOM per month, consistent with levels observed in 2024.

-

The only notable deviation occurred in February, when restaking volume dipped slightly to 241,000 ATOM.

-

Over the same period, the proportion of delegators engaging in restaking increased gradually, rising from 18.5% in January to 20.7% in June.

-

This trend suggests steady, incremental adoption of restaking as a preferred strategy for maximizing staking yields.

Redelegations

During the first half of 2025, the Cosmos Hub maintained a high level of redelegation activity across its full active validator set of 180 participants. Approximately 11 million ATOM were redelegated by 41,640 unique staking addresses, reflecting sustained engagement and validator competition.

This represents a 15% decline in redelegated volume compared to the second half of 2024, alongside a 15% increase in participating addresses. This shift may additionally signify the consolidation of smaller accounts, potentially contributing to a lower overall delegator count while maintaining or increasing individual activity levels.

APR

The staking APR on the Cosmos Hub is directly affected by the total volume of staked ATOM. Typically, an increase in total stake leads to a decline in APR. While the total stake rose significantly during the first half of 2025, the effect on APR was offset by the approval of Proposal #996 in May.

-

This proposal revised the inflation distribution, increasing the share allocated to staking rewards from 90% to 98% and reducing the Community Pool's allocation from 10% to 2%.

-

As a result, the APR declined only marginally by 0.35 percentage points over the six months, reaching 16.34% as of July 1.

Discover your daily, monthly, and yearly returns with the cosmos staking calculator.

Proposals and Governance

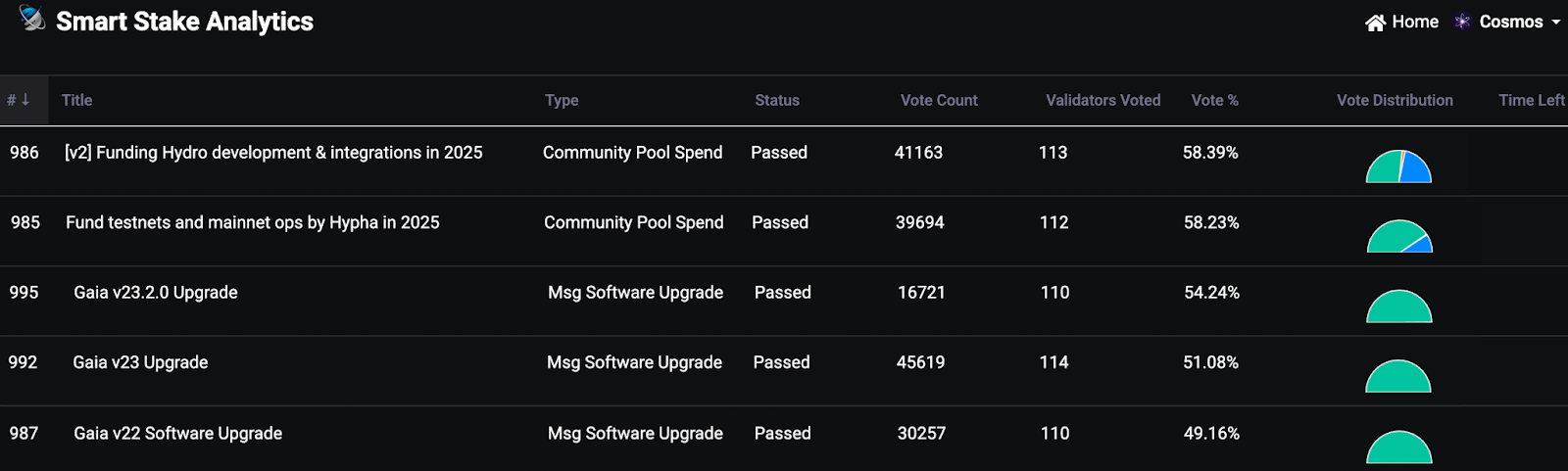

In contrast to the previous year, no governance proposals on the Cosmos Hub in 2025 exhibited spammy characteristics. This change is likely attributable to Proposal #980 (November 2024), which increased the proposal deposit requirement to 500 ATOM, discouraging low-effort submissions.

-

During the first half of 2025, 19 proposals were submitted.

-

Seven focused on network upgrades, including IBC-go, CometBFT, and Interchain Security. This matches the total number of upgrade-related proposals for 2024 and suggests accelerating technical development.

Of the proposals submitted, 15 passed, two were rejected, and two failed to meet the required thresholds. One failed proposal, initially focused on funding the Hydro liquidity export portal, was revised and resubmitted as Proposal #996, which later passed with the highest quorum observed during the period. Proposal #1001, despite strong support, failed due to formatting issues.

Voter participation remained consistently high, particularly for proposals involving major upgrades, Hydro funding, and Proposal #985, which supported continued development by Hypha, the team responsible for maintaining Cosmos testnets and coordinating upgrades.

The proposals with the highest voter turnout are shown in the picture below.

Source: Smart Stake Analytics

Future Prospects

The focus for the second half of 2025 will likely shift toward refining Cosmos’ product-market fit and advancing its role as an infrastructure layer for sovereign Layer 1 chains. The Cosmos Hub can provide core services, such as routing via IBC Eureka, access to oracle networks, centralized exchange integrations, and general interoperability infrastructure, to networks across the interchain ecosystem.

While plans to deploy a native smart contract virtual machine on the Hub were set aside due to implementation complexity and user experience considerations, development of the Cosmos EVM stack continues. Additional integrations and improvements are planned throughout H2 2025 to support sovereign EVM chains.

Enterprise and institutional engagement is also expanding through pilot programs. These efforts are supported by structured feedback cycles and focused research into developer and business requirements.

Economic design remains an area of active evaluation, with a long-term objective of positioning ATOM as the monetization and coordination layer across the Cosmos Stack, rather than emphasizing smart contract execution on the Hub itself.

Conceptually, Cosmos focuses on its core differentiators: interoperability, sovereign chain architecture, and modularity. These capabilities are now supported by a comprehensive stack that includes Cosmos SDK v0.53, IBC v2, IBC Eureka, the Cosmos EVM, and shared security.

The remainder of 2025 will be critical in determining how effectively these components can be integrated into a cohesive offering and how much demand they can generate across Web3-native projects and enterprise applications.

Disclaimer

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.

Sign Up for

Our Newsletter

By submitting this form, you are acknowledging that you have read and agree to our Privacy Notice, which details how we collect and use your information.