2024 IN 1,000 CHARACTERS

What shaped Ethereum in 2024?

It seems pretty challenging to find a common denominator, but there were some milestones no one can’t argue about being included. Here are my top-3 picks in chronological order:

DENCUN UPGRADE

The Dencun upgrade, a significant milestone within a broader Ethereum roadmap, among others introduced danksharding—a crucial interim solution for Ethereum scaling that dramatically increased the network’s scalability and reduced transaction fees.

Ethereum ETF Launch

The highly anticipated launch of ETH ETFs in July allowed traditional investors a more accessible and regulated way to gain exposure to ETH. It has also enabled the further adoption of Ethereum blockchain technology and decentralized applications.

DEVCON 7

Held in Bangkok, it brought together 12k people from all around the world. A number of side events crossed one thousand, making the 7th Devcon edition the biggest Ethereum-related event to date, showcasing the community’s devotion to growth and development:

ETHEREUM: THE GREAT AND POWERFUL

Every DevCon since the first conference in 2014, Vitalik Buterin has a flagship keynote with exactly the same title—"Ethereum in 30 minutes” (check the latest one via the link).

As time and protocol change, so does the content. Vitalik noted this during Devcon 2024:

What thrilled or concerned us back then may no longer exist (uncle blocks, you are not missed!). Meanwhile, what is currently driving and challenging this evolving ecosystem was hardly imaginable in 2014 (there are no more talks on Ethereum without mentioning L2s).

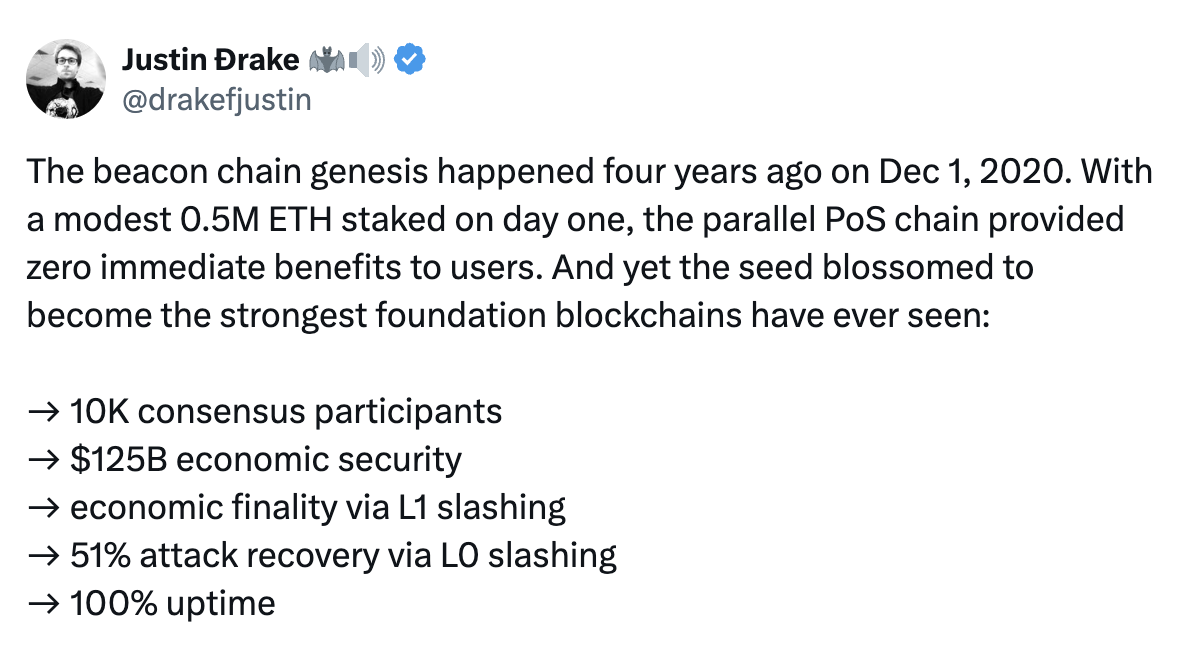

Justin Drake, Ethereum Foundation Researcher, known for his disruptive proposals, like MEV burn, pre-confirmations, and a most-talked recent one on a redesign of the current Consensus Layer to become Beam Chain, summarized end-of-year Ethereum stats as follows:

Although there is a ton of data to analyze and present, in this section, I will go through the key network and ecosystem metrics that, in my opinion, define Ethereum in 2024.

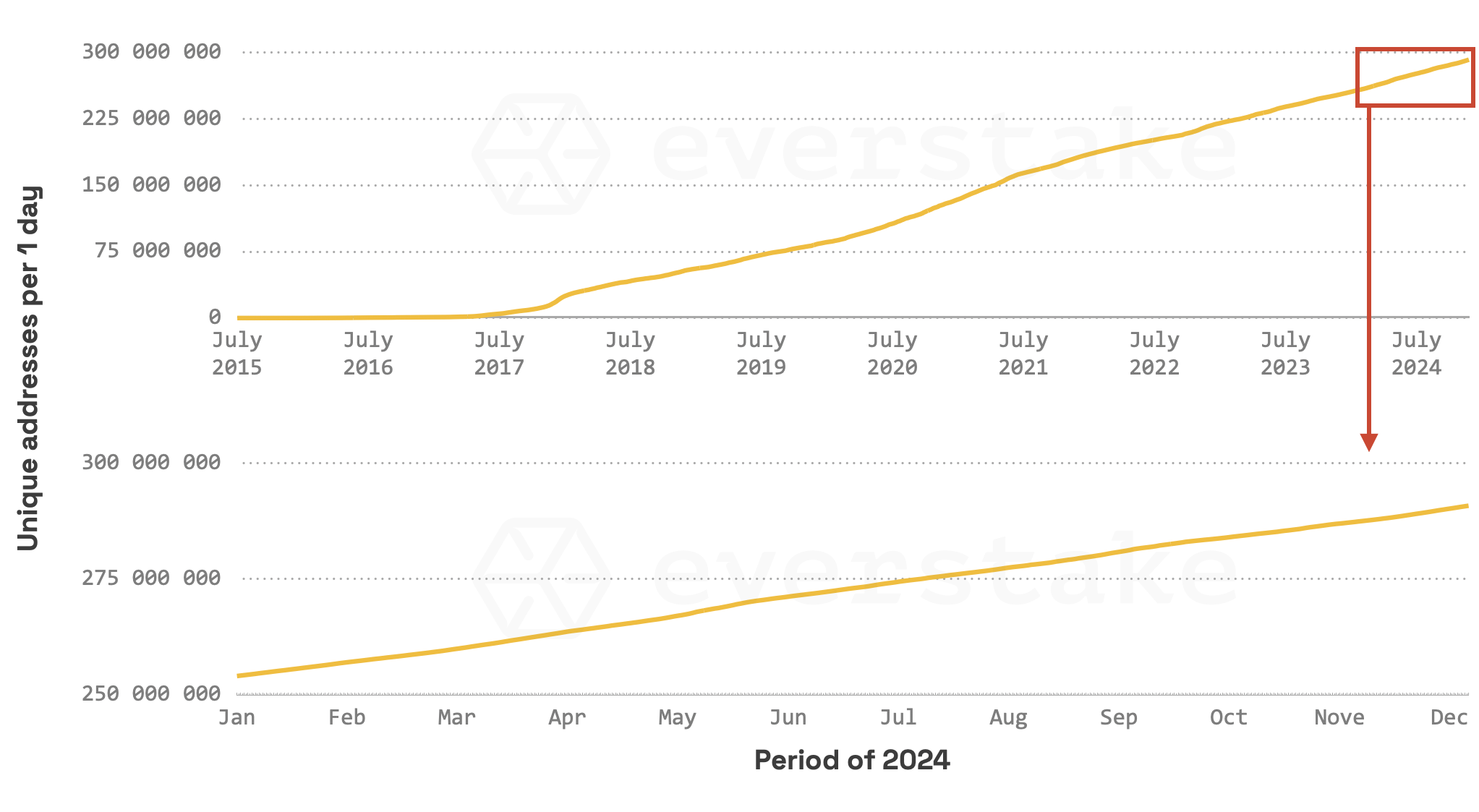

Starting with the basics—the total number of addresses on the Ethereum blockchain.

TOTAL NUMBER OF UNIQUE ADDRESSES

The chart below shows stable growth since the network launched in 2015. The 2024 progress was perfectly linear, with no spasmodic jumps showcasing Ethereum’s maturity. Key metrics for unique Ethereum addresses (including both Externally Owned Accounts (EOA) and contracts) for the year include:

- Total increase: 39.6 million (+15.76%)

- Average daily growth: 108,200

- Median daily growth: 103,121

- Peak daily growth: 213,228 on May 4, 2024 - a fitting "May the Force be with you" moment, nearly doubling the daily average

Source: Etherscan Charts & Stats: Ethereum Unique Addresses Chart

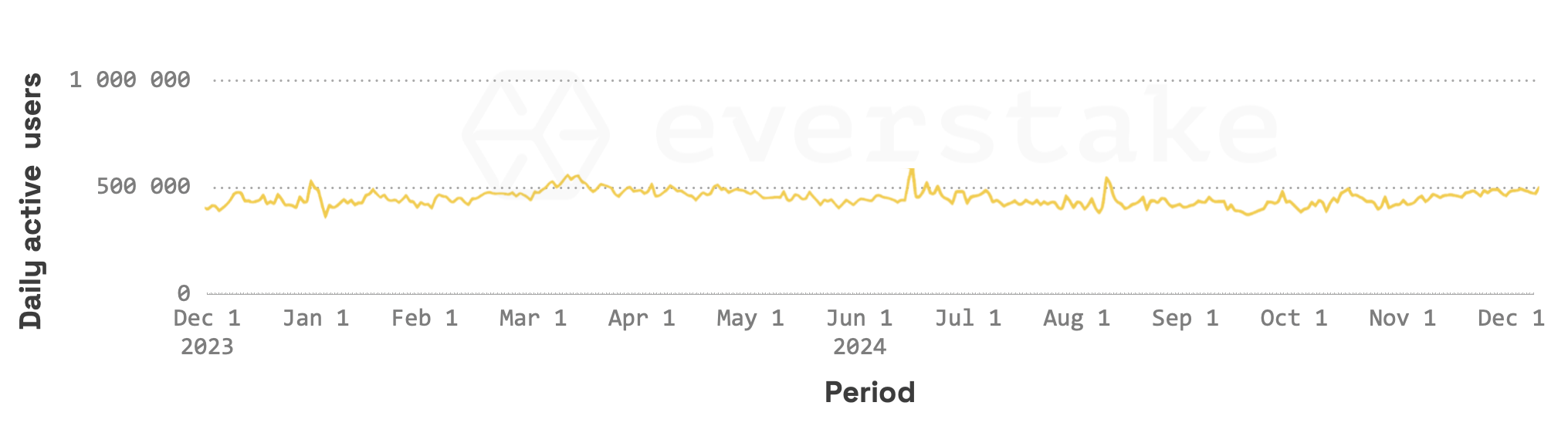

DAILY ACTIVE USERS

The chart above is complemented by another, showcasing the number of daily active users on Ethereum. Throughout most of the year, this figure ranged between 300,000 and 400,000, with occasional spikes above 500,000 during key events such as the network upgrade and market surge in June and the launch of ETH ETFs in July. Following the price rally and renewed market optimism sparked by the U.S. presidential elections, daily active users consistently surpassed 400,000.

Source: token terminal: Projects > Ethereum

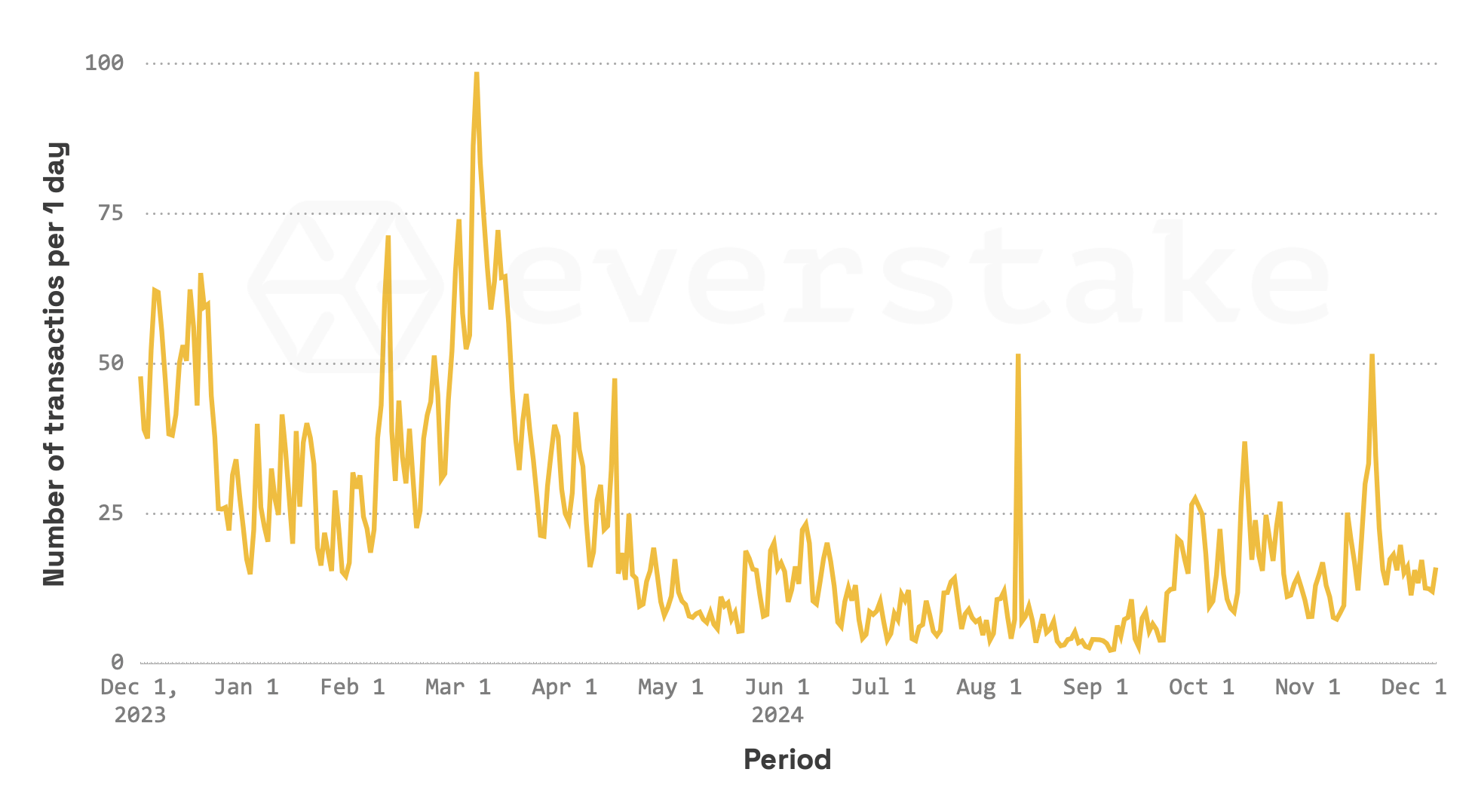

DAILY TRANSACTION VOLUME

Let’s continue with the daily transaction volume metric. This network never sleeps—really NEVER. No matter whether it is a holiday or not, whether it is lazy summer vacation season or busy autumn, whether the price is up or down. The chart below is an accurate echogram of the living beat of Ethereum activity.

Source: Etherscan Charts & Stats: Ethereum Daily Transactions Chart

As you can see from the chart above, the volume of transactions was usually between 1.03 million and 1.2 million. During this period, the average daily number of transactions was 1,164,911, with a median value of 1,156,305.

If we compare this year’s stats with the same metrics for 2023, the average result throughout 2024 increased by 11.83% (+10.47% for the median value).

The highest number of transactions in 2024—1,961,144—occurred on Sunday, January 14, as a result of whale activity. In contrast, the lowest daily transaction volume, 965,098, was recorded on Sunday, October 27. That was the last day of the token price drop before getting back to the upward trend. Notably, the peak transaction volume surpassed 2023’s highest by 20.47%, or 333,284 transactions.

The growth of the daily transaction volume metrics showcases consistent network activity. It is clear evidence of the sustainable interest in the protocol among the broader users and a testimonial of Ethereum’s resilience and growing adoption.

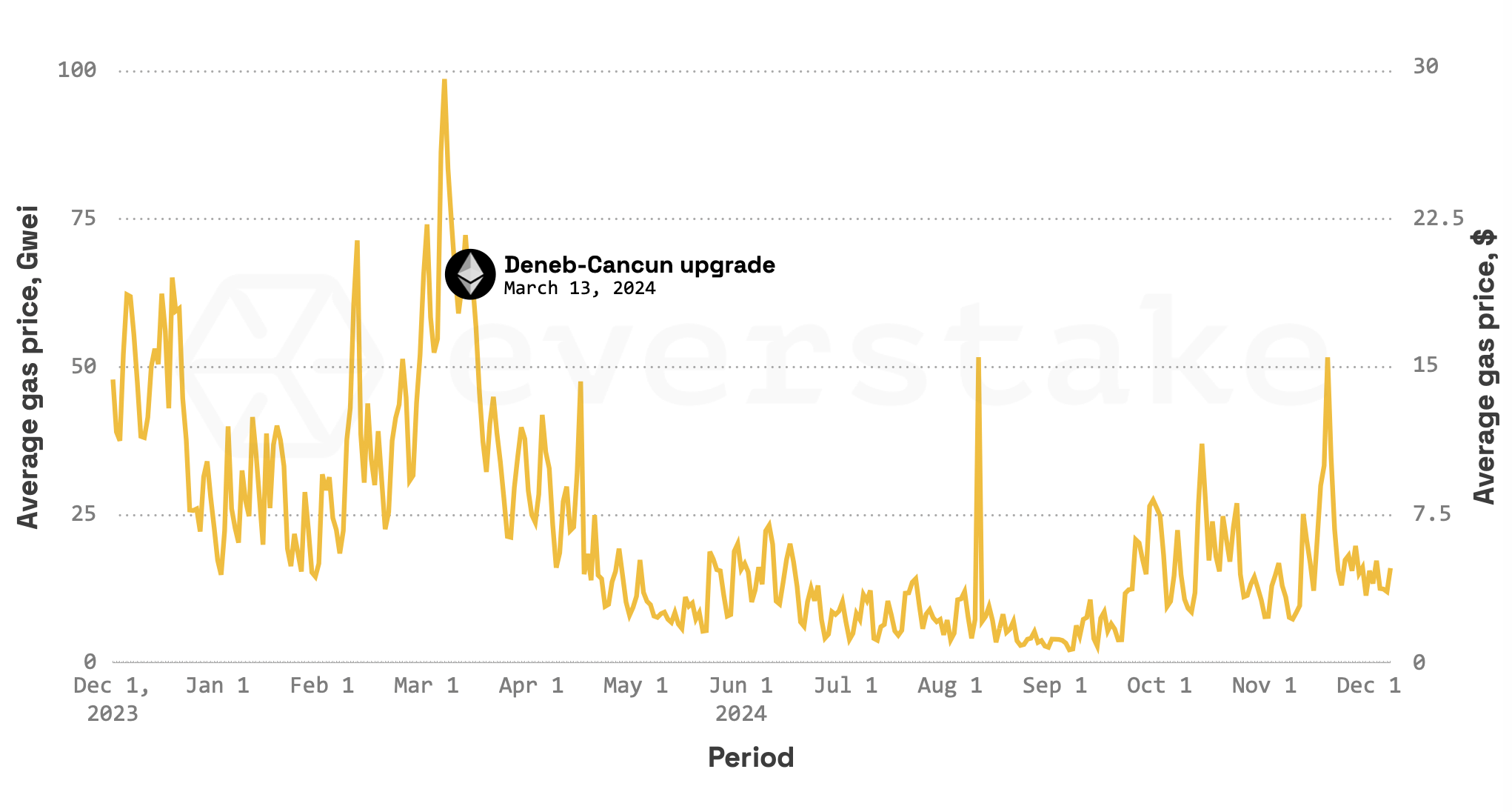

GAS PRICES POST-DENCUN

There is no transaction without gas. Thus, gas price is another important metric to consider when analyzing the network activity.

A long-standing problem with Ethereum congestion, which slowed down transaction speeds to 10–15 TPS and raised gas fees to over 300 Gwei at times, became a snowball that reached its apogee at the end of 2023 and the beginning of 2024. It became a true bottleneck for Ethereum scaling and wider user adoption, as paying a transaction fee twice the usual transaction price was nonsense.

Although the approach to tackle this challenge was figured out in early 2022, it became mainnet-ready only within the Deneb-Cancun (Dencun) fork 2 years later. This upgrade introduced the eagerly awaited proto-danksharding functionality through EIP-4844. It seamlessly integrates off-chain data blobs—inexpensive and temporary memory carrying data about transactions—significantly reducing the expenses associated with storing transaction data for L2s.

Did it work out? More than anyone can imagine! If you don’t know or remember the fork date, it's obvious to guess when it happened if you take a look at the chart: after the upgrade, gas prices dropped from an average of 98 Gwei to an average below 10 Gwei most of the time, with minimum fees regularly hitting 1 Gwei.

Source: YCHARTS Ethereum Average Gas Price

Check all stats and progress tracking around blobs and gas in my posts throughout the year.

The Dencun made Ethereum more cost-friendly for users and rollups, enhancing wider network adoption and opening a new page for further network scaling [until the next roadblock].

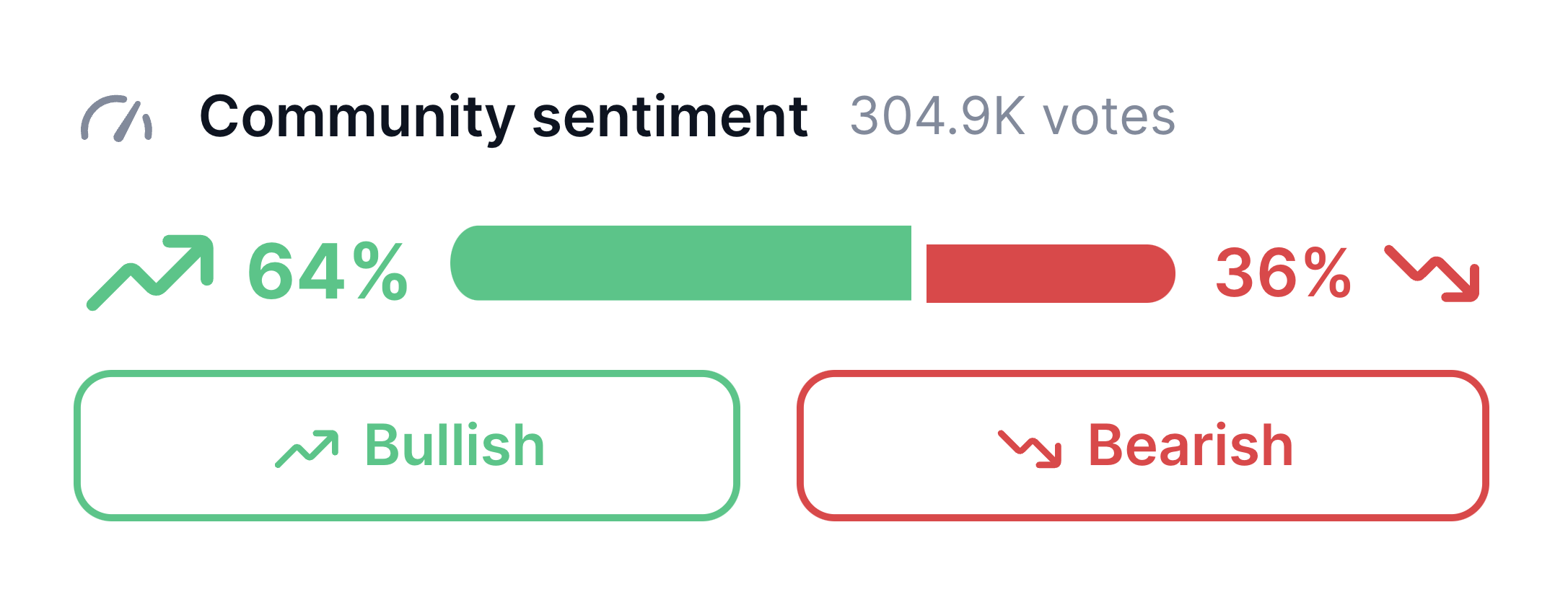

To end this section on a high note, what about community sentiment around all these metrics and the upcoming protocol future? With almost 300k votes on the CoinMarketCap Ethereum page, almost ⅔ of those engaged are positive and optimistic about Ethereum.

What about YOU?

Source: CoinMarketCap Ethereum

STATE-OF-THE-ART STAKING

This year, ETH staking results have been not only about celebration but also have opened a floor to hot discussions around issuance policy, gas prices, lowering the staking threshold to welcome more solo stakers and many more.

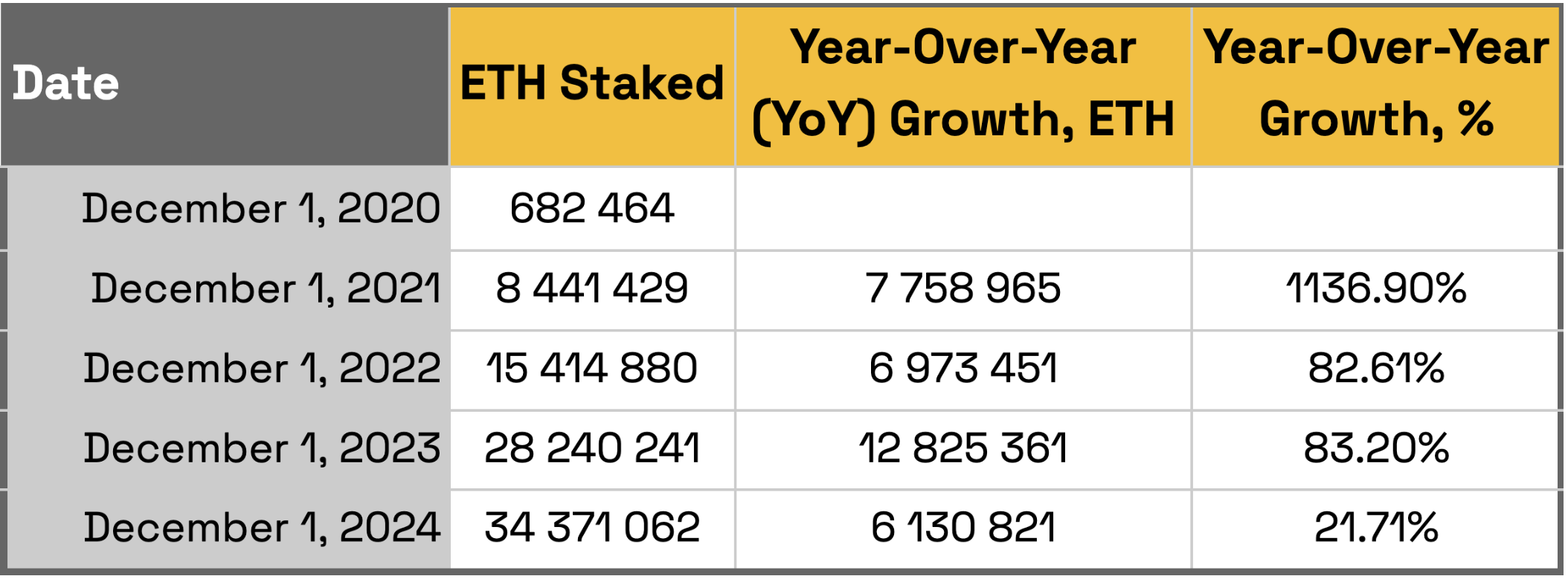

For the purpose and consistency of this report, I will present all data as of December 1, 2024. Accordingly, “year-over-year” metrics will represent the period from December 1 of year N to December 1 of year N+1, where N is the starting year.

December 1 is a particularly fitting date to summarize these results, as it marks the 4-year anniversary of Beacon Chain—an event that introduced the staking consensus mechanism to the Ethereum chain. It has become a pivotal moment for Ethereum, marking a significant step towards unlocking its full potential.

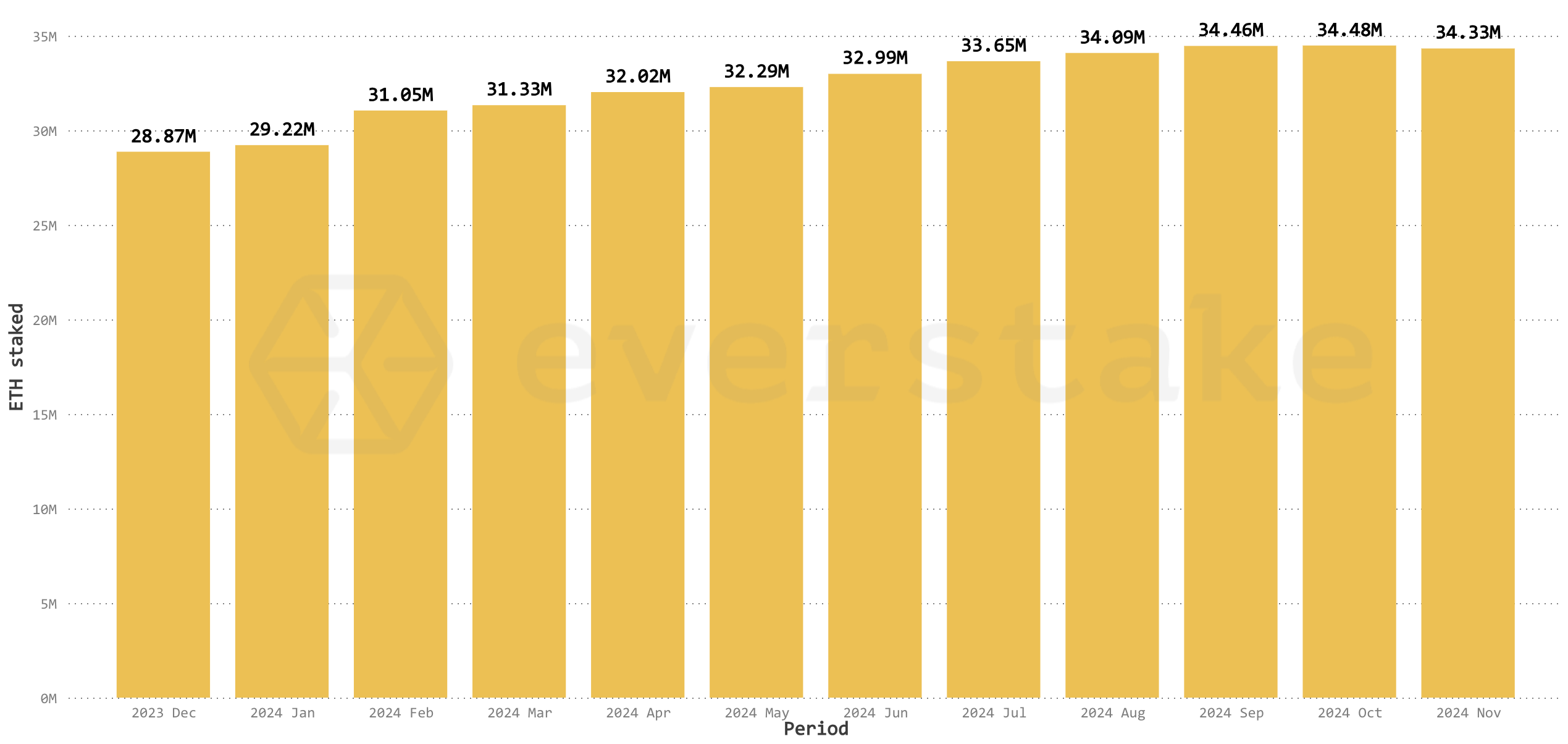

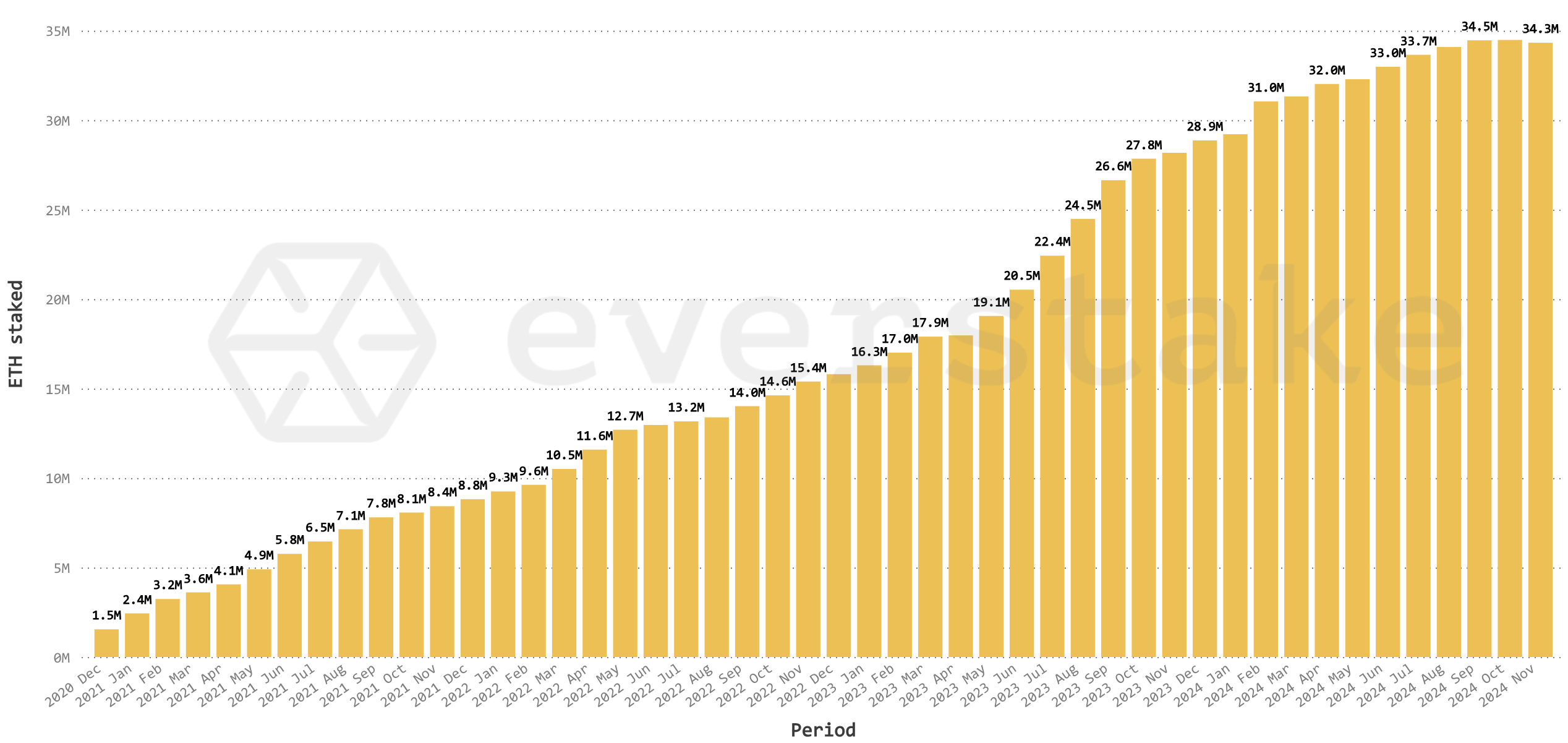

STAKING METRICS

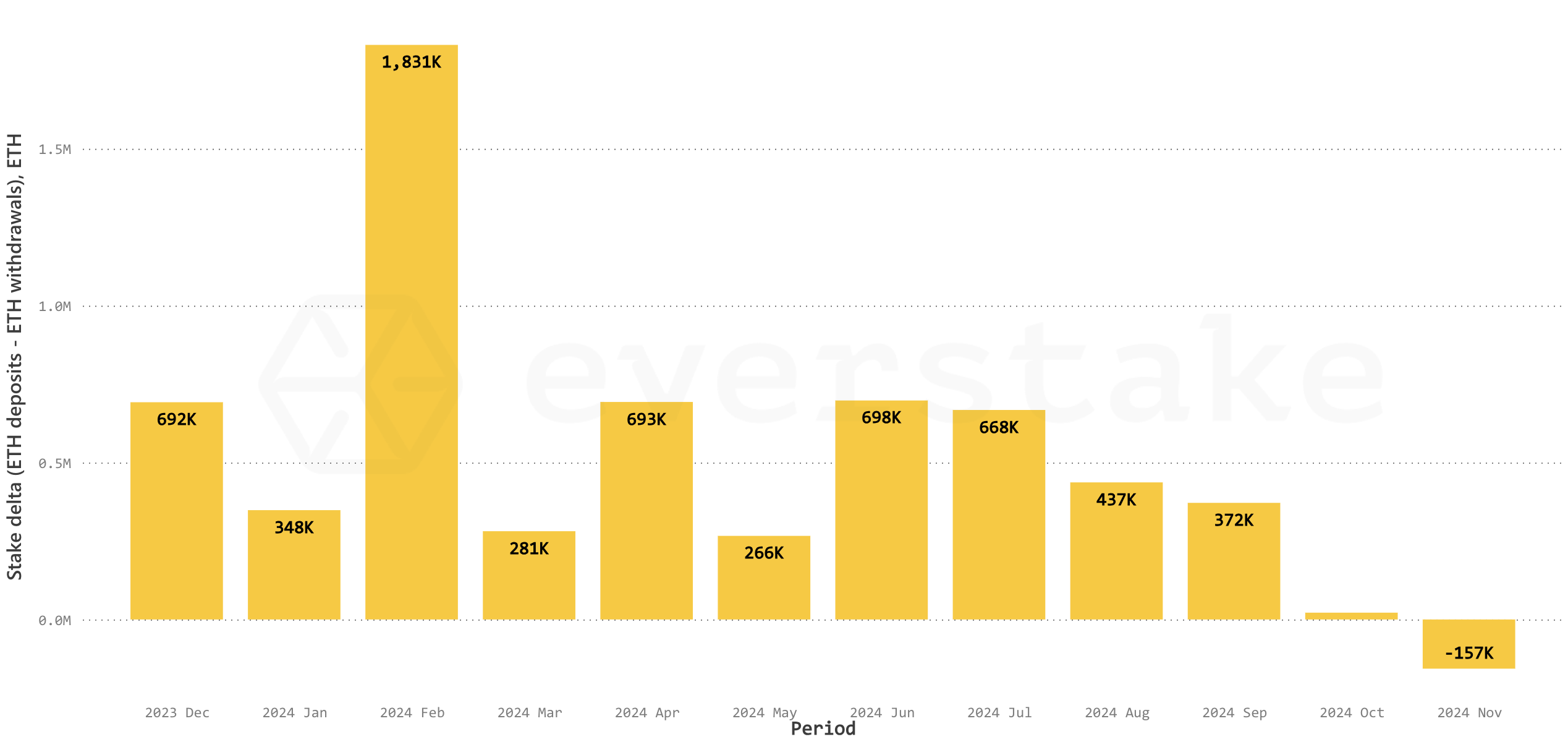

In 2024, Ethereum staking experienced steady and sustainable growth, driven by consistent deposit inflows that annually outpaced withdrawals. Unlike in 2023, when the Shapella upgrade introduced withdrawal capabilities and spurred exponential growth, 2024 was marked by the mature, informed decisions of ETH holders, decoupled from the volatility of ETH speculation.

For those who are more clear-number persons, here is a comparison of year-to-year staked ETH stats according to the Beaconcha.in explorer.

As you may see from the table above, year-over-year growth is 6.13m ETH or +21.71%. Don’t be saddened or fooled by the fact that growth has decreased 3-4 times compared to the previous years. There are a couple of reasons behind that:

-

Before April 12, 2023, the day when the Shanghai-Capella upgrade introduced withdrawal functionality, no unstakes were possible on the network. Due to this technical constraint, the amount of staked ETH can only increase.

-

The absolute growth in 2024 can be compared with a post-Merge 2022, but as soon as the total amount of staked ETH increased by ~2.23 times, the relative growth in 2024 was less.

Also, it is worth noting that the adjusted activation churn limit artificially capped the growth speed as a precaution to slow down the speed of stake growth, as some core developers were concerned about whether the network consensus could withstand the growing number of validators. Find out more about the “churn limit,” the activation queue in 2023, and why and how it was mitigated in my last-year Ethereum report.

As a result of the Dencun upgrade in March 2024, the activation limit was decreased from 16 to 8 validators per epoch (or 1,800 new active validators per day), causing new validators to stay longer in the queue. In my opinion, this change feels like a nonsensical band-aid, as the tsunami wave for staking already subsided during the fall of 2023. Its rationale that a deposit queue would be continuously full didn’t happen, leaving stakers with unnecessary waiting times and potential capital opportunity costs instead of addressing any real issue.

Over the past four years, we can see a clear continuous growth trend of staked ETH with major spikes from the introduction of highly anticipated community features on the Ethereum blockchain: moving from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism with the Merge upgrade in 2022 and withdrawals implemented by the Shapella upgrade in 2023.

Throughout 2024 the biggest inflows were in February, driven by whale activity. The only instance when unstaking surpassed new deposits, resulting in negative stake dynamics, occurred in November. This was influenced by two key factors:

-

token price growth following the U.S. elections, which led to profit-taking

-

and a recurring trend of elevated withdrawals during the November-December period, similar to last year.

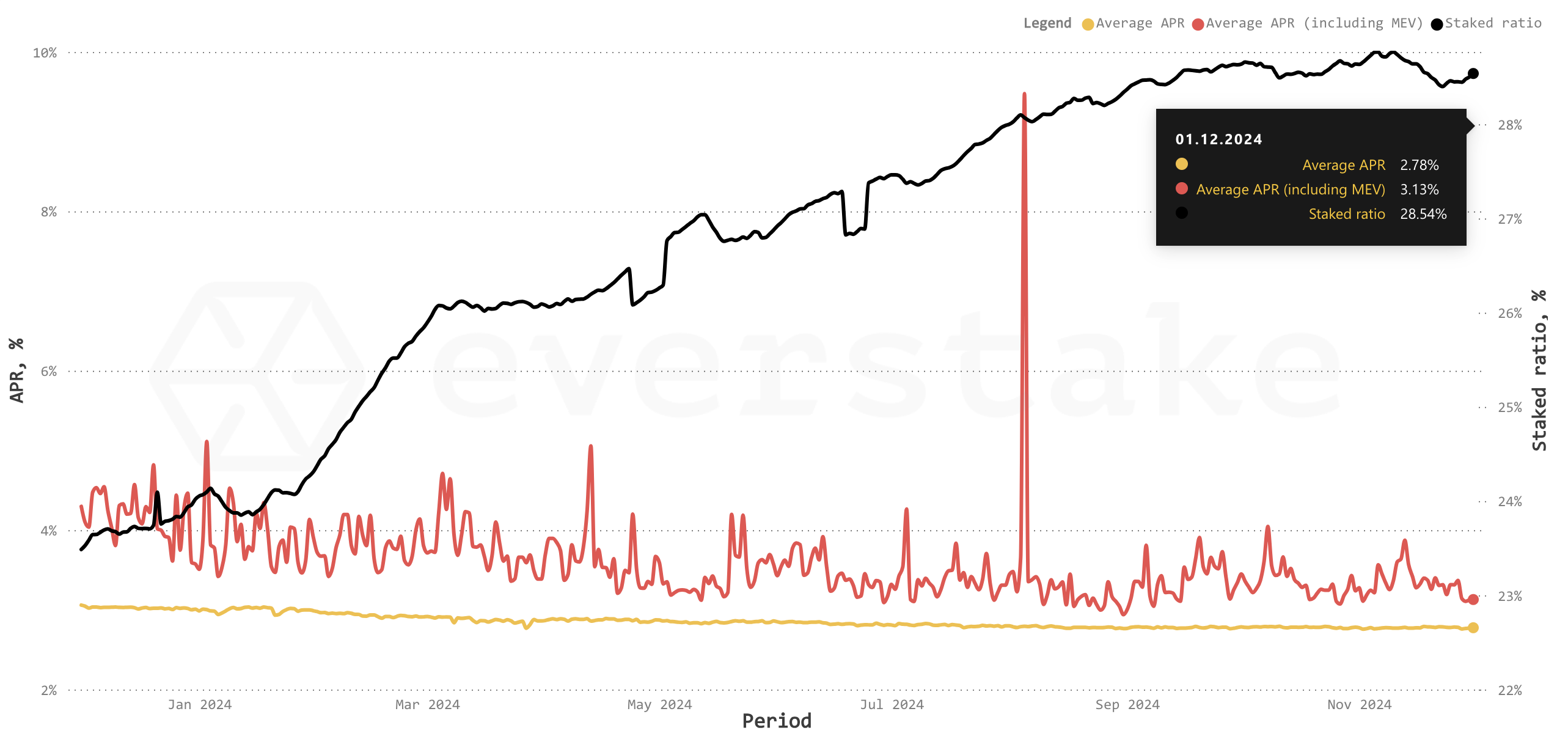

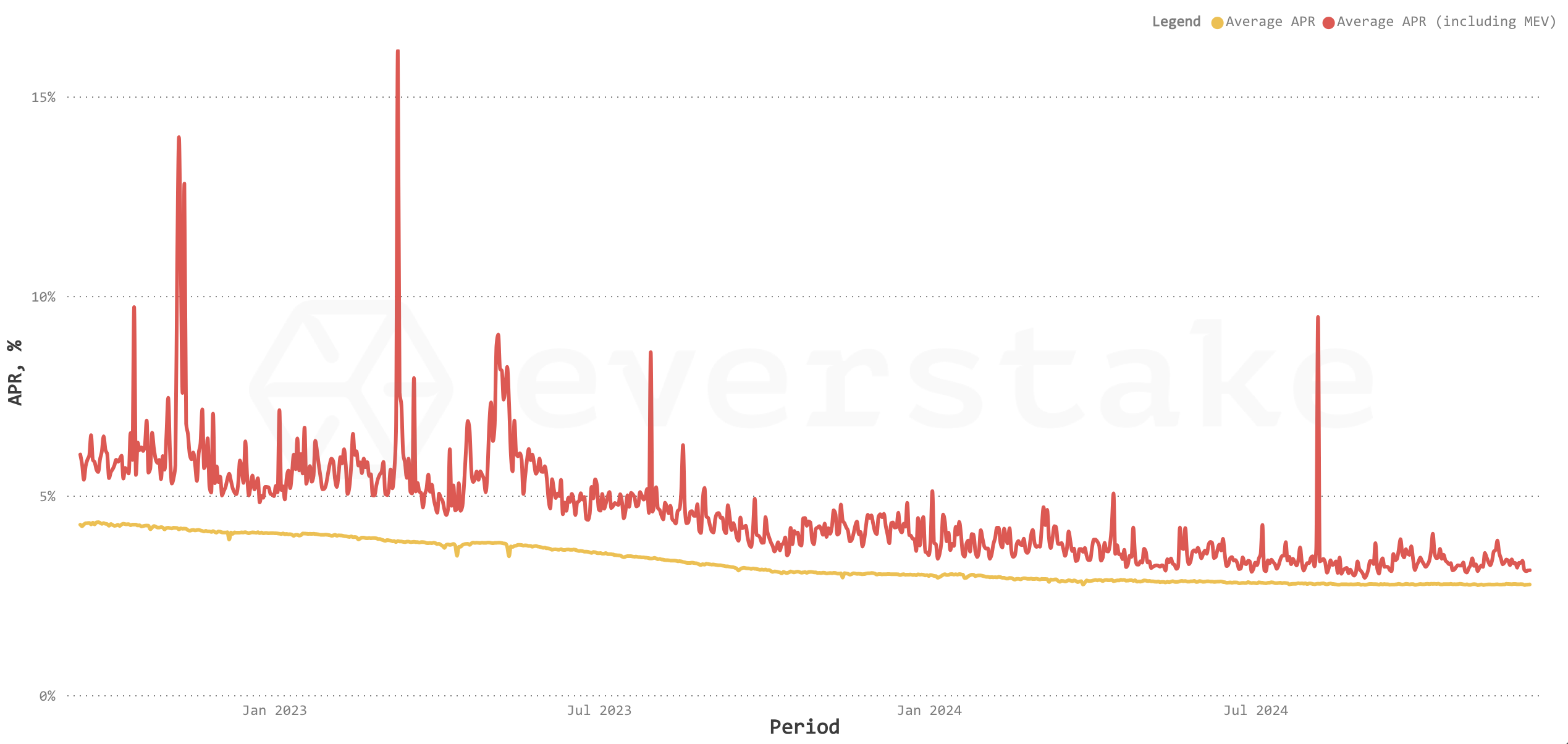

APR TRENDS

As a result of the gradual growth of the amount of staked ETH, Ethereum’s APR has continued to drain. This is due to the existing economic model—the more validators are active, the lower the APR is (you may find a short explanation of why this is interconnected in my previous report).

Thus, while the staked ratio increased by 5.05pp. to 28.54%, the network-average APR (including MEV) lowered from above 4.30% to 3.13% by the beginning of December 2024. Average APR, excluding MEV, decreased slightly less—from 3.06% to 2.78%.

Worth noting that APR can significantly differ (from 2.7% to 10%) depending on the validator or staking provider. Everstake offers an APR of 3.6-10%, catering both to those who wish to stake as little as 0.1 ETH through our staking pool and to those opting to stake 32 ETH or more to activate their own validator.

In the chart above, you may see that MEV’s influence on APR has become significantly less as a result of the following:

Implementation of the Deneb-Cancun (Dencun) upgrade that introduced a new type of transaction, blob, for transmitting data. According to Vitalik Buterin's blogpost: “Initially, the fork reduced the transaction fees of rollups by a factor of over 100…”, as blobs are extremely larger and cheaper than regular CALLDATA, which rollups previously utilized (the latter are stored in history forever compared to the blobs pruned after ~2 weeks).

Following this, gas prices dropped to an average of below 20 Gwei, reducing not only the Consensus Layer rewards but also the priority fee and MEV.

The next one emerges from the previous one—a decrease in the cost and volume of arbitrage, which also affects MEV since this is its main source.

In the long term, the Ethereum core devs consistently work to reduce the impact and eliminate MEV’s negative consequences on the protocol.

ETH STAKED RATIO

Another highly debated issue is the ETH staked ratio, as some Ethereum Foundation researchers raised concerns about the negative externalities of continuous stake growth and existing issuance policy. While the topic remains under discussion, a few proposals have already been introduced to address it. As a result, it’s difficult to predict what changes might come to staking rewards in the coming year.

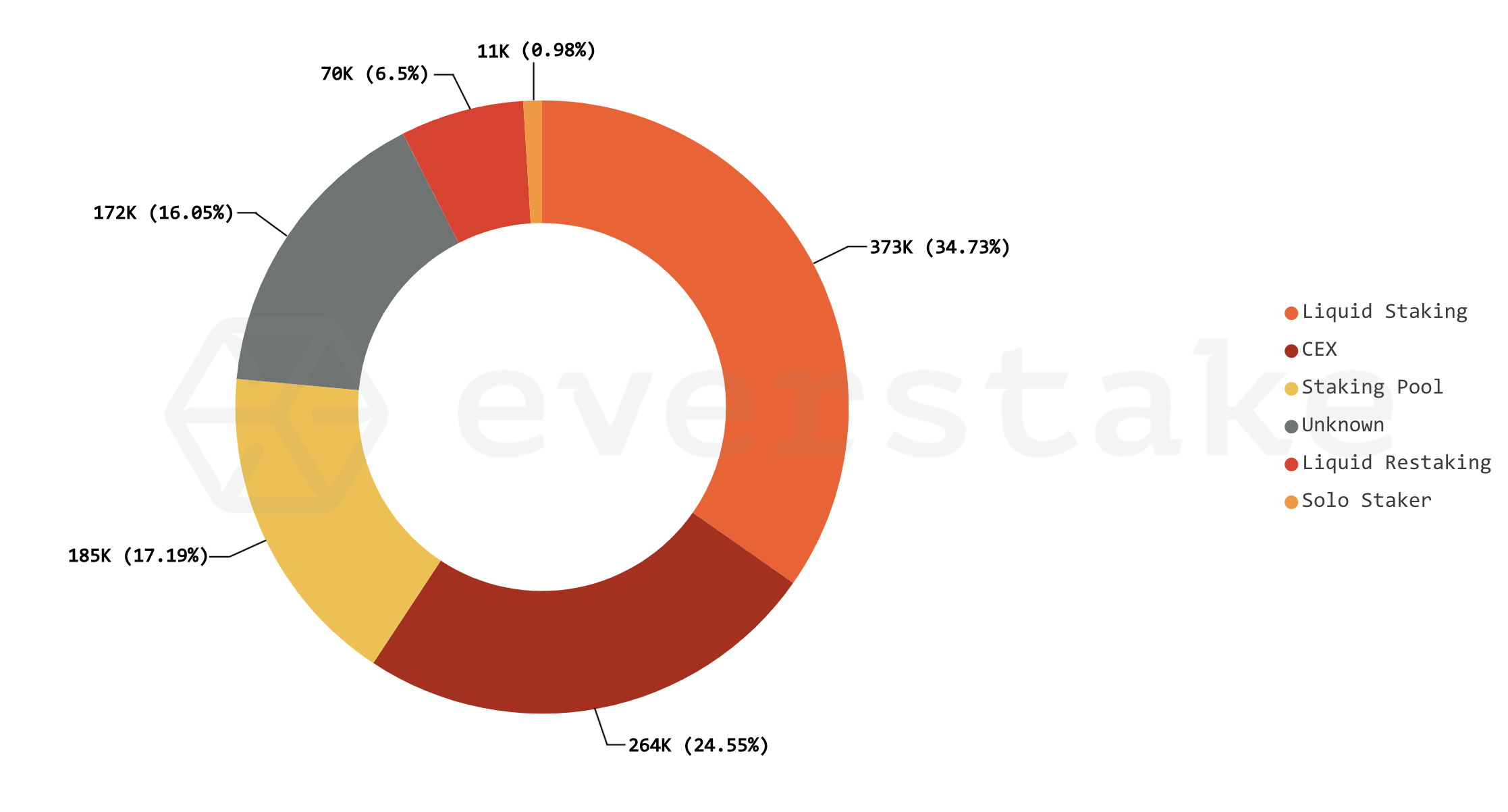

Nevertheless, the share of staked ETH added +5.05pp. to the previous year's results. Below is a breakdown of stake distribution per different entities and groups that provide staking services or stake on their own behalf.

Nothing new here—liquid staking continues to lead with almost ⅓ staked ETH there within different protocols. Although being the top choice for many individual and institutional stakers as it removes the need for 32 ETH and capital lock, it implies several risks, which include, but are not limited to:

-

Depegging risk: The price of derivative or staked tokens may deviate from the original ETH price, often due to the market value of the new token being lower.

-

Network centralization: Any intermediary platform or service can disrupt the balance of validator shares, potentially concentrating power among large validators and threatening decentralization.

-

Smart contract vulnerability: The use of an additional smart contract for staking ETH and issuing liquid tokens introduces extra security risks. These can arise from internal bugs, design flaws, or targeted attacks by malicious actors.

Check out our article for a deeper dive into these risks and a comprehensive comparison between liquid and traditional staking. It’s designed to help you make informed staking decisions.

Another growing category was liquid restaking, a high-promising novel staking approach that stirred the ecosystem and grabbed almost 7% of ETH staked. Although possessing the same risks as a liquid one, it also implies additional risks from the solution approach.

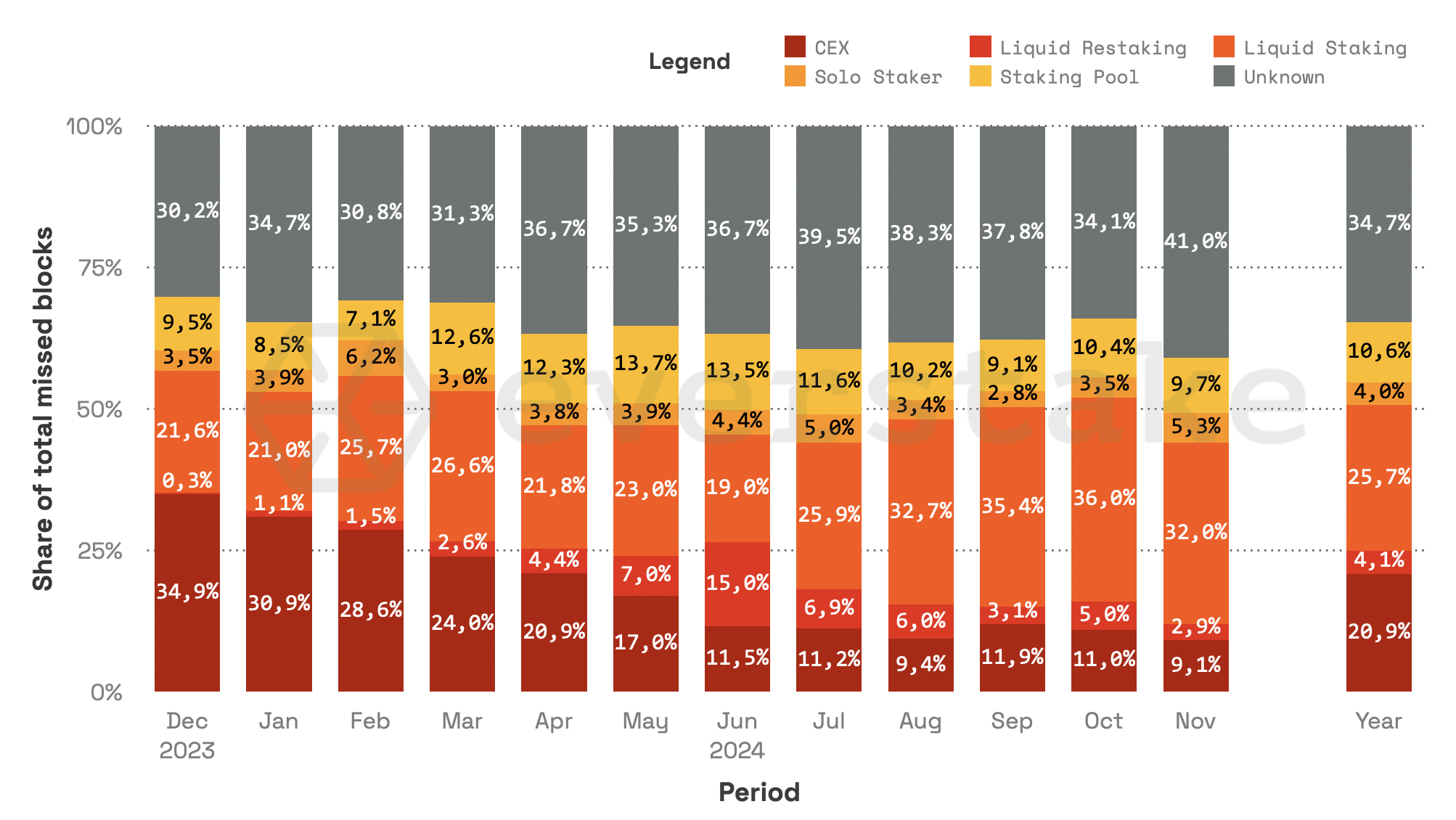

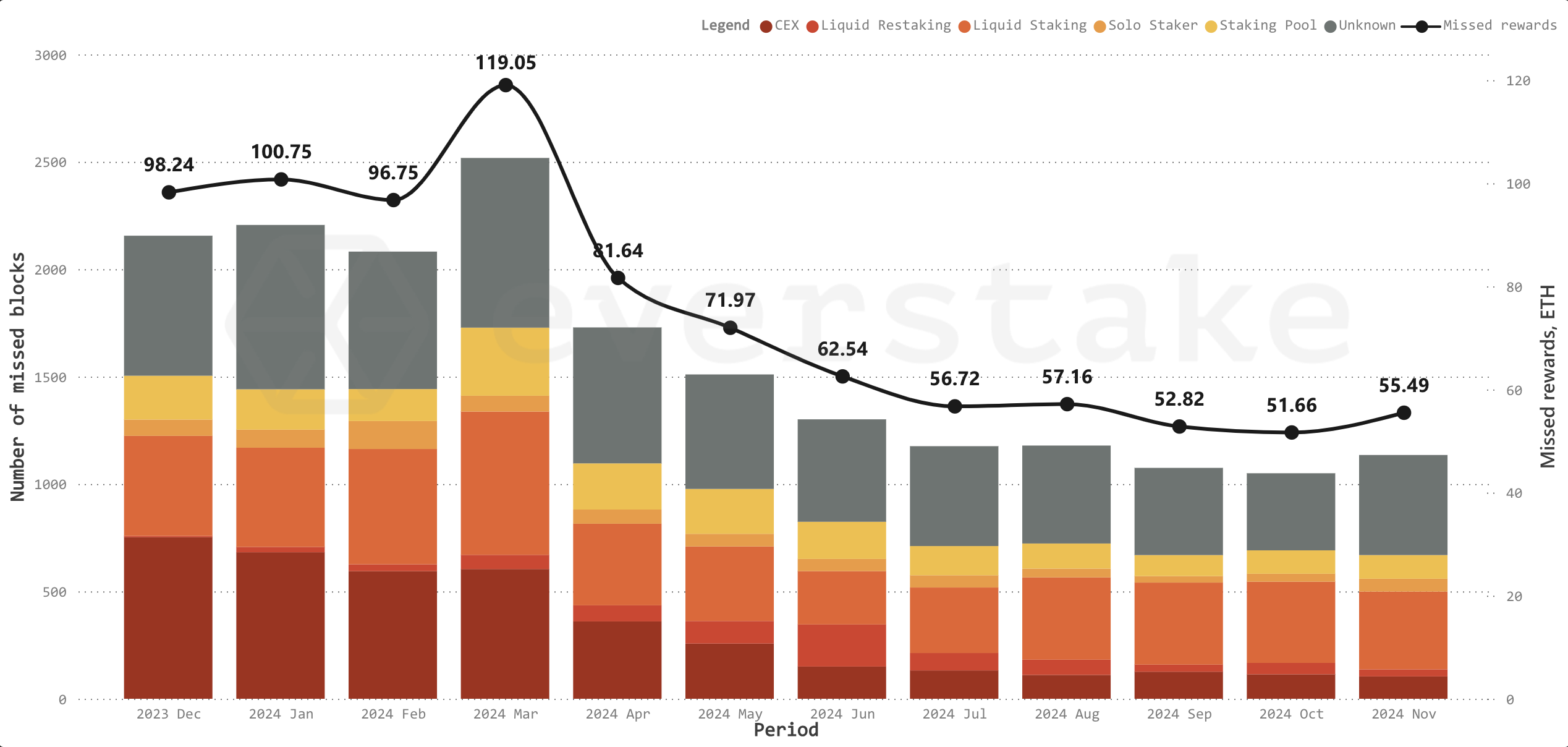

MISSED BLOCKS

19,251 blocks, or 0.73% of all 2024 blocks, were missed during 2024. The Unknown category, which mostly comprises unidentified individual solo and community stakers, is accountable for the biggest number of missed blocks—6,681 or 34.70% of all missed blocks. While they run 16.11% of all active validators, they miss more blocks than statistically they should have, which can be explained by a lack of technical knowledge or inefficient validator set-up.

At the same time, Solo stakers category (solo and community stakers that were identified) are more diligent and miss only 4% of all missed blocks, compared to their 6.99 share of ETH staked.

If we take a look at professional node operators (CEX, liquid staking and restaking, staking pools), yearly results are much better within each category and are lower than the share of the ether stake they operate. However, if we dive into the detailed view, it's easy to see that these numbers were smoothened as the 12-month average for some of the categories.

While CEX had 20.9% of all missed blocks on an annualized basis, when we take a look at the per-month chart during December and Q1 2024, the share was significantly higher, reaching 35% at the highest. Out of this, Coinbase missed the most, 68.68%, of blocks within the CEX category, while it operates 43.15% of staked ETH within the same category.

The highest number of Coinbase missed blocks occurred during December 2023 (attributing for 87.58% or 663 of CEX missed blocks) and January-March 2044, making the overall share of the CEX category the highest across other categories. Later, the monthly amount of missed blocks decreased and correlated with the share of stake they operate. Looks like the team managed to improve their validators setup up, and the number of missed blocks decreased.

In total, across all entities that run validators, the losses from the missed block reached 918.96 ETH or $3.6 million at current prices. For a detailed breakdown of stake share, the number of missed blocks, and the share of missed blocks, please see Appendix 1 (find it by clicking DOWNLOAD REPORT in the heading).

On the contrary, staking pool offerings, which were also in high demand among stakers, accounting for 17% of all staked ether, missed only 10.6% of all blocks. With 182,653 ETH being staked with Everstake staking pool (a total of 2.48% of all staked ETH operated by Everstake), trusted by over 20k stakers, we have missed only 0.23% of all missed blocks (approximately a value of 2 ETH).

You may enjoy ETH staking powered by Everstake both via our website, the most reliable and user-friendly cold and hot wallets (see the difference in our article), as well as via Wallet Connect.

ETH STAKING OPTIONS

ETH staking with Everstake offers versatile options to suit your preferences, from secure cold wallets to user-friendly hot wallets. Here’s how you can get started.

COLD WALLET STAKING

Security is a top priority within Web3, and ETH owners know the value of this reliability. In just a few clicks, you can leverage the renowned security of Trezor's hardware wallets and the reliable infrastructure of Everstake to participate in ETH staking.

Source: Trezor Product Showcase

This guide will lead you through the ETH staking process in Trezor step-by-step.

By staking ETH via Trezor, you start small with a minimum stake of just 0.1 ETH and earn rewards on your ETH holdings without needing a complex setup, while benefiting from industry-leading security thanks to Trezor's hardware wallet technology.

More than 7,300 users entrust their ~120k ETH to be staked through Trezor, powered by Everstake smart contracts.

Another cold wallet that supports the Everstake ETH pooling solution is OneKey, one of the world's top-notch crypto wallets. Here is the guide that shows how to stake ether using the OneKey wallet.

HOT WALLET STAKING

You can stake your ETH with the Everstake staking pool, which is available in a bunch of the most popular hot wallets. Check out the full list below, accompanied by a comprehensive manual to guide you through every step of the ETH staking process:

-

Mobile:

- Exodus Wallet;

- ZenGo Wallet;

- Pal Wallet;

- Web:

- Desktop, mobile and web:

-

StakeKit Widget and Zerion Wallet.

2025: OVERCOMING CHALLENGES

2025 will be another transformational year for Ethereum with the highly anticipated Pectra upgrade, advancements in shared security, and newly-tested preconfirmations. These developments aim to enhance scalability, security, and user experience, solidifying Ethereum’s role as the core of the Web3 ecosystem.

THE PECTRA UPGRADE: SETTING NEW STANDARDS FOR ETHEREUM SCALABILITY AND EFFICIENCY

The Prague-Electra upgrade, currently being tested on the Mekong Testnet and Devnet 4, represents another step towards Ethereum’s scalability and efficiency roadmap. Being the largest Ethereum upgrade to date, Pectra introduces several pivotal features:

-

Execution Layer Triggerable Withdrawals (EIP-7002): This feature enables triggering validator exits and withdrawals, adding greater flexibility for staking applications and improving the user experience. The latter allows the ultimate ETH owner to exit and begin the withdrawal process independently without relying on the staking provider.

-

Increased Validator Stake Limits (EIP-7251): This proposal raises the maximum effective balance for validators from 32 ETH to 2048 ETH (NB: the minimum stays the same—32 ETH). This will allow for reducing the validator set size (currently above 1 million) and the BeaconState memory footprint while improving operational efficiency for large node operators and reducing hardware constraints for solo and community stakers.

-

Blob Throughput Increase (EIP-7691): Following the Dencun upgrade that brought blobs live, the initially set blob gas target and maximum parameters (3 and 6, respectively) were largely experimental and turned out to fall behind the actual network needs. This proposal aims to adjust their values to better reflect L2 demand, providing a temporary scaling solution until more comprehensive improvements are implemented in the future.

These updates aim to introduce smoother staking workflows, better tools for developers, increased blob throughput to provide more scale to Ethereum via L2s, and overall network efficiency. By addressing one of Ethereum’s most persistent challenges—scalability—Pectra ensures the network remains competitive, robust, and user-friendly.

These improvements in Ethereum are crucial for onboarding millions (if not billions) of users and supporting the growing ecosystem of DeFi, NFTs, and beyond.

SHARED SECURITY: A GAME-CHANGING PARADIGM

IN BLOCKCHAIN INTEROPERABILITY

Restaking sets the standard for shared security, offering a scalable and cost-efficient model for new blockchain networks. Basically, it enables blockchains to attract borrowed capital without the need to build a large community necessary for security and to tap into existing validator sets instead of building their own. This drastically reduces the costs associated with securing a blockchain, democratizing access to security for smaller projects.

Restaking takes shared security a step further by allowing stakers to reuse their staked assets across multiple protocols at one time. This capital-efficient model incentivizes capital owners while unlocking cheaper access to Ethereum’s security for new networks.

Projects like Symbiotic are at the forefront of this movement, offering a permissionless protocol that enables decentralized networks to bootstrap ecosystems with shared security. Symbiotic’s flexible design allows networks to customize their restaking implementations, fostering a more interconnected blockchain environment.

By adopting shared security models, network builders and the community facilitate a more collaborative ecosystem where new chains can inherit robust security without establishing it independently, reducing costs and complexity. This approach democratizes access to security for developing networks and fosters a more collaborative and interconnected blockchain environment.

PRECONFIRMATIONS: ENHANCING TRANSACTION CONFIDENCE

Preconfirmations, or “preconfs,” are another novel mechanism in the Ethereum ecosystem designed to provide users with nearly-instant transaction confirmations with latency as low as 100ms. By offering signed promises to include and execute transactions within a guaranteed timeframe, preconfirmations address one of Ethereum’s key pain points: transaction uncertainty and delays.

This system enables block proposers to issue preconfirmation guarantees in exchange for a tip paid by the user. Leveraging mechanisms such as EigenLayer and Symbiotic, preconfirmers are subject to slashing penalties if they fail to fulfill their promises, ensuring trust and reliability.

Preconfirmations aim at bringing several benefits to the entire ecosystem community:

-

For Users: Immediate confirmation of transaction inclusion and execution, enhancing speed and confidence during critical interactions such as DeFi trades or cross-chain bridging.

-

For Validators and Preconfirmers: Additional incentive through user tips for delivering timely confirmations.

-

For Infrastructure Providers: Reliable guarantees enforced through slashing, reducing risks of dishonesty or failure.

-

For Wallet Users: Streamlined preconfirmation support via simplified RPC integrations.

By combining preconfirmations with Ethereum’s evolving infrastructure, the network moves closer to delivering real-time transaction assurances, making it more competitive and attractive for a global user base.

On the forefront is Primev, a novel network that enables preconfs through mev-commit (a P2P networking platform designed to facilitate real-time interactions and coordination between MEV actors and execution providers).

With the above mentioned and many other improvements on the table, constant passion for excellence and innovations, a vibrant ecosystem of dApps, and a strong developer and user community, Ethereum is well-positioned to shape the future of blockchain technology and stay the preferred choice for builders and users.