2024 has been a transformative year for Injective, marked by exceptional growth and advancements across multiple sectors. The network has made noticeable progress in both technical development and ecosystem expansion. This annual report explores key milestones achieved in the ecosystem throughout the year.

Injective’s growth was not limited to its technical advancements but also reflected in the increasing number of delegators, rising trading volumes, and the introduction of new yield products. Alongside these achievements, Injective’s introduction of cutting-edge technologies such as inEVM, gas compression, and major tokenomics upgrades like INJ 3.0 was key to its progress in 2024.

Notable integrations with Solana and Binance Pay, as well as the launch of the first native stablecoin on Injective, furthered the network’s outreach and influence within the Web3 industry.

KEY FINDINGS AND TAKEAWAYS

-

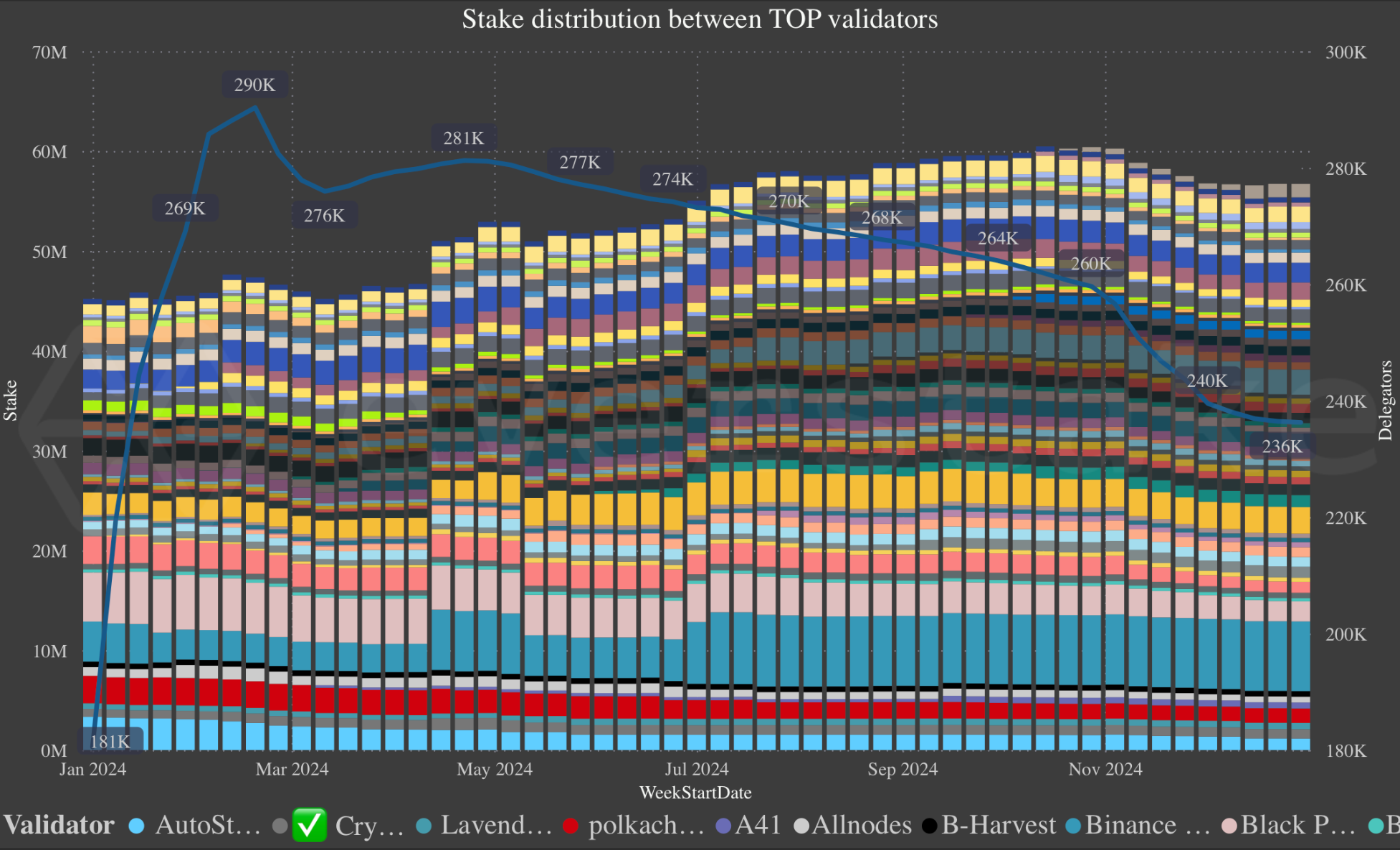

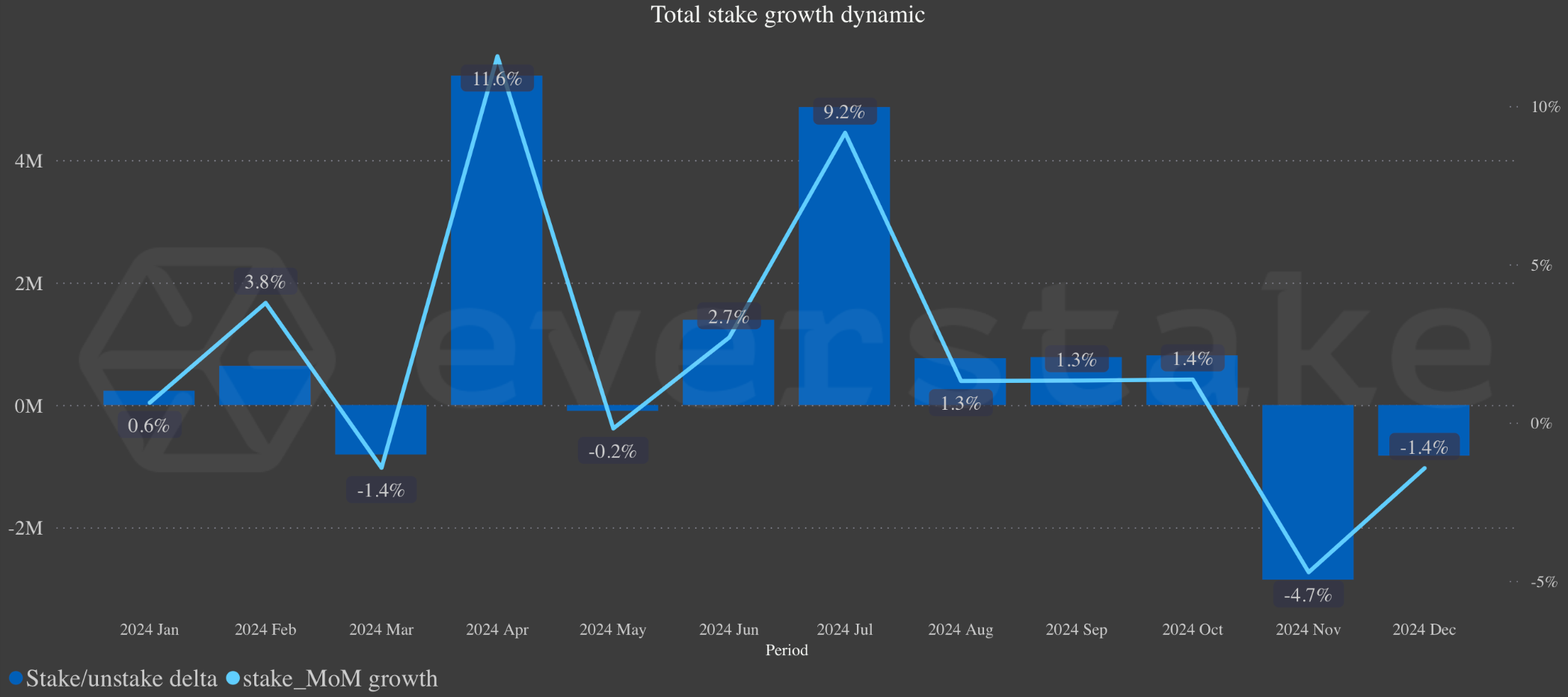

In 2024, the total stake on Injective increased from 46,6 million to 51,5 million, corresponding to a 10.34% stake growth, or +4,8 million INJ staked over the year.

-

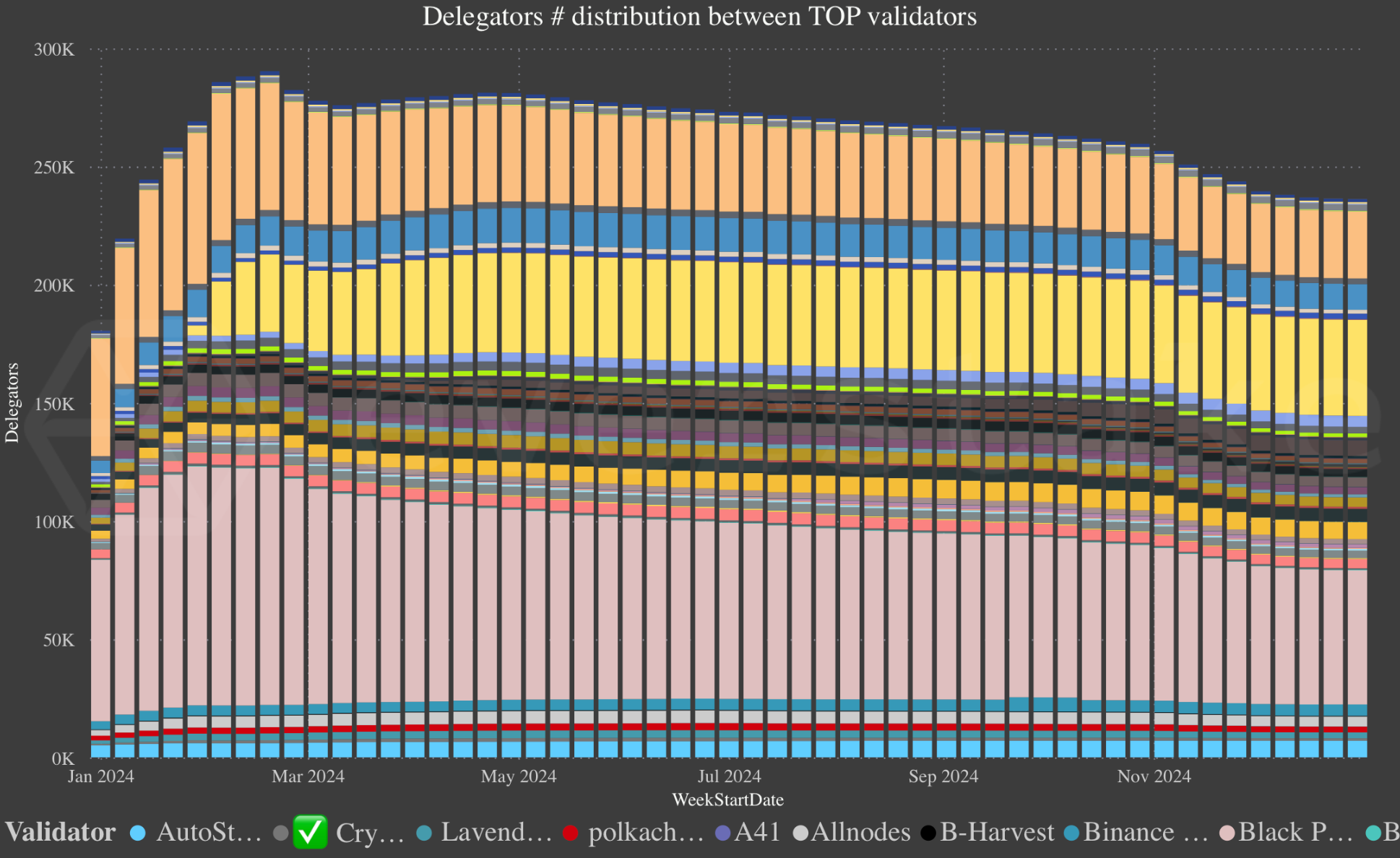

As of December 31, 2024, the network recorded 561,017 active addresses, of which 236,255 were Injective delegators, representing 42% of the total active addresses.

-

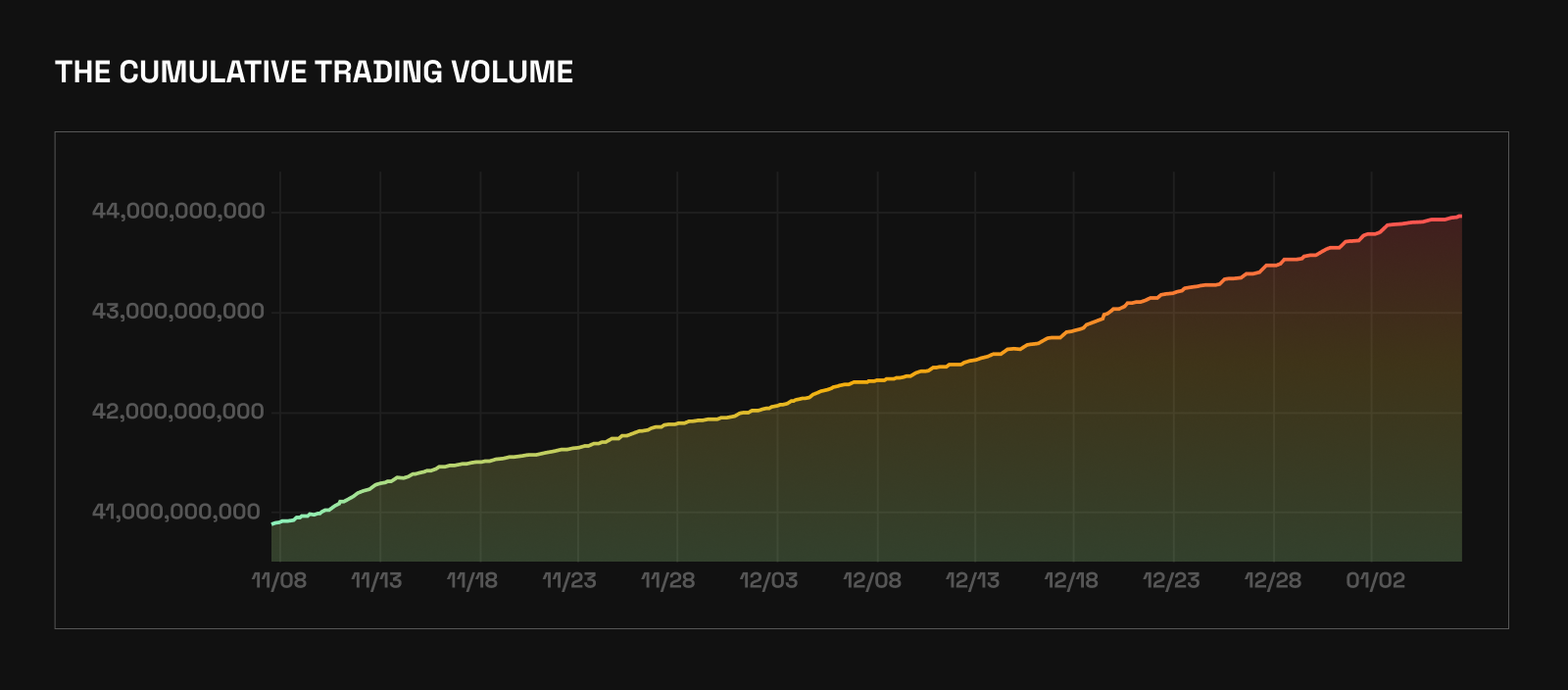

The cumulative trading volume on Injective reached $43,7B over the year.

-

The most important releases and upgrades of 2024 include inEVM, RWA Module, gas compression, the April 2024 burn upgrade, INJ 3.0, and iAgent, among others. Some of them are important stepping stones to becoming a go-to blockchain solution for institutional players.

-

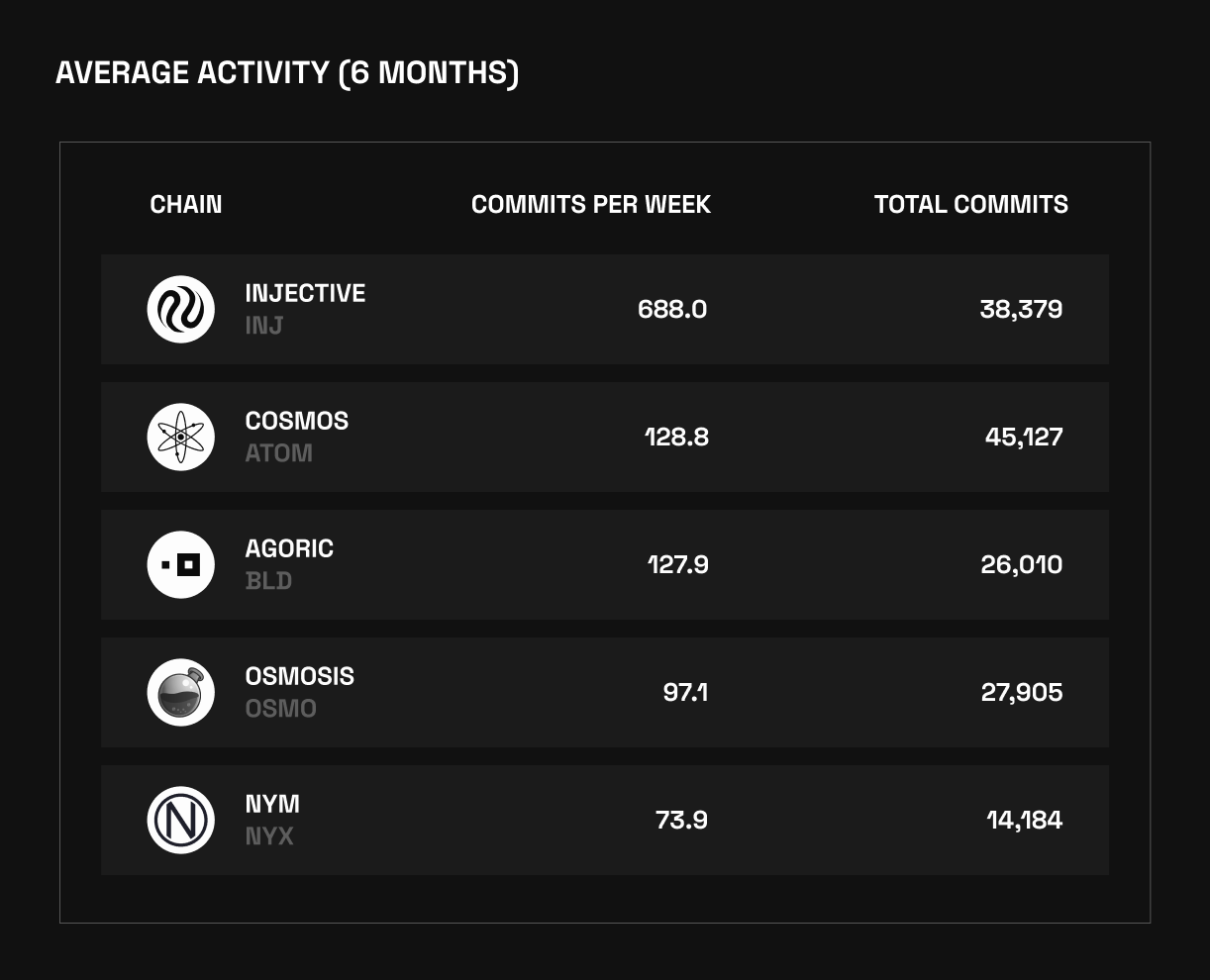

As of December 2024, Injective has led the Cosmos ecosystem in development activity over the past six months, with 38,379 commits.

-

By the end of 2024, Injective had 6,38 million INJ tokens burned to date. Notably, in the first half of 2024, the weekly INJ burn rate experienced extraordinary growth, nearly quadrupling with a 274% increase and an average weekly growth rate of 5.85%.

-

In October, Injective introduced its first native stablecoin: Agora’s fully collateralized U.S. digital dollar, AUSD.

TOTAL STAKE, DELEGATORS, AND ADDRESSES GROWTH

In 2024, the total stake on Injective increased from 46,6 million to 51,5 million, corresponding to a 10.34% stake growth, or +4,8 million INJ staked over the year.

April 2024 was Injective's most productive month in terms of staking, with an 11.6% total stake increase (equivalent to +5,3 million INJ staked).

Another period marked by a rapid increase in the total stake was in summer 2024, demonstrating a consistent upward trend and culminating in a +4,8 million INJ stake (9.2% increase) in July.

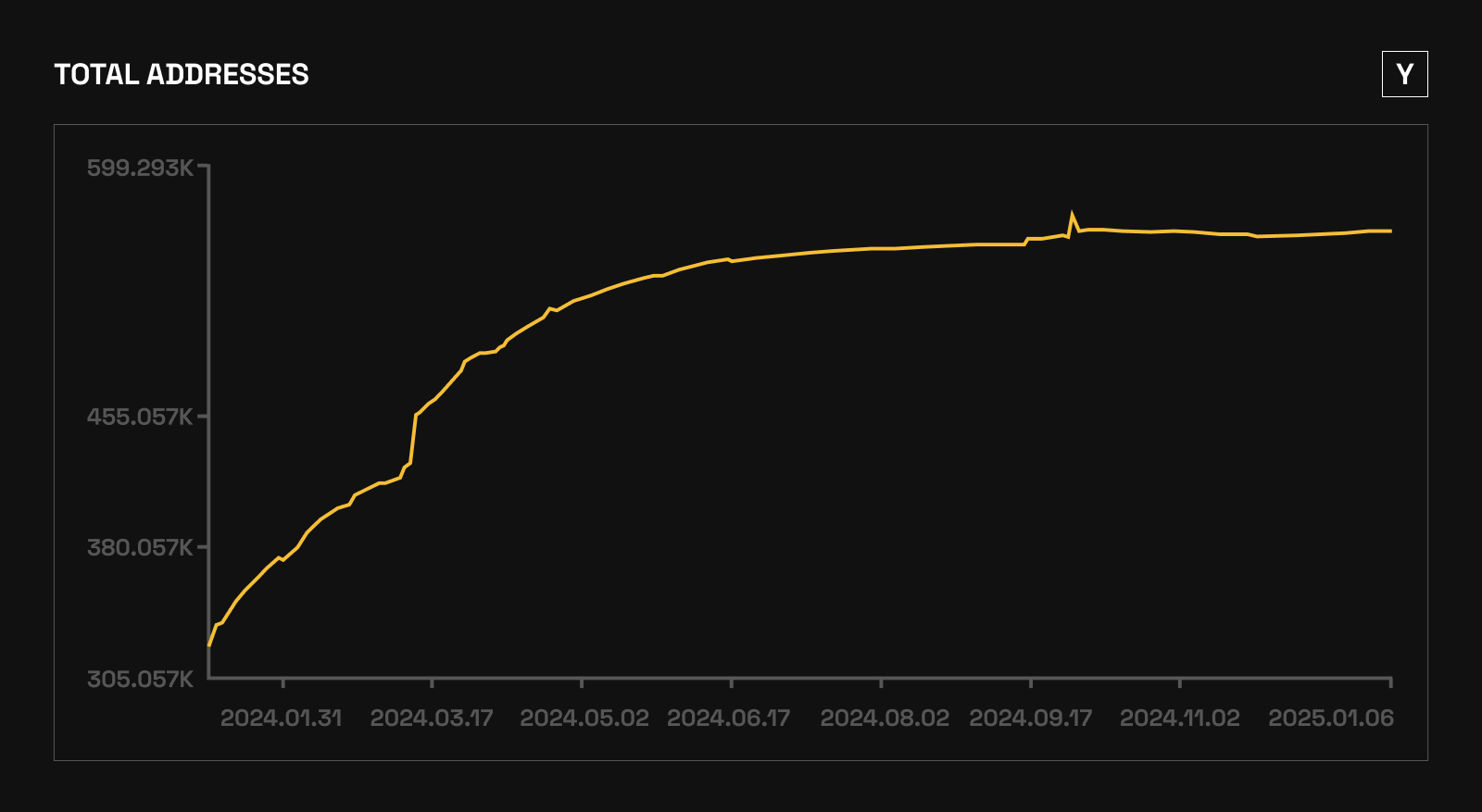

Over 2024, the active addresses on Injective increased from 291,228 to 561,017 (a 92.6% increase or +269,789 addresses). This surge can be attributed, in particular, to numerous integrations, the Ninja Ambassador program update, the growth of Helix DEX, new pre-launch futures markets, and the launch of a trading competition.

Of the 561,017 active addresses recorded as of December 31, 236,255 were Injective delegators, representing 42% of the total active addresses. Injective delegators increased by 64% during the year, rising from 143,574 to 236,255.

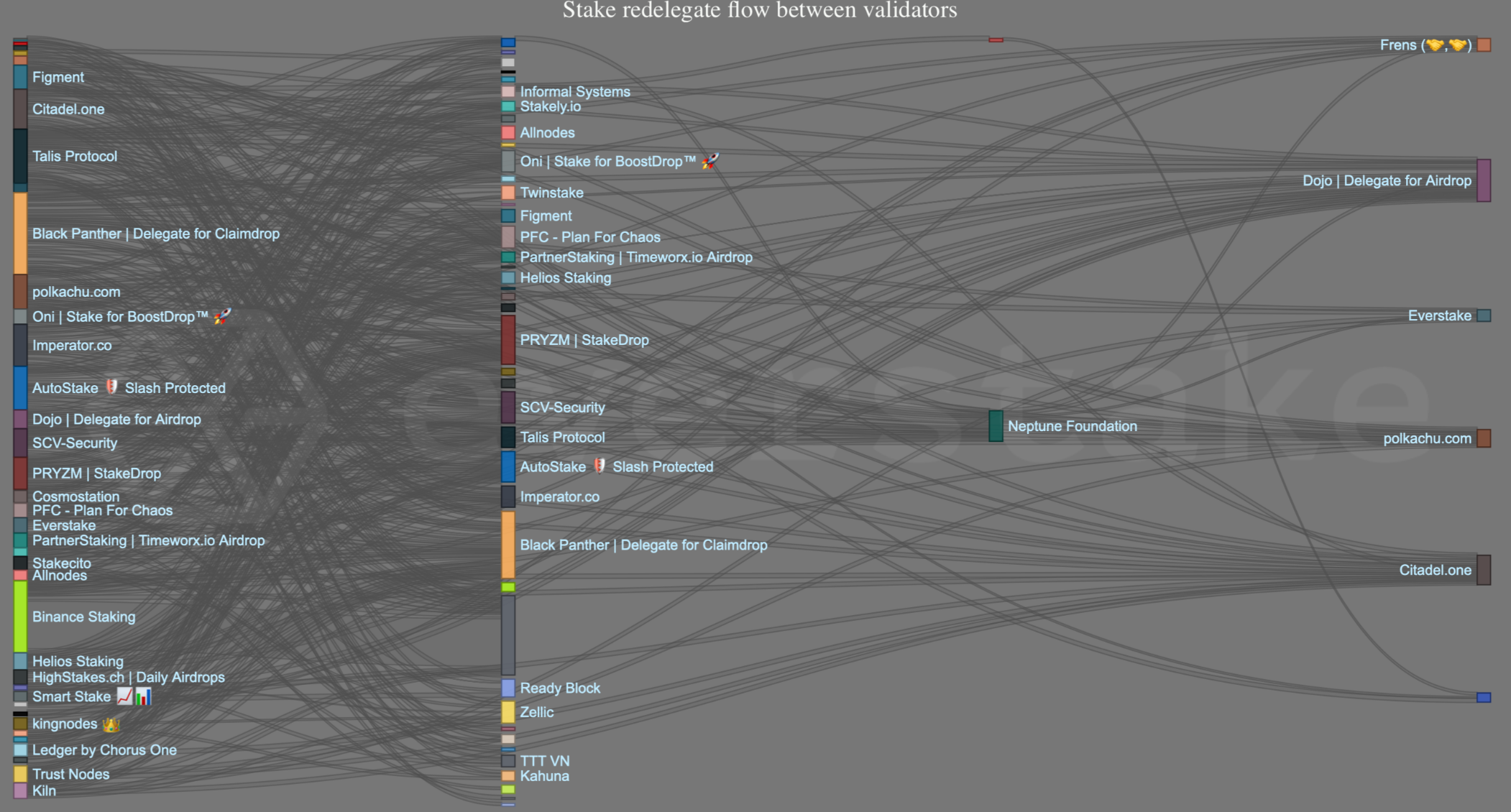

In 2024, 55,140 unique Injective delegators participated in redelegations between validators, resulting in a total redelegation amount of 14.9 million INJ. Most redelegations, specifically 88.55%, were directed towards validators offering a lower fee.

TRADING VOLUME

The cumulative trading volume on Injective reached $43,7B over the year.

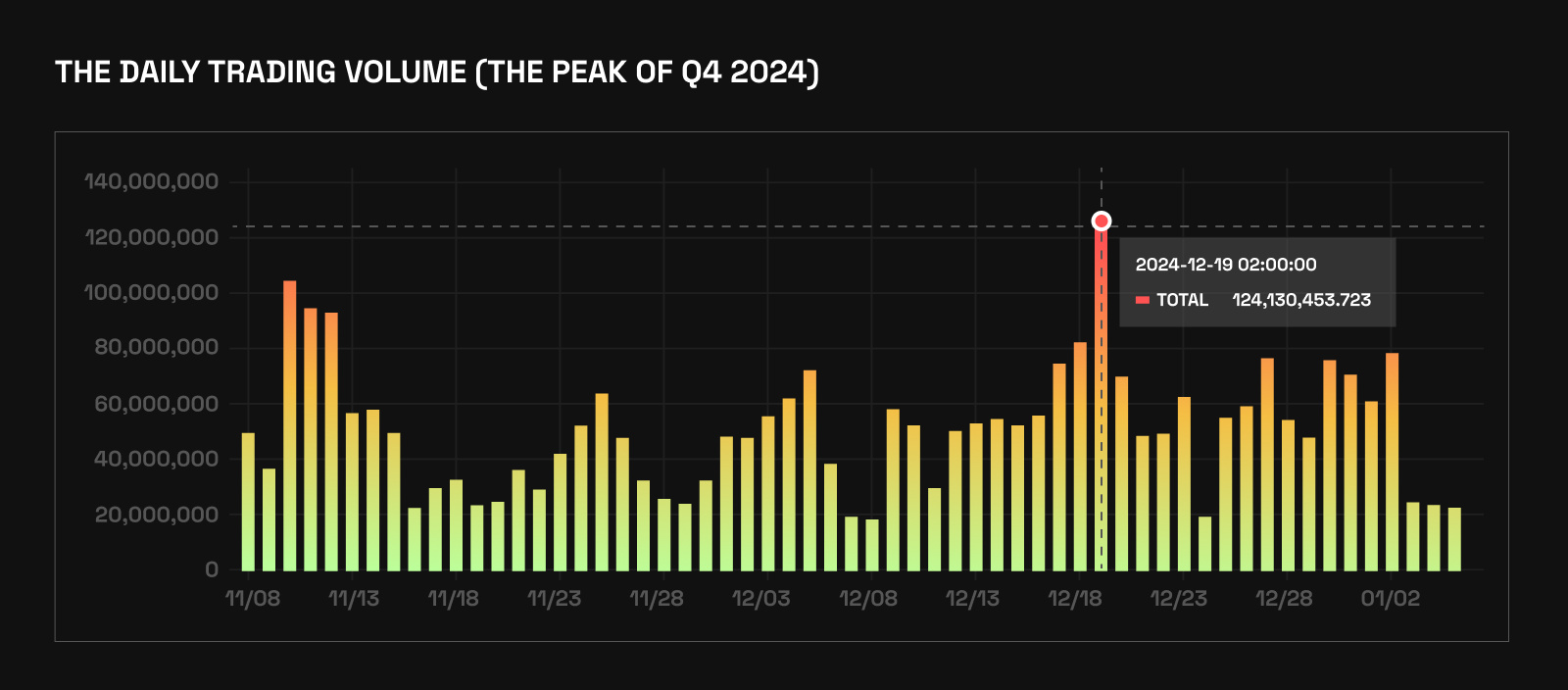

The peak of Q4 2024 was on December 19, with the daily trading volume surpassing $124M.

MAJOR RELEASES

In 2024, Injective saw some major improvements and releases, which helped redefine its proposition and boosted its expansion within the broader Web3 ecosystem.

inEVM

In March, Injective launched Injective EVM (inEVM) on the mainnet, thus becoming the only Layer 1 blockchain capable of combining Cosmos interoperability, Solana's speed, and Ethereum's developer access.

As the first Ethereum-aligned rollup of its kind, inEVM enables Ethereum developers to build applications that can leverage Injective’s rapid speeds and near-zero fees while achieving composability across the WASM and EVM ecosystems.

The development of inEVM was a collaborative effort supported by several key contributors: Caldera, Hyperlane, LayerZero, Pyth Network (oracle provider), and Celestia (Data Availability layer for the rollup).

RWA Module

Injective has introduced the world's first Real World Asset (RWA) Module, offering an advanced solution for creating and managing permissioned assets with extensive customization options. This move made Injective a lucrative option for institutional players as it ensures resilient infrastructure, compliance, and high efficiency. Institutions can use the module to seamlessly launch and access a wide array of structured products and RWAs, including tokenized fiat pairs, treasury bills, exclusive credit products, and more—all through compliant gateways. The platform also enables the creation of tokens with customized features, such as specific allow lists to regulate asset accessibility.

Gas Compression

Injective consistently offers some of the lowest fees in the industry. In 2024, tokenomics upgrades, including the groundbreaking gas compression release, reduced transaction costs on Injective even further.

With gas compression, activities such as staking, governance participation, trading, lending, or minting NFTs now incur almost zero cost (approximately 0.00001 INJ or $0.0003 per transaction). This innovation unlocks vast potential for developers, users, and institutions as it enables dApps and high-frequency traders to execute thousands of transactions per second at a fraction of the cost compared to other blockchains.

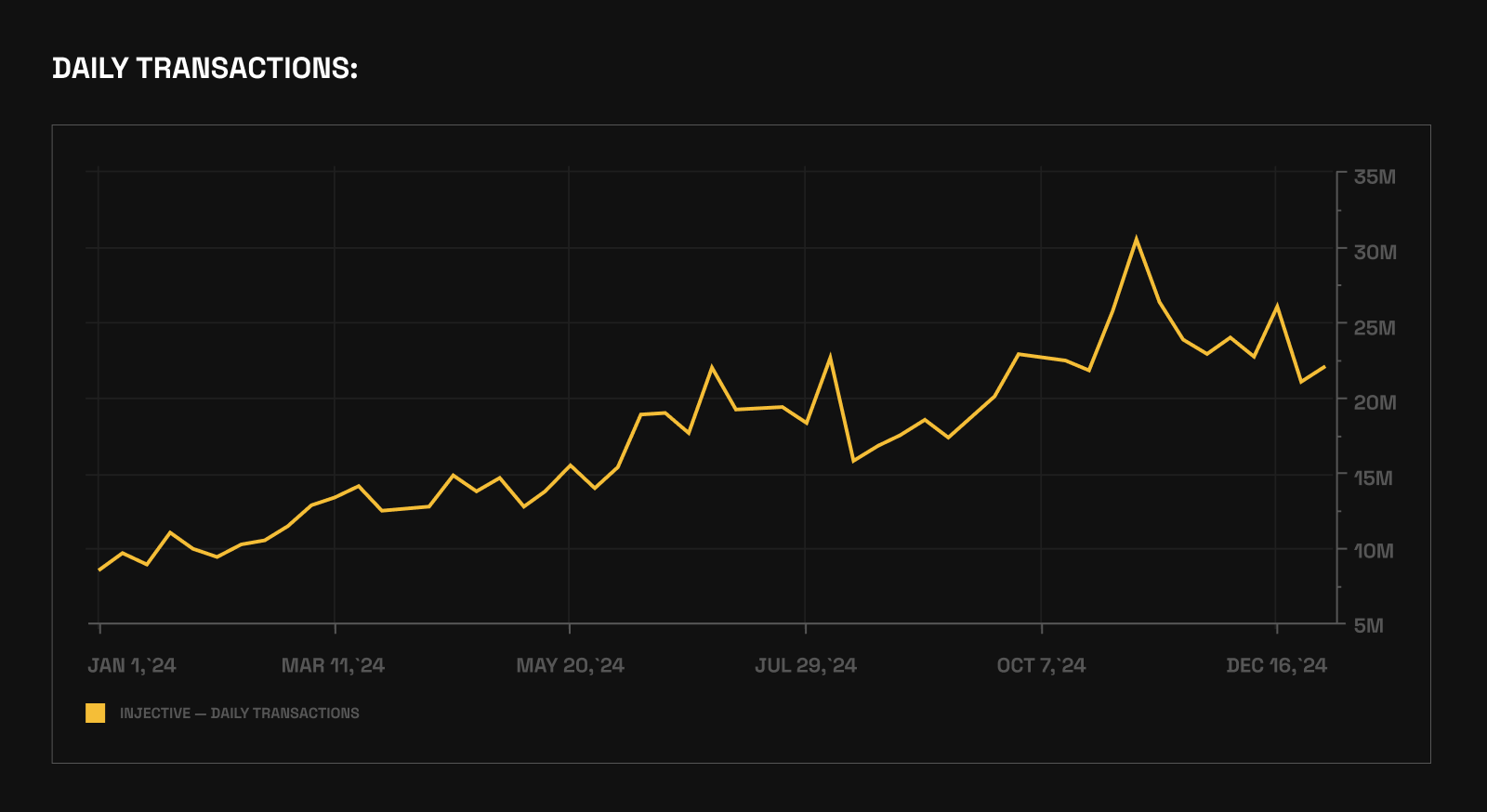

The efficiency of gas compression is especially evident in the correlation between daily transactions and fees. Daily transaction volumes have continued to rise over the reviewed period while fees have concurrently decreased.

April 2024 Burn Upgrade

Injective’s unique burn mechanism suggests that a portion of protocol-generated revenue is collected weekly from dApps utilizing the exchange module. These assets are then put up for a public auction denominated in INJ, with the highest bidder acquiring the entire basket of assets. The winning INJ bid is subsequently burned. This mechanism makes Injective one of the blockchains with the highest burn ratios in the industry.Initially, the burn auction included only assets from dApps using the exchange module. The release of INJ 2.0 in 2023 expanded the auction’s scope to allow all Injective dApps—not just those using the exchange module—to participate without any restrictions on the amount of fees that can be burned, which substantially increased the amount of INJ burned. The April 2024 Burn Upgrade took this a step further by allowing individual users to participate as well, thus potentially increasing the token’s overall value and impact.

INJ 3.0 Upgrade

The INJ 3.0 tokenomics update introduced significant enhancements to Injective’s tokenomics, making INJ one of the most deflationary assets in the blockchain industry. This solution was designed to accelerate the reduction of INJ supply over the next two years, with deflation rates tied directly to the percentage of INJ staked on-chain.

Injective uses a dynamic supply mechanism, where the supply rate adjusts within a lower and upper bound block by block, targeting the percentage of INJ staked on-chain. INJ 3.0 set forth a schedule to decrease the lower and upper bounds quarterly and increase the network's responsiveness to staking activity (the lower and upper bounds represent the minimum and maximum values that the supply rate can reach). Over the two years, the lower bound will decrease by 25%, from 5% to 4%, while the upper bound will drop by 30%, from 10% to 7%. This will allow for increased network stability while accelerating the deflation rate. As more INJ is staked, the deflation rate will increase. Furthermore, increased revenue from dApps will lead to higher weekly INJ burns.

These INJ 3.0 adjustments increased INJ’s deflation rate by an impressive 400%, ensuring long-term value for the Injective ecosystem.

Injective Tokenomics Paper

In June 2024, Injective released a groundbreaking paper detailing the Injective Token, its key utilities, and the innovative mechanisms shaping its programmable token economy.

The paper provides a detailed overview of the genesis distribution and vesting schedule that forms the foundation of Injective’s economic model.

The full Injective Tokenomics Paper is available here.

The Injective Staking ETP Launch

In July, Injective introduced AINJ, the Injective Staking Exchange-Traded Product (ETP) developed by 21Shares. The product enables users to access INJ through traditional finance platforms, such as major exchange venues and brokerages, while benefiting from staking rewards.

The launch of AINJ marked a key advancement in Injective's efforts to connect with traditional institutions and also paved the way for greater institutional involvement with Injective.

Visit Injective's blog for a deeper understanding of how AINJ works and the concept of ETPs and their various types.

iAgent Release

To wrap up the innovative 2024 releases, Injective launched iAgent in November—a cutting-edge SDK that lets anyone set up their on-chain AI agent.

This AI-driven tool simplifies blockchain interactions on Injective, enabling users to perform tasks like sending payments, placing trades, and managing funds using natural language commands. In particular, they can do the following:

-

Create and manage Agents: with iAgent, users can create and manage multiple agents, each tailored for specific tasks, such as tracking market data or executing trades.

-

Interact with commands: users can interact with iAgents using plain-language commands like create_agent, place_market_order, or check_balance.

-

AI-Powered automation: iAgent leverages AI to automate complex tasks, allowing users to analyze market trends and make data-driven decisions without coding.

Details on the solution are available in the official iAgent Documentation.

Tokenized BUIDL Index Release

2024 was a landmark year for Injective’s expanding role in asset tokenization. Among its notable achievements was the launch of the tokenized index for BlackRock’s BUIDL Fund, enabling users to access the fund through innovative on-chain financial instruments. It introduced the first perpetual index market designed to track the supply of the BUIDL Fund, BlackRock’s tokenized fund offering U.S. dollar yields. The BUIDL Index is exclusively accessible through various dApps on Injective, such as Helix, providing users access to the tokenized fund at extremely low fees and high speeds.

Agora AUSD

In October, Injective introduced its first native stablecoin, Agora’s fully collateralized U.S. digital dollar, AUSD. It enables users to seamlessly acquire, trade, and sell without additional bridging or compatibility challenges.

STATS MILESTONES

Development activity

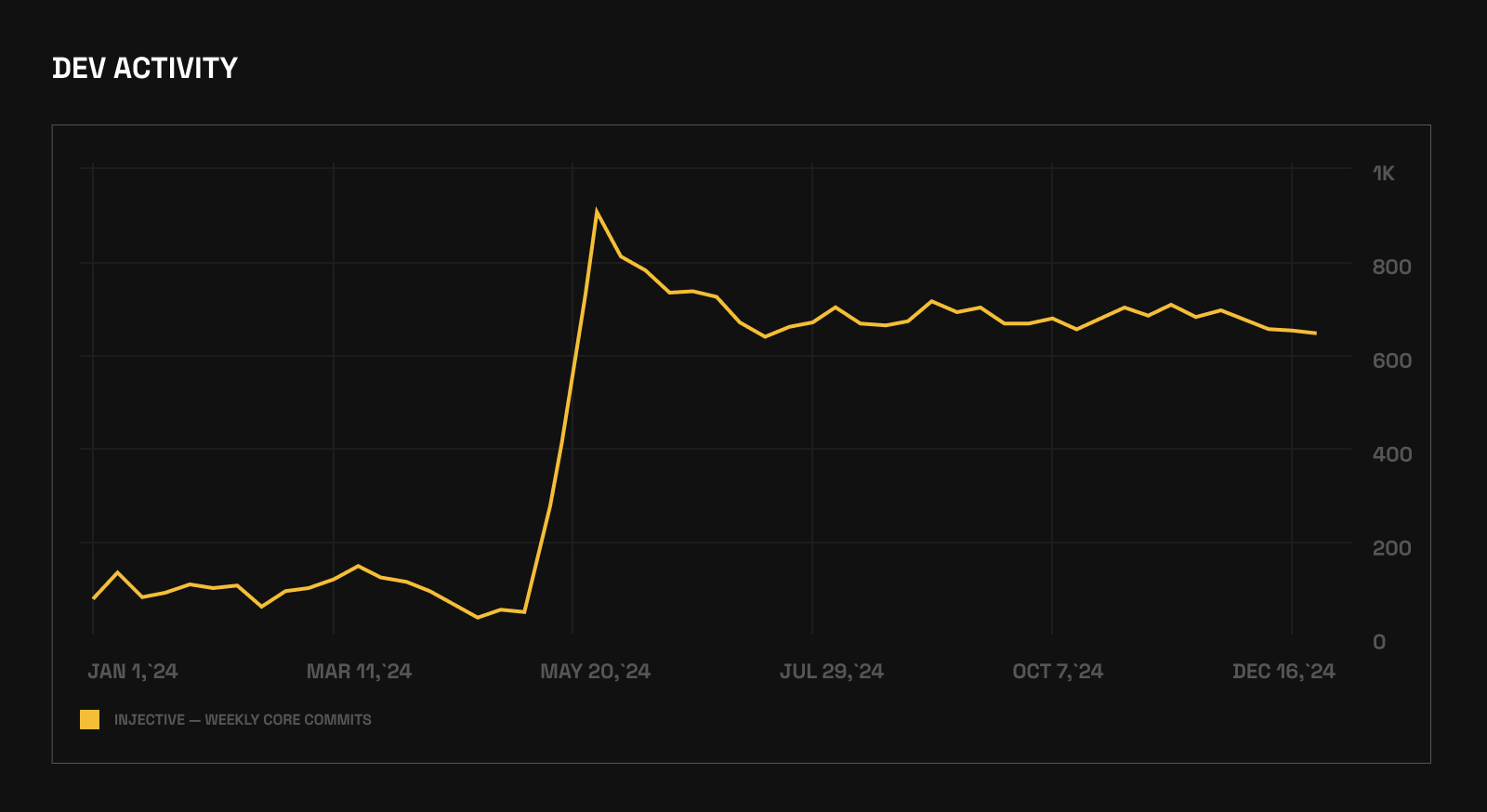

May saw a notable surge in development activity on Injective, a trend that remained prevalent for the rest of the year.

As of December 2024, Injective has led the Cosmos ecosystem in development activity over the past six months, with 38,379 commits.

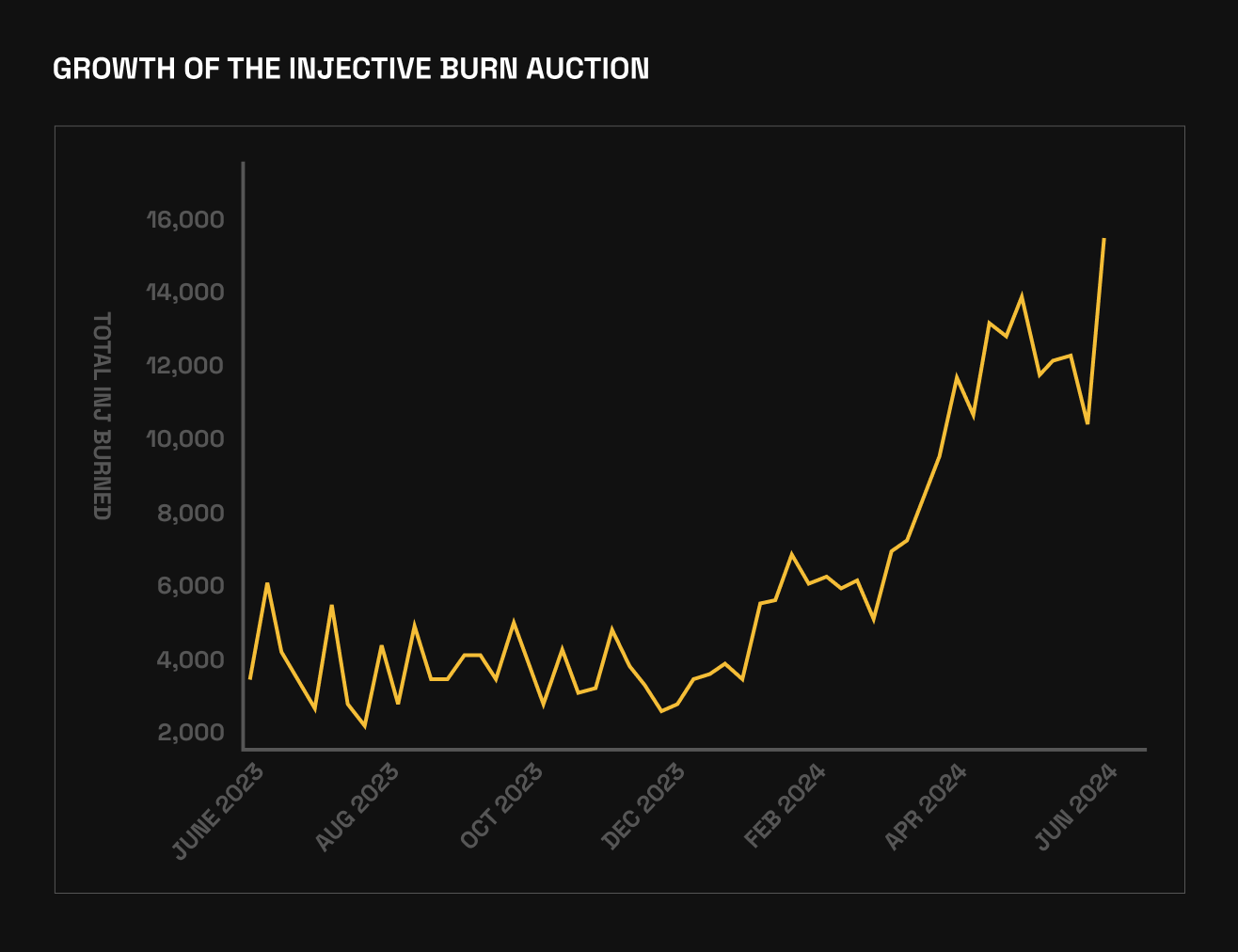

Burn auction growth

By the end of 2024, following the completion of another INJ burn auction, Injective had 6,38 million INJ tokens burned to date.

In the first half of 2024, the weekly INJ burn rate experienced extraordinary growth, nearly quadrupling with a 274% increase and an average weekly growth rate of 5.85%.

Pic:

Growth

of the Injective Burn Auction

Pic:

Growth

of the Injective Burn Auction

In October, Injective reached another major milestone, surpassing 1 billion total on-chain transactions. By the end of 2024, this figure grew to over 1,3 billion.

CHAIN UPGRADES AND THEIR IMPACT ON THE NETWORK

To keep up with the ecosystem's growth, Injective continuously introduces new chain upgrades that enhance performance and expand capabilities. Below are the most notable 2024 upgrades and their impact.

Volan Mainnet Upgrade

The Volan Mainnet Upgrade, released in January, introduced numerous crucial features, including:

-

Real World Asset (RWA) Module, as described above

-

IBC Protocol enhancement, which grants seamless interaction with Injective’s Web3 financial modules, including Injective's on-chain orderbook, and enables efficient cross-chain transactions, advanced order routing, and swaps

-

Improved enterprise-grade scalability that reduces latency by up to 90% and allows transactions to be posted directly onto the blockchain without the need for indexers.

-

New exotic oracle feed design that supports direct integration of off-chain price feeds.

-

Optimized tokenomics that are now more deflationary and dynamic.

-

Expanded token burn capabilities.

-

Minor features like increased wallet access to Injective-built dApps.

Altaris Mainnet Upgrade

The Altaris upgrade significantly improved scalability, performance, and developer tools. WASM 2.0 support enabled the creation of more advanced decentralized applications. It also enhanced cross-chain interoperability with features like IBC hooks and Packet Forward Middleware.

Apart from that, Altaris redefined the economic framework of the Injective ecosystem and introduced numerous important enhancements.

-

Enhanced scalability, including various optimizations to boost chain speed, improve overall performance, and provide a smoother developer experience.

-

RWA oracle that integrates an advanced oracle network to expand Injective's tokenized asset offerings.

-

Universal Injective burn auction that enhances INJ burn auction mechanics, allowing developers to create and launch pool auction contracts.

-

Improved user experience, market enhancements, better bridge management, governance optimization, advanced trading features, and more.

YIELD PRODUCTS DEPLOYED ON INJECTIVE

Introducing and expanding yield products was a significant development area within the Injective ecosystem in 2024. These are low-volatility digital assets often pegged to a stable basket of assets, providing holders with the added benefit of accrued yield. Leading yield projects deployed on Injective in 2024 include the following tokens.

USDM (Mountain Protocol)

Issued by Mountain protocol, USDM is the first permissionless yieldcoin. It gives holders access to the "risk-free rate" through a secure, regulated product backed by US Treasury bills.

USDe (Ethena)

Ethena's USDe is a censorship-resistant, stable, and scalable yieldcoin. Unlike traditional stablecoins, USDe relies on delta-hedging and established assets like ETH to maintain its peg to the dollar.

wUSDL (Paxos)

wUSDL (Wrapped Lift Dollar) is a yield-bearing stablecoin issued by Paxos. It enables users to engage with Injective's diverse DeFi protocols while getting rewards by holding the asset.

RWA TOKENIZATION

In September, Injective was officially selected to join the Tokenized Asset Coalition, a group focused on accelerating the growth of real-world assets (RWAs) and institutional DeFi. Other notable members of the group include Coinbase, Circle, and WisdomTree.

At the same time, Injective became one of the largest blockchains for tokenized assets, supporting over 11 tokenized RWAs on the chain.

KEY INTEGRATIONS

Injective has secured several high-profile integrations throughout 2024.

-

Injective x Solana: the partnership introduced the first omnichain domain name service, thus enhancing cross-chain user experiences between Solana and Injective. This integration allows seamless transactions across both ecosystems using the same domain.

-

DEX DojoSwap partnership: Injective collaborated with DojoSwap DEX to introduce the CW-404 standard, enabling fractional ownership of NFTs to enhance accessibility and provide new financial use cases for users.

-

Ethena integration: Injective became the first network outside Ethereum’s ecosystem to integrate with Ethena. This partnership granted Injective and the IBC community access to USDe and participation in Ethena’s Shard Campaign, creating new opportunities for users.

-

Noble: by integrating with Noble, the issuer of USDC within the IBC ecosystem, Injective gained access to native USDC. This collaboration connected Injective to one of the world’s most trusted stablecoins.

-

Galxe partnership: Injective integrated with Galxe, a leading Web3 community-building platform. This allowed Injective ecosystem projects to launch reward-based programs with on-chain transaction tracking and accelerated user acquisition and engagement for dApps within the Injective ecosystem.

-

AltLayer collaboration: Injective and AltLayer collaborated to kick off the first-ever restaking security framework for on-chain inEVM applications. It combined the power of Injective and Ethereum, essentially bringing the security of over $400 billion in assets to inEVM.

-

Artemis integration: Artemis brought institutional-grade analytics to Injective, offering a comprehensive dashboard for chain-level metrics. This provided Injective users and dApps with enhanced insights into ecosystem performance.

-

Jambo collaboration: Injective partnered with Jambo, the largest Web3 mobile infrastructure, to deliver blockchain-powered financial solutions via the JamboPhone. This collaboration made Injective-native dApps, such as Ninji Wallet, accessible on Jambo phones, thus opening the Injective ecosystem to millions of new users.

-

XION: Injective integrated with XION to introduce chain abstraction to the ecosystem. XION’s Chain Abstraction technology simplifies blockchain interactions by seamlessly connecting users, applications, and liquidity across ecosystems. This integration massively lowers the entry threshold for new users by providing a familiar interface for blockchain interaction.

-

Desig Multi-Sig Wallet: integrating the multi-sig wallet Desig with Injective enhanced security and operational flexibility for institutions, organizations, and advanced users within the Injective ecosystem.

-

Arbitrum collaboration: Injective teamed up with Arbitrum, a major Layer 2 solution, to enhance its inEVM capabilities by customizing Arbitrum’s Orbit stack. This integration provided users with seamless, efficient, and cost-effective transactions.

-

Fireblocks: Injective joined forces with Fireblocks, the world’s top digital asset custodian, to accelerate institutional adoption within its ecosystem.

-

Binance Pay integration: Binance Pay, one of the world’s leading cryptocurrency payment solutions, incorporated Injective, thus enabling the use of INJ for merchant and peer-to-peer transactions.

-

The Graph Integration: Injective integrated the Graph to provide open data for builders worldwide. This collaboration gave a major boost to developer opportunities within the Injective ecosystem.

-

Balanced: Balanced integrated with Injective to expand cross-chain DeFi opportunities. Users can borrow Balanced’s native stablecoin (bnUSD), perform cross-chain swaps, and transfer assets to Injective from other networks.

-

Injective x Fetch: Injective's integration with the Artificial Superintelligence Alliance (ASI), which includes Fetch.ai, SingularityNET, and Ocean Protocol, was an important step toward bringing AI-powered capabilities to on-chain finance. In particular, it enabled Injective to accelerate decentralized AI development within the ecosystem. Injective users will have access to FET, the native token of the ASI Alliance, via dApps such as Helix, which provides advanced AI and autonomous agent functionalities.

-

Mercuryo: Injective partnered with Mercuryo to streamline access to INJ through a seamless fiat-to-crypto on-ramp. Mercuryo supports over 25 fiat currencies and various payment methods, including Visa, Mastercard, Apple Pay, Google Pay, and bank transfers, so it became substantially easier for users worldwide to acquire INJ via the Injective Bridge.

-

TruFin launch: TruFin introduced its institutional-grade liquid staking solution, TruStake, and its liquid staked token, TruINJ, to the Injective ecosystem.

-

Sonic partnership: Injective and Sonic, a leading Solana Virtual Machine (SVM), launched the first cross-chain AI agent platform. AI agents built on the SVM can now integrate seamlessly into Injective via the Inter-Blockchain Communication Protocol (IBC), advancing cross-chain AI applications.

-

Aethir collaboration: Injective and Aethir engaged in tokenizing GPU compute resources. This initiative transformed GPU capacity into tradeable tokens on Injective, offering developers, researchers, and institutions flexible and cost-effective access to computational resources.

FUTURE PROSPECTS

Albert Chon, co-founder and CTO of Injective Labs, identified two primary growth drivers expected to influence Injective’s trajectory in 2025 significantly: the expansion of its application ecosystem and growing institutional adoption.

The first major advancement vector stems from the Injective multi-VM initiative. It is set to allow builders currently operating on Ethereum or L2 solutions to deploy their applications on Injective as well. The enhanced accessibility would enable various applications from other blockchains to leverage Injective's unique features, such as its shared liquidity layer and plug-and-play modules.

The second key prospect centers on the institutional adoption of Injective. The platform is becoming a hub for RWA deployments and innovative asset offerings. These developments are very likely to attract new users and further drive the growth of the Injective ecosystem.

Overall, Injective’s prospects for 2025 look highly promising in the context of its achievements back in 2024.