INJ

Injective

keplr

Staking

wallet

INJECTIVE (INJ) STAKING INSIGHTS & ANALYSIS: FIRST HALF OF 2025 | EVERSTAKE

Explore the Injective staking report for the first half of 2025. Key metrics, validator performance, the Injective ecosystem's trends and staking.

JUL 24, 2025

Table of Contents

Key insights and takeaways

State of Staking

Cumulative trading volume

iAssets

Upgrades

Gas compression

Development activity

INJ 3.0 inflation parameters update

The iAgent 2.0 launch and AI agent hackathon

Blockchain Association

Injective Summit NYC: key highlights

H1 2025 in numbers

Future prospects

Share with your network

Key insights and takeaways

-

By the end of June, Injective had reached several key milestones, including over 2 billion on-chain transactions, $56.9 billion in cumulative trading volume, and more than 6.6 million INJ burned. The network’s user base grew by 13%, reaching 634,609 active addresses, with delegator participation reaching 204,440 delegators, which corresponds to 32% of the total active addresses.

-

The network saw two major mainnet upgrades, Nivara and Lyora, which introduced enhanced support for real-world asset tokenization, a dynamic fee mechanism, improved exchange module security, and more.

-

The ecosystem also experienced notable progress at the intersection of AI and blockchain. The launch of iAgent 2.0 put Injective at the forefront of innovation in this domain.

-

Injective expanded its iAssets offering to include the full Magnificent 7 (MAG7) stocks.

-

Injective became a member of the Blockchain Association.

-

The period culminated with the Injective Summit, which brought together top-tier developers and industry leaders to discuss and demonstrate the network’s latest product launches, including iBuild, the Helix Mobile App, and the Injective Revenue Fund.

State of Staking

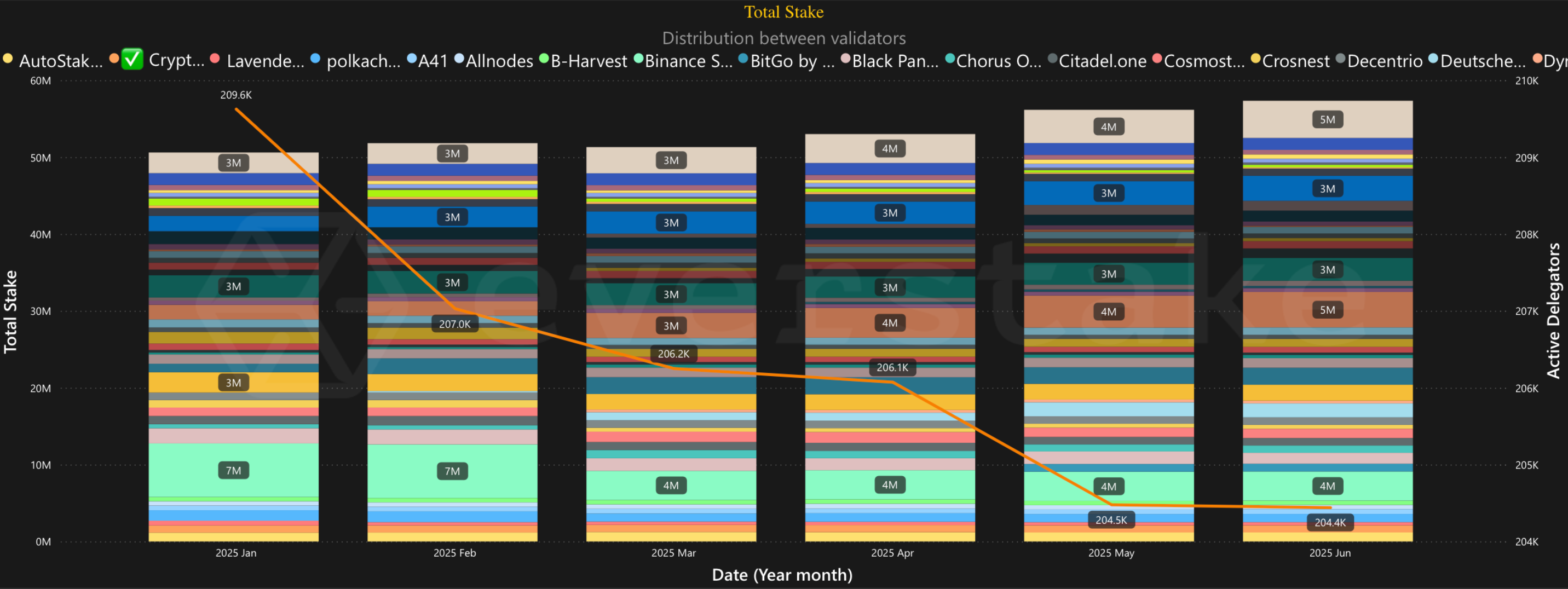

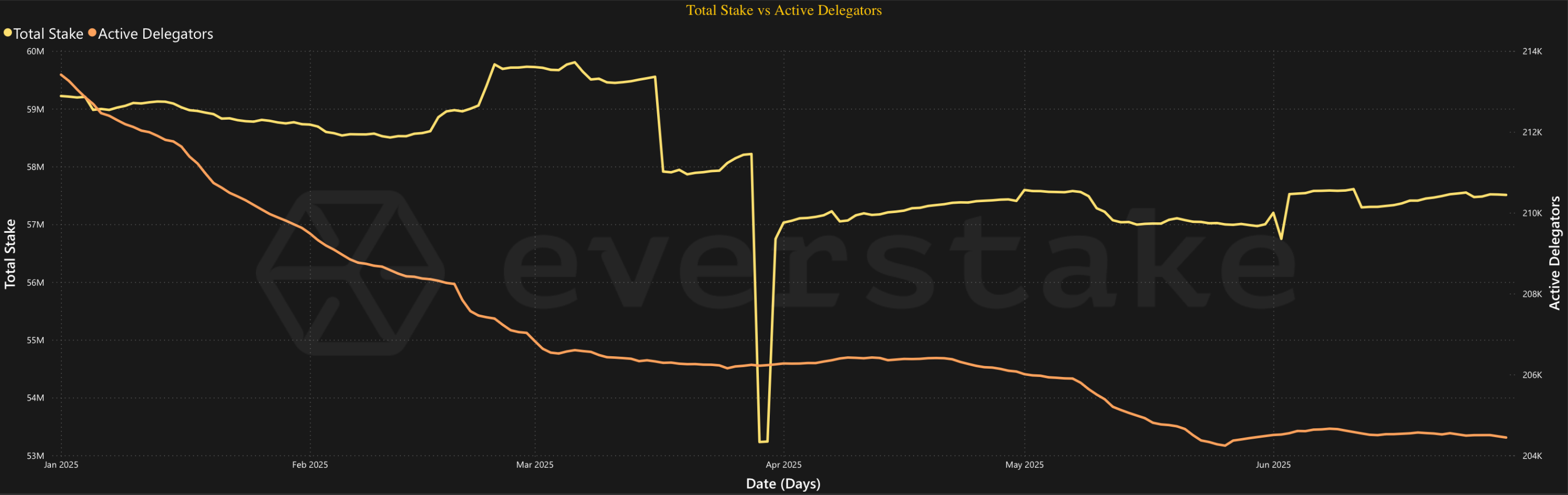

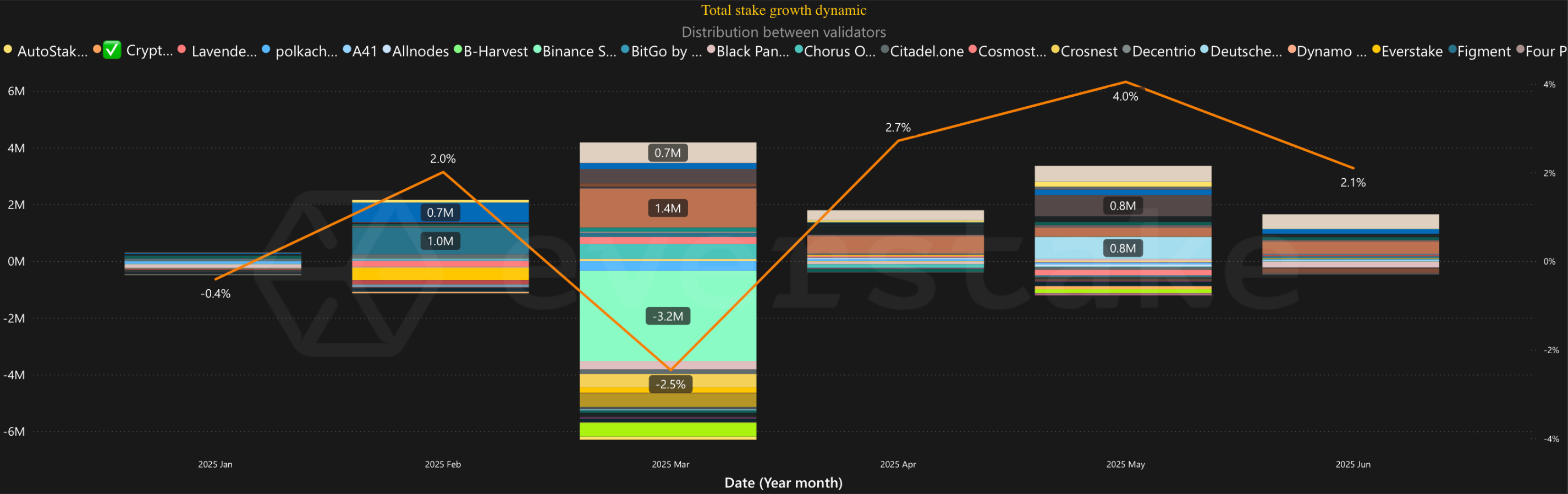

In the first half of 2025, the total stake on Injective slightly decreased from 59,2 million to 57,5 million, corresponding to a 2% stake decline.

May 2025 was Injective's most productive month in terms of staking, with a 4% total stake increase.

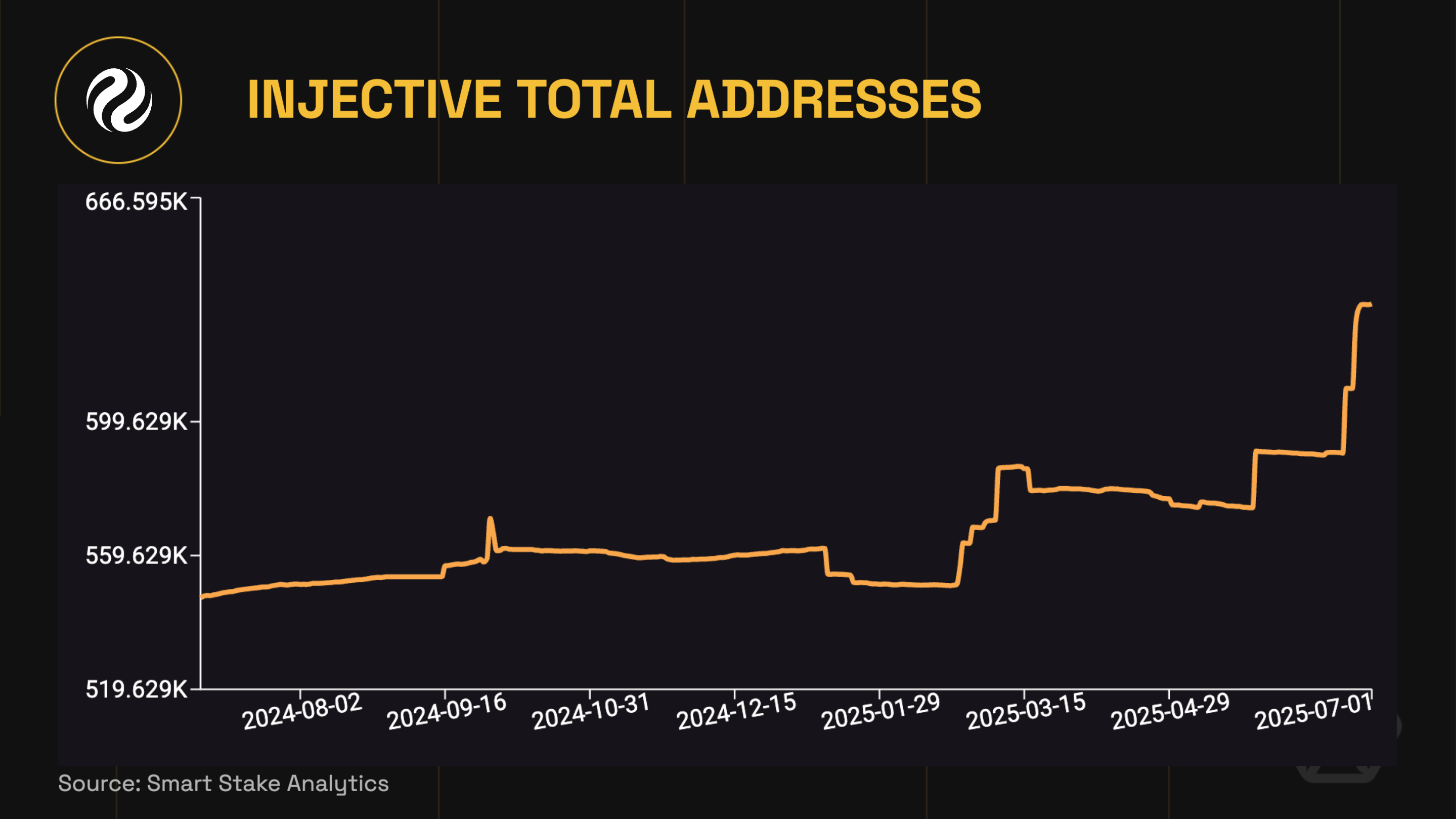

Over the first half of 2025, the active addresses on Injective increased from 561,017 to 634,609 (a 13.12% increase or +73,592 addresses).

This surge can be attributed, in particular, to the launch of the new Injective Ambassador program, Helix DEX going mobile, iAssets releases, and numerous Injective integrations.

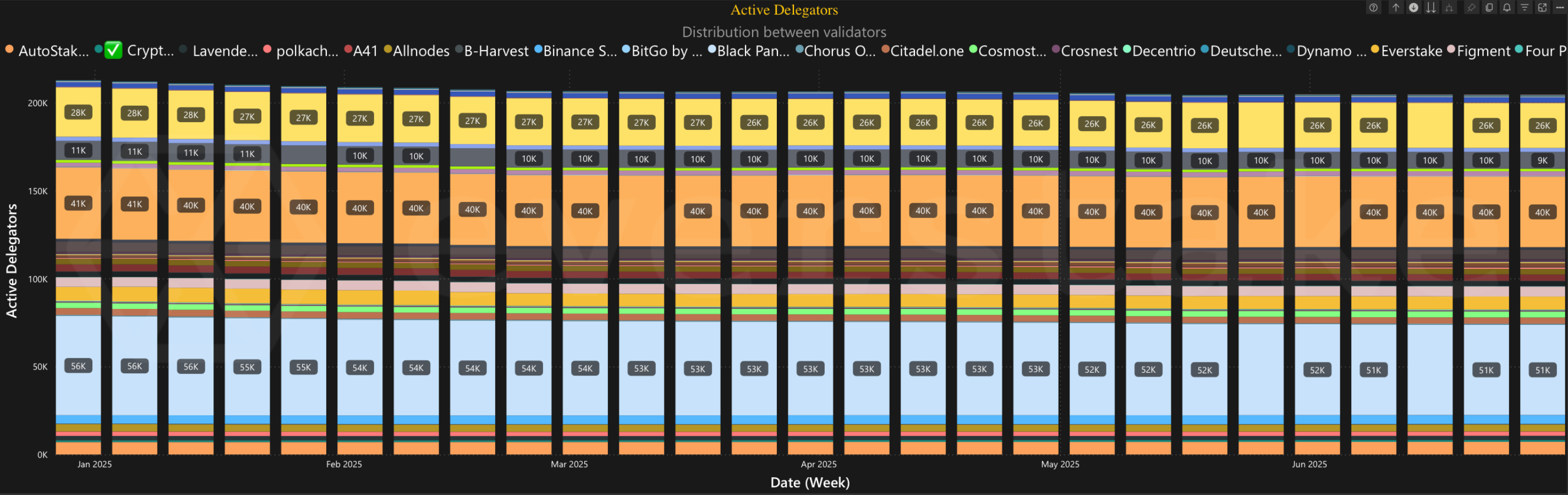

Of the 634,609 active addresses recorded as of June 30, 204,440 were Injective delegators, representing 32% of the total active addresses.

Redelegations

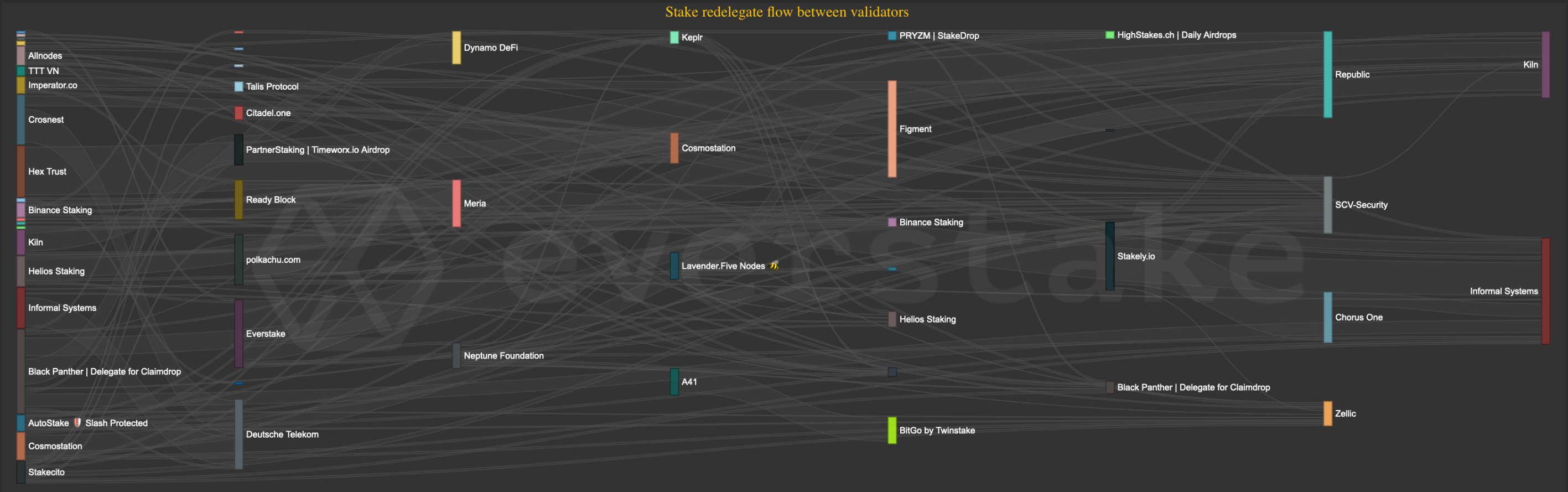

In the first half of 2025, 3270 unique Injective delegators participated in redelegations between validators, resulting in a total redelegation amount of 6,54M INJ.

Most redelegations, specifically 79.8%, were directed towards validators offering a lower fee.

Redelegation activity was partially driven by the launch of the Injective Validator Rebate Campaign in May 2025. This strategic initiative was introduced to incentivize delegators to support validators with a demonstrated commitment to the long-term development of the Injective ecosystem.

Under the terms of the campaign, which ran from May to July 2025, delegations directed to four selected validators (Zellic, Informal Systems, SCV-Security, and Kiln) were eligible to receive rebates on the commissions accrued during the campaign period.

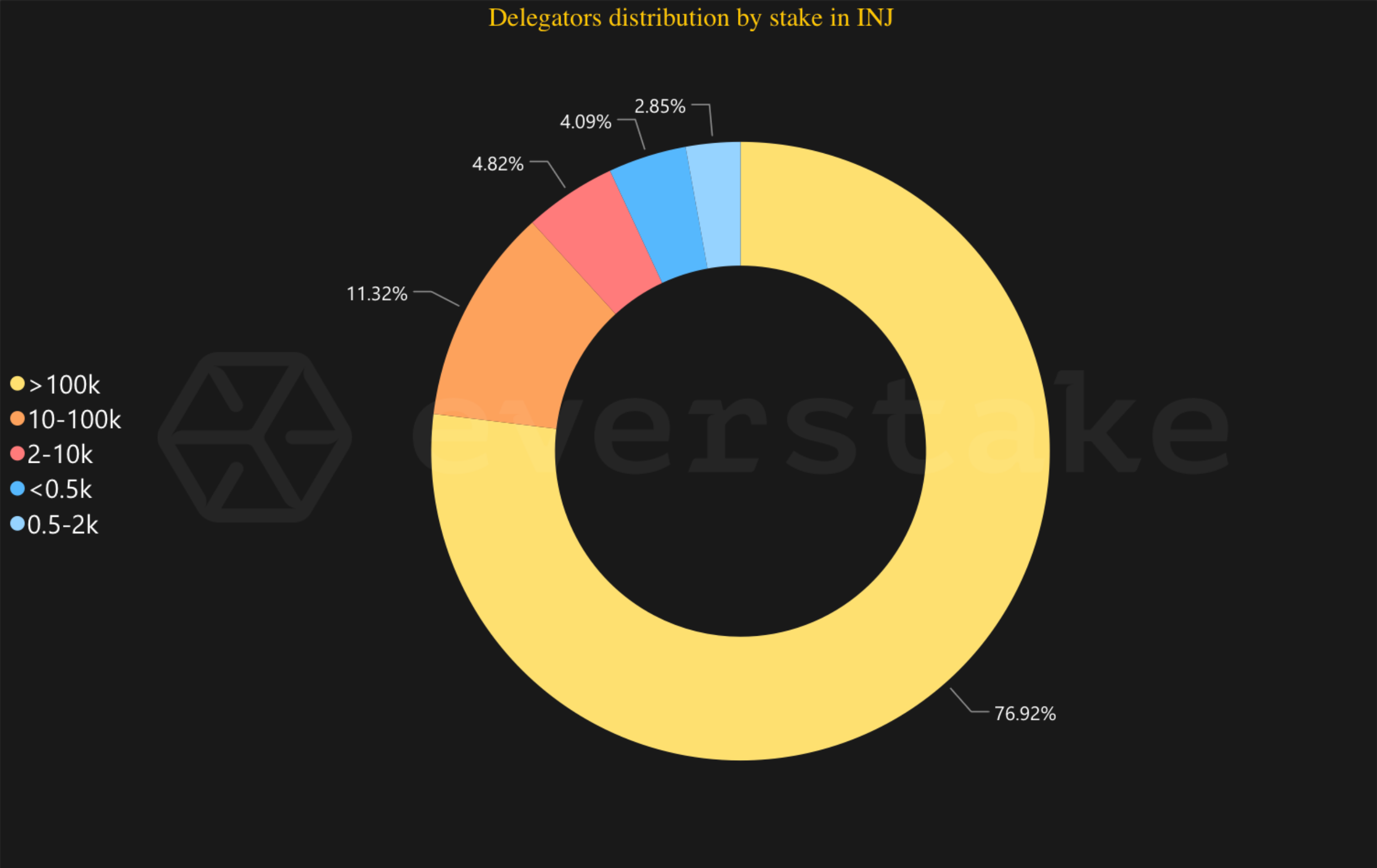

Delegator distribution by stake

As of the end of June 2025, the distribution of delegators by staked INJ amount was as follows:

-

>100K: 76.92% of total stake (total delegation amount - 41,388,457 INJ, 48 delegators)

-

10-100K: 11.32% of total stake (total delegation amount - 6,088,356 INJ, 141 delegators)

-

2-10K: 4.82% of total stake (total delegation amount – 2,595,378 INJ, 445 delegators)

-

0.5-2K: 2.85% of total stake (total delegation amount – 1,531,340 INJ, 1,280 delegators)

-

<0.5K: 4.09% of total stake (total delegation amount – 2,200,632 INJ, 105,704 delegators)

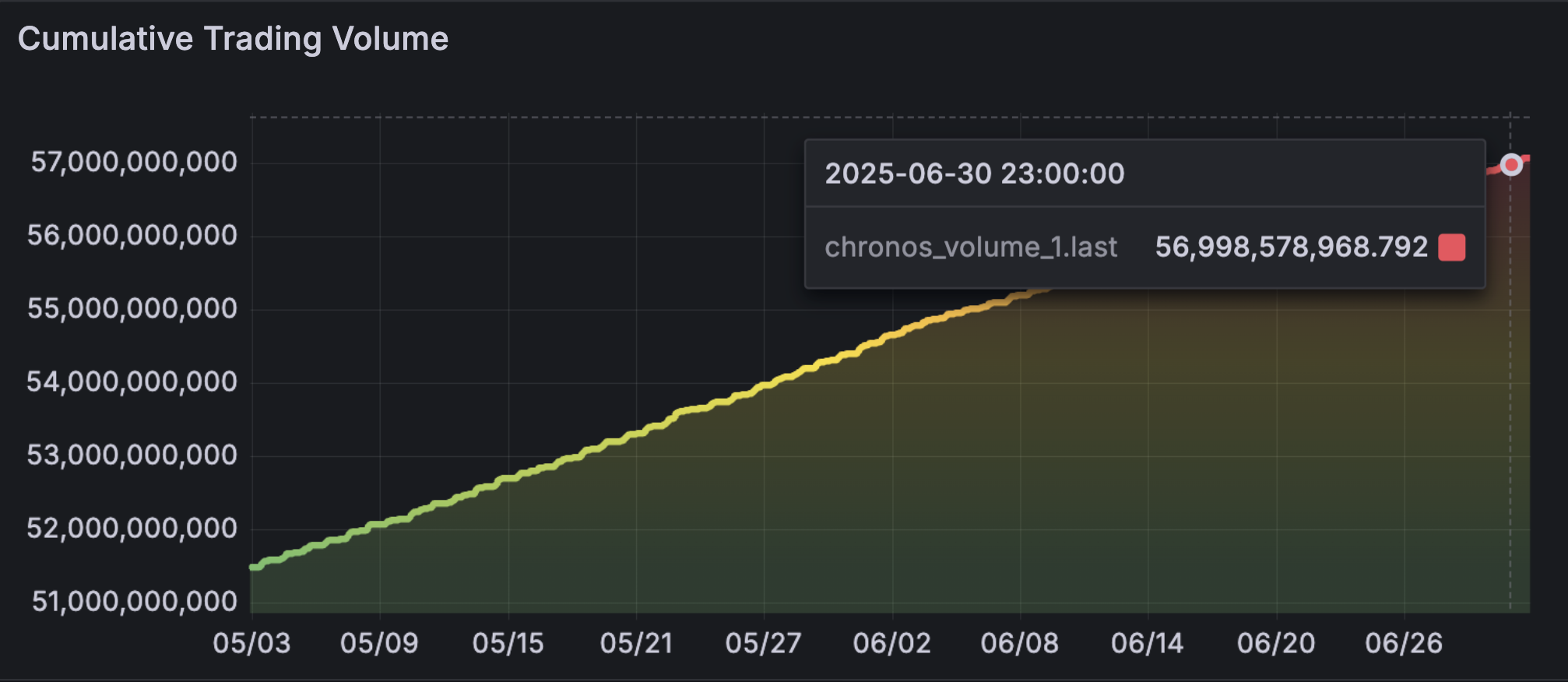

Cumulative trading volume

By the end of the first half of 2025, Injective reached almost $57B in cumulative trading volume.

Source: Injective Analytics

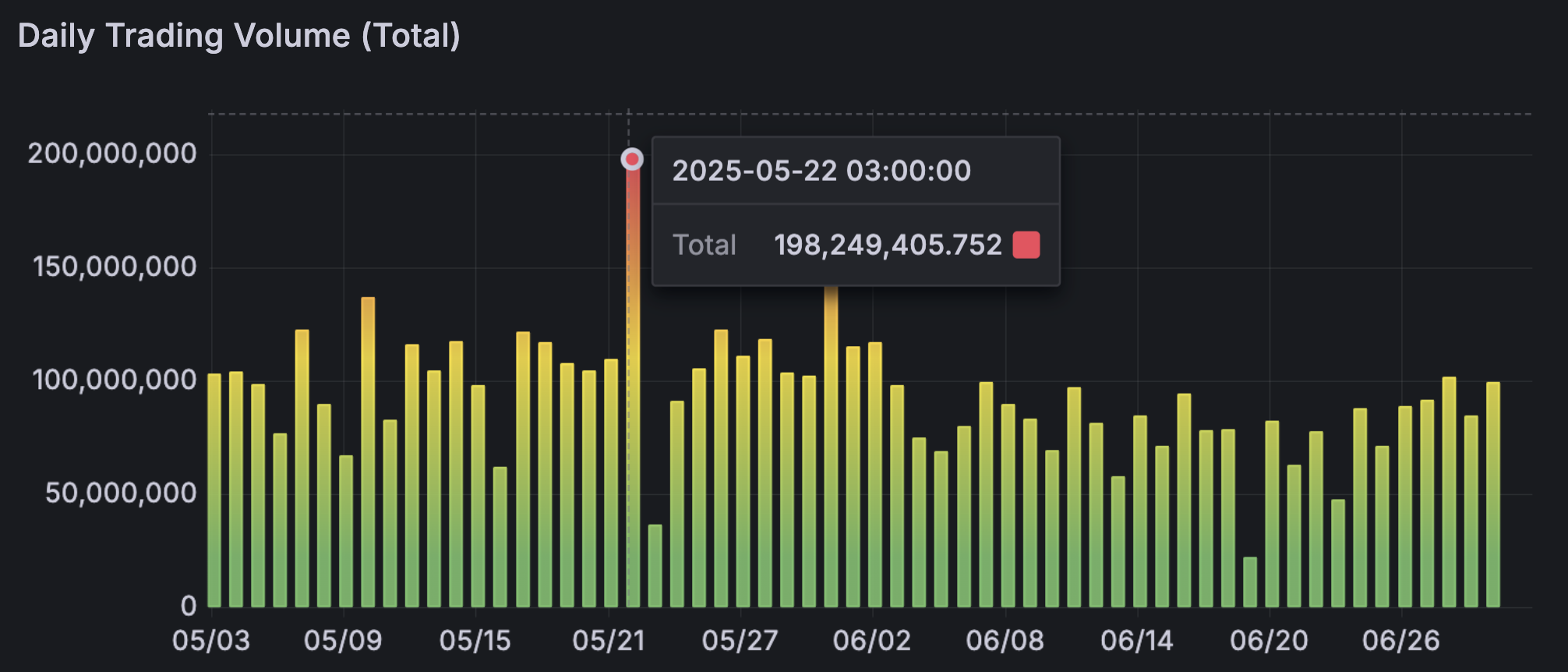

The peak of activity was recorded on May 22, with more than 198M in daily trading volume.

Source: Injective Analytics

The steady growth in cumulative trading volume on Injective can be attributed in part to the release of iAssets and the very Injective infrastructure designed to seamlessly bridge the gap between TradFi and DeFi.

Further supporting mainstream adoption, Helix went mobile in June 2025, now available on both the Apple App Store and Google Play Store. This step significantly improved accessibility, offering users a familiar, mobile-first interface to interact with Injective’s ecosystem and expanding Injective’s reach across global retail and institutional audiences.

iAssets

In March, Injective introduced iAssets, a novel framework designed to bring real-world assets (RWAs) on-chain.

iAssets represent a new financial primitive that enables the seamless tokenization and on-chain deployment of any stock, bond, ETF, FX, or commodities.

The iAssets whitepaper outlines the architecture of its framework.

-

The first iAsset launched was an Nvidia stock. This was soon followed by additional offerings, including McDonald’s stock futures and Robinhood stocks.

-

In May, Injective expanded its iAssets offering by deploying Meta (META), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), and Netflix (NFLX) stocks.

-

With these additions, Injective now supports onchain trading for the full suite of the Magnificent 7 (MAG 7): Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta, and Tesla.

These stocks are made accessible to users globally through Injective’s premier exchange, Helix.

Upgrades

The first half of 2025 marked a period of continued technical improvement for Injective, highlighted by the implementation of several mainnet upgrades aimed at expanding the chain’s functionality.

In February, Injective introduced the Nivara mainnet upgrade, which was met with strong governance participation, with 42.3 million INJ used in the voting process. The Nivara upgrade introduced a series of enhancements for Injective, including:

-

Next-Generation RWA Oracle enabled advanced real-world assets (RWA) oracle price update support in the chain stream.

-

Modernized RWA Module Architecture. The new RWA module featured enhanced access control mechanisms and flexible configuration capabilities to support sophisticated tokenization capabilities.

-

Expanded Authorization Framework added support for Authz grants (specifically for wasmx/MsgExecuteContractCompat), offering more granular delegation controls for institutional and retail users.

-

Enhanced Exchange Module Security introduced market fund isolation mechanisms for both derivative and binary options markets, significantly boosting reliability across Injective-powered exchange dApps.

-

Strengthened Injective Bridge Security implemented protective measures, such as segregated wallet implementation for suspicious deposits, enforced batch fee constraints, and new event logging for successful deposits.

On April 22, Injective successfully implemented the Lyora Mainnet upgrade (v1.15.0), which introduced a range of technical enhancements to improve network performance:

-

The Dynamic Fees Mechanism introduced an adaptive fee model that adjusts transaction costs based on network demand, promoting cost-efficiency and effective transaction prioritization.

-

Predictable Gas Usage + Smart Mempool optimized transaction ordering, particularly during periods of peak demand.

-

Chain-level optimizations included performance enhancements and security improvements across core modules, bringing Injective lower latency and higher throughput.

Gas compression

Injective is one of the most cost-efficient Layer 1 blockchains, offering one of the industry's most competitive transaction fee structures.

A major milestone in this regard was the 2024 introduction of the gas compression mechanism, which significantly minimized the transaction costs.

This upgrade reduced the average transaction cost to near-zero levels of approximately 0.00001 INJ (or $0.0003), enabling users to stake, participate in governance, trade, lend, or mint NFTs with minimal expenses. This improvement has proven especially impactful for dApp developers and high-frequency traders, who benefit from the ability to execute a high volume of transactions at negligible cost.

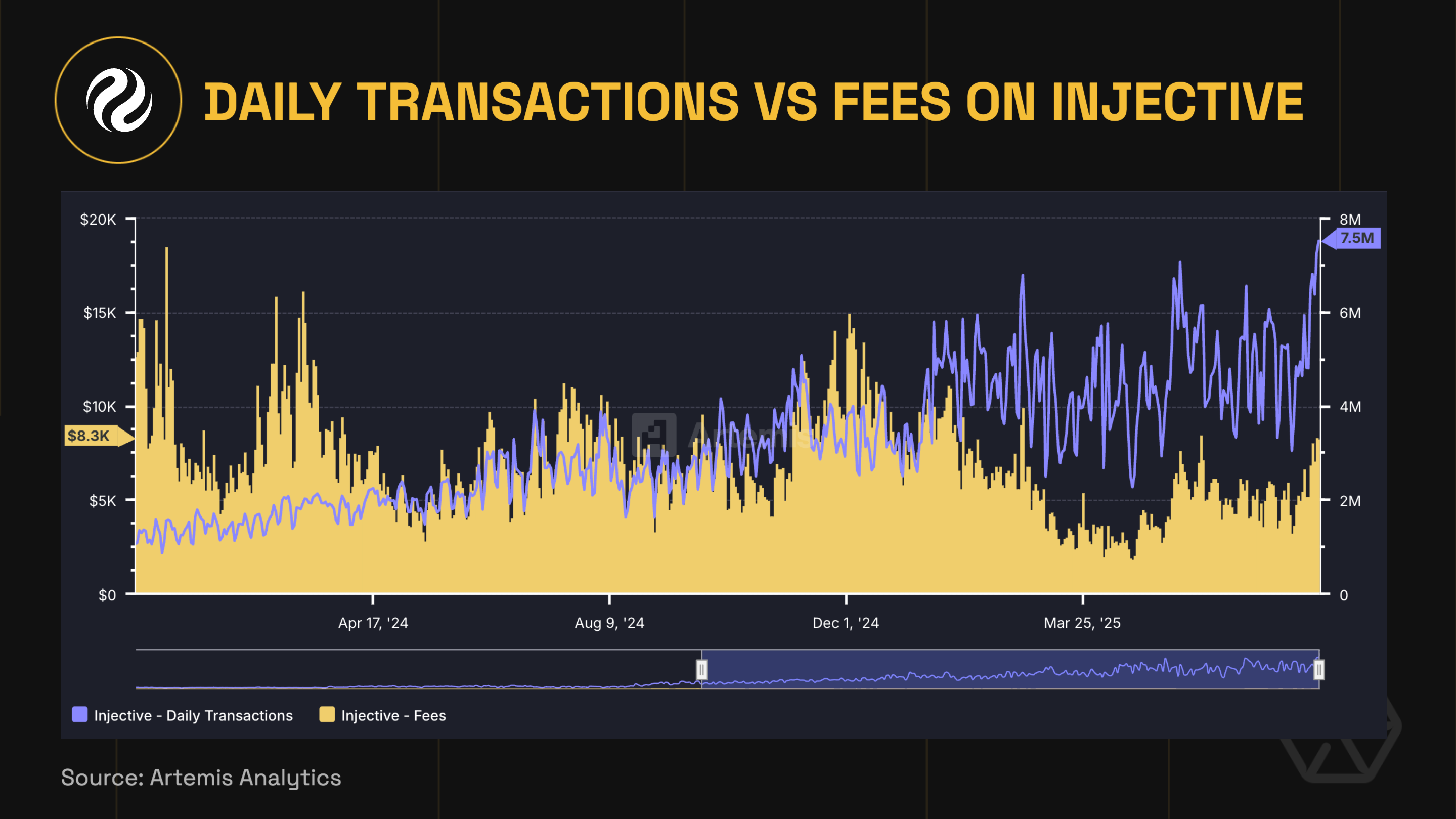

The impact of gas compression is clearly reflected in network data: since the introduction of gas compression in January 2024, daily transaction volumes have steadily increased, while overall fee costs have declined.

This tendency persisted into 2025.

Source: Artemis Analytics

Development activity

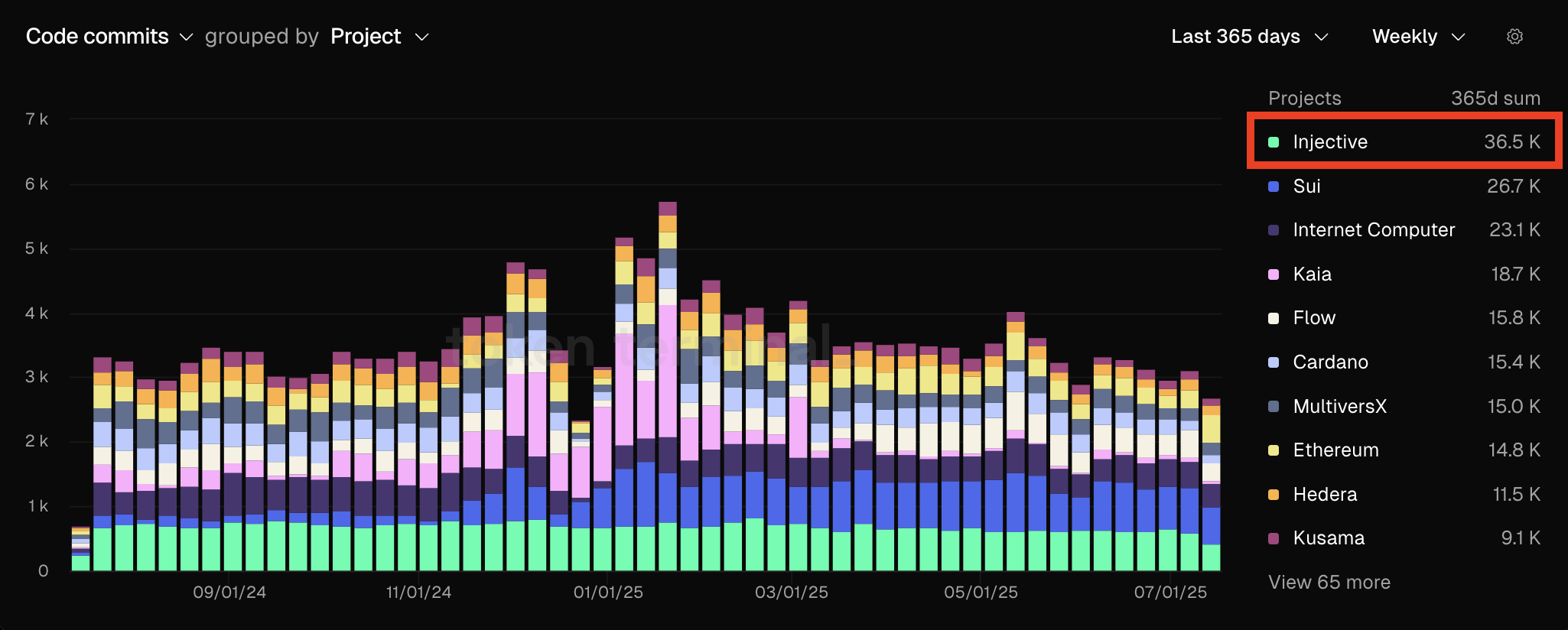

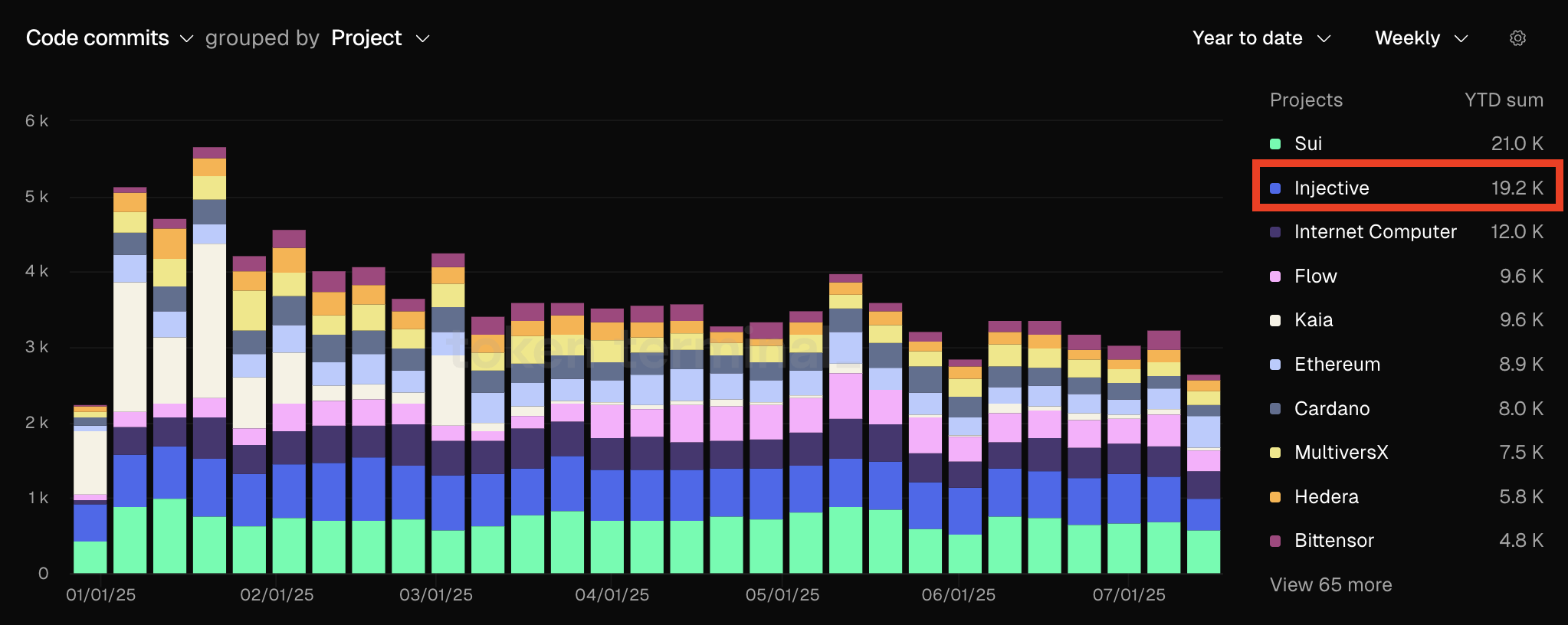

As of June 2025, Injective is one of the leading L1s in development activity over the past six months, with 56,136 total commits.

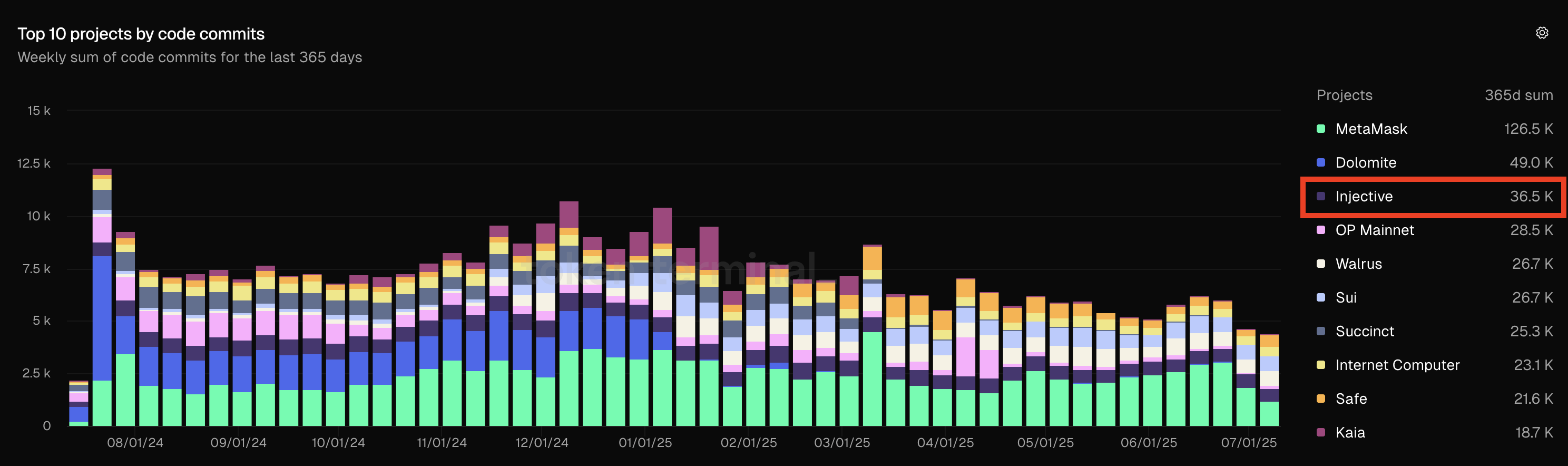

Further solidifying its strong and consistent developer engagement, Injective ranks third across all projects in crypto by code commits over the last year.

Source: Token Terminal

Moreover, Injective holds the first position in code commits among all Layer 1 networks in the past year and ranks second in year-to-date (YTD).

Source: Token Terminal

INJ 3.0 inflation parameters update

The first half of 2025 marked continued progress in implementing INJ 3.0, a tokenomics update approved by the Injective community via governance in 2024. It is designed to make INJ one of the most deflationary assets in the crypto realm.

Injective employs a dynamic supply mechanism that adjusts the supply rate within defined lower and upper bounds on a block-by-block basis, with these parameters directly linked to the percentage of INJ staked on-chain.

INJ 3.0, released in 2024, introduced quarterly schedule reductions of the lower and upper bounds while increasing the network’s responsiveness to staking activity.

Over the two-year period following INJ 3.0 approval, the lower bound is set to decrease by 25% (from 5% to 4%), while the upper bound is set to drop by 30% (from 10% to 7%).

The governance proposal #472, passed in January 2025, decreased the lower and upper bounds of the INJ token supply parameters to 4.625% and 8.875% respectively, aligning with the broader roadmap of the INJ 3.0 tokenomics framework.

The iAgent 2.0 launch and AI agent hackathon

In 2024, Injective introduced iAgent, an SDK that empowers anyone to create on-chain AI agents. iAgent makes use of natural language commands and enables users to perform tasks such as payments, trading, and portfolio management using AI models like OpenAI's ChatGPT.

iAgent 2.0 was launched in January 2025. The upgraded framework introduced enhanced functionality, flexibility, and scalability, and incorporated the Eliza multi-agent framework, enabling seamless interoperability between AI agents and Injective’s financial infrastructure.

As the next step, Injective launched its first AI Agent Hackathon, powered by iAgent 2.0 and co-hosted by DoraHacks. The event attracted a wide range of builders exploring the potential of AI in DeFi. Two standout projects, Paradyze and Jecta, were awarded the grand prizes for their contributions to the ecosystem.

Blockchain Association

In March 2025, Injective took a significant step toward shaping the regulatory future of the blockchain industry by becoming a member of the Blockchain Association.

-

Blockchain Association is a group of industry giants that includes Brevan Howard, Circle, Coinbase, and Pantera Capital. It collectively works to ensure that the blockchain industry's priorities are reflected in policy discussions.

Injective’s participation in the Blockchain Association is expected to deliver several strategic advantages:

-

Membership offers Injective a formal way to contribute to regulatory discourse, helping to influence the development of policies that support innovation, security, and broader adoption of decentralized technologies.

-

Injective can develop strategic relationships and share best practices by engaging with fellow members, accelerating industry-wide initiatives, and unlocking new collaboration opportunities.

-

Active involvement in the Association's initiatives boosts Injective’s ability to stay ahead of evolving regulatory frameworks.

Injective Summit NYC: key highlights

Injective hosted the Injective Summit, held on June 26, 2025, in New York City. The event brought together a diverse group of industry leaders, developers, and community members to explore the next phase of innovation across the Injective ecosystem.

The summit served as a strategic platform for major product announcements and ecosystem initiatives:

-

Launch of iBuild: A developer tool enabling dApp creation using natural language prompts, designed to streamline on-chain development and lower the barrier to entry for new builders.

-

Helix Mobile App Release: Helix unveiled its new mobile trading application, delivering an accessible and intuitive DeFi experience.

-

Introduction of the Injective Revenue Fund: a new initiative to grow Injective’s onchain revenue and fuel ecosystem innovation.

-

Introduction of the Community Burn – an upgrade to the Injective Burn Auction, which marked a shift from weekly to monthly auctions and enabled everyone in the ecosystem to have a chance to win in the auction by directly contributing to the INJ Burn.

The event featured in-depth discussions and panels, including participation from representatives of the New York State Department of Financial Services, Dragonfly Capital, Plume Network, and NYC Mayor Eric Adams.

A recording of the event is available via the full livestream and CoinDesk’s livestream coverage.

H1 2025 in numbers

In the first half of 2025, Injective demonstrated consistent growth.

-

The total number of on-chain transactions surpassed 2 billion.

-

Cumulative trading volume on Injective exceeded $56.9 billion by the end of June.

-

Injective recorded 56,136 total commits, which makes it one of the most actively developed L1s.

-

Burn auction activity remained strong, with over 6.6 million INJ (approximately $31 million) burned by the end of the reporting period.

-

The network’s user base expanded to 634,609 total active addresses. Of those, 204,440 were INJ delegators, representing approximately 32% of all active addresses.

-

Injective iAsset trading surpassed $1B in volume.

Future prospects

With strengthened RWA module architecture and oracle support introduced via the Nivara upgrade, Injective is likely to see increased engagement in real-world asset tokenization.

The launch of tools like iBuild is expected to accelerate dApp development on Injective. Such efforts aim to lower entry barriers for new builders and create a more diverse ecosystem of financial applications on Injective.

The continuing execution of the INJ 3.0 tokenomics roadmap will contribute to further supply reductions, maintaining INJ as one of the most deflationary assets in the blockchain space. At the same time, the Injective Revenue Fund will help strengthen protocol sustainability and community-led growth.

With its advanced infrastructure, cross-sector integrations, and increasing developer and user engagement, Injective will likely play one of the most crucial roles in the next phase of DeFi development.

Disclaimer

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.

Sign Up for

Our Newsletter

By submitting this form, you are acknowledging that you have read and agree to our Privacy Notice, which details how we collect and use your information.