Osmosis is a decentralized exchange (DEX) and application-specific blockchain (appchain) built on the Cosmos SDK, designed to enable seamless and efficient digital asset swapping. As a key DeFi hub within the Cosmos ecosystem and beyond, it makes full use of the Inter-Blockchain Communication (IBC) Protocol to facilitate cross-chain transactions.

KEY INSIGHTS AND TAKEAWAYS

Rising Network Activity and User Growth

-

The number of active addresses on Osmosis surged by 40%, reaching 987,083 by the end of 2024.

-

User retention on Osmosis remained one of the highest across major blockchains and top decentralized exchanges.

-

Osmosis led the Cosmos ecosystem in IBC activity and transaction volume.

Trading Volume Growth

-

Osmosis maintained over $1 billion in monthly trading volume for five consecutive months starting in December 2023.

-

The DEX processes over $12 billion in trading volume in 2024.

Major Internal Developments

-

Block times were optimized to 1.5 seconds, improving network efficiency.

-

Over 2 million OSMO were burned.

Bitmosis

-

Contributors introduced Bitmosis, a strategic initiative to bring Bitcoin liquidity to multiple chains and position Osmosis as the premier platform for Bitcoin trading.

-

Native BTC deposits and withdrawals were enabled via Nomic integration, allowing zero-fee transfers.

TOTAL STAKE AND DELEGATORS’ GROWTH

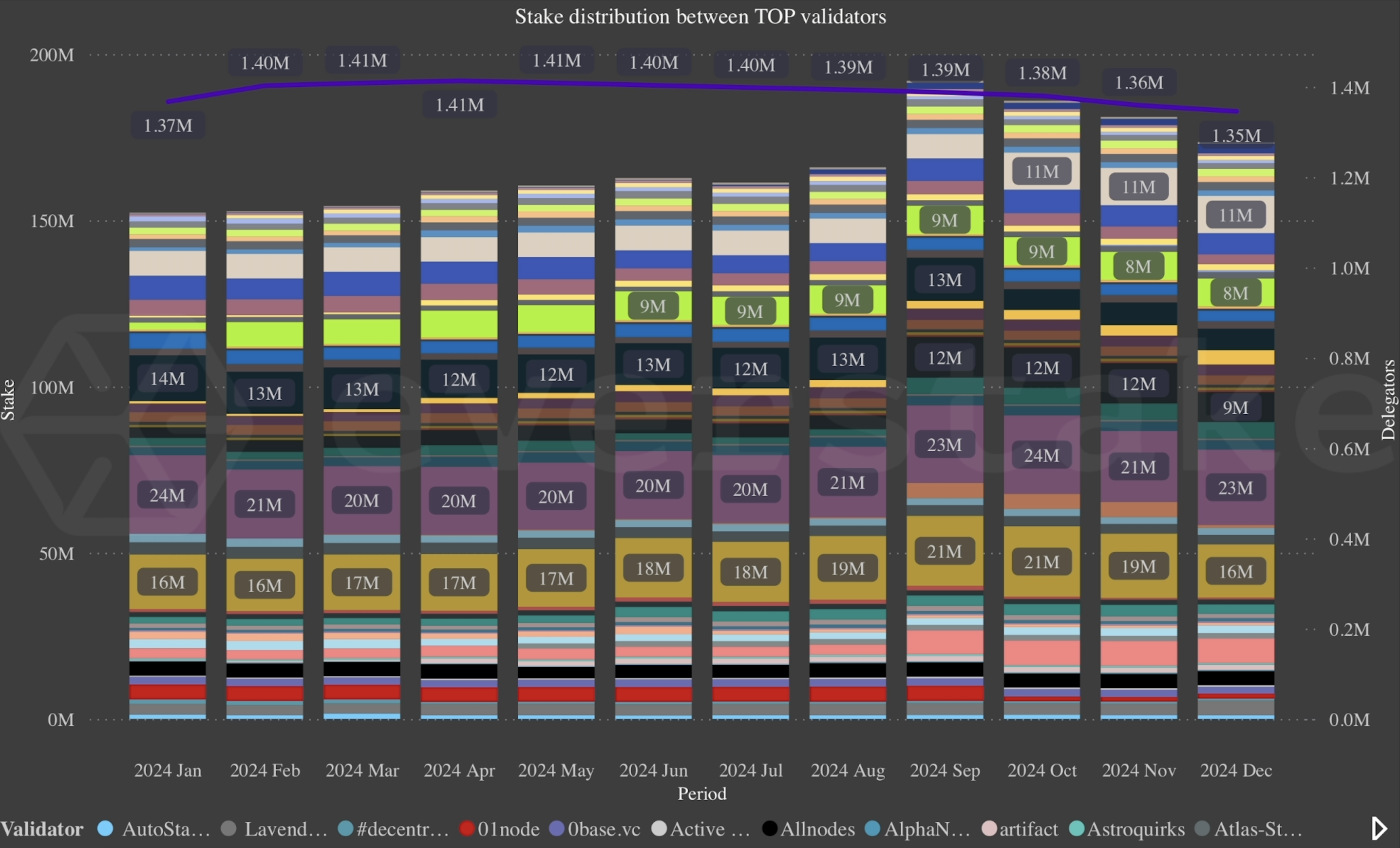

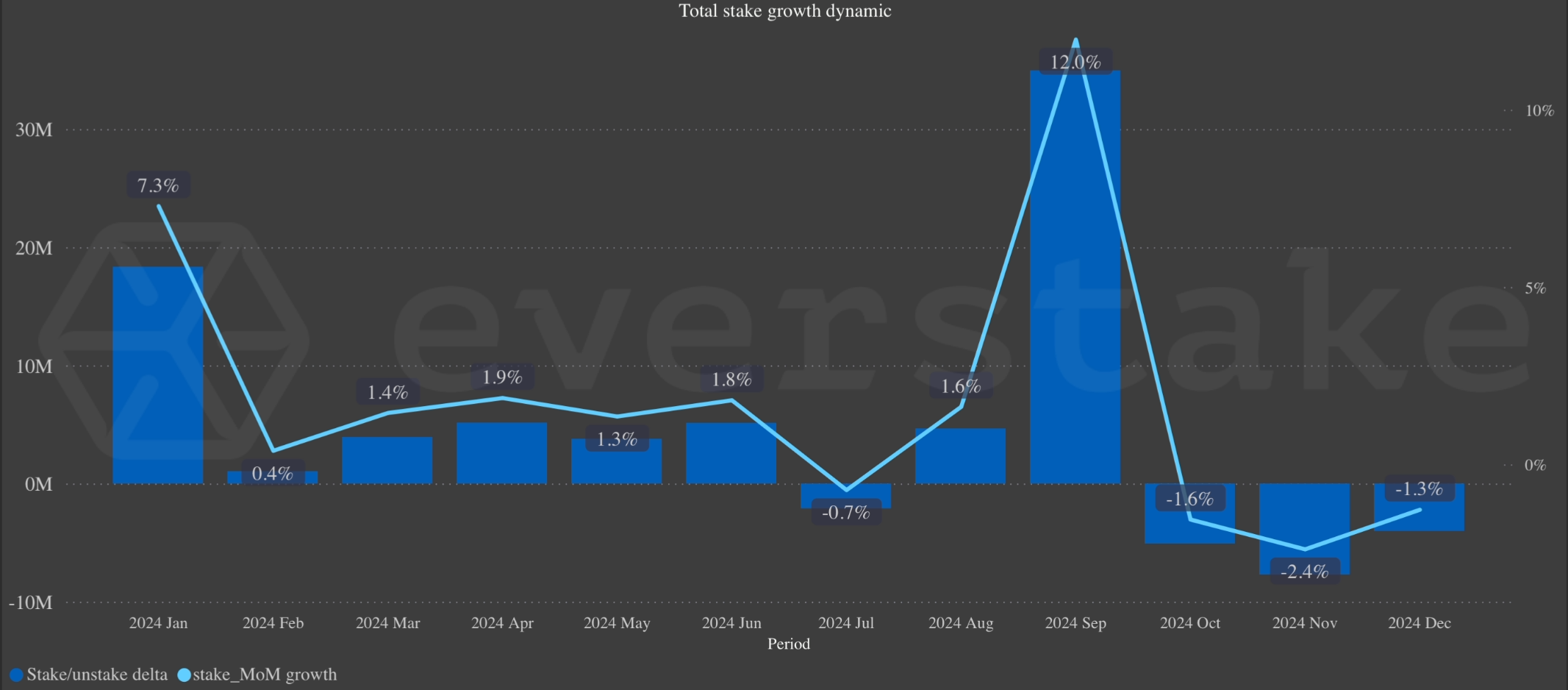

Throughout 2024, the staked ratio on Osmosis remained relatively

consistent, fluctuating between 47% and 53%, with the total staked amount

ranging from 318 million to 319 million OSMO.

September was particularly notable, with a 12% increase in total stake (+34 million OSMO).

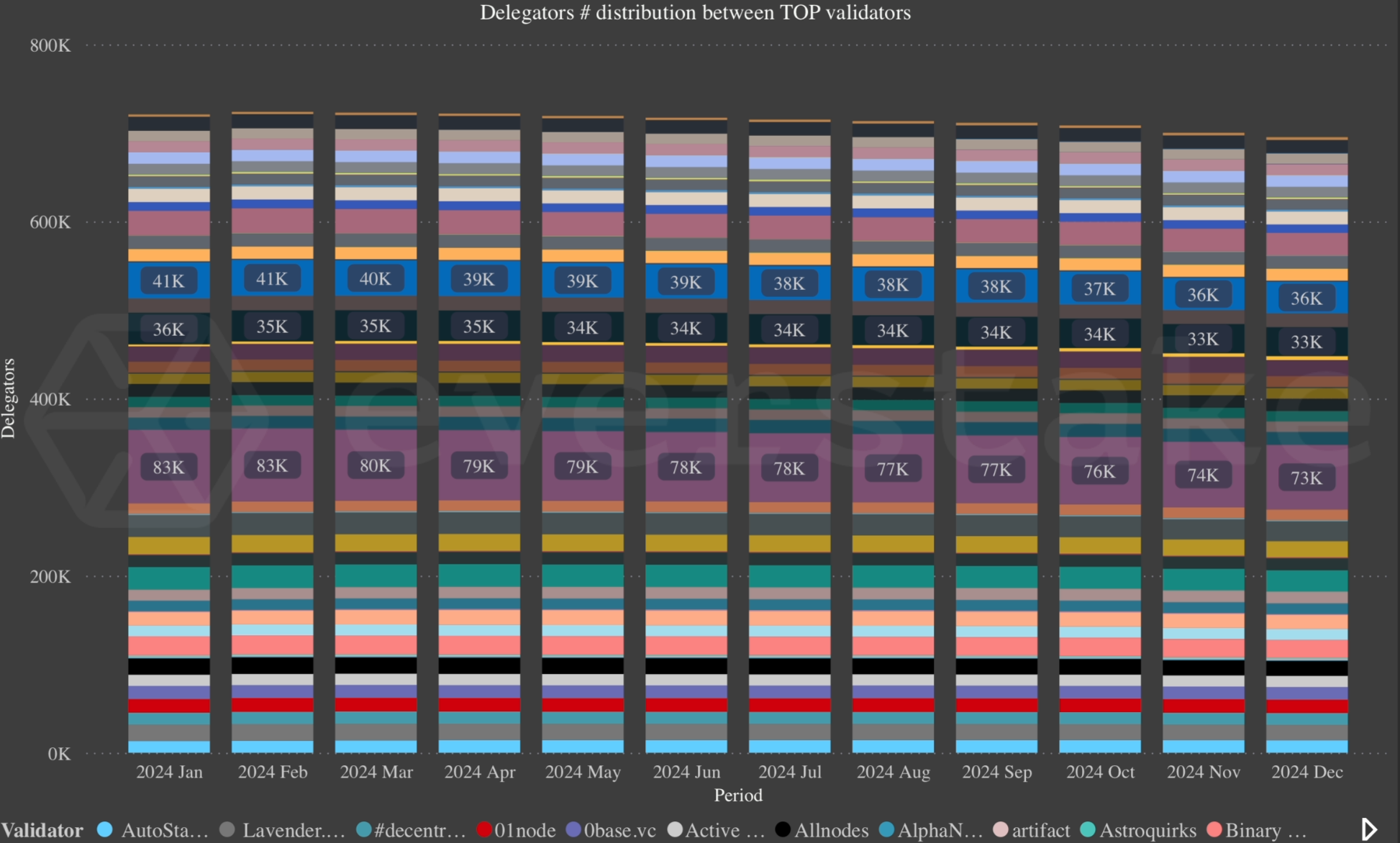

The total number of Osmosis delegators reached 1.3 million by

the end of 2024.

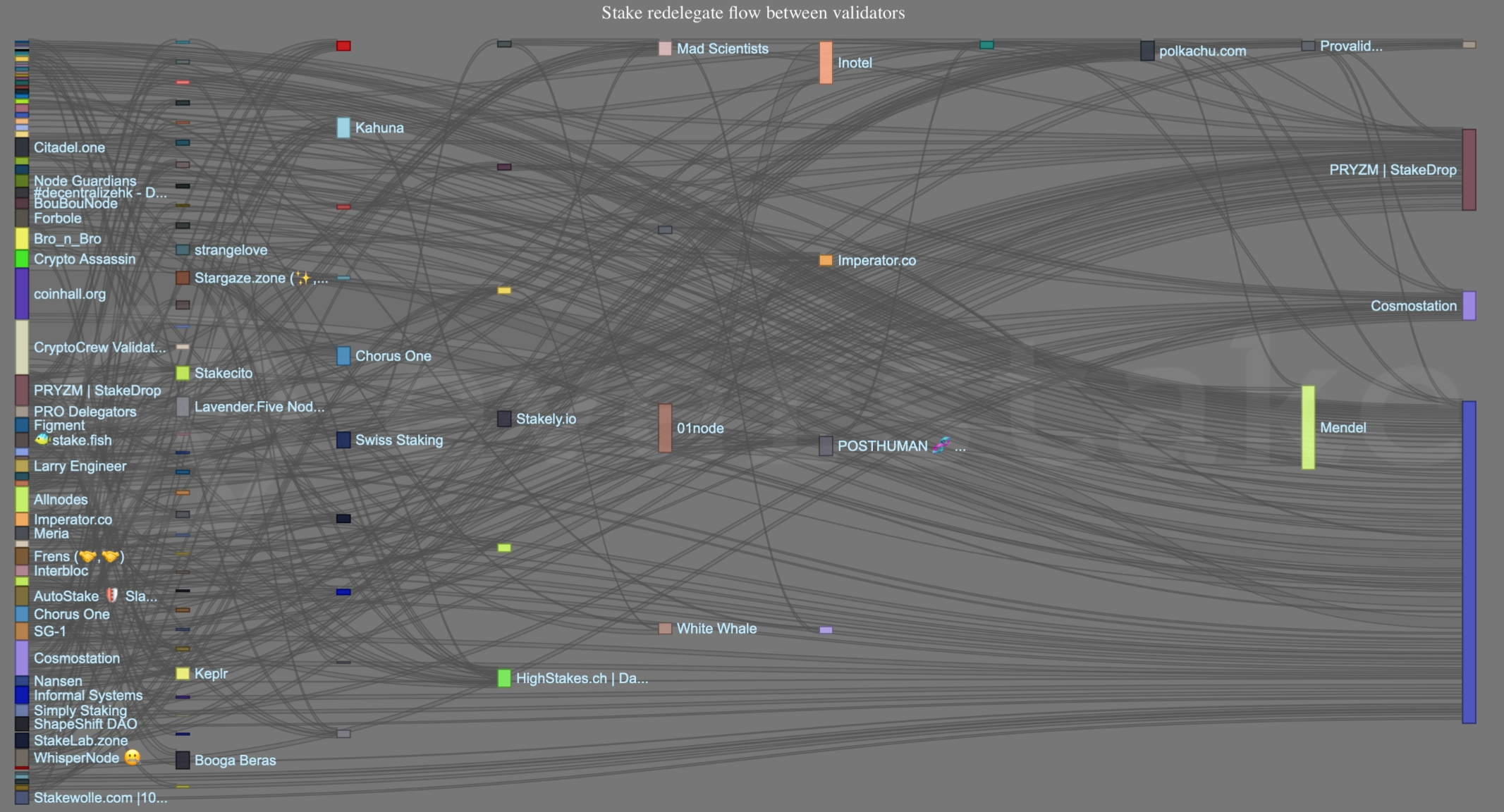

In 2024, 88,910 Osmosis delegators actively redistributed their stakes among validators, with the total redelegated amount reaching 53.1 million OSMO. Notably, the vast majority (98.63%) of these funds were allocated to validators with lower commission rates.

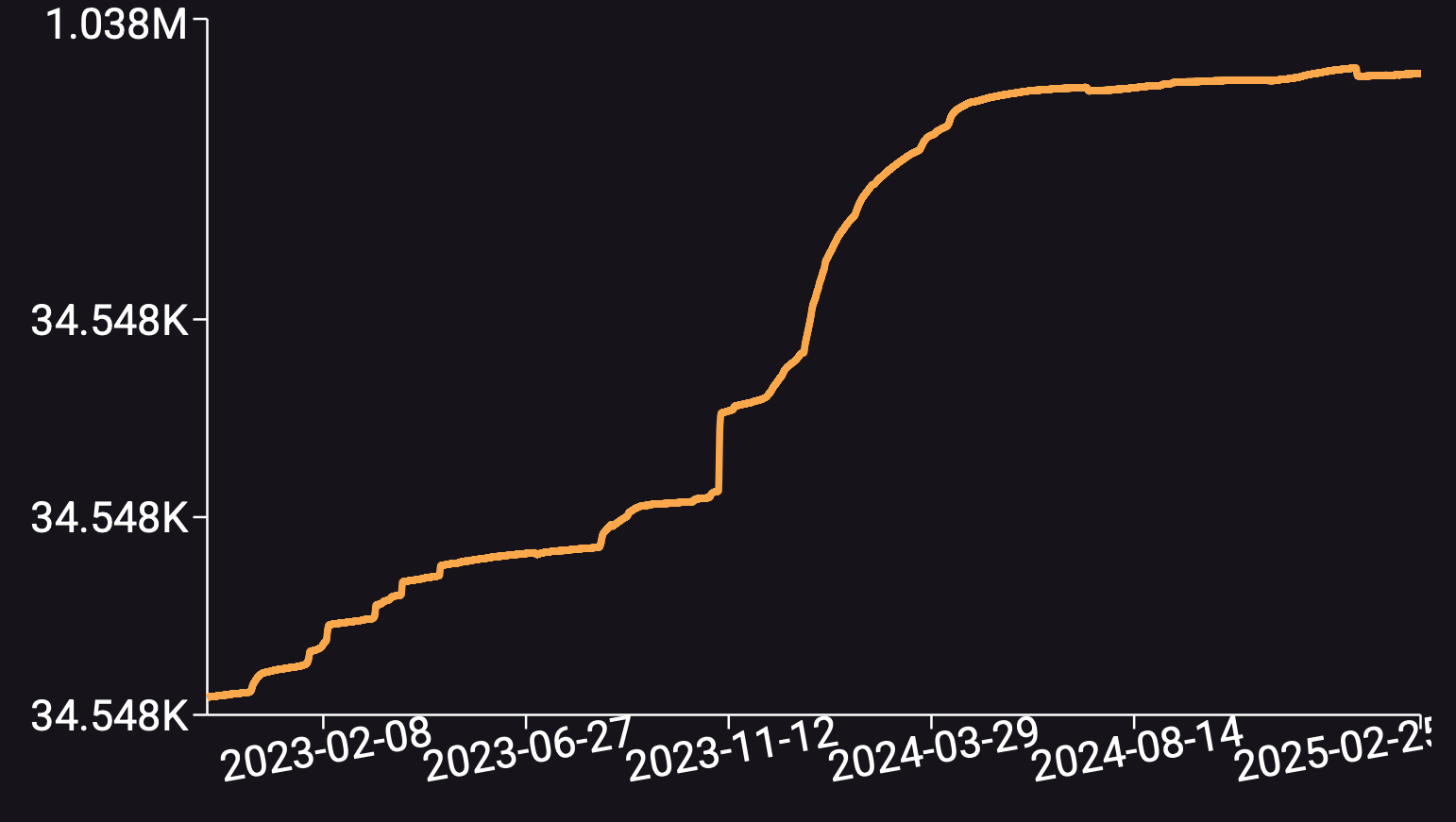

ACTIVE ADDRESSES GROWTH

By the end of 2024, the number of active addresses on Osmosis approached 1 million, reaching 987,083 as of December 31. This represents an increase of 286,612 addresses over the year and corresponds to a growth rate of +40%.

Source: Smart Stake Analytics

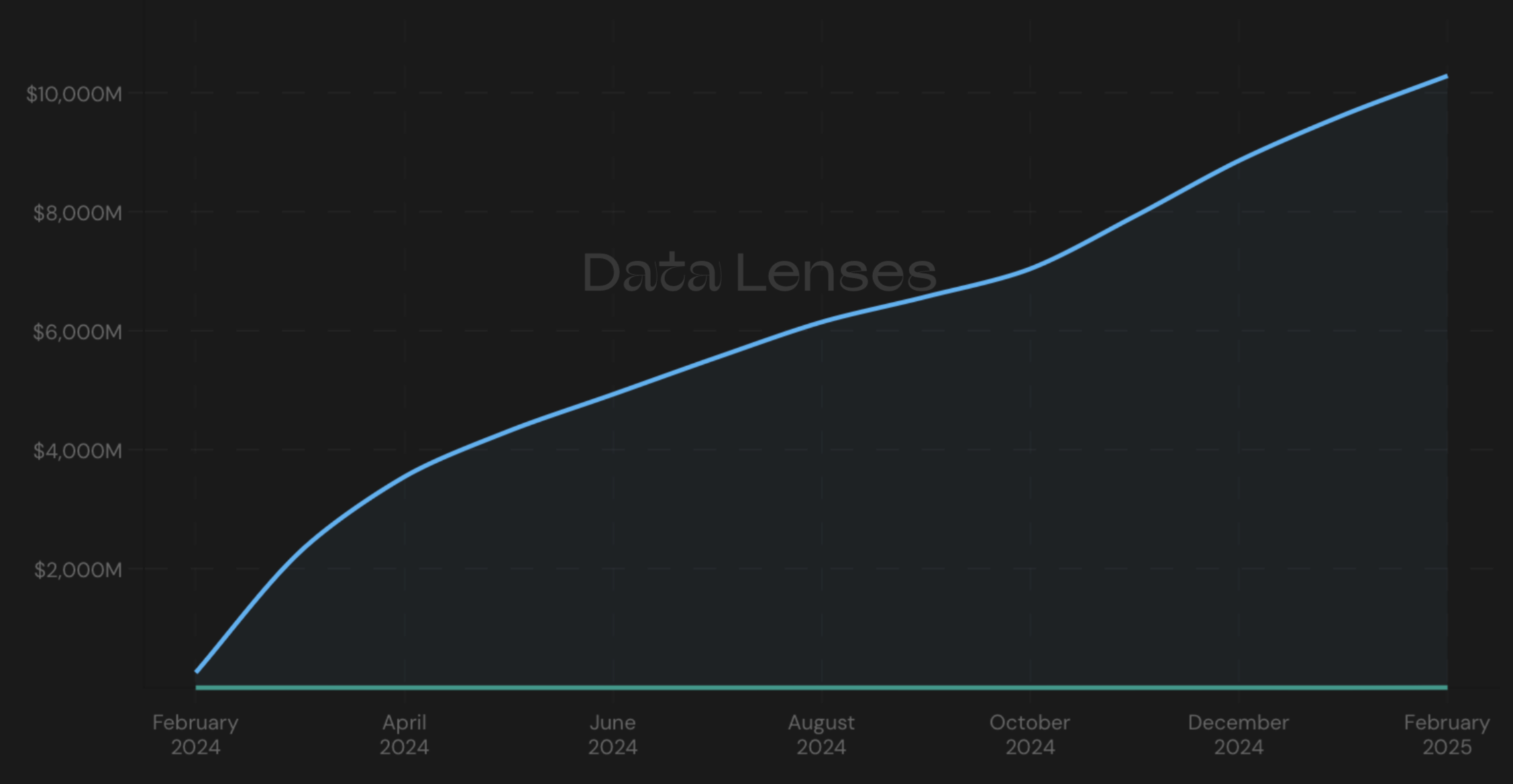

TRADING VOLUME

Osmosis experienced a substantial increase in trading volume at the beginning of 2024. Starting in December 2023, the Osmosis DEX maintained a monthly trading volume exceeding $1 billion for five consecutive months.By the end of the year, the cumulative trading volume on the Osmosis DEX exceeded $12 billion.

Source: Data Lenses

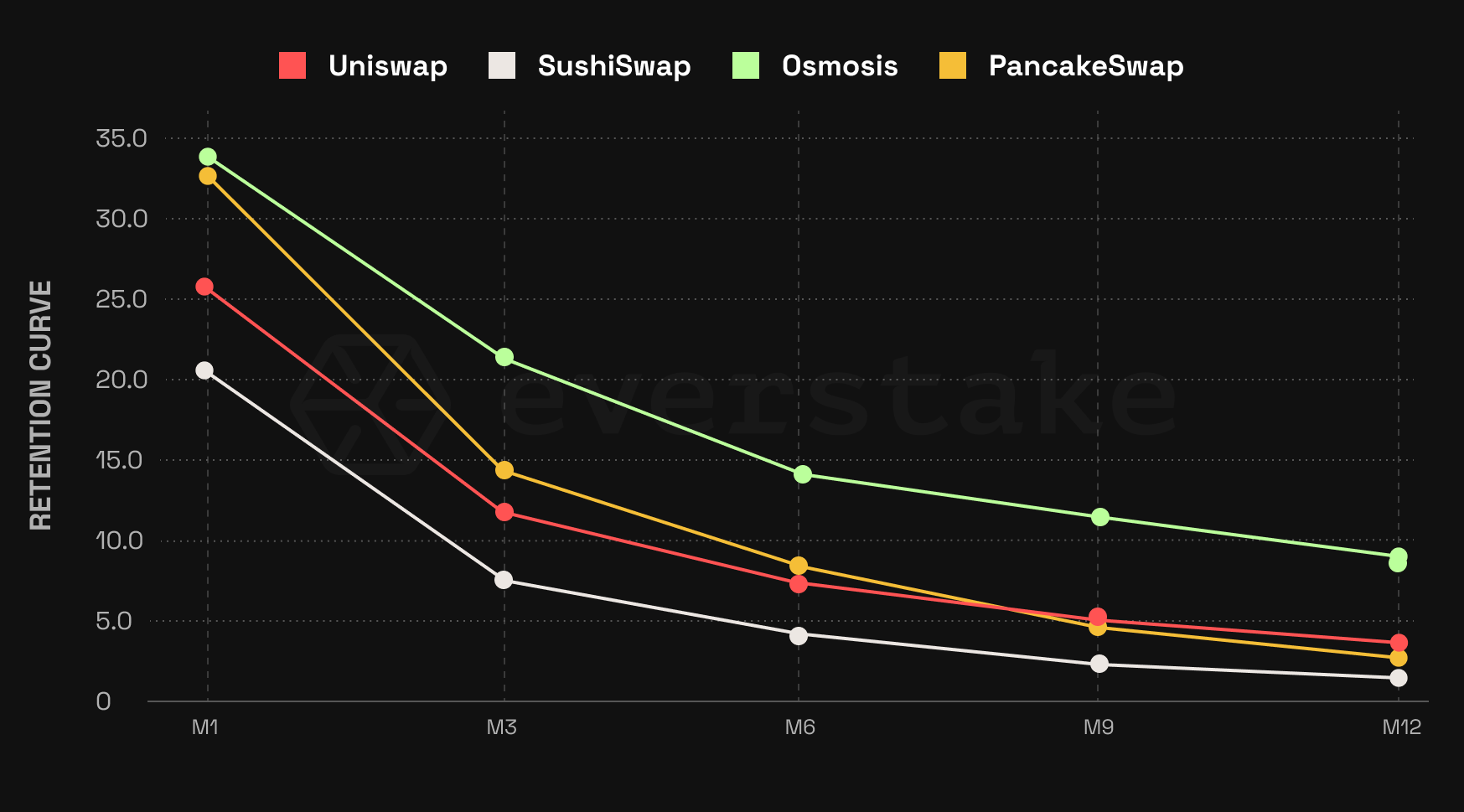

USER RETENTION AND IBC ACTIVITY

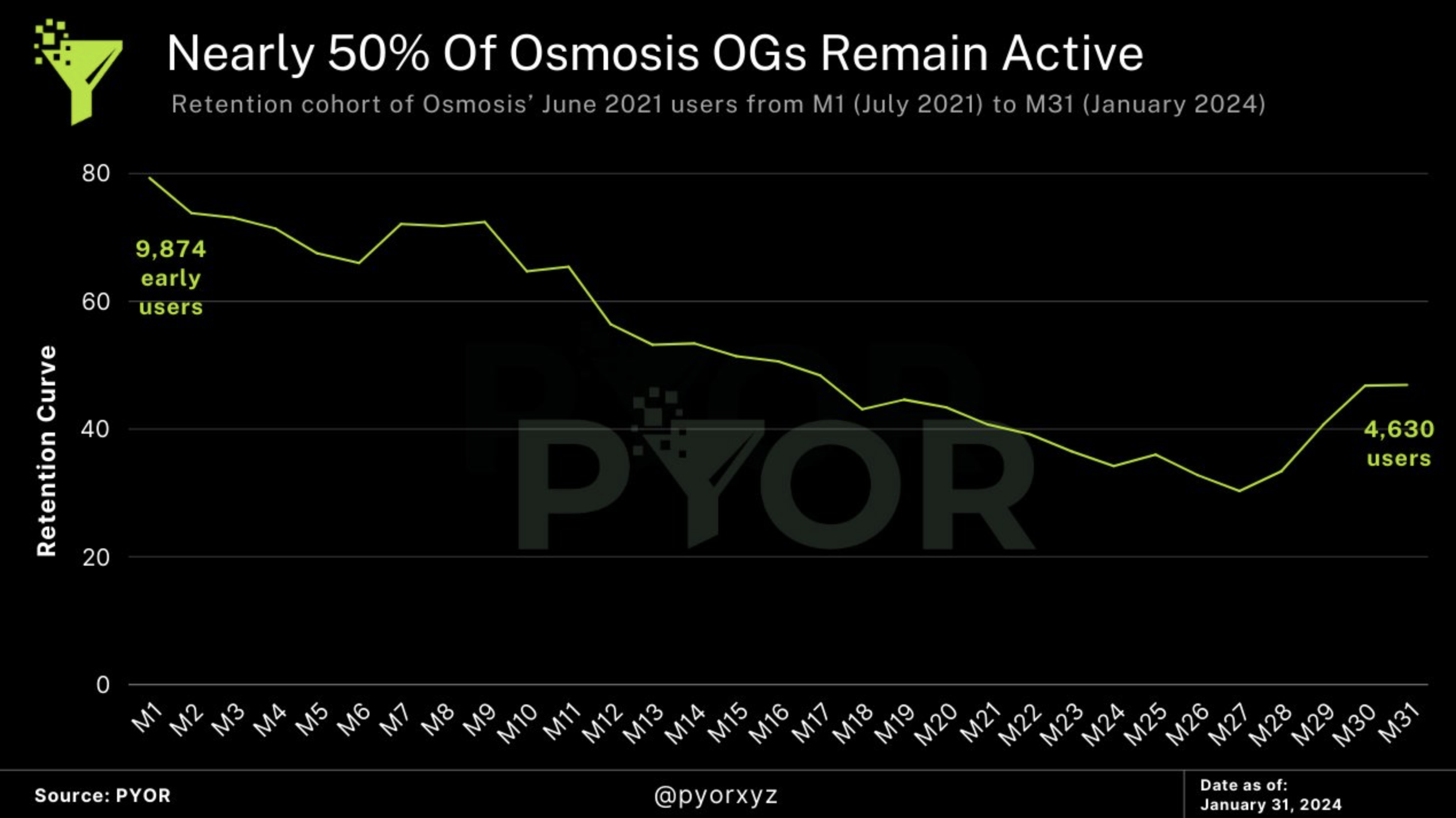

According to PYOR data, Osmosis maintained the highest user retention rates among major blockchains and top decentralized exchanges (DEXs).

In

terms of numbers, 4,630 (or 46.9%) of the 9,874 users who used Osmosis in June

2021 remained active in January 2024, as the PYOR data

suggests.

In

terms of numbers, 4,630 (or 46.9%) of the 9,874 users who used Osmosis in June

2021 remained active in January 2024, as the PYOR data

suggests. According

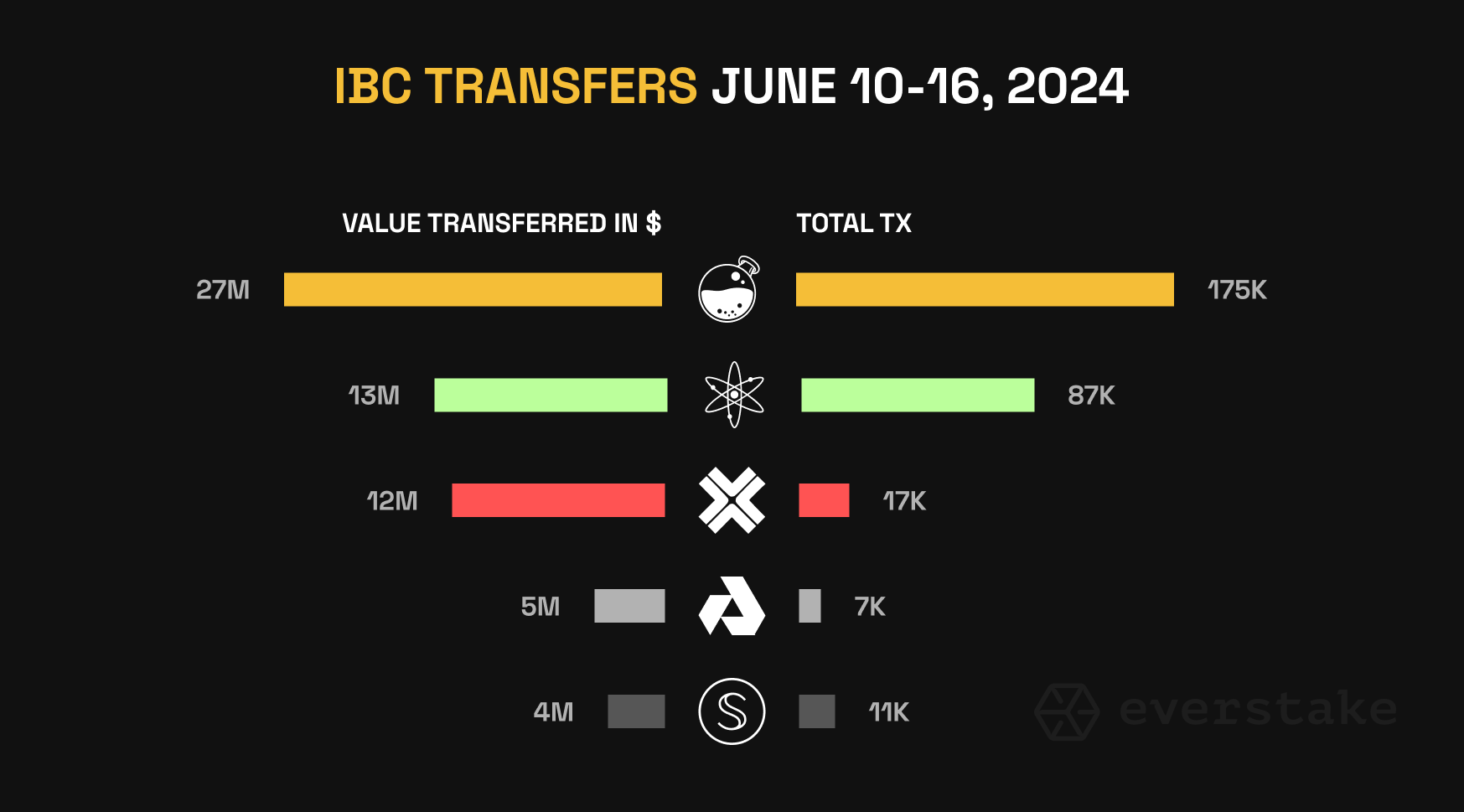

to Cosmolytics data, Osmosis was at the forefront of the Cosmos ecosystem in

IBC activity and transaction volume.

According

to Cosmolytics data, Osmosis was at the forefront of the Cosmos ecosystem in

IBC activity and transaction volume.

KEY INTERNAL DEVELOPMENTS

Throughout the year, Osmosis introduced several major upgrades aimed at enhancing network efficiency, user experience, and ecosystem integration.

Optimized Block Speeds

Several upgrades significantly improved block processing time, reducing it to 1.5 seconds. This brought about faster transactions and enhanced network performance.

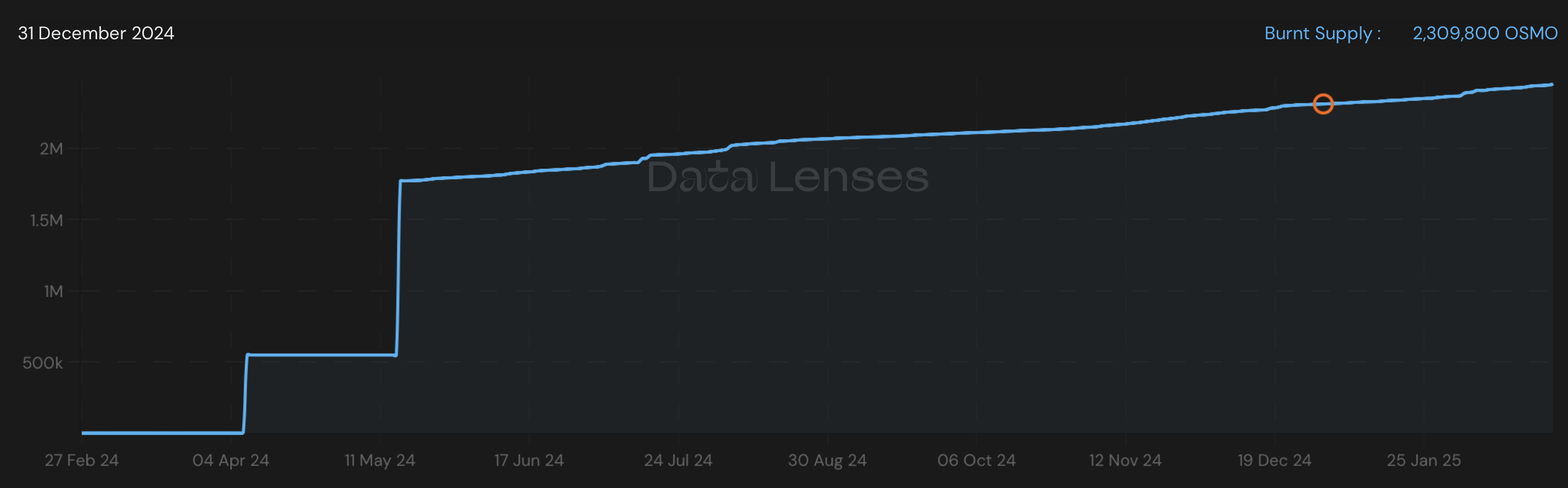

OSMO Token Burn

As part of the v25 upgrade, Osmosis implemented a burn mechanism, which led to the burning of 1.3 million OSMO tokens shortly after launch. Over 2 million OSMO have been burned and removed from the circulating supply overall.

Source: Data Lenses

Introduction of Smart Accounts

Osmosis launched Smart Accounts, enabling 1-click trading to streamline the DeFi user experience. t

Astroport Passive Concentrated Liquidity (PCL) Pools

Osmosis collaborated with Astroport to launch passive concentrated liquidity (PCL) pools, optimizing capital efficiency and improving the trading experience by bringing together two of Cosmos' most dynamic DEXes.

Liquidity Hub for Solana and Ethereum Assets

With the Picasso Network extending the IBC protocol to Solana and Ethereum, Osmosis has become the primary liquidity hub for assets from these ecosystems within Cosmos.

Limit Orders

Osmosis introduced Limit Orders powered by Onchain Orderbooks, which significantly enhanced the trading experience on Osmosis.

Taker Fee Revenue Sharing Mechanism

Osmosis implemented a Taker Fee Revenue Sharing protocol, approved through governance, to incentivize liquidity contributions from external chains. Under this model, any chain that supplies liquidity to Osmosis via this mechanism can get a share of the revenue generated from Taker Fees.

Alloyed Assets

Osmosis introduced its Alloyed Asset solution, which merges different versions of related assets into a unified token. The first asset to leverage this innovation was USDT, which was designated as the canonical version of USDT on Osmosis following the approval of Proposal 792 on June 18.

With the launch of the Alloyed Asset solution, Osmosis introduced Alloyed Bitcoin, a tradable asset representing a share in a liquidity pool composed of different types of BTC. The Alloyed BTC on Osmosis comprises several underlying bridged assets, currently consisting of five different BTC versions.

BITMOSIS

2024 marks the start of Bitmosis, a strategic initiative aimed at unlocking Bitcoin liquidity across chains and positioning Osmosis as the premier platform for Bitcoin trading. With Bitcoin as the core focus, the Bitmosis initiative seeks to establish Osmosis as the leading decentralized exchange (DEX) for Bitcoin. It relies on the triad of concepts listed below.

-

Establishing liquidity for the Bitcoin Layer 2 ecosystem

-

Becoming the premier platform for Bitcoin trading

-

Accumulating Bitcoin within the protocol’s treasury

Osmosis employs its Alloyed Assets system to ensure seamless interoperability between various Bitcoin versions, consolidating multiple BTC representations into a single tradable asset.

Additionally, through its integration with Nomic, Osmosis enabled seamless, decentralized, and non-custodial Bitcoin deposits and withdrawals: users can transfer native BTC directly from any Bitcoin wallet or exchange without incurring any fees.

KEY EVENTS IN 2024

Throughout 2024, Osmosis contributors actively participated in major blockchain conferences, including DEVMOS, which was hosted by Osmosis and brought together leading developers from the Cosmos ecosystem for in-depth technical discussions. Other notable events included Consensus, Solana Breakpoint, The Staking Summit, Devcon, and more.

FUTURE PROSPECTS

As Osmosis continues to progress, 2025 will likely become a crucial year for expanding its role as the leading decentralized exchange for Bitcoin. Using the momentum generated by the Bitmosis initiative, Osmosis is expected to further solidify its position as the go-to venue for BTC liquidity and ensure seamless interoperability across Bitcoin Layer 2 networks and beyond.

Beyond Bitcoin, Osmosis is also preparing the launch of Polaris, the Token Portal, a product designed to enable the trading of any token across all chains.

Additionally, continued infrastructure upgrades and innovative developments will further enhance Osmosis’ efficiency, security, and user experience.