KEY INSIGHTS & TAKEAWAYS

-

Institutional & Financial Integration: In 2025, Solana became usable for traditional capital at scale. The launch of spot-SOL ETFs created a regulated entry point, and by the end of December, U.S. products had attracted around USD 766 million in net inflows. These flows strengthened Solana's role as an execution layer where trading and settlement happen directly on-chain, accelerating the emergence of Internet Capital Markets (ICM).

-

Technical Advancement: The network announced its largest technical upgrade, Alpenglow, scheduled for implementation in 2026. Alpenglow, which aims to reduce block finality from roughly 12.8 seconds to an industry-leading 100–150 milliseconds.

-

Ecosystem and Economic Growth: Solana became a major hub for digital-dollar liquidity, with the total supply of stablecoins reaching USD 16 billion. Monthly payment-related transfers exceeded USD 60 billion. This economic activity drove high throughput and record-breaking surges in Network REV (Real Economic Value), which surpassed USD 550 million in January 2025, and Decentralized Exchange (DEX) volume, which accounted for approximately USD 400 billion in January alone.

-

Exceptional Network Throughput: The blockchain sustained high activity beyond short-lived spikes. In July 2025 alone, the network processed about 3.5 billion transactions, reflecting consistent demand for low fees and low latency across DeFi, trading, and payments.

-

Decentralization and Staking Resilience: The Nakamoto coefficient remained near 20 throughout the year, indicating a consistently high level of stake decentralization and strong resistance to validator concentration.

METHODOLOGY

This report is based on direct on-chain data from the Solana blockchain and supporting ecosystem sources. The goal was to produce an analysis that is transparent, reproducible, and grounded in observable network activity.

-

On-Chain Data Collection: We pulled raw data directly from Solana, including transaction activity, staking behavior, and inflation metrics. Data access relied on RPC calls to public Solana nodes, covering both real-time and historical states of the network. All collected data was stored in relational databases to ensure reliability and enable efficient querying at scale.

-

Data Preparation: We processed and cleaned the datasets using Python. This included handling missing values, filtering outliers, and resolving inconsistencies across sources. On-chain data was combined with API-sourced information related to staking, transactions, and inflation to form a single, consistent dataset. Early-stage exploration and visualization were done in Power BI to surface key patterns and anomalies.

-

Data Analysis: We analyzed the prepared data using standard statistical methods. Charts and visualizations were used to examine trends in staking participation, transaction volumes, inflation dynamics, and other core metrics. Where relevant, we applied hypothesis testing to confirm statistically meaningful relationships.

-

Interpretation: Our research team interpreted the results in the context of existing industry research and comparable blockchain benchmarks. Based on these findings, we identified implications for network performance, validator economics, and usage trends, as well as areas for further research.

This methodology is documented to ensure transparency and allow independent verification or extension of the analysis.

MAIN ECOSYSTEM NEWS AND UPDATES

2025 was a year where Solana's technical upgrades moved from roadmap to production, stablecoin usage scaled materially, and adoption spread beyond crypto-native use cases. The sections below cover the developments that most directly shaped Solana's role as a high-performance execution layer.

INTERNET CAPITAL MARKETS

In 2025, Solana became one of the main environments for Internet Capital Markets (ICM), where trading, settlement, and liquidity are handled on-chain and in real time. High throughput, fast finality, and low transaction costs allowed capital flows that would be difficult to support on slower blockchains or traditional rails.

Several major trends define Solana's ICM landscape in 2025:

-

Institutional-grade settlement rails: Stablecoins and tokenized dollars on Solana are becoming core payment and settlement instruments, enabling instant clearing for trading venues, fintechs, and global merchant applications.

-

Composability as a market accelerator: Liquidity, identity, risk engines, and orderbooks exist as interoperable modules. DeFi protocols, prime brokers, and RWAs plug into the same liquidity fabric, creating an open financial stack with minimal friction.

-

Decentralized order flow and high-frequency execution: Thanks to Solana's parallelized runtime, on-chain orderbooks support speed and volume comparable to centralized exchanges. This attracts algorithmic traders, market makers, and cross-exchange arbitrage flows directly to the network.

-

Tokenized assets and on-chain credit expansion: Treasuries, invoices, and cash equivalents are now issued and traded natively on Solana, powering new lending, repo, and collateral markets with full transparency and 24/7 uptime.

-

Payments merging with capital markets: Solana's expanding merchant ecosystem creates a unique feedback loop: payments, swaps, lending, and trading converge into a single programmable environment, blurring the boundaries between consumer and institutional finance.

By 2025, Solana's Internet Capital Markets were no longer limited to mirroring traditional financial structures. In practice, the network supported forms of on-chain activity that are difficult to execute efficiently on legacy systems or slower blockchains, particularly where continuous settlement and low-cost execution are required. Growing participation from liquidity providers, institutions, and real-world issuers reflects this shift in usage.

SOLANA ETFS

2025 marked a turning point for Solana's integration into traditional capital markets, with the first wave of spot-SOL exchange-traded funds (ETFs) launching across multiple jurisdictions. The approval and listing of Solana ETFs positioned SOL alongside Bitcoin and Ethereum as one of the few crypto assets with regulated, mainstream investment products.

Multiple spot-Solana ETFs launched globally throughout the year, including products by 21Shares, Bitwise, Grayscale, Franklin Templeton, and others.

Several issuers introduced staking-enabled ETF structures, allowing investors to capture a portion of on-chain yield in addition to price exposure—an industry first for Solana.

Institutional Demand and Inflows

Early-market performance demonstrated a strong appetite from traditional investors. Inflows into newly launched Solana ETFs repeatedly exceeded expectations, with some products attracting hundreds of millions of dollars within weeks.

-

By the end of December 2025, U.S. spot-SOL ETFs continued to attract capital throughout the fourth quarter, with cumulative net inflows reaching approximately USD 750–766 million and combined assets under management climbing to around USD 930–950 million, representing roughly 1.35 % of SOL's market capitalization. On December 24, Solana spot ETFs recorded $931 million in total net assets with about $752 million in cumulative net inflows.

-

The first-day inflows for Bitwise's BSOL product alone reached USD 69.5 million, and several ETFs maintained inflow streaks of 10-20 consecutive days, with daily inflows often exceeding USD 20-40 million.

-

The first significant outflow occurred on November 27, when 21Shares' TSOL experienced a USD 34.4 million redemption, resulting in a net outflow of USD 8.1 million, while other funds continued to attract capital. During peak periods, BSOL captured up to 89% of total ETF inflows, highlighting early-mover advantage in the Solana ETF space.

Market Impact and Outlook

ETF activity deepened liquidity across both crypto-native and traditional venues, contributing meaningfully to market flows. More broadly, ETFs reinforced Solana's position as a core digital asset in multi-asset portfolios.

Looking ahead, ETFs are likely to remain a key gateway to capital. As staking-enabled products mature and regulatory frameworks evolve, Solana stands to benefit from continued institutional participation and tighter integration with traditional financial infrastructure.

ALPENGLOW UPGRADE

Alpenglow represents the largest consensus and networking upgrade in Solana's history. Its primary goal is to reduce block finality from roughly 12.8 seconds to 100–150 milliseconds, enabling real-time applications such as high-frequency trading, gaming, and instant payments.

At the core of the upgrade are two major innovations: Votor and Rotor.

-

Votor replaces the old TowerBFT voting system with an off-chain aggregated voting mechanism, allowing blocks to finalize in one round if around 80% of validators participate, or in two rounds if participation is lower. This removes per-slot on-chain voting and significantly reduces validator overhead.

-

Rotor reworks Solana's data-propagation layer, distributing block data more efficiently and reducing network latency through erasure-coded "shreds."

Together, these changes improve finality, throughput, and overall network stability.

Alpenglow was formalized through proposal SIMD-0326 and approved with over 98% of participating stake. It also introduces changes to validator economics, replacing per-slot voting with a lightweight Validator Admission Ticket (VAT) system, lowering operational costs.

The implications of Alpenglow are significant; its implementation is scheduled for 2026. Users benefit from near-instant transaction confirmations, while validators gain reduced resource requirements and a more efficient network. For developers and enterprises, the upgrade unlocks the potential for larger block sizes, higher throughput, and more complex applications, solidifying Solana as a high-performance, reliable blockchain for real-time and Internet-scale markets.

STABLECOIN EXPANSION

Stablecoin usage on Solana grew materially in 2025. Total supply reached approximately USD 16 billion, placing Solana among the top three blockchains by stablecoin market capitalization. Monthly peer-to-peer transfers exceeded USD 50-60 billion, with millions of active addresses interacting with stablecoins each month.

Several factors contributed to this expansion:

-

Solana's throughput and low fees made stablecoin transfers viable for frequent payments, remittances, and DeFi activity, including high-volume, low-value transactions.

-

USDC accounted for the majority of stablecoin supply (approximately 60-80%), with USDT and newer stablecoins contributing additional liquidity.

-

Stablecoins remained a core input for decentralized exchanges, lending protocols, and other capital allocation mechanisms across Solana's DeFi ecosystem.

-

Beyond DeFi, stablecoins were increasingly used for peer-to-peer transfers, merchant settlements, and cross-border payments.

Together, these factors supported sustained stablecoin activity on Solana across both financial and non-financial use cases.

Payments on Solana

Solana continued to gain traction as a payments network in 2025. Near-instant finality and minimal fees supported peer-to-peer transfers, merchant payments, and cross-border settlements.

Notable Partners & Integrations

-

BitPay: In August 2025, BitPay added full support for Solana, allowing users and merchants to pay and receive using SOL, USDC, or USDT via BitPay Wallet and its merchant network.

-

Solana Pay: The native Solana payment framework remains a key rail for crypto payments and has been used by wallets and merchants to enable fast, low-fee stablecoin checkout.

-

Bitget Wallet: In mid‑2025, Bitget Wallet integrated Solana Pay, allowing users globally to make instant, low‑fee crypto payments with stablecoins and other Solana tokens.

-

Worldpay: The global payment processor has announced a partnership involving Solana and a stablecoin for instant global payments settlement, signaling interest from large-scale payment networks in Solana rails.

-

Kalshi: Tokenization of prediction markets. Tokenized predictions powered by Kalshi are now live on Solana, via Jupiter and DFlow.

-

R3 Foundation: The launch of Corda Protocol, a new platform on Solana designed to offer institutional-grade curated real-world asset (RWA) yields.

While payment adoption improved efficiency and reduced friction, reliance on a small set of major stablecoins remains a structural concentration risk.

BREAKPOINT 2025

Solana's flagship developer and ecosystem event, Breakpoint 2025, took place from December 11-13 in Abu Dhabi, bringing together thousands of builders, projects, and institutional participants from across the Solana network.

A key milestone was the mainnet deployment of Firedancer, Jump Crypto's high‑performance validator client. After extensive testing, Firedancer is now fully operational and has begun producing blocks on Solana's mainnet, underscoring significant improvements in network performance and decentralization.

Jupiter unveiled a comprehensive suite of upgrades that extend its role beyond token aggregation into a full‑featured on‑chain finance hub. Highlights included the launch of JupUSD, a native dollar‑pegged stablecoin integrated across Jupiter's products, the graduation of Jupiter Lend from beta to open source, new developer tools, trading terminals, and a USD 1 million rewards program to incentivize user engagement. Further, Jupiter's strategic acquisition of RainFi signals deeper expansion into peer‑to‑peer lending infrastructure.

The event also put a spotlight on real‑world asset (RWA) adoption and institutional infrastructure on Solana. Capital allocators such as Keel announced large‑scale tokenization initiatives, including a USD 500 million RWA campaign. At the same time, Bitwise noted strong institutional interest with its Solana ETF outpacing network issuance, pointing to growing traditional capital flows into the ecosystem.

User-facing tooling also advanced, with Solflare unveiling Solar Shield, a low-cost NFC hardware wallet. Coinbase announced an on-chain trading integration for newly issued Solana tokens, alongside expanded cross-chain support via Chainlink CCIP. DoubleZero co-founder Austin Federa highlighted the project's expansion of its blockchain-optimized fiber network, now with 15 independent contributors laying dedicated fiber capacity to create a faster and more reliable transmission layer for Solana validators and distributed systems — an unprecedented crowdsourced fiber approach without a single centralized owner.

Overall, Breakpoint underscored Solana's transition toward a mature, institution-ready platform while continuing to attract developers and consumer-facing applications.

KEY NETWORK METRICS ANALYSIS

This section reviews Solana's core network metrics in 2025, including user activity, transaction throughput, and on-chain economic output. Together, these indicators offer a snapshot of how the network was utilized throughout the year.

DAILY ACTIVE ADDRESSES

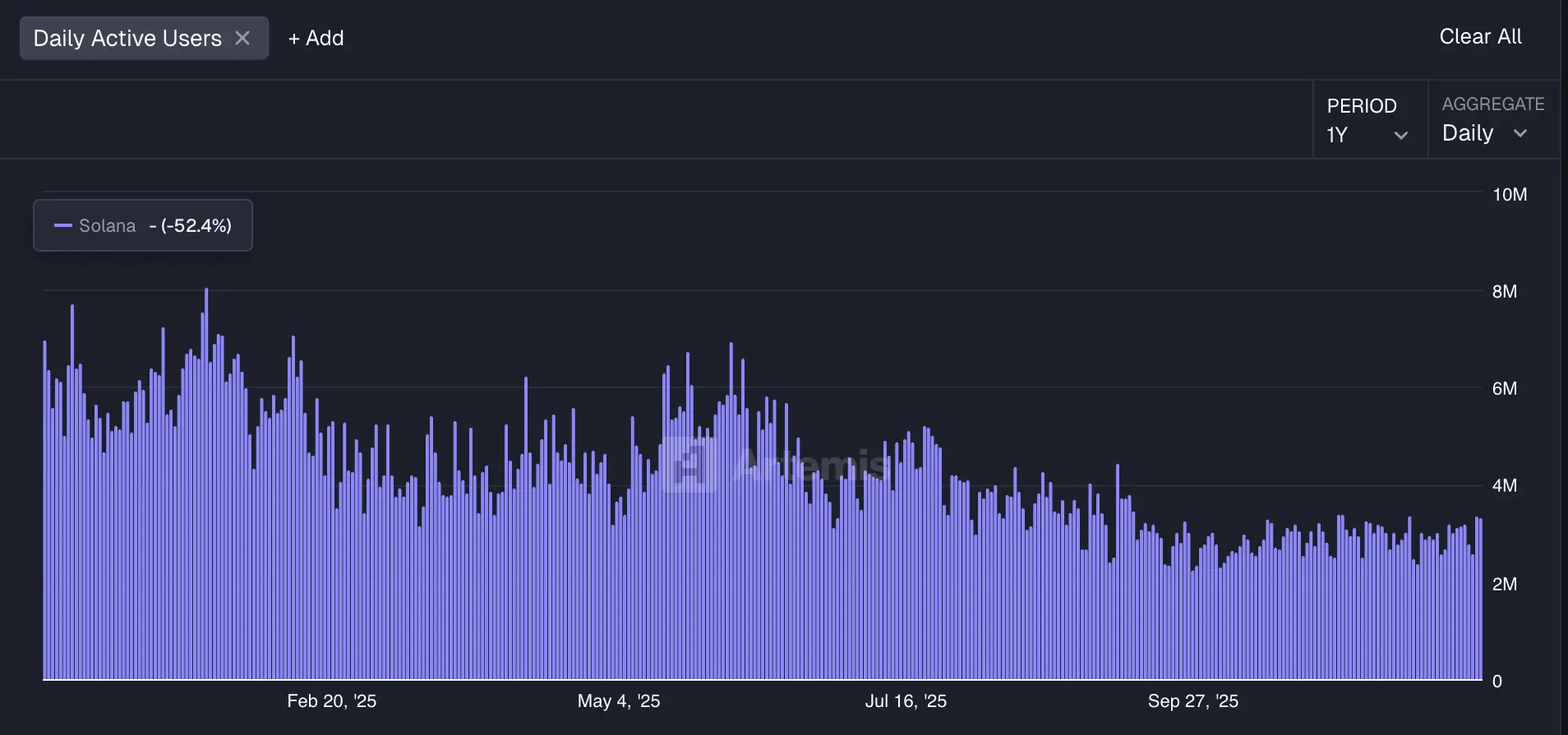

In 2025, Solana's daily active addresses (DAA) averaged approximately 3-6 million, with occasional peaks exceeding 8 million during periods of heightened activity. Activity reached its highest levels in late January and early May, exceeding 8 million daily active addresses on select days. These spikes reflect fluctuations in user engagement, likely influenced by memecoin-related events (such as the TRUMP token surge in January), overall market sentiment, and broader developments within the Solana ecosystem.

Weekly aggregates ranged between 22–30 million active addresses, indicating sustained on-chain usage throughout the year.

Source: Artemis

High address activity was supported by Solana's throughput and low transaction costs, which enabled frequent interactions across DeFi, decentralized exchanges, stablecoin transfers, and token swaps.

TOTAL VALUE LOCKED (TVL)

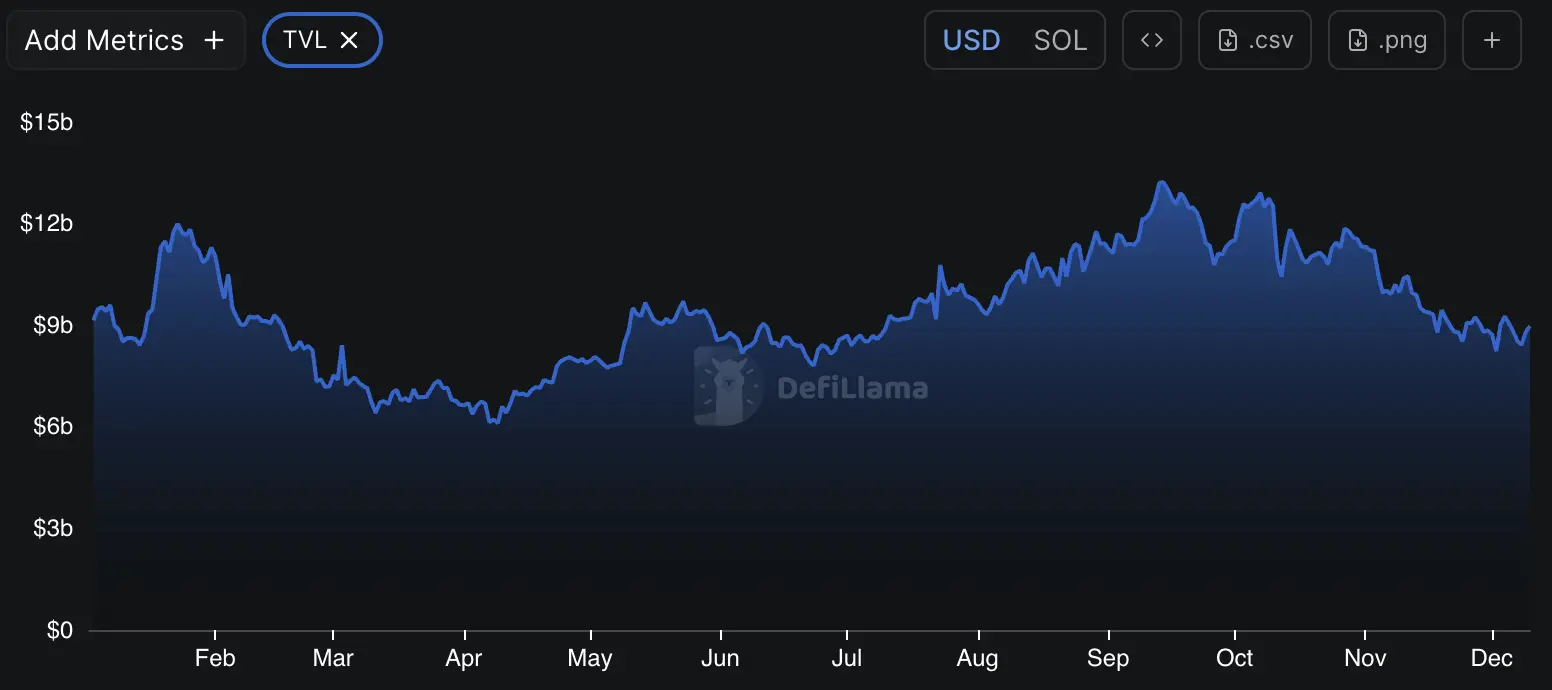

In 2025, Solana's Total Value Locked (TVL) across its DeFi ecosystem demonstrated significant growth, rising from approximately USD 9.5 billion in early 2025 to a new all-time high of USD 13 billion by September. Weekly and monthly data show steady inflows into major protocols, reflecting the network's recovery and increasing adoption after prior market stresses.

Source: DefiLlama

Several factors drove TVL growth:

-

Expansion of DeFi protocols and DEX platforms,

-

Increased stablecoin liquidity,

-

The proliferation of liquid staking solutions that allow users to deploy capital efficiently while receiving rewards,

-

Renewed investor confidence and broader ecosystem developments.

TRANSACTIONS

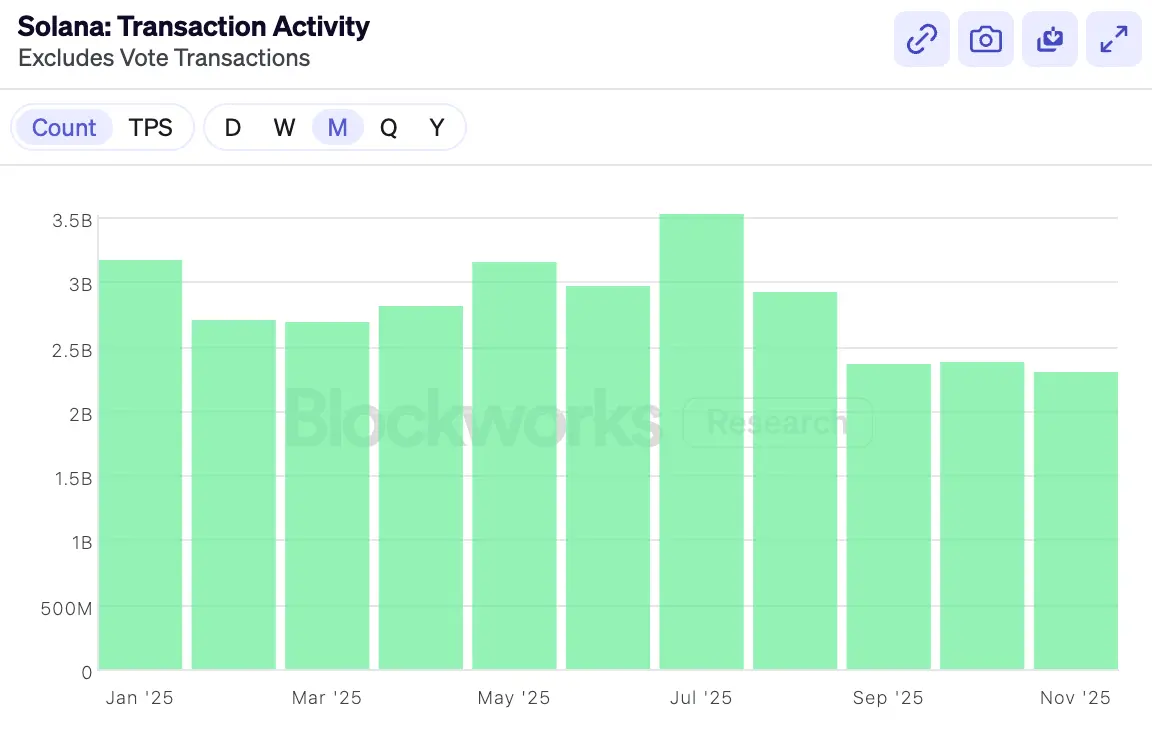

According to on-chain analytics, Solana processed approximately 3.5 billion transactions in July 2025, a level of monthly activity that industry sources have compared to the cumulative lifetime transactions of some older blockchains, underscoring the chain's throughput capacity and ecosystem engagement.

Source: Blockworks

Across the year, monthly transaction counts consistently exceeded billions of transactions as a function of high daily throughput (with typical daily transaction volumes observed in the tens of millions). In January, Solana recorded nearly 3.2 billion total transactions for the month, driven by a broad mix of activity spanning decentralized exchanges (DEXs), token swaps, stablecoin transfers, memecoin interactions, and other smart-contract calls. Additionally, weekly activity snapshots from late 2025 show hundreds of millions of transactions per week, indicating that high continuous usage extended beyond isolated surges.

The drivers of Solana's elevated monthly transaction volumes in 2025 include its low-fee, low-latency design, which supports high-frequency operations at scale, as well as diverse ecosystem activity across DeFi, trading, wallets, and token issuance.

REAL ECONOMIC VALUE (REV)

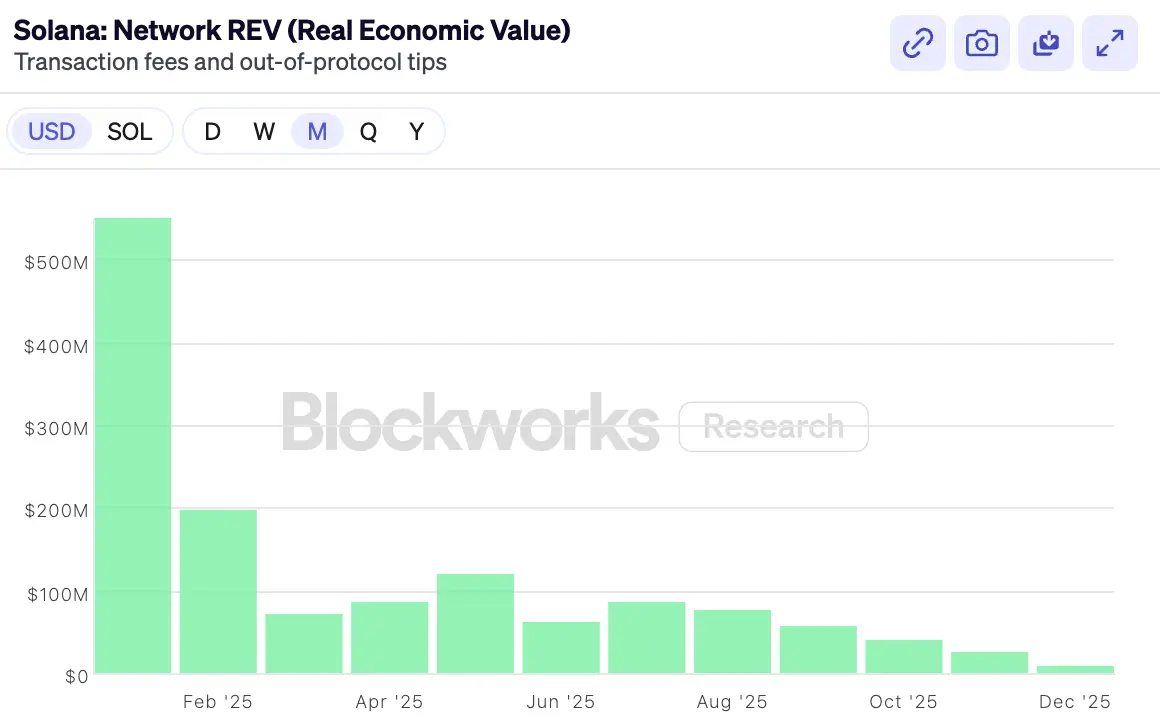

Network Real Economic Value (REV) is a consolidated metric that captures the total value a blockchain generates from real user activity. It combines on-chain transaction fees with off-chain priority fees (tips), providing a holistic measure of the network's true economic throughput.

Source: Blockworks

-

In January 2025, Solana generated exceptionally high revenue, over USD 550 million, outperforming many other blockchains and reflecting strong demand for on-chain transactions. Overall, Solana Network REV totaled USD 1.4 billion in 2025.

-

Daily REV hit record levels in mid-January, briefly surpassing the combined REV of large networks like Ethereum and Bitcoin on certain days.

This early surge was supported by intense decentralized exchange (DEX) trading volume and high throughput (with sustained DEX dominance and large trading flows across DeFi applications).

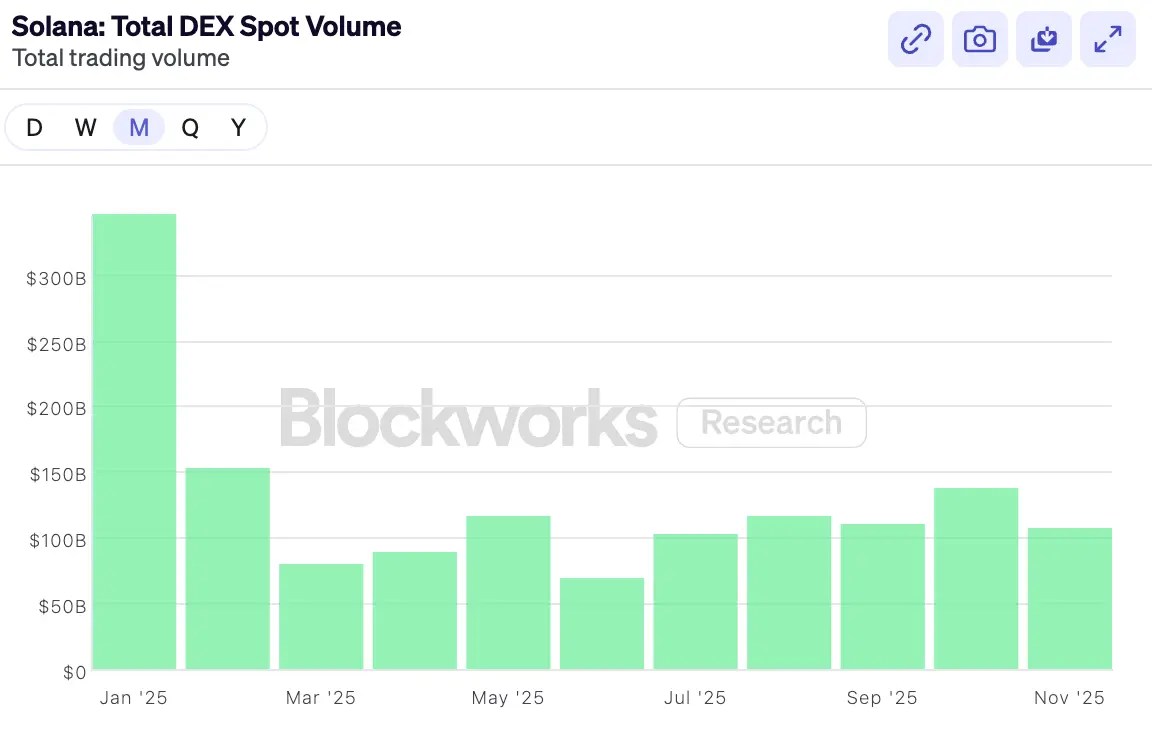

DEX VOLUME

January 2025 marked a record-breaking surge in Solana's DEX trading volume, establishing the network as a leading hub for decentralized finance at the start of the year. This month alone accounted for around USD 400 billion in DEX volume, roughly 50% of the total annual trading volume.

-

The spike was primarily fueled by a wave of highly speculative and meme-inspired token launches, which attracted massive short-term trading activity.

-

Many of these tokens experienced rapid price movements, encouraging both retail and algorithmic traders to engage in high-frequency swaps on Solana DEXs.

-

January also saw heightened DeFi ecosystem engagement, including liquidity provision and yield farming strategies on platforms such as Raydium, Orca, and Jupiter, which amplified transaction frequency and overall network throughput.

Source: Blockworks

The ecosystem structure contributed significantly to the overall trading volume:

-

Jupiter, one of Solana's major DEX aggregators, accounted for a large share of 2025 volumes, processing approximately 55% of total DEX activity and dominating routing efficiency across liquidity pools.

-

Humidifi's mid-June launch marked a structural shift in Solana's DEX landscape. The protocol introduced execution and liquidity dynamics that altered trader routing behavior across the network.

-

Execution-layer platforms such as Raydium, Meteora, Orca, and SolFi also contributed materially, with Raydium alone capturing substantial direct trading volume.

These distribution patterns indicate a multi-protocol ecosystem where both aggregators and automated market makers (AMMs) drive liquidity and trader engagement.

STATE OF STAKING

In 2025, Solana's staking ecosystem expanded in scale while undergoing structural changes in validator economics and participation. Staked supply increased, institutional participation grew, and decentralization metrics remained broadly stable.

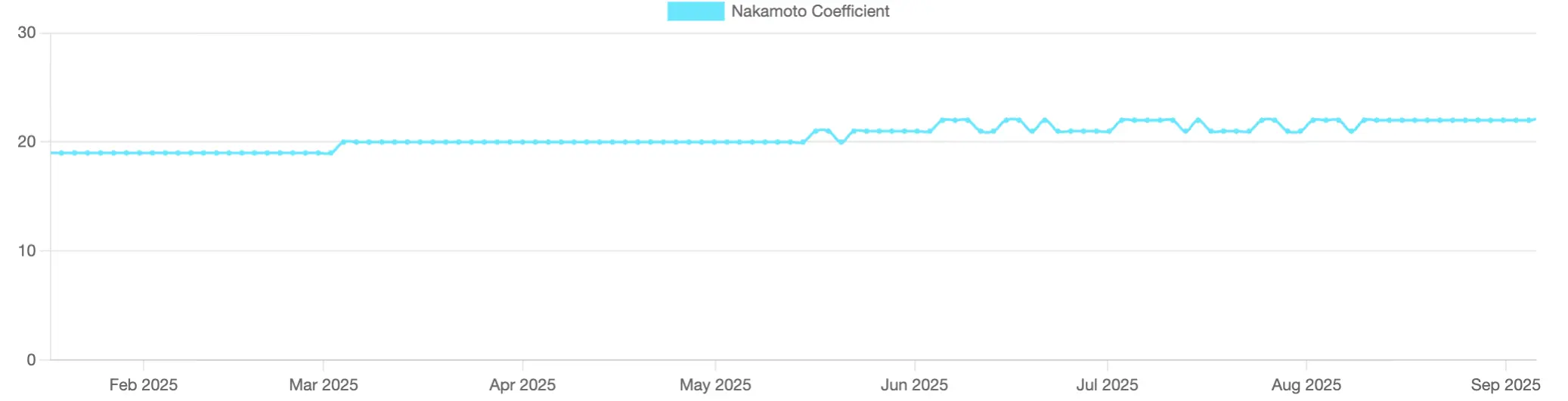

NAKAMOTO COEFFICIENT

Solana maintains a Nakamoto coefficient of around 20, indicating that at least twenty independent validators would need to collude to control roughly one-third of the network's total stake and meaningfully disrupt consensus. This level places Solana among the more decentralized proof-of-stake networks by this metric, highlighting a relatively balanced distribution of voting power across top validators.

Source: Solana Compass

Importantly, the coefficient has remained broadly stable throughout 2025, despite fluctuations in the total number of active validators. While rising hardware and operational costs have led to validator attrition, the concentration of stake among the largest operators has not increased materially, helping preserve Solana's decentralization profile.

Solana's Nakamoto coefficient in 2025 reflects a network that remains structurally resilient, while ongoing efforts to support smaller validators will be key to sustaining decentralization over the long term.

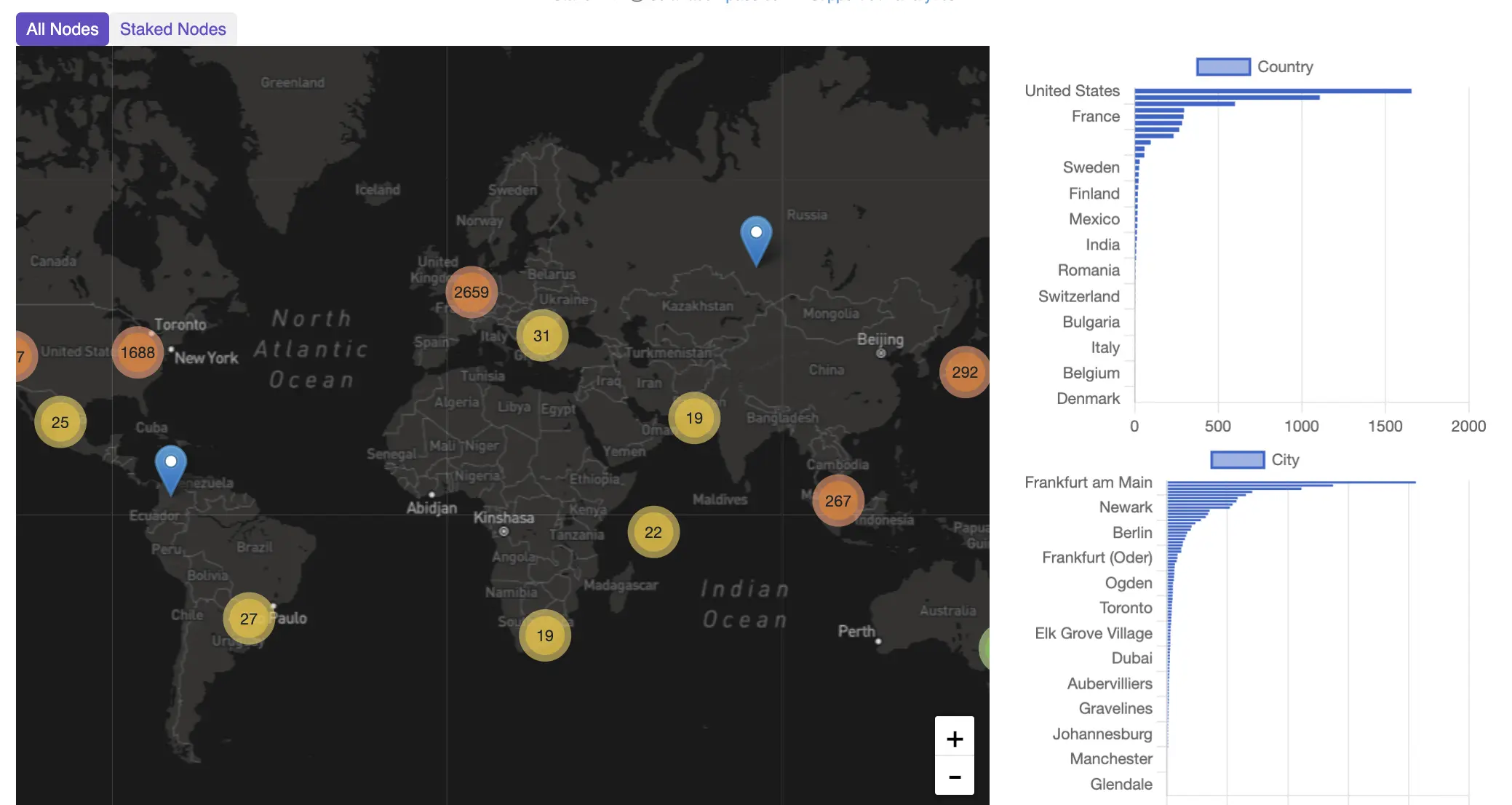

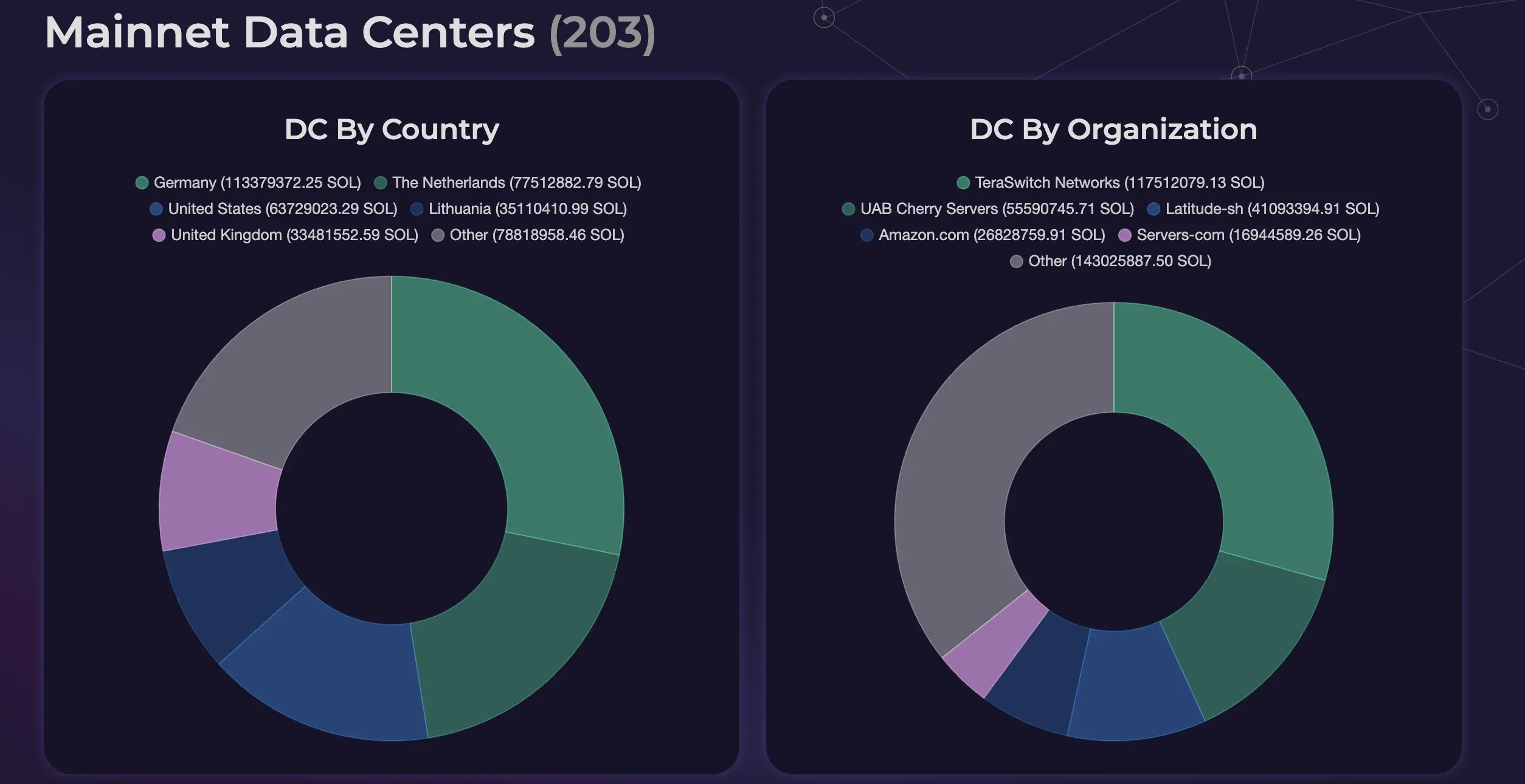

NODE DISTRIBUTION

Solana operated with 5,334+ nodes distributed across 49 countries, 206 cities, and 496 data centers, reflecting a geographically broad validator footprint.

Source: Solana Compass

Node distribution remained uneven across regions:

-

North America: The United States is the clear leader, with the bar chart showing it hosting over 1,500 nodes (roughly 1,688 based on the map cluster).

-

Europe: This is the most "dense" region collectively. The large orange cluster in Central Europe shows 2,659 nodes. Top-ranking countries include France, Sweden, Finland, Romania, and Switzerland.

-

Asia & Oceania: There is a notable drop-off in node density in this region. While there are clusters in East Asia (292) and Southeast Asia (267), they pale in comparison to the thousands in the West.

-

Global South: Participation remained limited. South America hosted around 27 nodes, while Africa accounted for fewer than 50 nodes combined across regions.

Source: ValidatorsApp

This distribution reflects a common pattern among high-performance networks, where hardware requirements and bandwidth costs influence geographic participation.

VALIDATOR CLIENTS

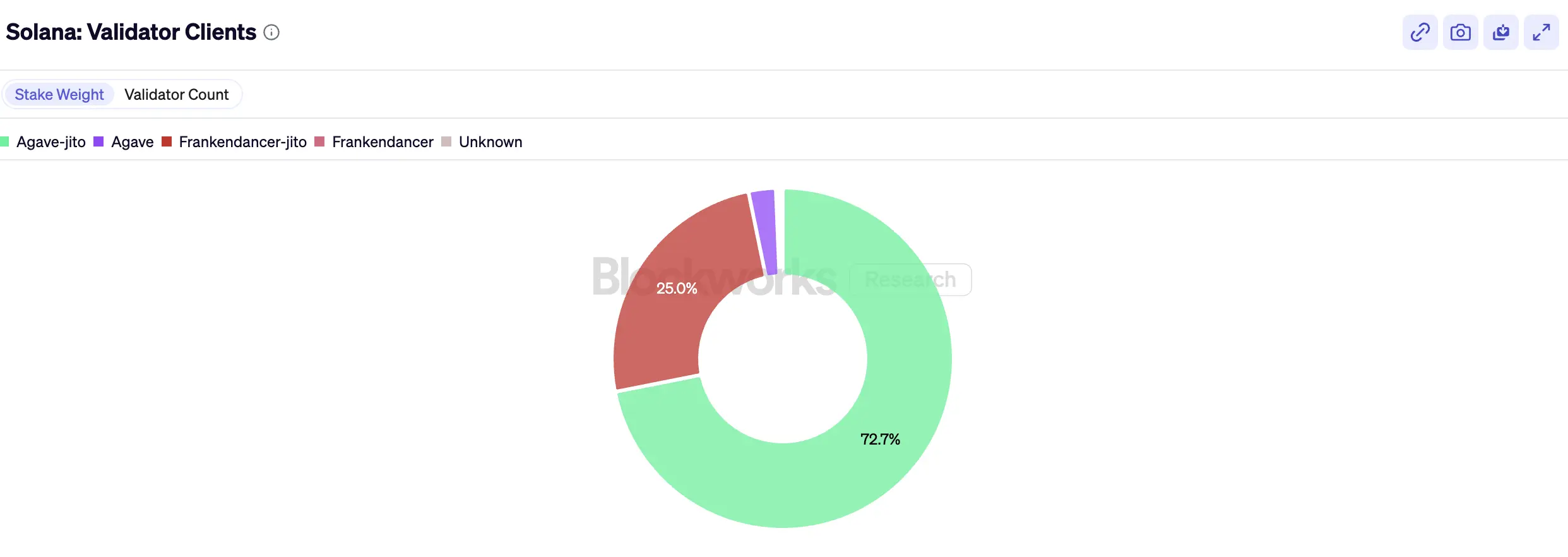

Source: Blockworks

Stake weight across validator clients in 2025 was distributed as follows:

-

Agave-jito (72.7%): The dominant client, based on the Agave codebase with MEV-related modifications introduced by Jito Labs.

-

Frankendancer (25.0%): This represents a major shift in Solana's architecture. Frankendancer is a "hybrid" client that combines the high-performance networking and block-production components of Jump Crypto's Firedancer with the existing Agave consensus and execution layers.

-

Agave (standard, <3%): The reference client maintained by Anza without MEV extensions.

The move toward multi-client setups is a prerequisite for Solana's 2025 performance goals:

-

Throughput Benchmarks: While the hybrid Frankendancer focuses on resilience, the full Firedancer client (now in mainnet rollout) has demonstrated the capability to process over 1,000,000 TPS in controlled testing environments.

-

Latency Improvements: The combination of client diversity and the Alpenglow consensus upgrade aims to reduce transaction finality to the 100–150 ms range by late 2025/early 2026.

-

Economic Diversification: As native inflation rewards decline toward a terminal rate of 1.5%, MEV and transaction fees—facilitated by optimized clients—will become the primary incentives for validators to maintain diverse, high-performance nodes.

STAKE AND STAKING ACCOUNTS DISTRIBUTION

In 2025, Solana operated with approximately 800 active validators, fewer than in prior years. This contraction reflected higher operational thresholds rather than increased stake concentration. The top 20 validators (the superminority) continued to secure the network.

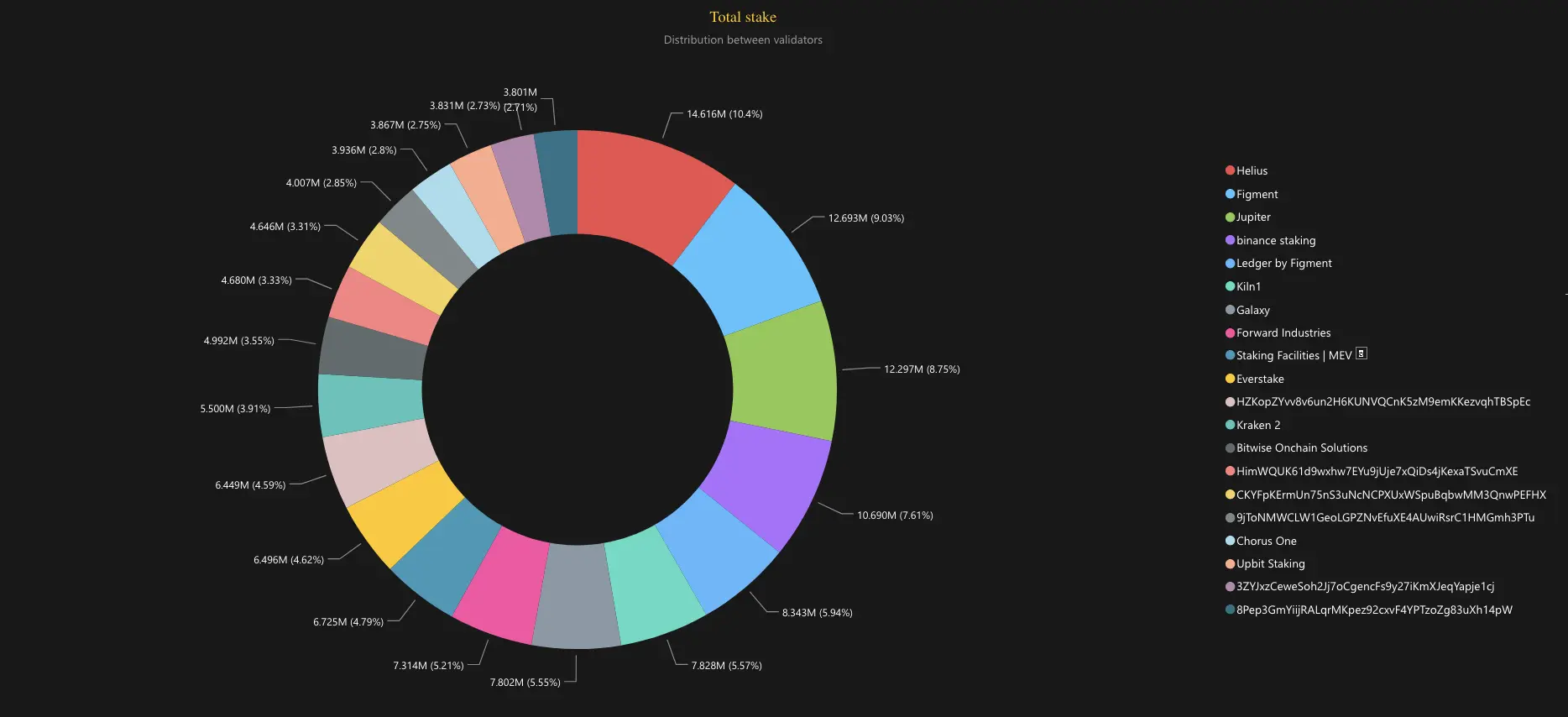

Top validators by stake included:

-

Helius: 14.5M SOL

-

Figment: 12.6M SOL

-

Jupiter: 12.3M SOL

-

Binance: 11.4M SOL

-

Ledger by Figment: 8.3M SOL

-

Kiln1: 7.8M SOL

-

Forward Industries: 7.3M SOL

-

Staking Facilities: 6.7M SOL

-

Everstake: 6.4M SOL

-

HZKopZYvv8v6un2H6KUNVQCnK5zM9emKKezvqhTBSpEc: 6.4M SOL

Overall, the current validator landscape reinforces Solana's position as a network where decentralization is maintained through a balance of stake dispersion, operator diversity, and infrastructure quality, rather than solely relying on validator count.

Source: Solana on-chain data, processed by Everstake (Power BI)

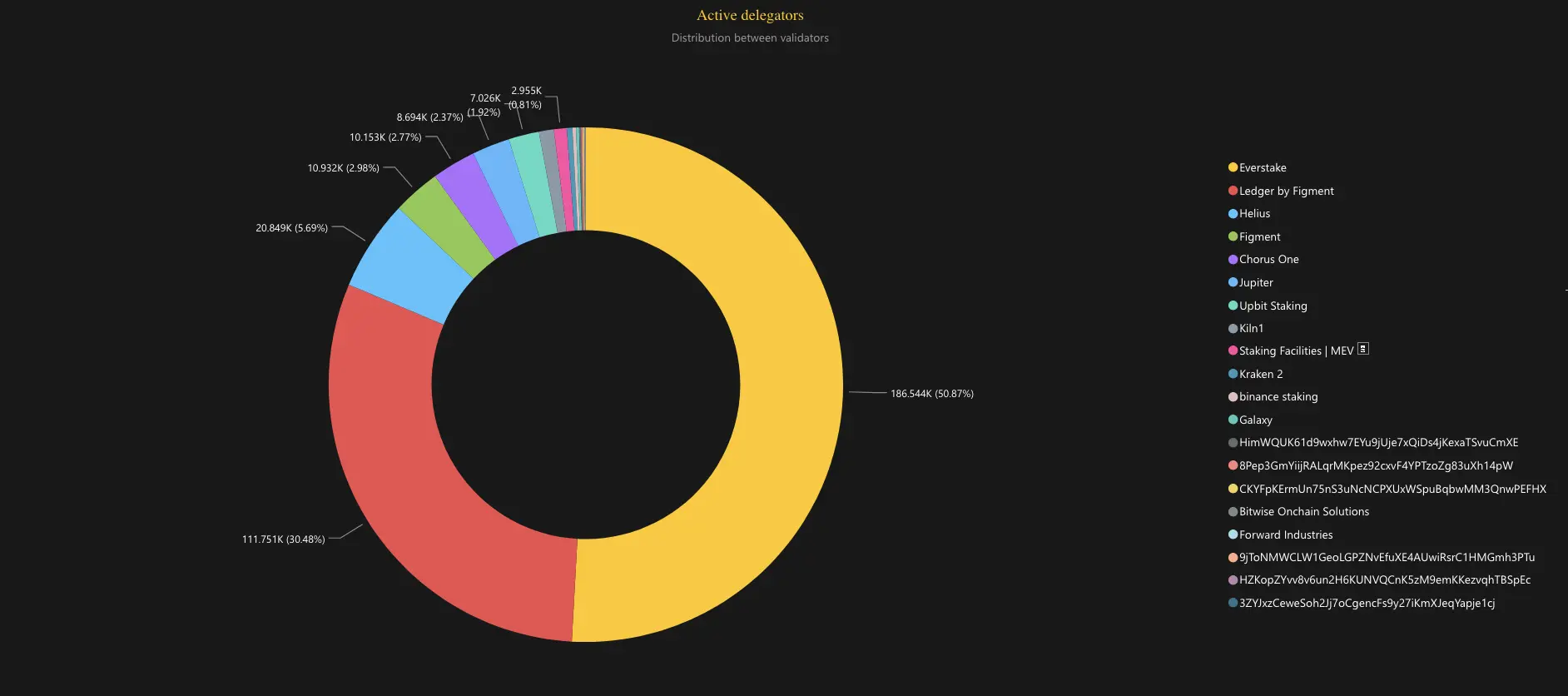

The distribution of active Solana stake accounts showed a strong concentration among a few major validators. Everstake led the network by a wide margin, securing over 186,600 stake accounts, followed by Ledger by Figment with approximately 111,750 each. Helius, Figment, and Chorus One held smaller but notable portions of the stake accounts base with around 20,850, 10,930, and 10,150, respectively.

Source: Solana on-chain data, processed by Everstake (Power BI)

Between January and October, the stake required for validators to reach break-even increased substantially. As priority fees and tipping revenue declined, operating a validator profitably at a 0% commission became markedly more capital-intensive. The minimum stake required rose from approximately 24,000 SOL in January to about 117,000 SOL by October. Even at a 5% commission, the break-even threshold nearly tripled, increasing from roughly 20,000 SOL to 62,000 SOL over the same period.

DELEGATOR BEHAVIOR ANALYSIS

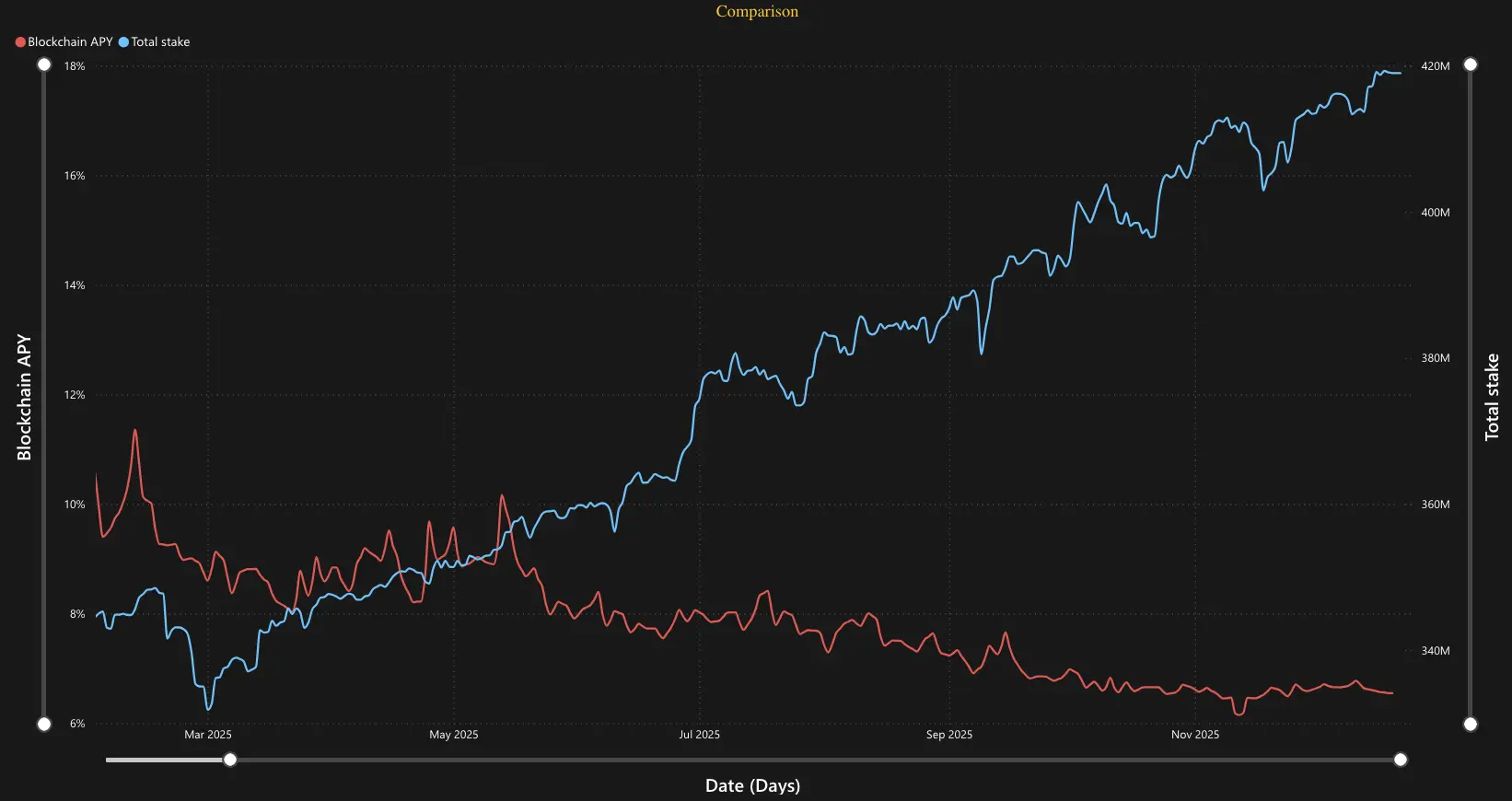

Total Stake showcases a strong upward trajectory. The sharp increase in Total Stake during the second half of the year is attributed to growing institutional interest and the launch of products like Solana Staking ETFs.

The APY was much more volatile in the first half of the year (Jan–May). As the Total Stake grew larger and more stable in the second half of the year, the APY fluctuations smoothed out, indicating a more "settled" or efficient market.

Source: Solana on-chain data, processed by Everstake (Power BI)

Solana has a "disinflationary" schedule, meaning the base staking rewards automatically decrease over time. In 2025, the base network inflation has dropped toward its target terminal rate of 1.5%. Approximately 75% of the circulating supply is now staked, reflecting strong long-term confidence among holders.

FUTURE PROSPECTS

By the end of 2025, Solana had shown that high throughput can coexist with increasing decentralization, professional validator operations, and sustained economic activity.

On the technical side, further client diversification and protocol-level improvements are expected to remain the main focus. Progress across alternative validator clients and networking upgrades should continue to reduce correlated risk and improve fault tolerance, particularly under periods of elevated load.

Economically, activity on Solana is increasingly driven by recurring use cases rather than short-lived speculation. Payments, decentralized exchanges, stablecoin settlement, and consumer-facing applications are likely to remain the primary sources of transaction volume and Network REV.

Solana staking has transitioned from a niche activity to a serious consideration for institutional portfolios as a viable component of a diversified digital asset strategy. In 2025, we saw a clear shift toward productive, yield-bearing assets, as institutions moved away from holding idle capital and focused on generating on-chain yield. This shift is supported by a more mature ecosystem: better infrastructure, improved custody and staking operations, deeper liquidity, and clearer risk management practices. Staking is increasingly viewed as a standard component of digital asset exposure rather than an added complexity.

Looking ahead to 2026, we expect this trend to continue. Solana staking is well-positioned to meet institutional demand for scalable yield, operational efficiency, and long-term participation in the network.

Overall, Solana entered 2026 as a network with demonstrated capacity to operate at scale. While market cycles will continue to influence activity levels, the combination of technical maturity, validator infrastructure, and diversified on-chain usage provides a stable foundation for continued relevance.