Key Insights and Takeaways

-

Solana maintained consistently high on-chain activity throughout H1 2025, averaging 3 to 6 million daily active addresses. The activity peaked in late January and again in early May, surpassing the 7 million mark for several days.

-

Solana's Alpenglow is a transformative consensus upgrade set to redefine the blockchain's performance, security, and scalability. Developed by Anza, a research and engineering team spun out from Solana Labs, Alpenglow replaces the existing Proof of History (PoH) and Tower BFT systems with two new components: Votor and Rotor.

-

Solana Accelerate 2025 was a landmark week-long event held from May 19 to 23 in New York City. It brought together over 3,000 developers, founders, policymakers, and investors to shape the future of blockchain in the U.S.

-

At the start of 2025, Solana’s governance process marked a historic milestone with record-breaking participation in the voting on two proposals: SIMD-228 and SIMD-123.

-

Trezor has integrated Solana (SOL) staking into its ecosystem, giving users a simple and secure way to receive rewards while maintaining complete control over their assets.

-

Since the beginning of 2025, Solana has demonstrated consistently high transaction activity, with weekly volumes generally exceeding 600 million non-vote transactions.

-

The Solana network experienced a sharp surge in REV, peaking in early February with a weekly revenue exceeding $200 million.

-

In the first half of 2025, Solana’s staking ecosystem has entered an expansion phase marked by increasing adoption, dynamic yields, rising institutional interest, and growing decentralization.

-

Solana has a Nakamoto Coefficient of 20, which is robust and leading across the industry, and is a measure of the network's decentralization (Source: Solana Network Health Report: June 2025).

-

The top three validators (Helius, Binance Staking, and Galaxy) control over 26% of the network’s delegated SOL. The multitude of validators in the 3–6% range indicates a healthy level of decentralization.

Methodology

This report provides an in-depth analysis of the Solana blockchain, using the data practices and sources described below to ensure a comprehensive and reproducible study.

On-chain Data Collection

We collected extensive data directly from the Solana blockchain. This included raw transaction data, information on staking, inflation metrics, and other relevant data points.

Data was gathered through Remote Procedure Calls (RPC) to public nodes on the Solana network. These RPC calls facilitated the retrieval of real-time and historical blockchain data. To ensure data reliability and availability, we stored the gathered data in relational databases (DBs), allowing for efficient querying and analysis.

Data Preparation

The collected data was meticulously cleaned and formatted using Python. To ensure the dataset's integrity, we manually handled missing values, outliers, and inconsistencies.

The data was merged from various sources to form a cohesive dataset for analysis. This includes integrating data from the blockchain with API-sourced information on staking, transactions, and inflation. The initial data visualization and exploratory analysis used PowerBI, which was substantial in identifying key trends and patterns.

Data Analysis

We comprehensively analyzed the prepared data, employing various statistical methods and analytical techniques. This included generating graphs, charts, and visualizations to illustrate key metrics such as staking trends, transaction volumes, and inflation rates.

Identifying significant trends and correlations within the data used hypothesis testing.

Interpretation

Our research and development team interpreted the findings from the data analysis. We compared our findings with existing research and industry benchmarks to obtain insights into the Solana blockchain's performance and trends.

Based on our findings, we formulated recommendations for future research and potential actions to optimize blockchain performance and usage.

Principal Developments in the Ecosystem

In the first half of 2025, Solana’s progress was marked by rapid growth, major technical upgrades, and deepening institutional interest. From record-breaking DeFi activity and infrastructure rollouts to the entry of traditional financial giants and expanding developer engagement, Solana demonstrated its prowess to scale as one of the leading Layer-1 networks. Altogether, this period showcased the network’s ability to handle massive on-chain demand and proved its growing relevance in retail and institutional areas.

Confidential Transfers

Confidential Transfers on Solana hide transaction amounts from the public ledger. This feature is built on the Token-2022 standard and uses zero-knowledge proofs, specifically Twisted ElGamal encryption and bulletproofs, to ensure that token amounts are encrypted while remaining verifiable on-chain.

Only the sender, receiver, and optional auditors can view the actual transfer amounts, making this a powerful tool for enterprises, institutions, and privacy-conscious users. It enables financial confidentiality while supporting regulatory compliance through optional auditor access.

Confidential Transfers are particularly valuable for use cases like private payroll, institutional fund movements, and donations. Thanks to Solana’s high speed and low costs, these private transactions remain practical at scale, unlike many privacy solutions on other chains.

While the feature is currently available only for tokens created with Token-2022, it marks a major step forward for on-chain privacy infrastructure on Solana.

Solana Governance: SIMD-123 and SIMD-228

At the start of 2025, Solana’s governance process marked a historic milestone with record-breaking participation in the voting on two crucial proposals: SIMD-228 and SIMD-123. Both aimed to reshape Solana’s internal economic structure, focusing on Solana inflation and how network rewards are distributed between validators and delegators.

SIMD-228 proposed moving from a fixed inflation model to a dynamic one that adjusts based on network conditions, effectively reducing SOL’s inflation rate over time. In parallel, SIMD-123 introduced a mechanism to automatically redistribute block rewards (transaction fees) to delegators, which wasn’t implemented by default.

Based on the voting results, SIMD-228 did not pass, receiving 61.39% approval, just below the required 66.67% supermajority threshold. On the other hand, SIMD-123 was approved with 74.91% voting in favor.

With the rejection of SIMD-228, Solana’s inflation rate and existing staking reward structure will remain unchanged. Meanwhile, the approval of SIMD-123 paved the way for a significant shift in validator incentives by introducing a formal mechanism for revenue sharing with delegators.

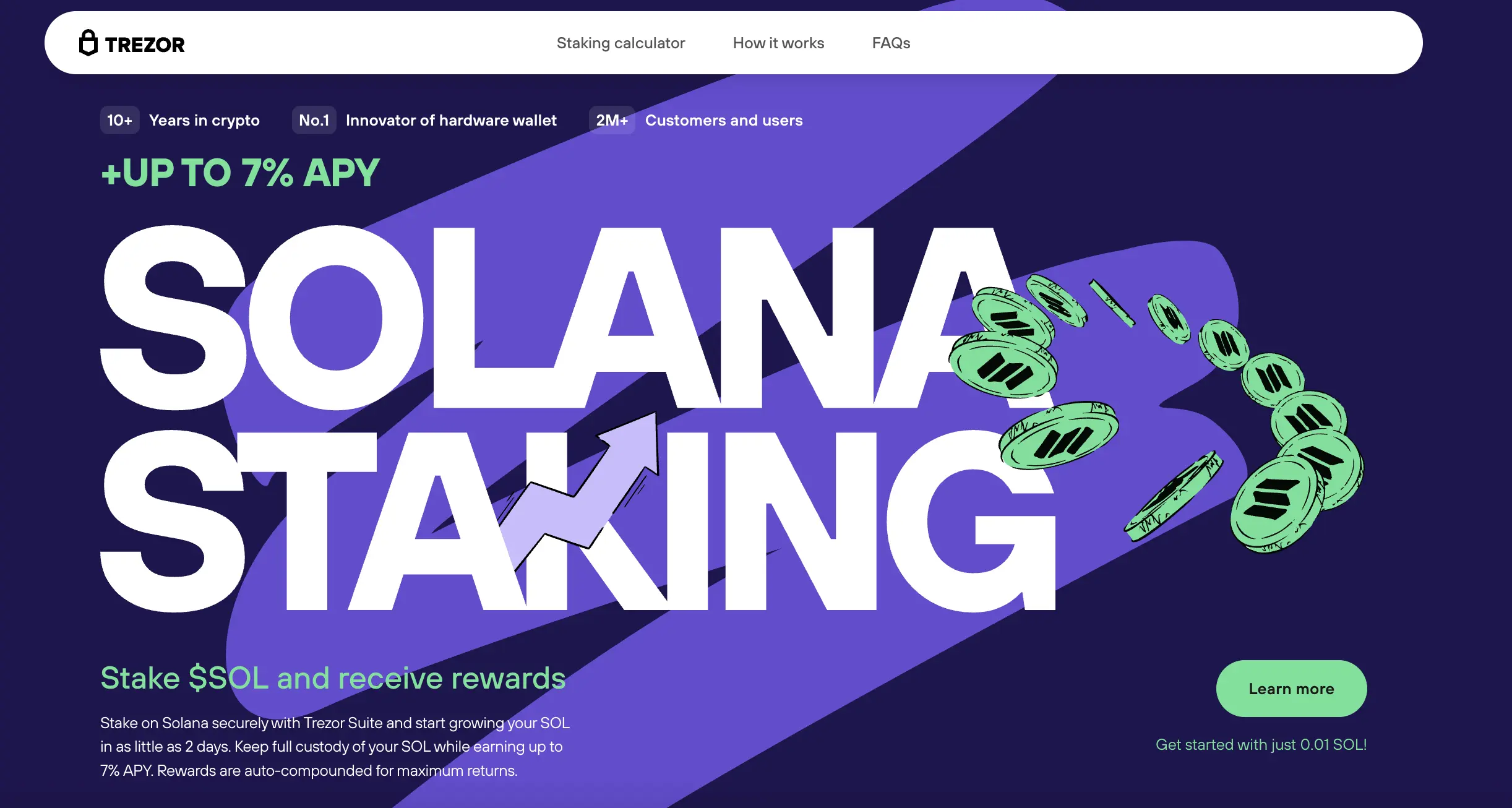

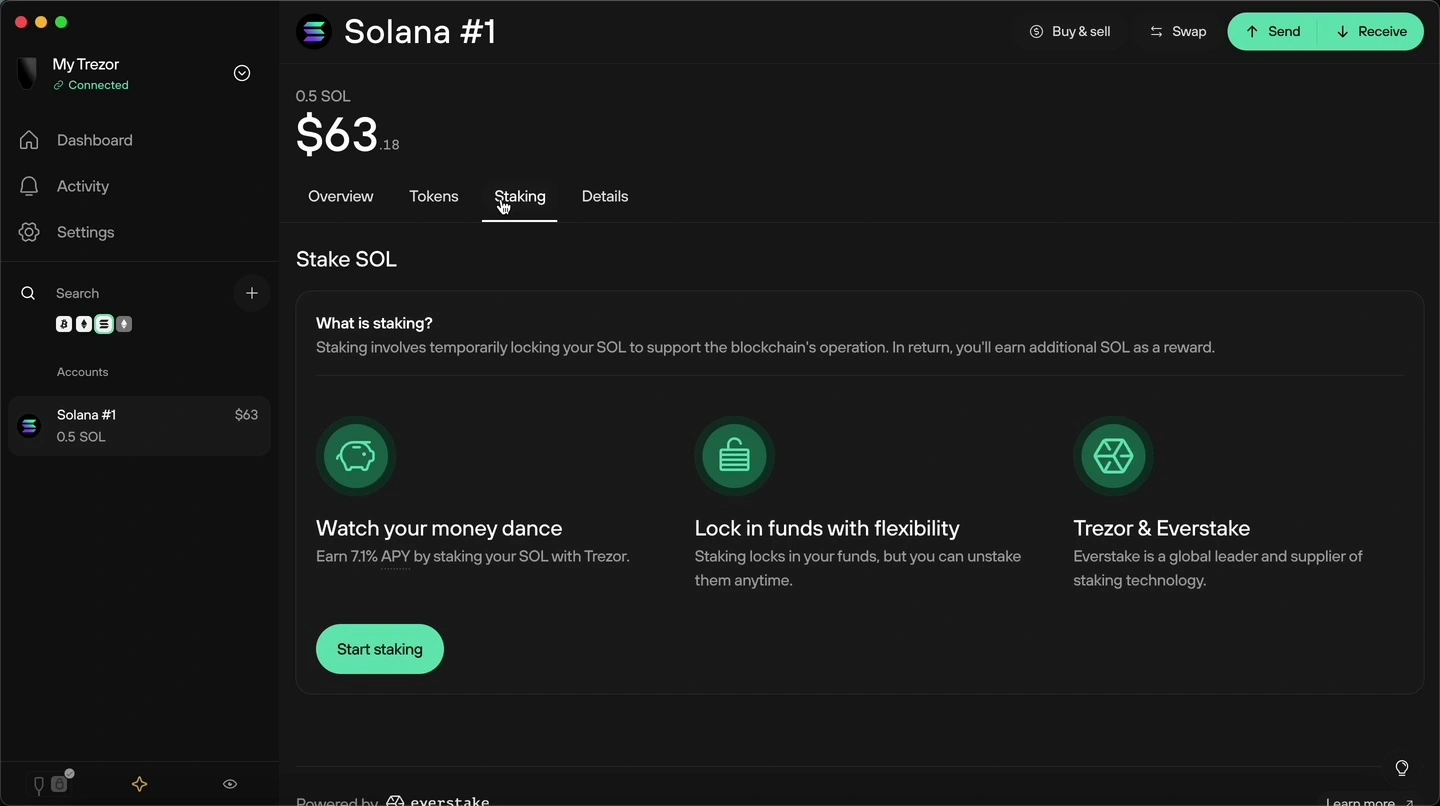

SOL Staking Integration in Trezor

Trezor has integrated Solana (SOL) staking into its ecosystem, giving users a simple and secure way to earn rewards while maintaining complete control over their assets. Everstake is the default validator for Solana staking within the Trezor Suite.

Trezor Suite is the official software developed by Trezor for securely managing crypto assets with your Trezor hardware wallet. It offers an intuitive interface to store, send, receive, trade, and stake cryptocurrencies like Solana (SOL). Key advantages of using a Trezor hardware wallet and Trezor Suite include:

-

Non-custodial storage, ensuring you remain in full control of your assets.

-

All transactions are authorized via the hardware wallet, minimizing the risk of hacks.

-

Staking functionality is seamlessly integrated into the platform for easy access.

-

Staking rewards can easily be monitored and managed from the same interface.

Staking Solana using Trezor Suite and Everstake offers a secure and seamless experience. With Trezor’s robust hardware security and Everstake’s dependable validation services, users can stake confidently while keeping complete control of their assets.

Learn more about Solana staking via Trezor from Everstake’s dedicated article.

Solana Accelerate

Solana Accelerate 2025 was a week-long event held from May 19 to 23 in New York City. It brought together over 3,000 developers, founders, policymakers, and investors to shape the future of blockchain in the U.S. Organized by the Solana Foundation, the conference featured two flagship tracks, Scale or Die and Ship or Die, alongside numerous workshops, side events, and product showcases.

Accelerate 2025 spotlighted major upgrades to Solana’s ecosystem, which are listed below.

-

Alpenglow consensus protocol: Developed by the Anza team, Alpenglow replaces TowerBFT and Proof‑of‑History with new Votor and Rotor components. This upgrade cuts transaction finality to ~100–150 ms and boosts theoretical throughput to 10,000 TPS. It’s now in testing, with a mainnet rollout expected in Q4 2025.

-

Firedancer client (Frankendancer): This enhanced version of the Solana validator client now supports Jito bundles and MEV optimization. Currently powering about 6% of stake, with a delegation program launched to drive adoption.

-

Solana Mobile Seeker phone + SKR token: Over 150,000 pre‑orders were made, with shipping planned for August 2025. It introduces the TEEPIN architecture and a native SKR token to fuel its ecosystem.

-

Kraken xStocks: In partnership with BackedFi, Kraken will offer tokenized U.S. equities (Apple, Tesla, Nvidia, etc.) to eligible international clients on Solana.

-

Solana Attestation Service (SAS): A new permissionless protocol for cryptographically signed attestations, such as KYC or accreditation, can be reused across dApps while preserving user privacy.

-

OKX ecosystem integration: OKX launched xBTC (wrapped BTC on Solana), integrated a cross‑chain DEX aggregator powering wallets like Phantom and Jupiter, and saw a 10x growth in Solana activity through its Ecohub.

Alpenglow

Solana's Alpenglow is a consensus upgrade developed by Anza. It aims to revamp the blockchain's performance, security, and scalability. Alpenglow replaces the existing Proof of History (PoH) and Tower BFT systems with two new components: Votor and Rotor.

Votor: Rapid Finality Engine

Votor introduces a streamlined voting mechanism that significantly reduces transaction finality times. By decoupling finality from slot times, Votor enables transactions to achieve finality in approximately 100-150 milliseconds, substantially improving over 12.8 seconds from before. This rapid finality is achieved through a dual-mode voting system: a single round with 80% stake participation or two rounds with 60% participation, both operating concurrently to optimize speed and resilience.

Rotor: Efficient Data Propagation

Rotor enhances data dissemination across the network by refining Solana's Turbine protocol. It utilizes erasure-coded data propagation and a single-layer relay system, reducing network hops and latency. This design ensures faster and more resilient transmission of transaction data, contributing to the network's overall efficiency.

Architectural Overhaul

Alpenglow marks a significant shift from Solana's original architecture. By eliminating PoH and Tower BFT, the network simplifies its consensus process, reducing complexity and potential points of failure. This overhaul not only accelerates transaction processing but also enhances the network's resilience against adversarial conditions.

Implications for Developers and Users

The drastic reduction in finality time ushers in real-time applications, including high-frequency trading, gaming, and decentralized finance platforms.

Improved User Experience

Users can expect near-instant transaction confirmations, bringing blockchain performance closer to traditional Web2 applications.

Deployment Timeline

While the official launch date for Alpenglow on Solana's mainnet is targeted for early 2026, the development team aims to showcase a working implementation by the end of 2025. This timeline is contingent upon thorough testing and validation to ensure network stability and security.

Key Network Metrics Analysis

A closer examination of Solana’s key metrics in H1 2025 reveals substantial growth and a clear uptick in network adoption.

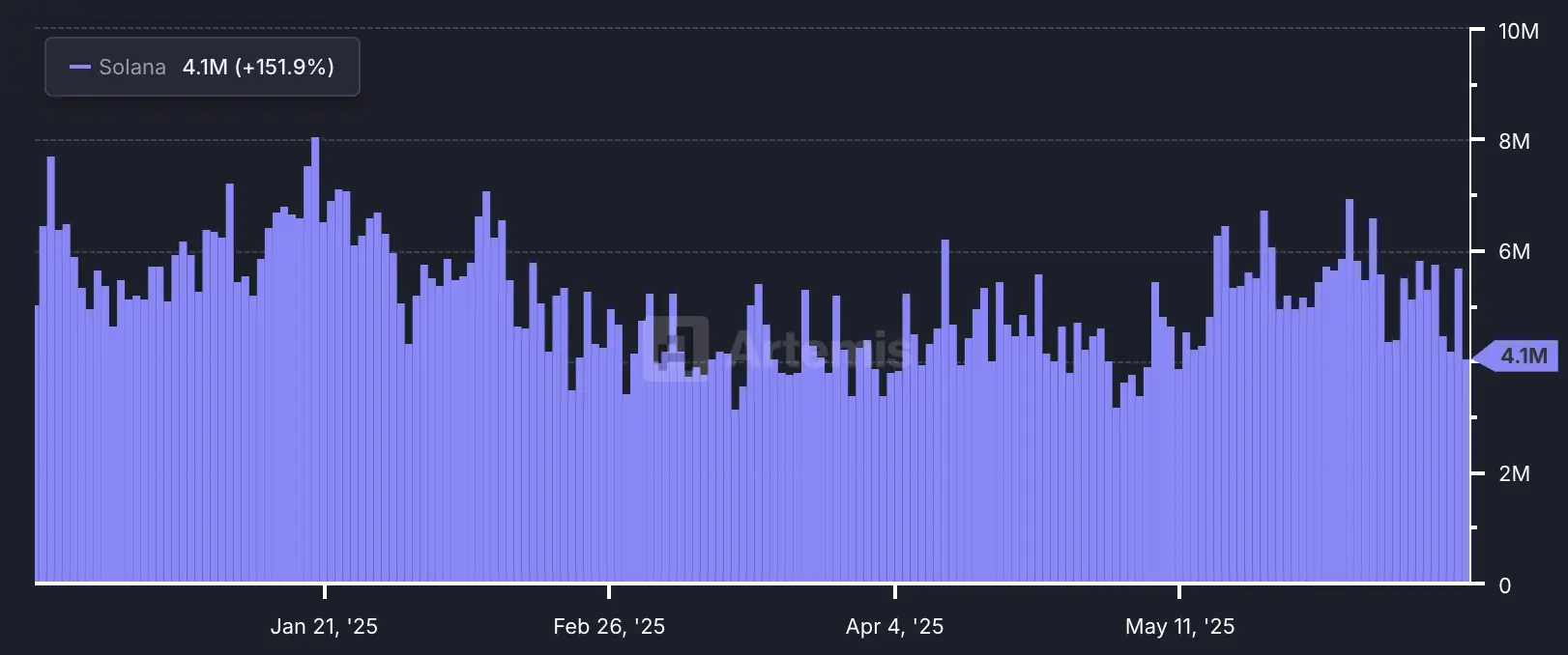

Daily Active Addresses

This chart displays daily active addresses on the Solana network from early January to June 2025. Solana maintained consistently high on-chain activity throughout the period, averaging 3 to 6 million daily active addresses.

The activity peaked in late January and again in early May, surpassing the 7 million mark on certain days. These peaks point to shifts in user engagement, likely driven by factors such as memecoin hype (e.g., the TRUMP token in January), market sentiment, and broader ecosystem developments. Despite short-term fluctuations, the trend reflects sustained usage, with the most recent data showing 4.1 million daily active addresses.

Source: Artemis

Transactions

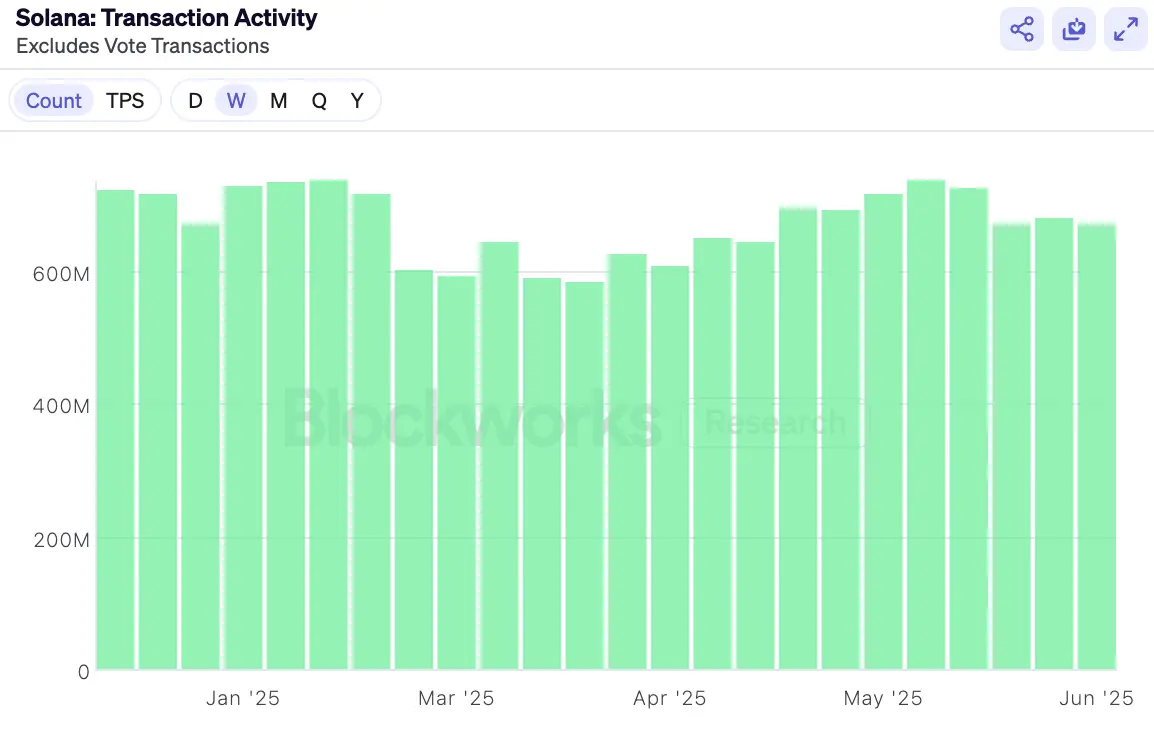

Since the beginning of 2025, Solana has demonstrated consistently high transaction activity, with weekly volumes generally exceeding 600 million non-vote transactions.

-

In January, the network saw particularly strong performance, averaging over 700 million transactions per week.

-

A slight decline followed in February and early March, dipping to around 590-610 million, possibly reflecting a temporary slowdown in user activity.

-

Transaction counts began recovering in late March and continued to rise steadily throughout April.

-

By May, activity peaked again, surpassing 710 million transactions in some weeks, likely driven by increased engagement across DeFi, NFT, and consumer apps.

-

Despite a modest drop in early June, overall transaction volume remains high.

Source: Blockworks

REV

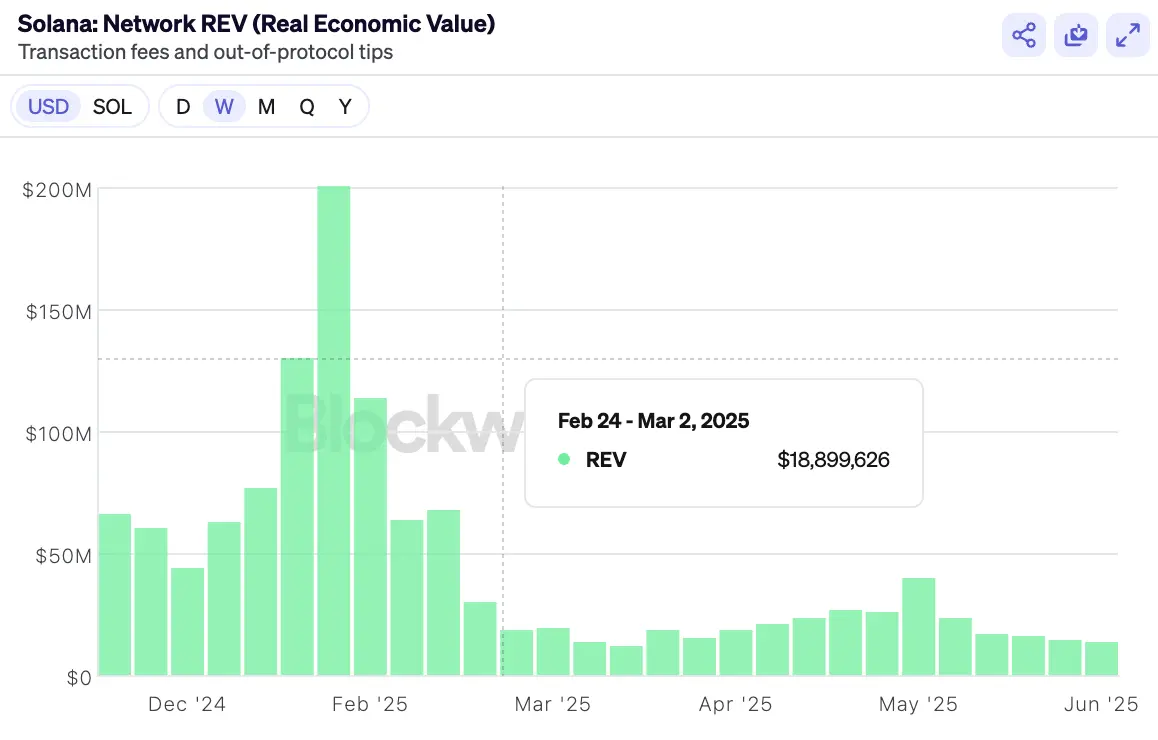

Network REV (Real Economic Value) is a unified metric that measures the value a blockchain generates from user activity. It includes both protocol-level transaction fees and off-chain tips paid by users to prioritize execution, offering a comprehensive view of the network's economic throughput.

-

From the beginning of 2025, the network experienced a sharp surge in REV, peaking in early February with a weekly revenue exceeding $200 million.

-

Starting in March 2025, network revenue dropped sharply, stabilizing at a lower range of approximately $15–25 million per week.

-

A modest rebound occurred in early May, but the overall trend since March indicates a normalization of economic activity on the network following the extraordinary Q1 peak.

Source: Blockworks

DEX Volume

-

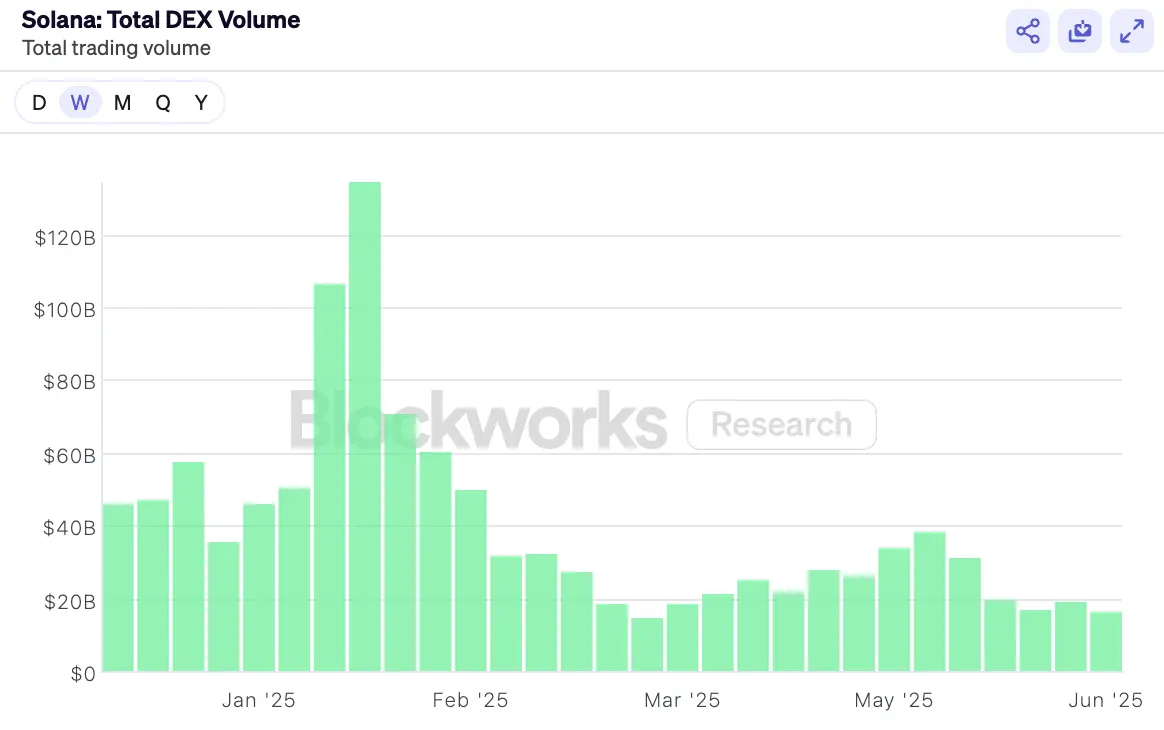

Since the beginning of 2025, Solana’s DEX ecosystem has witnessed explosive growth, driven largely by memecoins and increasing user activity.

-

In January alone, DEX volume surged to an unprecedented $408 billion, accounting for nearly half the year-to-date total.

-

By early June, cumulative trading volume surpassed $890 billion, marking a more than 4x increase compared to the same period in 2024.

-

The bulk of this activity was concentrated on leading platforms such as Jupiter, Raydium, Meteora, and Orca, with Jupiter alone facilitating over $330 billion in trades.

-

At its peak on May 7, Solana's daily DEX volume reached approximately $2.8 billion, briefly outpacing Ethereum.

-

Although volumes dipped in late February, they rebounded strongly in Q2 as memecoins continued to dominate trading, representing over 35% of all activity.

State of Staking

In the first half of 2025, Solana’s staking ecosystem has entered an expansion phase marked by increasing adoption, dynamic yields, rising institutional interest, and growing decentralization.

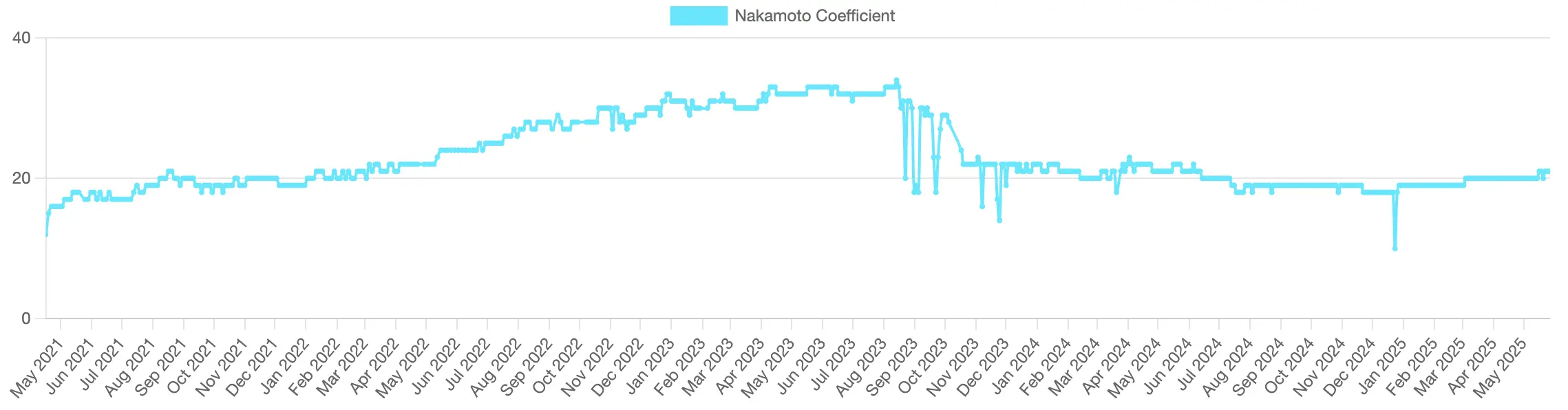

Nakamoto Coefficient

The Nakamoto coefficient is a key metric used to assess the decentralization and security of a blockchain network. It quantifies the minimum number of independent entities like validators, miners, or staking nodes that would have to collude to control over one-third (33.33%) of the network’s total stake or hash power. Reaching this threshold would allow them to disrupt consensus, halt block production, censor transactions, or reorganize the chain.

In Proof-of-Stake (PoS) networks like Solana, the coefficient is based on stake-weighted voting. Since consensus decisions are made proportionally to the amount of stake delegated to validators, the Nakamoto coefficient reflects how evenly distributed that stake is across the validator set.

-

A higher Nakamoto coefficient indicates greater decentralization, meaning no small group has outsized control over the network.

-

It also signals greater fault tolerance as the network can withstand failures or malicious behavior by several validators without being compromised.

-

A low coefficient means that a few entities can potentially collude to disrupt the system, making the network more vulnerable to centralization and attacks.

As of the most recent data, Solana’s Nakamoto coefficient is around 20, meaning roughly 20 of its largest validators control just over one‑third (33.33%) of the total staked SOL. Six months ago, the Nakamoto coefficient stood at 18. Its rise to 20 signals a measurable improvement in the network's decentralization and indicates that control is now distributed across a broader set of independent validators.

Source: Solana Compass

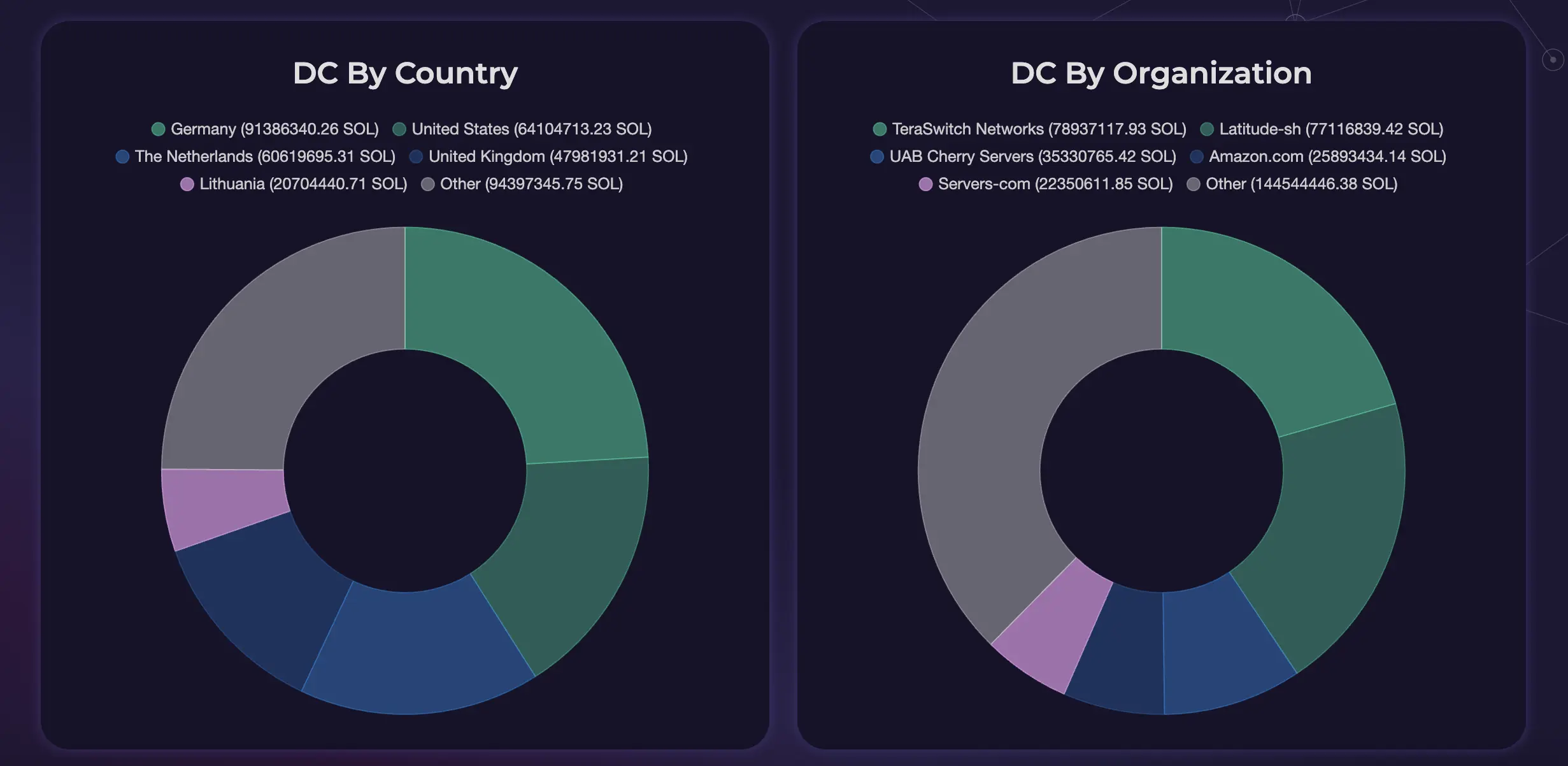

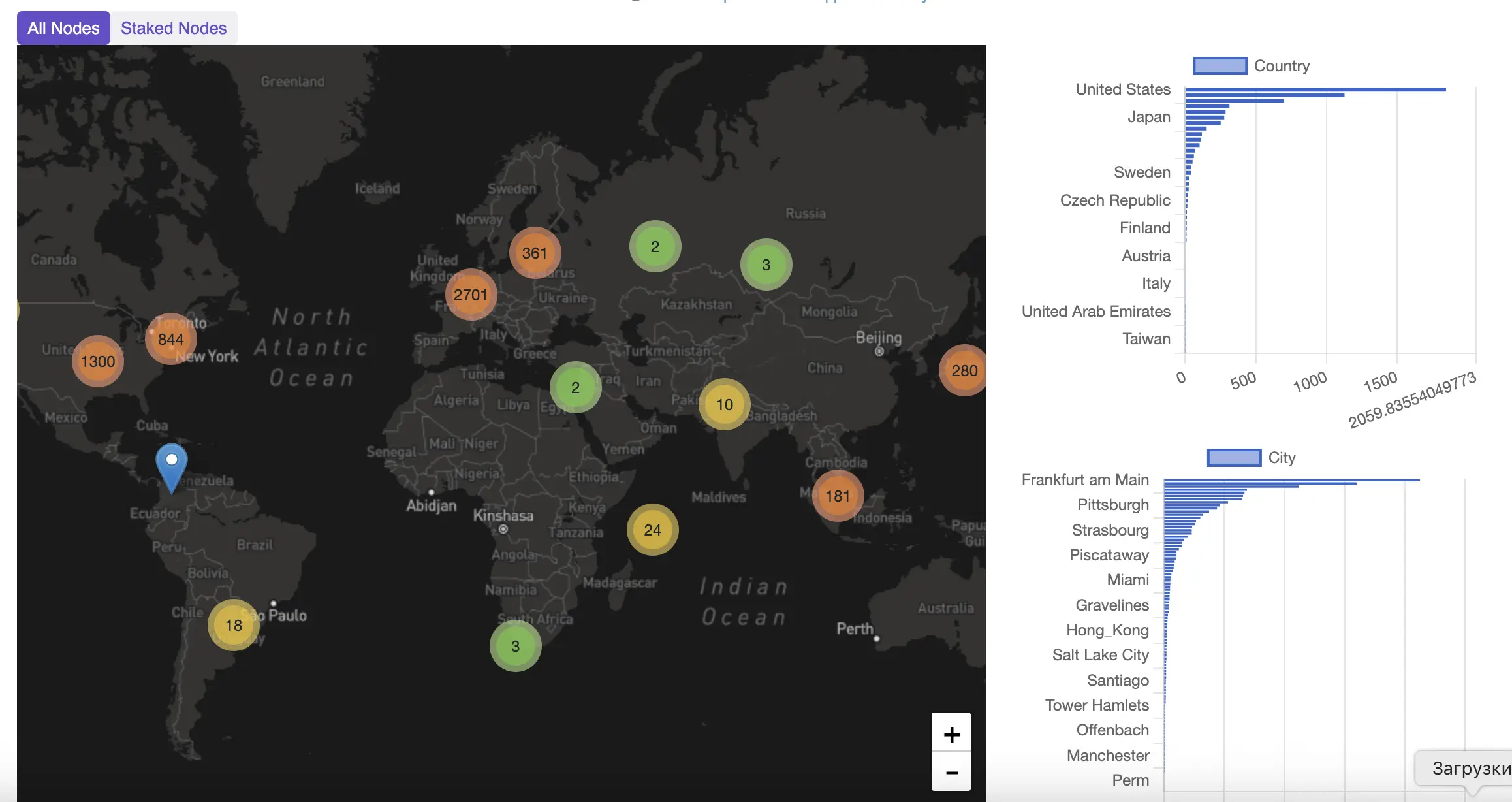

Node Distribution

As of mid-2025, Solana has a truly global network, with more than 5,789 nodes distributed across 48 countries, 204 cities, and 495 data centers.

Source: Solana Compass

Regional Breakdown (Approximate Percentage by Data Center Count)

-

Europe: 42%

-

Key countries: Germany, Netherlands, United Kingdom, France, Finland

-

Notable providers: Hetzner, OVH, Equinix Frankfurt

-

Europe remains the largest hosting region due to favorable regulations, advanced infrastructure, and widely available colocation services.

-

-

North America: 28%

-

Key countries: United States, Canada

-

Common hosting locations: Ashburn (Virginia), New York, Silicon Valley, Toronto

-

Providers: DigitalOcean, AWS, Equinix, Vultr

-

The U.S. leads in institutional staking operations and infrastructure reliability.

-

-

Asia: 16%

-

Key countries: Japan, Singapore, South Korea, India

-

Data centers concentrated in Tokyo, Seoul, Singapore, Mumbai

-

Asia contributes greatly to performance and coverage in high-growth Web3 markets.

-

Source: Validators.app

The network’s steady shift toward underrepresented regions also indicates progress in making blockchain infrastructure more inclusive.

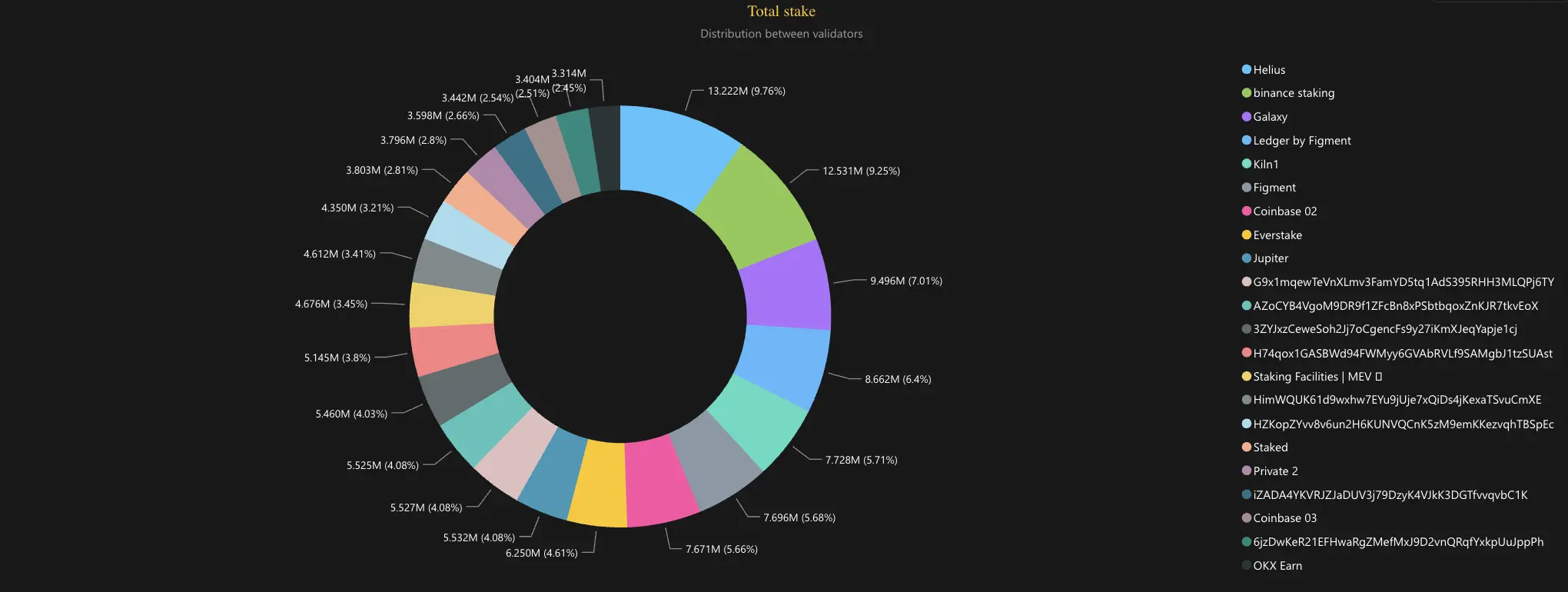

Stake and Staking Accounts Distribution

The chart below depicts a moderately concentrated staking landscape of Solana. While the top three validators (Helius, Binance Staking, and Galaxy) collectively control over 26% of the network’s total delegated SOL, the presence of multiple validators in the 3–6% range indicates a healthy level of decentralization.

As of June 2025, Helius holds the largest stake, 13.222M SOL, representing 9.76% of the total stake. Binance Staking follows with 12.531M SOL (9.25%) and Galaxy with 9.496M SOL (7.01%).

Other major validators include:

-

Ledger by Figment: 8.662M (6.4%)

-

Kiln1: 7.728M (5.71%)

-

Figment: 7.696M (5.68%)

-

Coinbase 02: 7.671M (5.66%)

-

Everstake: 6.250M (4.61%)

-

Jupiter: 5.532M (4.08%)

The remaining stake is distributed among smaller validators and anonymized addresses, each holding between 2.45% and 4% of the total stake.

The presence of both institutional and anonymous or private validators suggests a diverse and competitive validator ecosystem. This distribution supports the network’s resilience and decentralization goals, as no single entity dominates the staking market.

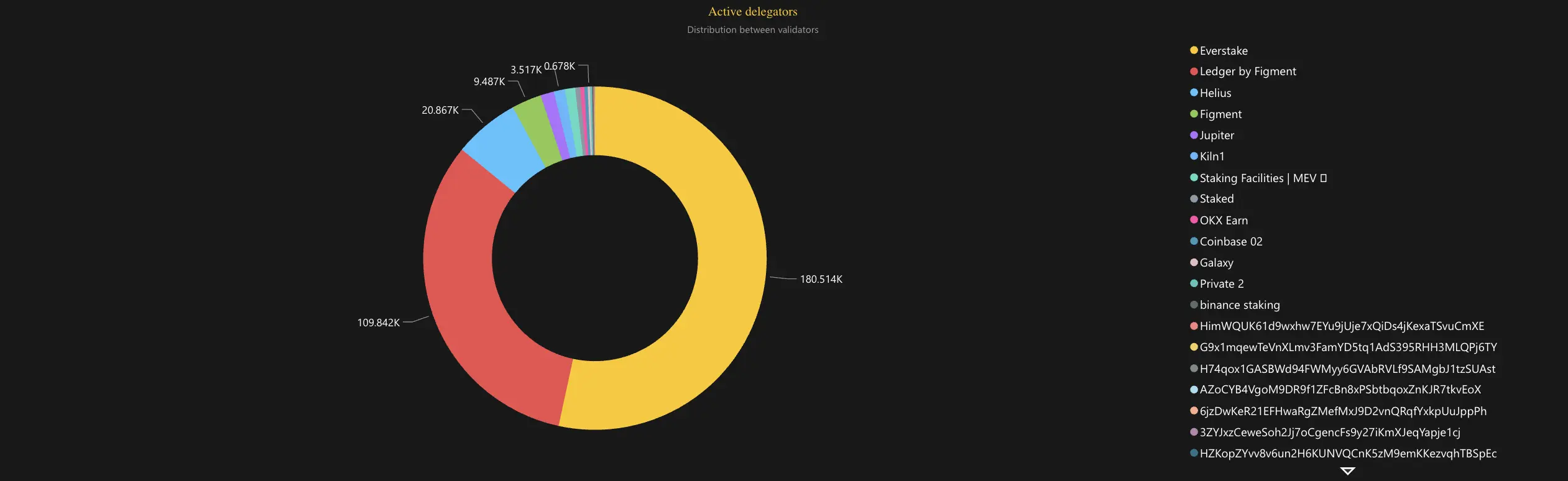

In early 2025, the distribution of active Solana stake accounts showed a strong concentration among a few major validators. Everstake led the network by a wide margin, securing over 180,000 stake accounts, followed by Ledger by Figment with approximately 110,000 each. Helius, Figment, and Jupiter held smaller but notable portions of the stake accounts base with around 20,000, 9,000, and 3,500, respectively.

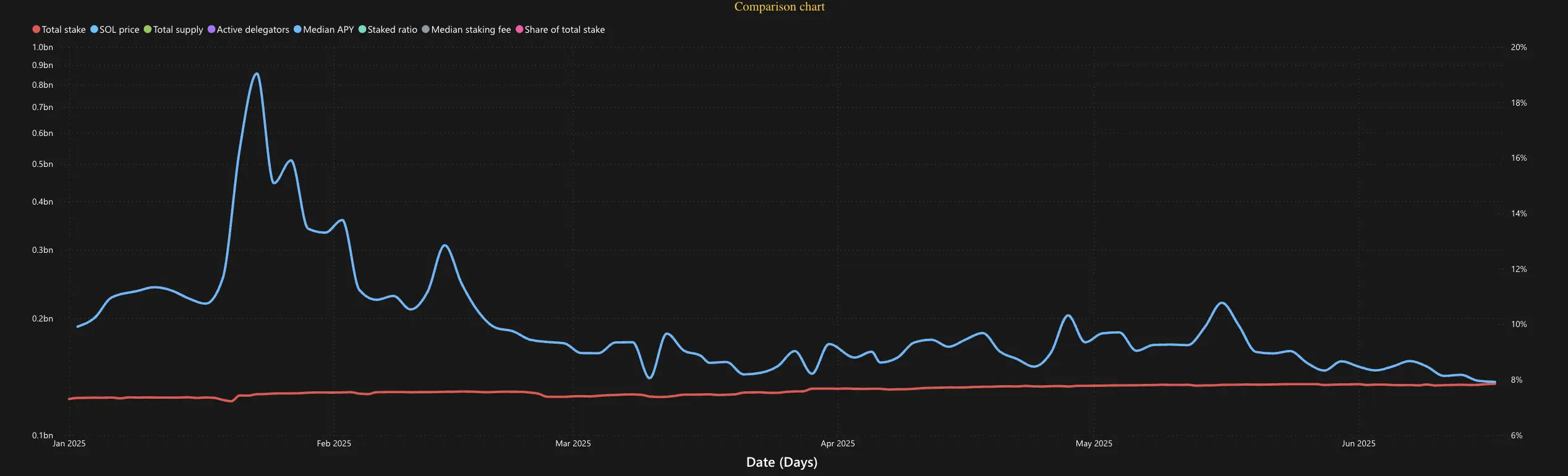

Delegator Behavior Analysis

According to the comparison chart, the median APY (Annual Percentage Yield) experienced sharp fluctuations at the beginning of the year, with significant spikes in January and early February.

This volatility likely stems from short-term shifts in network and market conditions. By June 2025, APY had settled at much lower levels than its January highs, suggesting that rewards became more evenly distributed across the network as more participants joined staking.

Overall, the data signals the maturing of Solana’s staking ecosystem, with growing participation contributing to the normalization of yield returns.

Future Prospects

Solana seems on track to solidify its role as a foundational layer for the next generation of Web3 applications. With major advancements like the Firedancer validator client, designed to increase throughput to hundreds of thousands of transactions per second, Solana is preparing for a future where high-performance, censorship-resistant infrastructure will be critical for mainstream adoption.

Validator distribution is also moving in the right direction. As of mid-2025, over 5,789 nodes are active across 48 countries and 495 independent data centers. This growing geographical and infrastructural diversity strengthens the network’s decentralization and resistance to single points of failure.

Solana's ecosystem continues to diversify and deepen. Beyond NFTs and DeFi, it is increasingly becoming the chain of choice for consumer apps, mobile-first experiences, and real-world utility. Projects like Helium (decentralized wireless infrastructure), DRiP (free NFT drops for community engagement), and decentralized physical infrastructure networks (DePIN) exemplify how Solana is employed for novel use cases. Integrating native staking into hardware wallets like Trezor also reflects growing interest from retail and self-custody users.

In parallel, Solana’s developer ecosystem is among the most active in crypto, with continuous growth in active developers, SDK improvements, and open-source contributions. Grant programs, hackathons, and accelerator events such as Solana Accelerate in New York are further cultivating a diverse community of builders.

From a strategic standpoint, Solana is positioning itself as a high-throughput chain and the default execution layer for applications requiring real-time responsiveness, such as gaming or micro-payments, AI inference marketplaces, and tokenized real-world assets. With improvements in data compression, zero-knowledge experimentation, and integrations with traditional finance infrastructure, Solana is increasingly compatible with Web2 and Web3 use cases.

Thus, Solana has the potential to become one of the few blockchain platforms capable of supporting billions of users without compromising on performance or decentralization.