SUI

WAL

crypto

staking

Sui & Walrus Staking Insights & Analysis: First Half of 2025 | Everstake

Dive into the Sui and Walrus staking trends for the first half of 2025. Key data, validator highlights, and Everstake’s impact across both ecosystems. If you have BTC, you can earn yield, trade, and lend via Sui.

AUG 20, 2025

Table of Contents

Key insights and takeaways

Methodology

Major updates in Sui

Active addresses

Transaction trends

Total value locked (TVL)

State of Staking

Stablecoins

Walrus overview

Future prospects

Share with your network

Key insights and takeaways

-

With over 2.7 billion transactions processed in the first half of 2025 and peak daily transaction counts exceeding 30 million, Sui has demonstrated high scalability and consistent throughput.

-

Despite market fluctuations, Sui maintained a TVL floor above $1 billion, peaking above $2 billion and at over $3.4 billion when including liquid staking and borrowed coins according to DeFiLlama TVL aggregator.

-

The validator set expanded to 116, and the stake remained well distributed, with no single entity holding excessive influence with the largest validator holding only around 2.9% of the total. Over 292,000 small-scale delegators contributed to a wider base of support.

-

Major liquid staking projects like SpringSUI, Haedal, and Volo remained strong and led liquid staking TVL, while newer protocols such as Winter Walrus and Liquid Agents began to show early promise.

-

USDC spearheaded stablecoin growth on Sui, tripling its market cap to $783M. Other stablecoins — USDT, FDUSD, and BUCK — also gained strong momentum, pushing Sui’s total stablecoin market cap to a remarkable $1.15B.

-

Walrus’s model for unstructured data storage positioned it as a vital infrastructure layer for future Web3 applications.

Methodology

This half-year report reviews Sui blockchain metrics and developments using the following approaches.

-

On-Chain Data: Examination of raw blockchain data, including transactions, staking activity, validator participation, and token movements.

-

Data Preparation: Analysis performed with Python, Power BI, and custom scripts, incorporating data from Sui explorer APIs, ecosystem dashboards, and external analytics platforms.

-

Data Analysis: Trends identified through statistical techniques and visualized using interactive dashboards.

Major updates in Sui

Sui has advanced in Bitcoin DeFi (BTCfi), institutional investment, and retail finance accessibility — all while sustaining a strong TVL, with BTC assets accounting for 20% of the total. A wave of DeFi-oriented product launches and partnerships suggests the growing confidence in its broader ecosystem.

The first half of the year saw two major global events in Sui.

-

Sui Summit in Denver (March 3–13, 2025) focused on builders and featured workshops and discussions on blockchain scalability and decentralized applications.

-

Sui Basecamp 2025 in Dubai (May 1–2, 2025) was the largest gathering of the Sui community and brought together developers, builders, and investors for major partnerships and ecosystem announcements.

Meanwhile, DeFi on Sui experienced noticeable progress as well.

-

BTCfi protocols gained traction, giving users new ways to receive yield and access liquidity using Bitcoin-backed assets. Together, they reinforced Sui’s role as a growing hub for Bitcoin-based finance.

-

New infrastructure launches, like Cetus Pro and Magma’s adaptive liquidity model, brought better trading tools, more efficient liquidity, and improved analytics.

-

User experience also took a big step forward. Many teams rolled out cleaner interfaces, simplified dashboards, and even added gamified features to make DeFi more accessible and engaging. Standout examples like Kai Finance, Nemo Protocol, Magma, and Zo by Sudo showcase a new wave of products designed to attract the next generation of users — from retail newcomers to seasoned DeFi veterans.

Active addresses

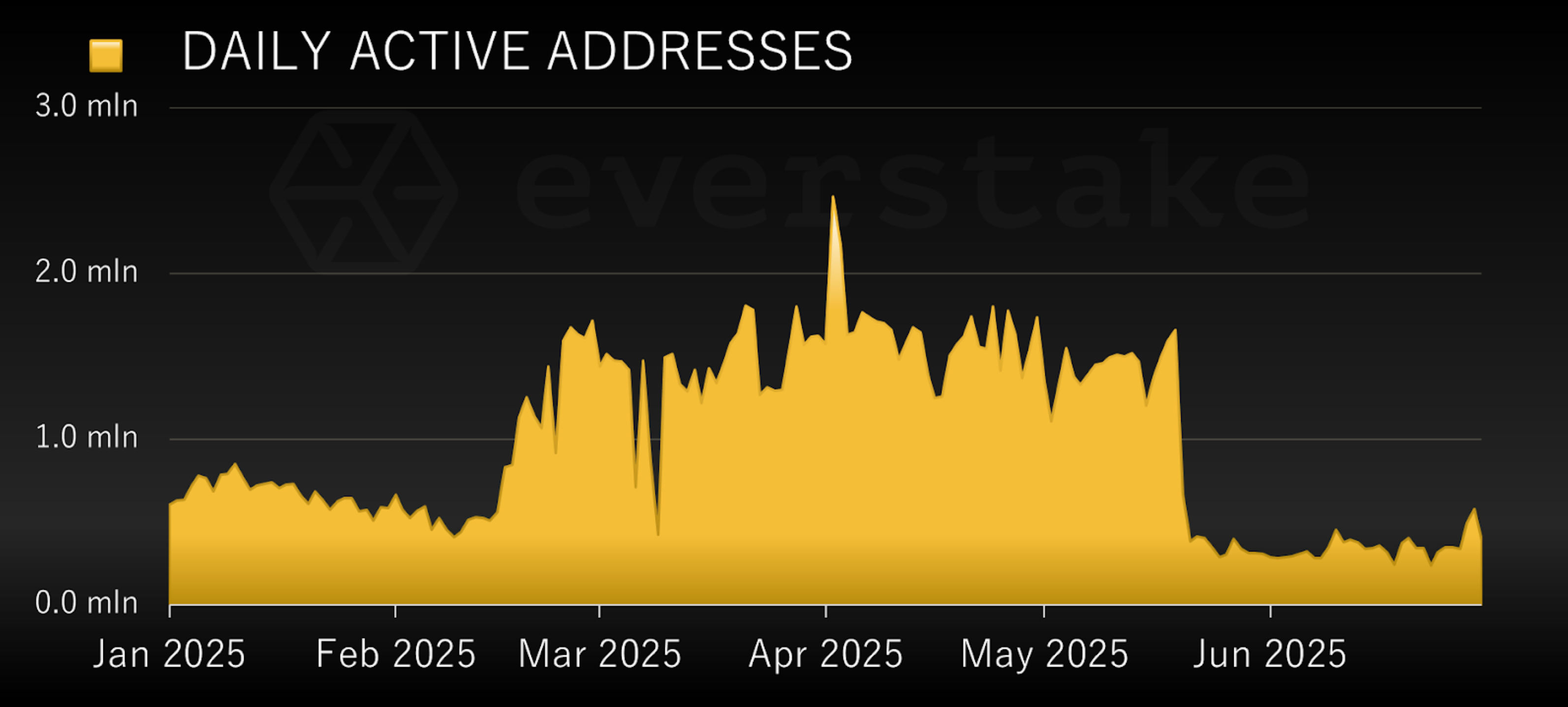

User activity on Sui remained strong throughout 2025. As shown in Figure 1, daily active addresses started the year steadily before experiencing a significant surge from the second half of February through mid-May, reaching a peak of approximately 2.5 million.

FIGURE 1. SUI DAILY ACTIVE ADDRESSES

In the first half of the year, daily active addresses averaged around 1 million. Although activity later eased to a more moderate range of 300,000–500,000, it remained healthy and showed a clear upward trend — climbing back toward 1 million by the start of Q3 (at the time of writing).

The dip at the end of Q2 can be attributed to RECRD’s temporary shutdown. As one of the largest drivers of activity on Sui in H1, RECRD paused operations for several weeks to complete a backend refactor. Since its relaunch, activity has rebounded.

Transaction trends

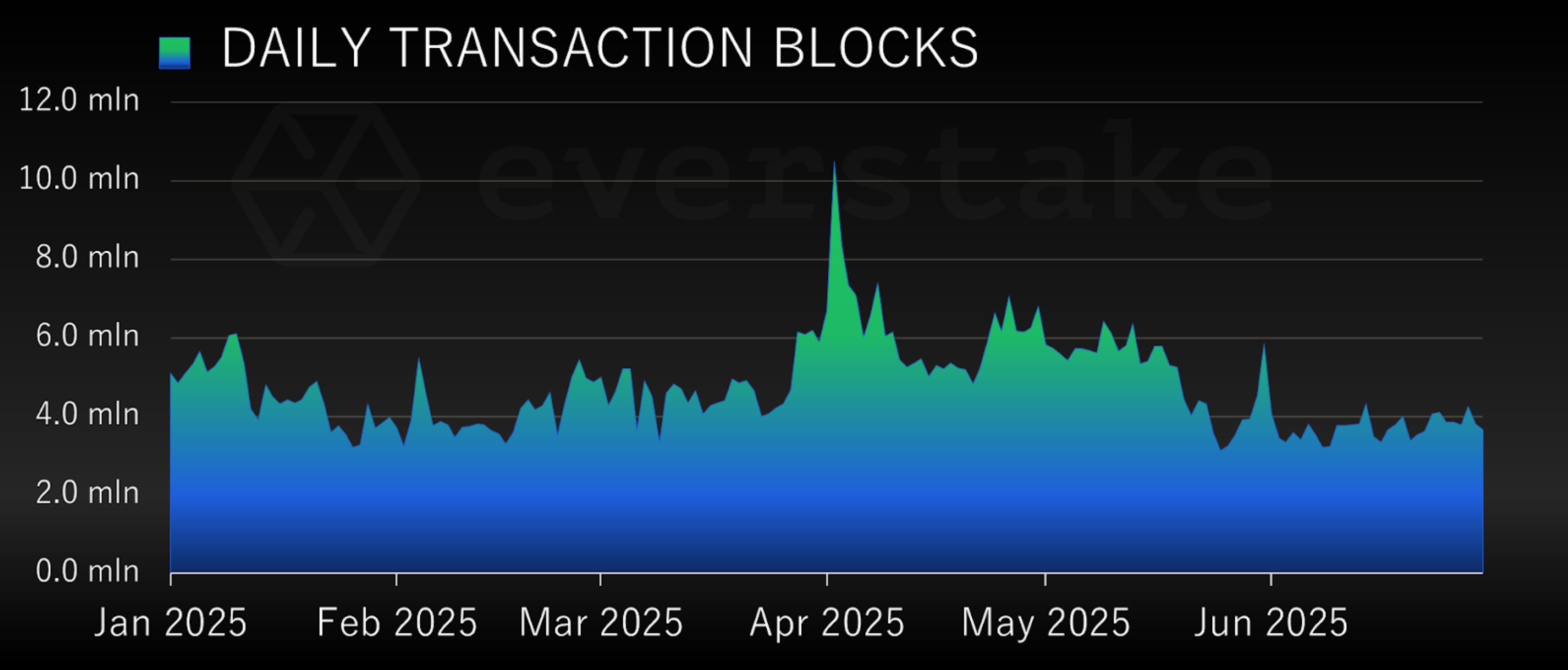

As shown in Figure 2, daily transaction blocks remained stable throughout the first half of 2025, peaking at over 10 million blocks per day in early April.

FIGURE 2. DAILY TRANSACTION BLOCKS

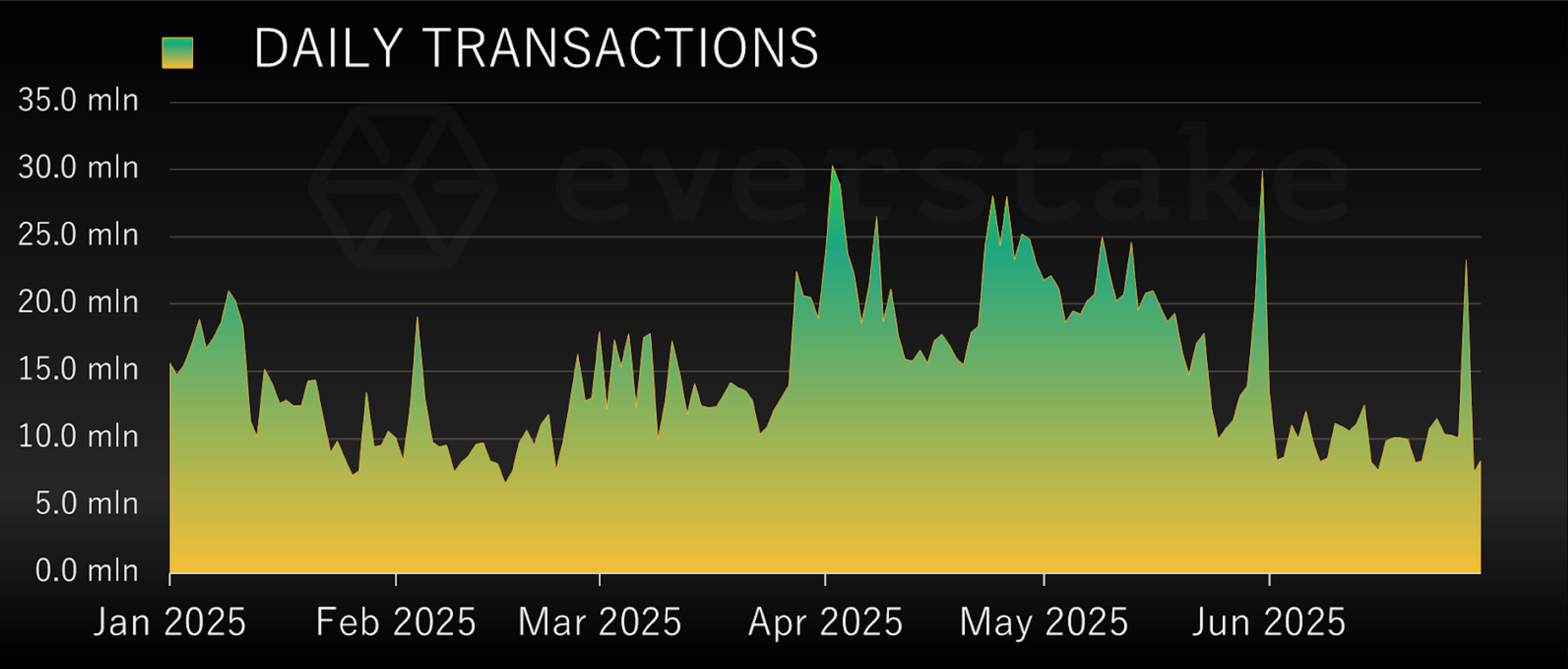

In Figure 3, daily transaction counts reflect similarly strong activity, with several spikes exceeding 30 million transactions per day. The sustained volume suggests ongoing user and application engagement.

FIGURE 3. DAILY TRANSACTIONS

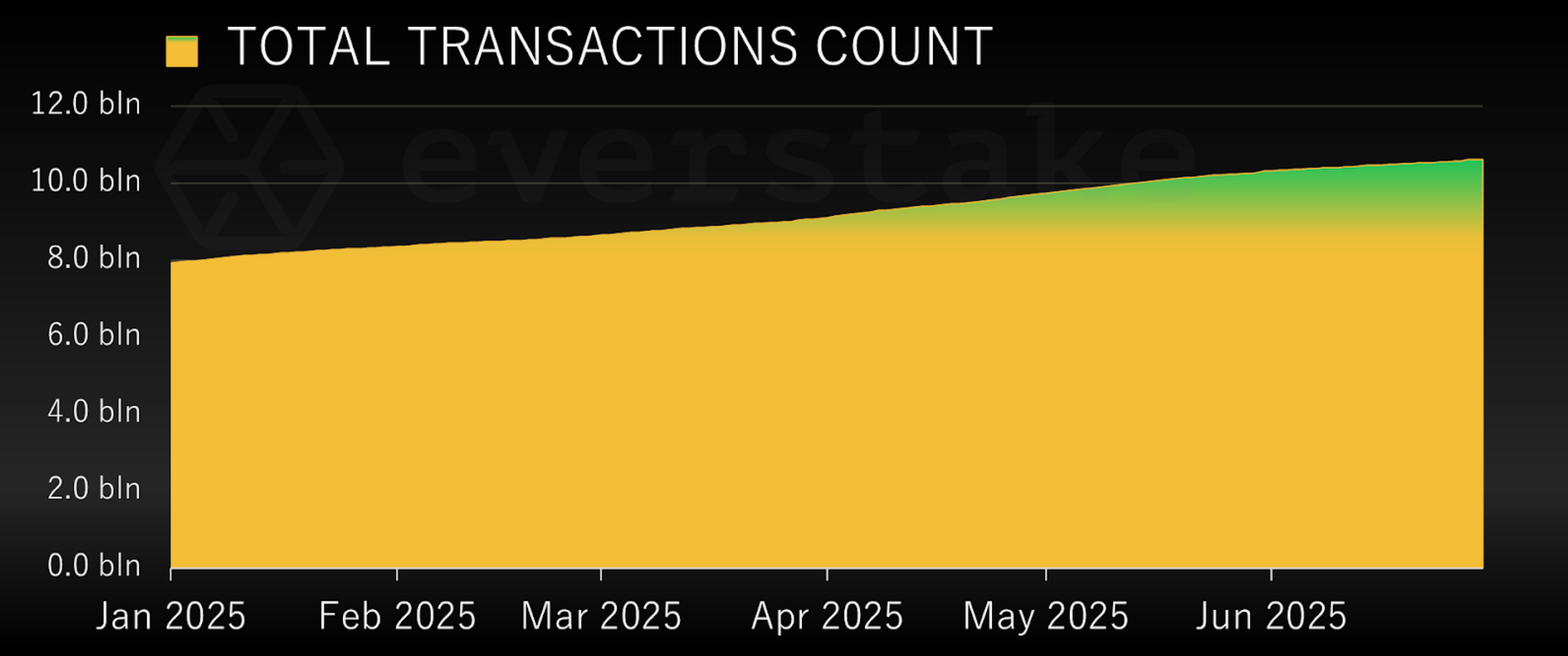

Cumulatively, as depicted in Figure 4, Sui processed approximately 2.7 billion transactions in just the first half of 2025, bringing the total transaction count to over 10.6 billion.

FIGURE 4. TOTAL TRANSACTIONS COUNT

Total value locked (TVL)

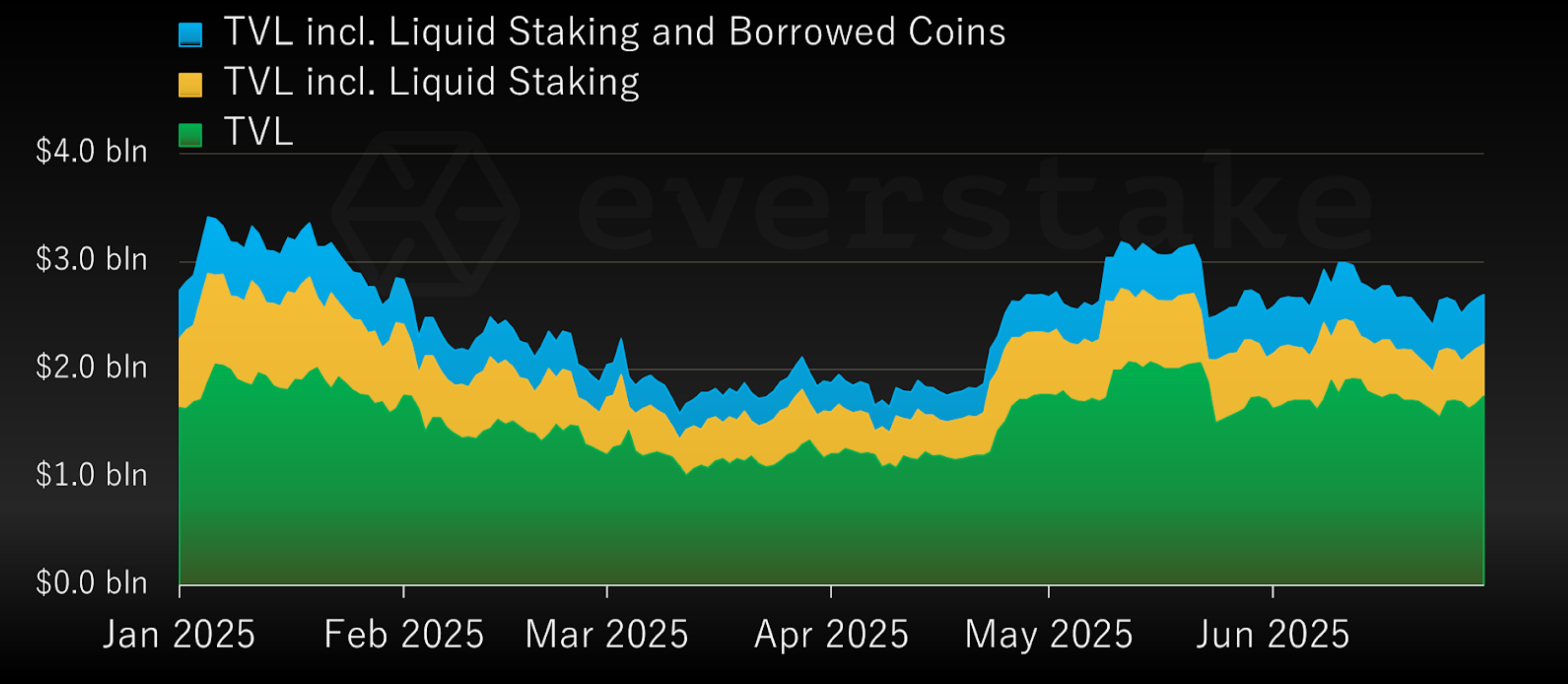

This analysis examines Sui’s TVL across three dimensions: Base TVL, TVL including Liquid Staking, and TVL including both Liquid Staking and Borrowed Coins. Figure 5 illustrates how these metrics changed over the first half of 2025.

FIGURE 5. TRENDS IN SUI CHAIN TVL

-

Base TVL on Sui experienced modest fluctuations in the first half of 2025, yet remained strong, never falling below $1 billion. A notable increase began in late April, with TVL peaking above $2 billion in May.

-

TVL, including both Liquid Staking and Borrowed Coins, followed a similar trajectory, climbing to over $3.4 billion. It remained resilient throughout the entire half-year period, fluctuating between $1.6 and $3.4 billion.

State of Staking

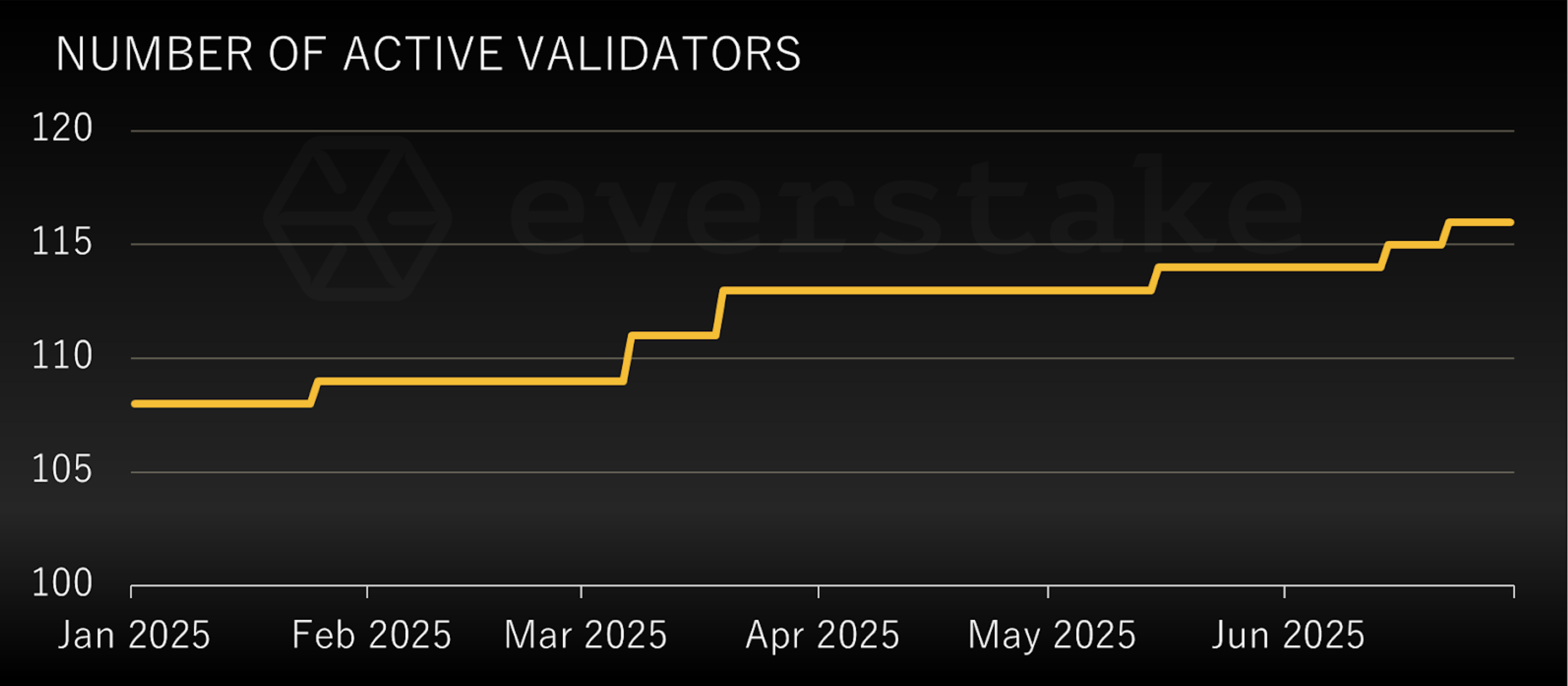

The number of validator nodes, as shown in Figure 6, grew from 108 to 116, suggesting greater distribution of stake.

FIGURE 6. NUMBER OF ACTIVE VALIDATORS ON SUI

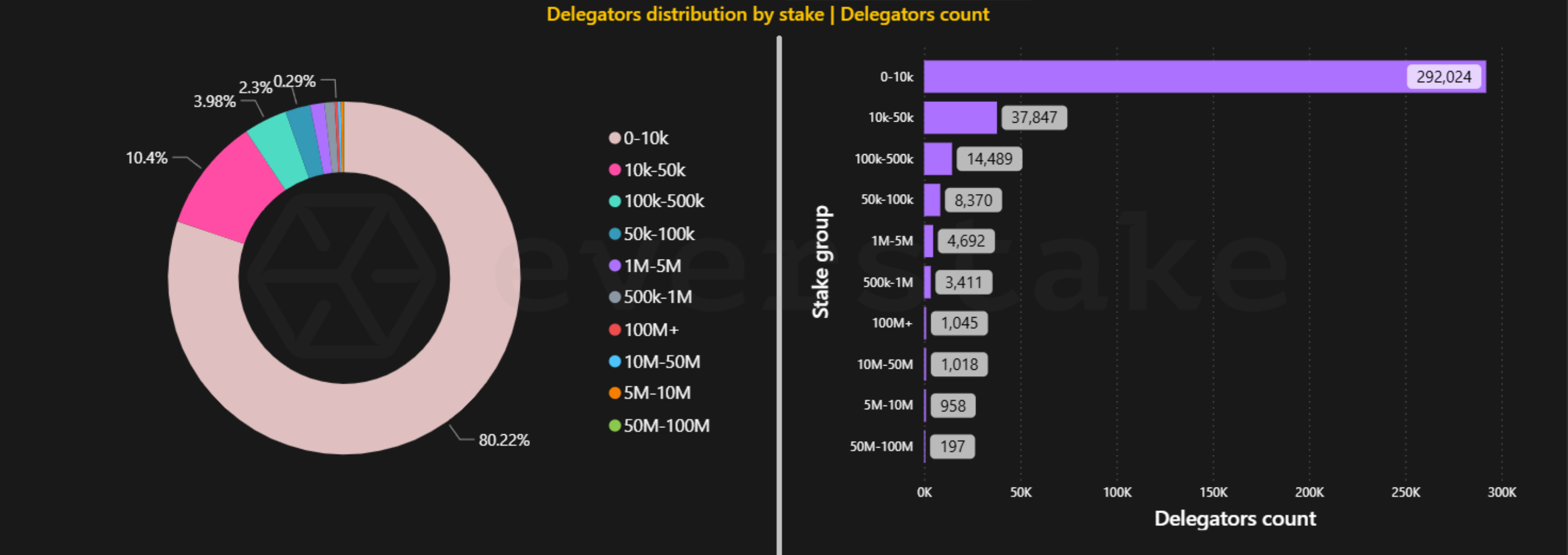

As of the end of June 2025, the total staked amount stood at 7.48 billion SUI, with the largest validator holding only around 2.9% of the total. The stake distribution among validators is shown in Figure 7, suggesting a balanced and healthy spread across the network that upholds its security and efficient operation.

FIGURE 7. SUI STAKE DISTRIBUTION BETWEEN VALIDATORS

Figure 8 shows that most delegators (292,000) are in the 0–10k SUI stake range, suggesting that participation tends toward smaller staking levels.

FIGURE 8. DISTRIBUTION DELEGATOR COUNT BY STAKE SIZE

Liquid staking

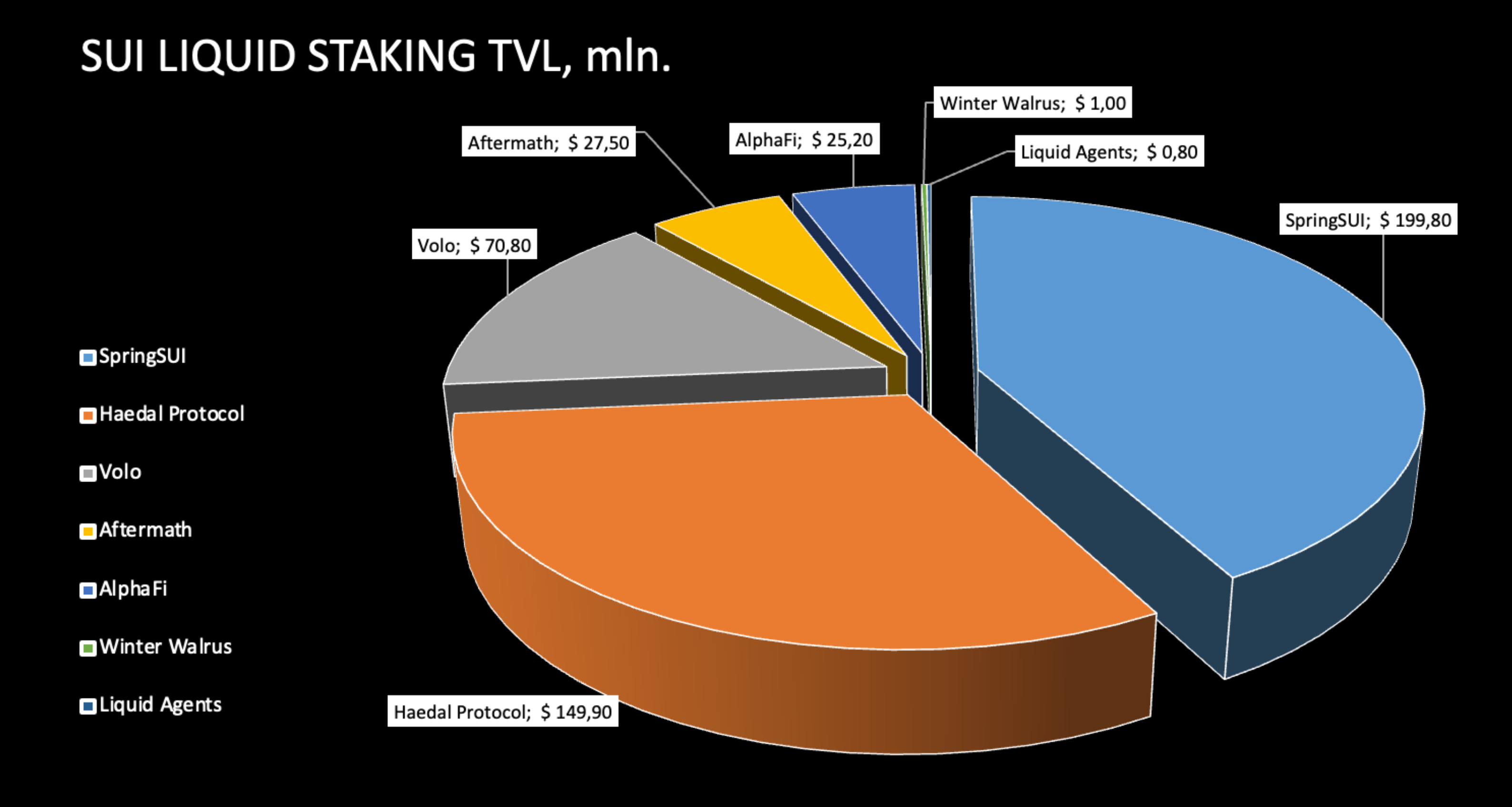

Liquid staking plays an important role in DeFi ecosystems built upon dPoS networks like Sui. As of June 30, 2025, the (TVL) for key contributors in liquid staking was as shown below.

-

SpringSUI: $199.8 million

-

Haedal Protocol: $149.9 million

-

Volo: $70.8 million

-

Aftermath: $27.5 million

-

AlphaFi: $25.2 million

-

Winter Walrus: $1.0 million

-

Liquid Agents: $0.8 million

Figure 9 provides a detailed breakdown of TVL contributions for liquid staking on Sui by individual protocols (as of June 30, 2025).

FIGURE 9. SUI LIQUID STAKING TVL (as of 30 June 2025)

SpringSUI represents a significant portion of total TVL. Haedal Protocol and Volo are also major contributors, delivering substantial value to the network. Meanwhile, Aftermath and AlphaFi enhance diversity and resilience within the ecosystem. Winter Walrus and Liquid Agents are recent entrants to the liquid staking space and have begun to show early signs of growth, with potential for further expansion.

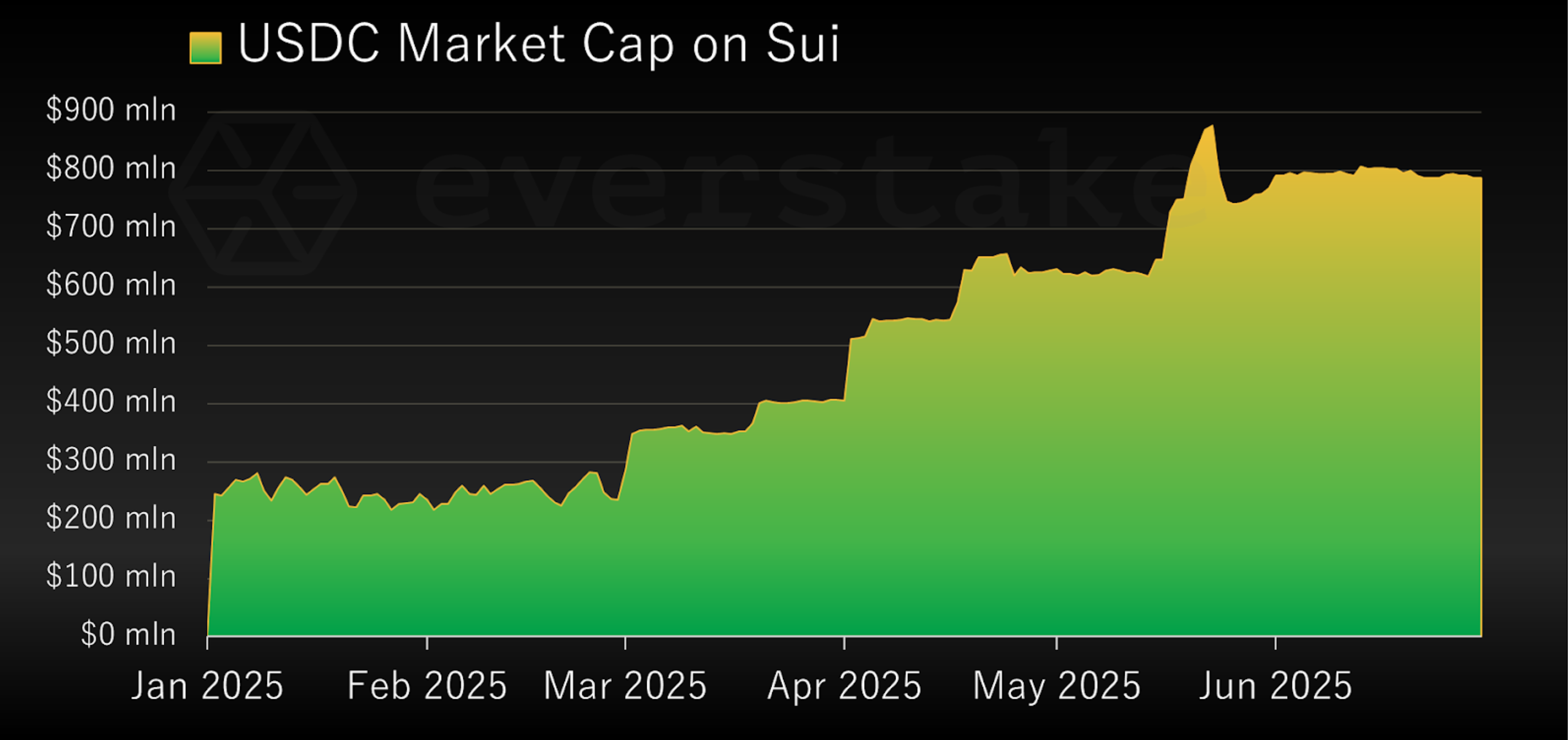

Stablecoins

The first half of 2025 has shown a significant rise in the adoption and utilization of stablecoins on Sui. A wide range of stablecoins are now active on Sui, including USDC, USDT, FDUSD, BUCK, AUSD, USDY, and others. These tokens collectively serve as important infrastructure for DeFi protocols, liquidity pools, and on-chain commerce within the Sui ecosystem.

Among them, USDC is the dominant stablecoin by market capitalization. Figure 10 illustrates the growth of USDC’s market cap on Sui from January through June 2025. Starting at $245 million on January 1st, USDC experienced steady and sharp increases, peaking at $877 million in mid-May and ending June at a strong $783 million. Thus, its cap has more than tripled over the period in question.

In addition, USDT has also crossed the $100 million mark, while both FDUSD and BUCK have exceeded $60 million.

Walrus overview

Walrus is a decentralized storage and data availability protocol built on Sui. Designed by Mysten Labs, it enables users to store and retrieve large, unstructured data across a global network of independent nodes. With strong integration with Sui, Walrus combines economic incentives, cryptographic guarantees, and flexible access options to support real-world storage needs.

Walrus’ key features

-

Storage and Retrieval: Walrus supports efficient data writing and reading, using cryptographic proofs of availability verified through random challenges. This ensures data remains accessible and intact.

-

Cost Efficiency: Using advanced erasure coding, Walrus stores each blob as ~5× its raw size, with encoded parts spread across all nodes. This approach costs less than full replication and offers greater resilience than protocols that store data on only a few nodes.

-

Sui Integration: Walrus is natively integrated with Sui, allowing users to leverage Sui smart contracts to manage storage coordination, payments, and metadata tracking. Sui’s high-performance architecture ensures scalability and transparency, with storage resources tokenized as programmable objects.

-

Epoch-Based Tokenomics: The WAL token is used for staking, rewarding node operators, and enabling decentralized governance. Storage node operators earn WAL based on uptime and performance, while stakers receive passive rewards for helping to secure the network.

-

Flexible Access and Interoperability: Walrus provides multiple ways to interact with the network, including a command-line interface (CLI) and software development kits (SDKs). It can seamlessly work with existing caching systems and content distribution networks.

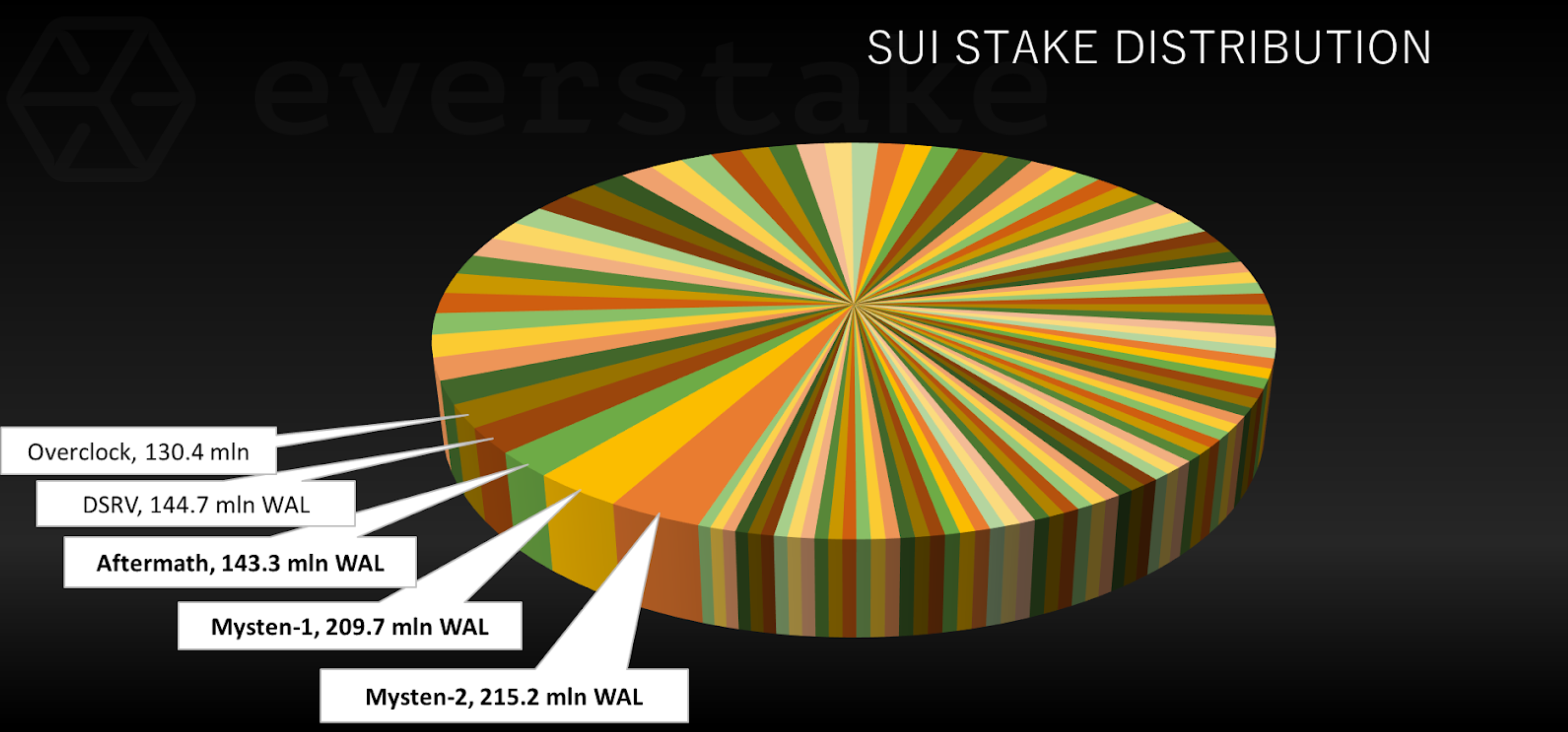

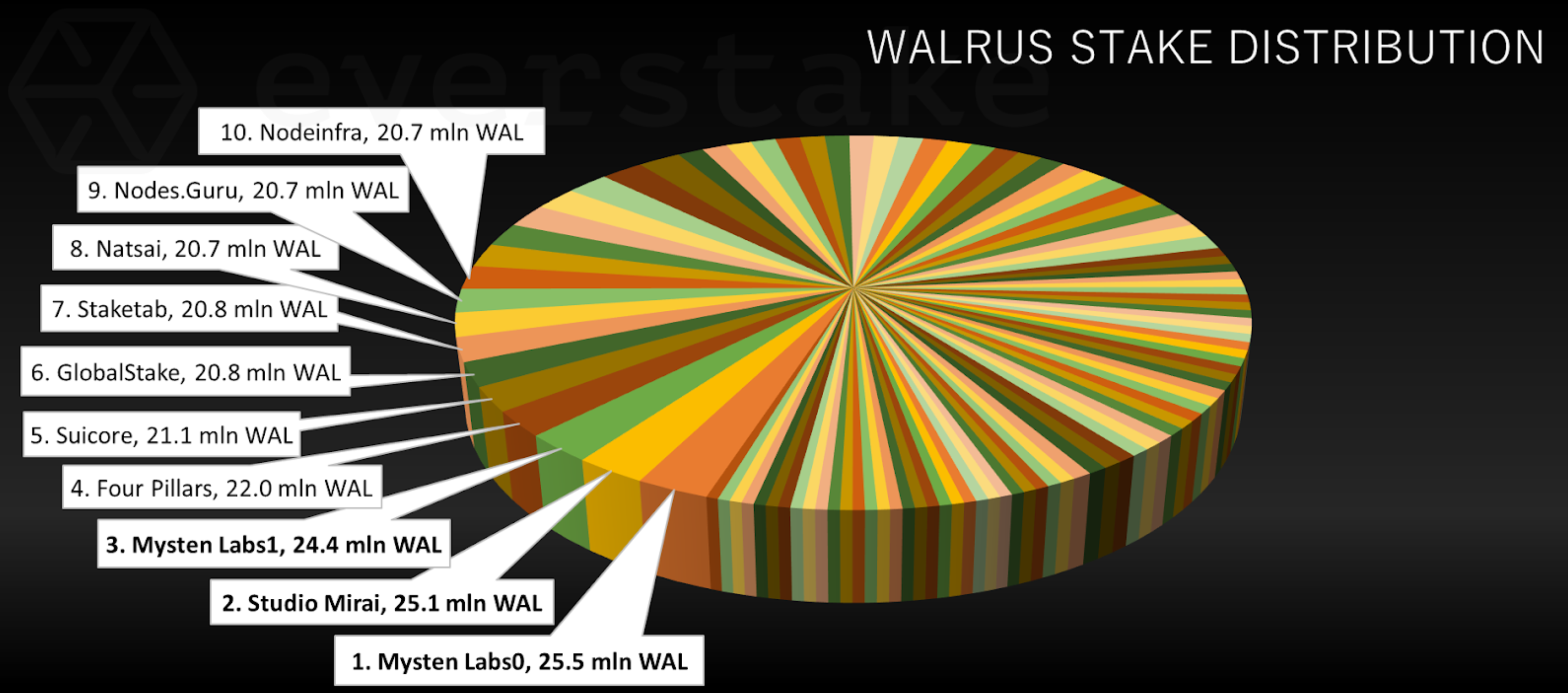

Decentralization in Walrus

Walrus demonstrates a healthy level of decentralization, as shown in Figure 11, which highlights the stake distribution among 103 node operators. The total stake in the network is 996.8 million WAL, with the top operator holding just 25.5 million WAL, or around 2.6% of the total. Such a wide distribution of stake reduces the risk of centralization and enhances the network’s security, fairness, and resilience.

FIGURE 11. WALRUS STAKE DISTRIBUTION BETWEEN VALIDATORS (as of 30 June 2025)

Future prospects

Sui is a serious contender in the Layer 1 space, particularly due to its technical innovations and developer-centric architecture. Notably, it lends itself well to modular and interoperable designs, which are increasingly favored in institutional settings where compliance, performance, and control are critical.

The ecosystem’s rising developer activity and the growth of its DeFi and NFT ecosystems suggest a substantial foundation for sustained innovation. The blockchain’s alignment with trends like abstracted user experience, horizontal scalability, and programmability makes it a strong candidate for enterprise experimentation and longer-term integration. If it continues to attract serious builders and maintains a stable, secure validator ecosystem, Sui could become a key player in shaping the next generation of blockchain infrastructure.

Looking ahead, Sui’s prospects appear strong, fueled by two pending ETF applications from 21Shares and Canary Capital, alongside a growing roster of institutional players building on the network. These developments could open the door to broader capital inflows, enhance market visibility, and position Sui as a key layer in the next wave of blockchain adoption.

Disclaimer

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.

Sign Up for

Our Newsletter

By submitting this form, you are acknowledging that you have read and agree to our Privacy Notice, which details how we collect and use your information.