As Aptos marks its third anniversary, we take this opportunity to reflect on the progress achieved since last year’s milestone. Over the past twelve months, the network has continued its steady progress, building on its foundations while expanding its reach and capabilities.

This report provides a clear overview of developments since the second anniversary, highlighting areas of growth, innovation, and community engagement. While the occasion is celebratory, we focus on providing a grounded account of Aptos’ journey and the work that brought it to where it stands now.

Key Insights and Takeaways

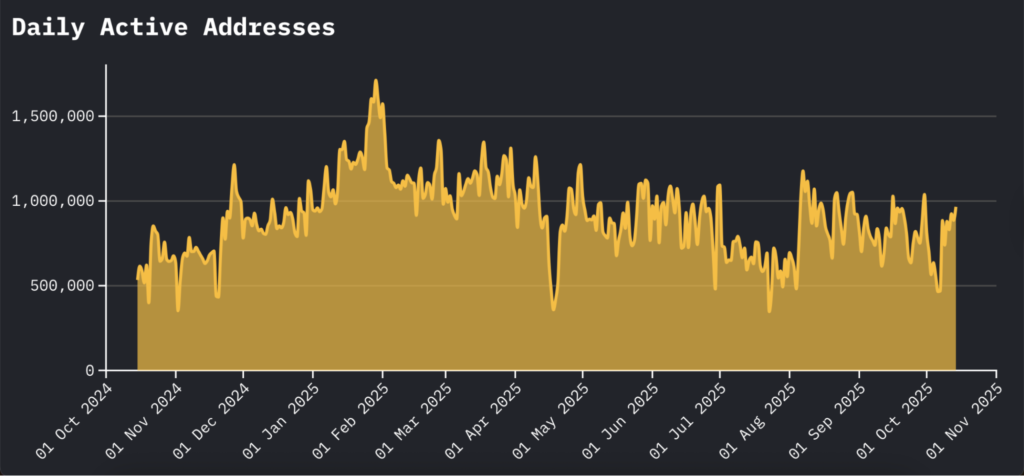

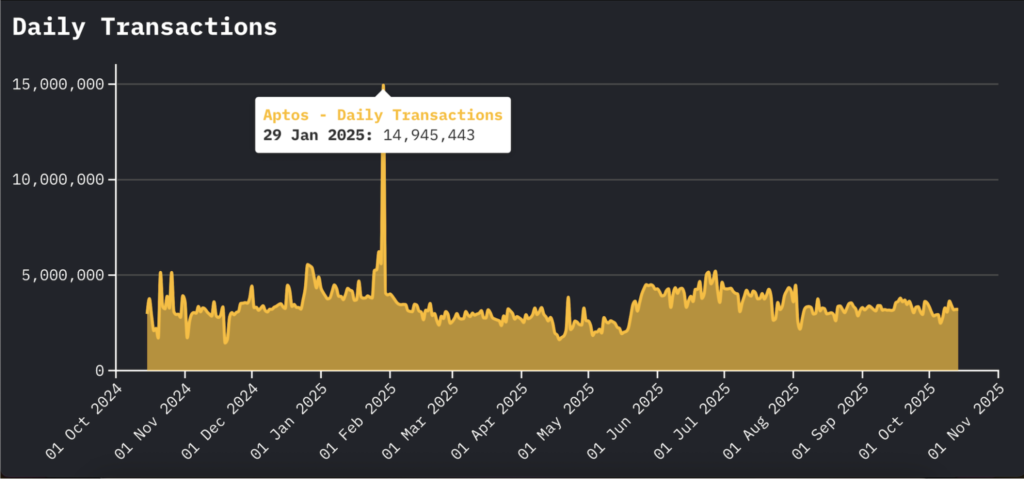

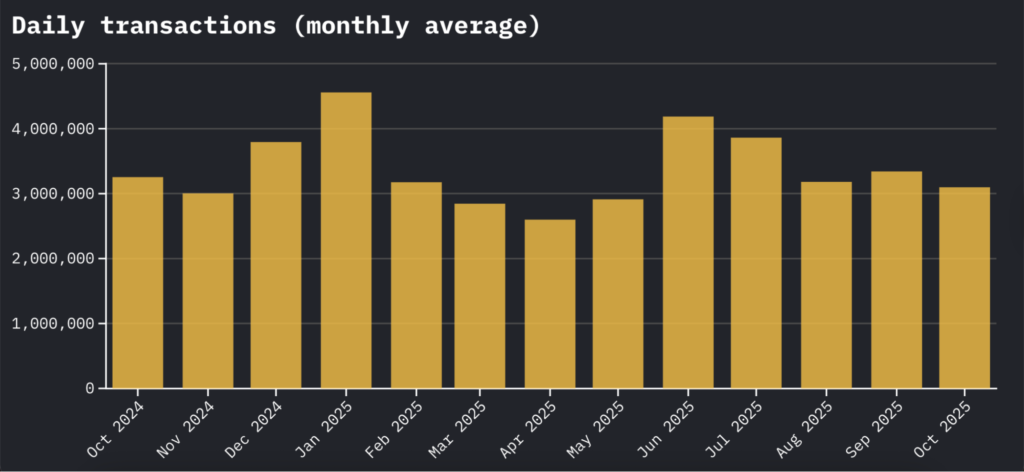

- Daily active addresses grew to ~900,000 in 2025, peaking above 1M in Q1, driven by USDC’s January launch. Transactions averaged 3M+ monthly.

- Base TVL surged 2.5x to $2.18B in early 2025. Liquid staking TVL hit $700M+ at its peak, led by Amnis Finance (39% share).

- Delegated staking rose by 33% to 0.4B APT. AIP-119 cut rewards from 7% to 6.443% APR by October 2025, stabilizing participation at 73%.

- Stablecoin supply doubled to $850M in H1, hitting $1.35B by mid-2025. Aptos ranked top-3 for RWAs with $720M+ (57% growth in 30 days by June). Velociraptr upgrade cut block times to sub-0.5s, boosting scalability and DEX volumes to $9B.

Activity Metrics

Daily active addresses (DAA) and Transaction count are important indicators of the network’s usability, performance, and user satisfaction.

The DAA chart below shows a clear improvement, rising from a lower base in 2024 to a more sustained ~900,000 base and up to 1.7M spikes in 2025. This change is in line with broader 2025 trends, where daily averages often exceeded 1 million in Q1 but settled higher overall than in 2024.

- The daily transactions spike coincides with the native launch of USDC (Circle’s stablecoin) on Aptos in January 2025. It enabled seamless cross-chain transfers and boosting DeFi and stablecoin activity.

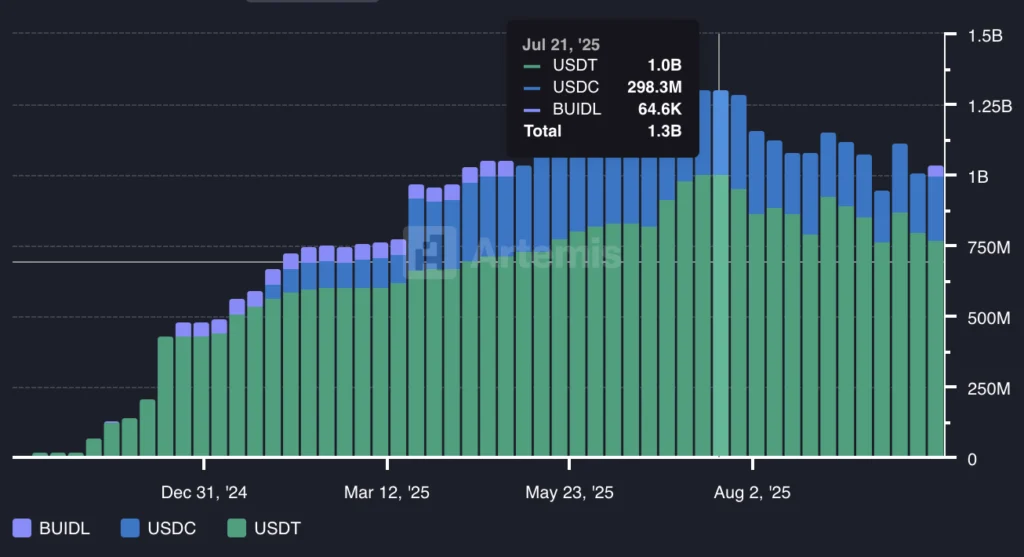

- Stablecoins like USDC and USDT became key growth drivers, with USDC issuance reaching $267 million by June 2025 and total stablecoin supply on Aptos growing from $431 million to $850 million in the first half of the year.

Comparing October 2024 to October 2025, the transaction volume showed a slight decline of about 4.8% (from 3,254,076 to 3,097,273 transactions daily), which contrasts with the 80% increase in daily active addresses noted earlier.

This suggests a shift toward more stable, possibly less transaction-intensive usage, such as institutional stablecoin operations or matured DeFi protocols, rather than the high-frequency activity seen in early 2025. The peak in January and subsequent recovery indicate resilience, with the network maintaining an average above 3 million transactions per day throughout the year.

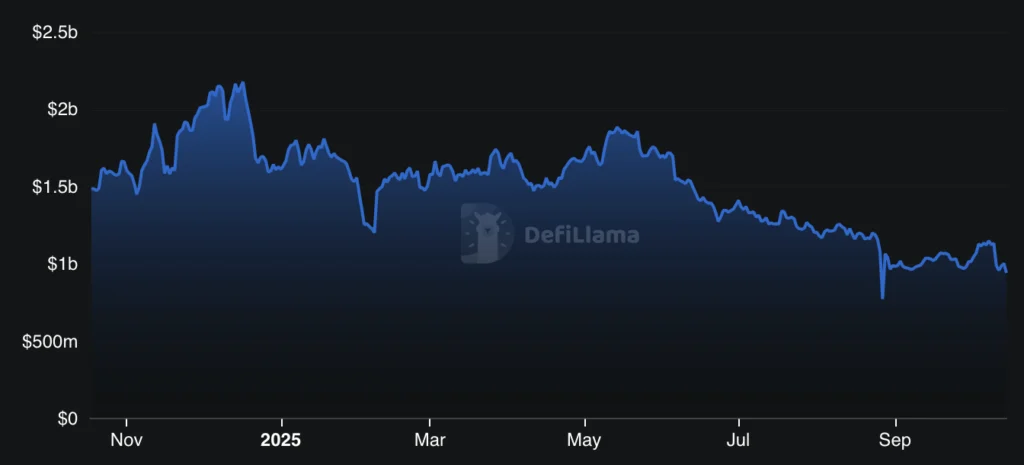

Aptos TVL Trends

Total Value Locked (TVL) is a key metric showing the total value of assets locked in a protocol, which often reflects trust and popularity.

The chart below tracks Aptos’s base TVL over the past year since its second anniversary in October 2024. It soared from about $874 million to a peak of $1.13 billion in early 2025, a growth of nearly 30%, driven by new apps and stablecoin inflows. Since then, it has dropped to around $710 million by mid-October 2025, due to token unlocks and market shifts.

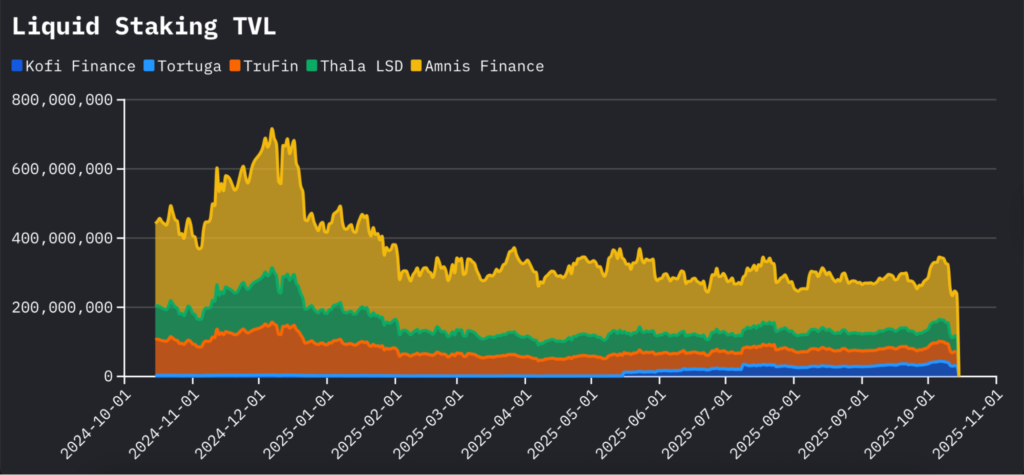

Liquid staking is a popular DeFi feature on Aptos, allowing users to stake APT tokens for rewards while keeping liquid derivatives (like stAPT) usable in other protocols for boosted capital efficiency.

The chart below shows Aptos liquid staking TVL starting at around $400 million in October 2024, surging to a peak of over $700 million in early 2025 (almost 2x growth).

Leaders in liquid staking include seven main protocols, with current (October 16, 2025) TVL dominated by Amnis Finance at $121.6 million (about 39% market share), followed by Thala at $43.9 million (14%), TruFin Protocol at $38.2 million (12%), Kofi Finance at $28.7 million (9%), Echo Liquid Staking at $8.3 million (3%), Ditto at $1.9 million (1%), and Tortuga at $0.06 million (negligible).

Aptos Delegated Staking

Delegated staking remains a cornerstone of Aptos’ network security, allowing users to contribute to consensus with a low entry barrier of just 11 APT since its launch in April 2023.

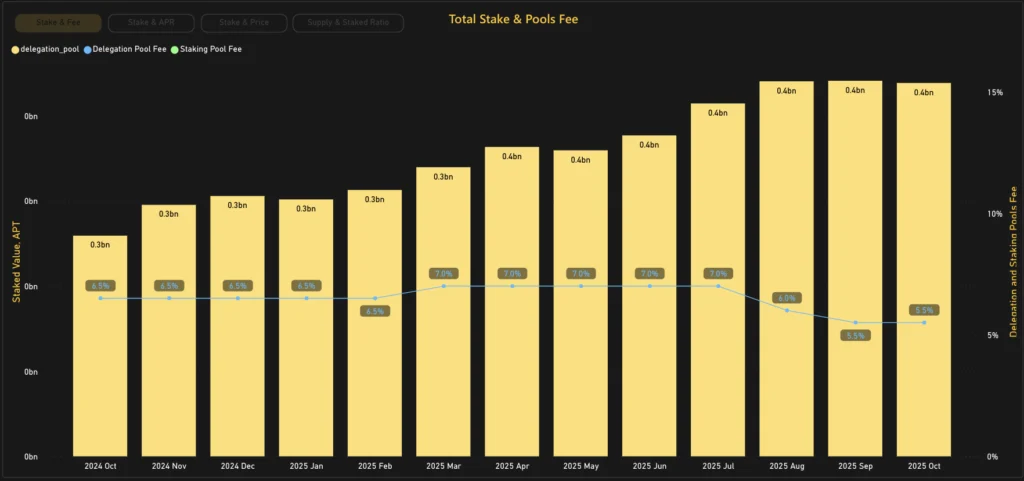

The chart tracking total delegated stake and associated fees from October 2024 to October 2025 illustrates a clear upward trajectory in stake value, rising from approximately 0.3 billion APT (300 million) at the start to 0.4 billion APT (400 million) by present time, which indicates a net increase of about 33%.

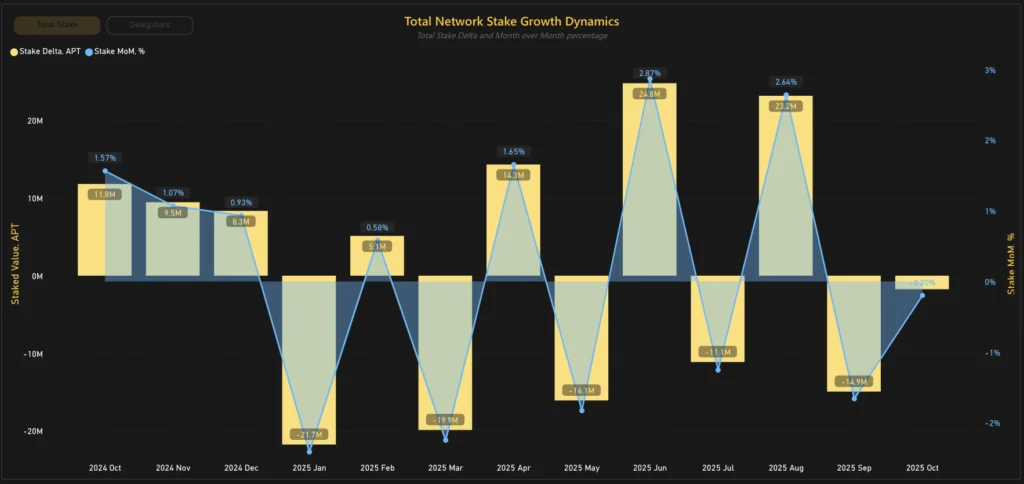

The second chart provides greater details on the monthly dynamics of total network stake. This metric captures net changes in staked APT, which reflects delegator behavior, reward reinvestments, and potential unlocks or market-driven unstaking.

The chart reveals a pattern of positive growth in Stake MoM% in more than a half of months. The trend keeps up with the steady growth during the early months post-second anniversary, with October 2024 adding 11.8 million APT (1.57% month-over-month), followed by 9.5 million in November (1.07%) and 8.3 million in December (0.93%). That said, the period from January to October 2025 indicates severe volatility reacting to seasonal adjustments, token unlocks, or broader crypto market volatility affecting confidence.

Aptos Ecosystem

Native USDT and USDC Integration and Stablecoin Growth Milestone

Aptos integrated native support for major stablecoins like Tether’s USDT and Circle’s USDC, which enabled seamless on-chain transfers without bridges. Integrations with exchanges like Binance, Kraken, and Crypto.com allowed for direct deposits and withdrawals. By mid-2025, stablecoin supply on Aptos reached $1.35B, with USDT growing 8x and USDC 2x since launch.

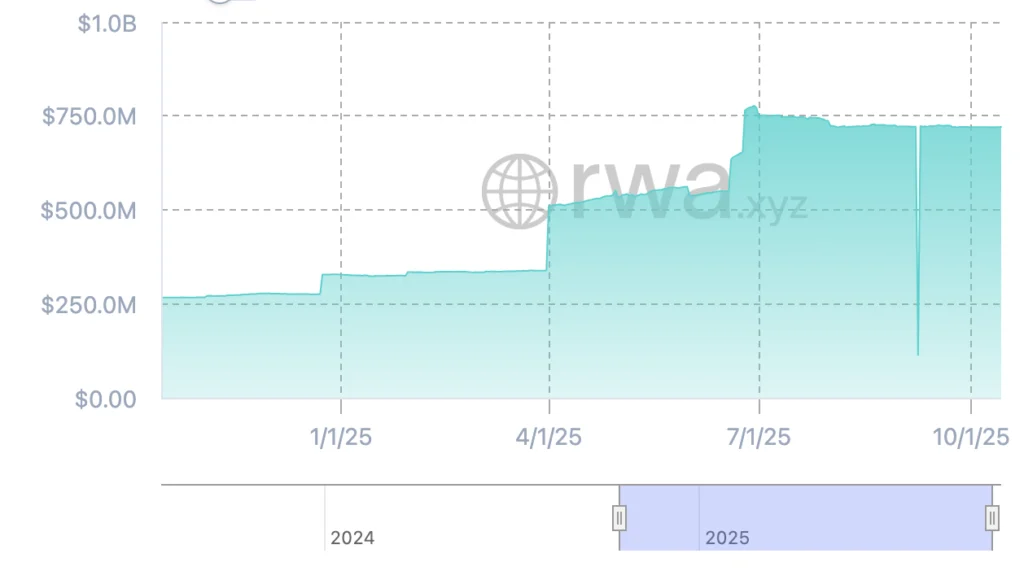

RWA (Real-World Assets) Milestone: Top 3 Chain with $720M+ in assets

Aptos became a top-3 chain for tokenized RWAs (e.g., treasuries, bonds), with $720M+ in assets like those from BlackRock, Franklin Templeton, and Pact Consortium.

RWA value grew 57.1% in 30 days by June 2025, contributing to 3B+ total transactions by July. Institutional inflows boosted TVL and propelled Aptos to #3 in RWAs, with daily actives averaging 1M+ and stablecoin supply hitting $1.3B.

Velociraptr Consensus Upgrade (September 2025)

The Velociraptr upgrade to Aptos’ consensus mechanism reduced block times and enhanced scalability, building on AptosBFTv4.

It optimized leader election and transaction propagation in the DAG-based consensus, cutting block times from ~0.9s to sub-0.5s while maintaining security. Combined with Block-STM, it parallelized execution for higher TPS.

Post-upgrade, transactions achieved 4ms finality, with 10M+ users and 18M peak monthly actives in H1 2025. Q2’25 DEX volumes reached $9B, and app revenue hit ATHs for two weeks straight in October 2025. These changes reduced latency spikes and improved network stability.

AIP-119: Aptos Staking Rewards Reduced

AIP-119, titled Reduce Staking Rewards, was a community-driven governance proposal co-authored by Aptos Labs’ Sherry Xiao (Head of Production Engineering) and core developer Moon Shiesty. The proposal’s core goal was to adjust Aptos’ monetary expansion by gradually lowering the base staking reward rate.

The implementation began in June 2025, with the APR gradually reduced from ~7% to the current 6.443%. Since June 2025, staking participation initially dropped ~7% but stabilized at 73% of circulating supply by October.

Conclusion

Aptos has demonstrably grown and matured from its second anniversary in October 2024 through 2025, eventually becoming one of the most prolific players in DeFi, stablecoins, and RWAs. Key drivers like stablecoin integrations, RWA adoption, and technical upgrades such as Velociraptr have stimulated user activity, TVL, and network efficiency.

With sustained DAA above 900,000, stablecoin supply exceeding $1.3 billion, and institutional inflows driving it to the third position as an RWA chain of choice, Aptos is continuing its expansion.

Stake with Everstake | Follow us on X | Connect with us on Discord

***

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.