Everstake is thrilled to announce our strategic partnership with Kryptonite Finance, the premier SEI liquid staking platform with a money market for earning compounded interest while accessing leverage. By joining Kryptonite’s liquid staking pool, Everstake contributes to SEI network growth and stability.

What is Kryptonite?

Kryptonite is a DeFi protocol based on the Sei blockchain. It offers liquid staking and collateralized lending.

The Kryptonite app allows traders to stake SEI, which is the native token of Sei. In return, they can earn rewards in the form of SEILOR tokens. One of the key benefits of owning SEILOR is the ability to earn a share of the revenue generated from transaction fees charged by Kryptonite.

Kryptonite’s Three-Pronged Approach

Kryptonite’s core strategy consists of three pillars:

-

Liquidity is crucial for trading, price stability, network growth, user adoption, and ecosystem success. It is also vital for applications and DeFi.

-

Staking centralization can lead to monopolies and block space manipulation, so diversification is important to ensure chain integrity.

-

Alignment and effective collaboration between protocols and validators are crucial for the long-term health of the Sei Network. Reward, token, and incentive programs can encourage community participation.

What Is the SEILOR Token?

SEILOR token is the driving force behind the Kryptonite protocol, providing users with valuable features. These include access to the SEI staking infrastructure, mint stablecoins via SEI, priority access to Kryptonite’s infrastructure, and special promotions.

Kryptonite provides liquid staking as a service to the SEI community. The service fees can be paid with the project’s utility token to receive a discount. SEI stakers can earn block rewards and transaction fees by delegating to secure and responsible network validators.

Kryptonite provides liquidity to stakers in exchange for a portion of the network fees they earn. If the fees are paid in the network’s SEILOR token, they are discounted.

What is Liquid Staking?

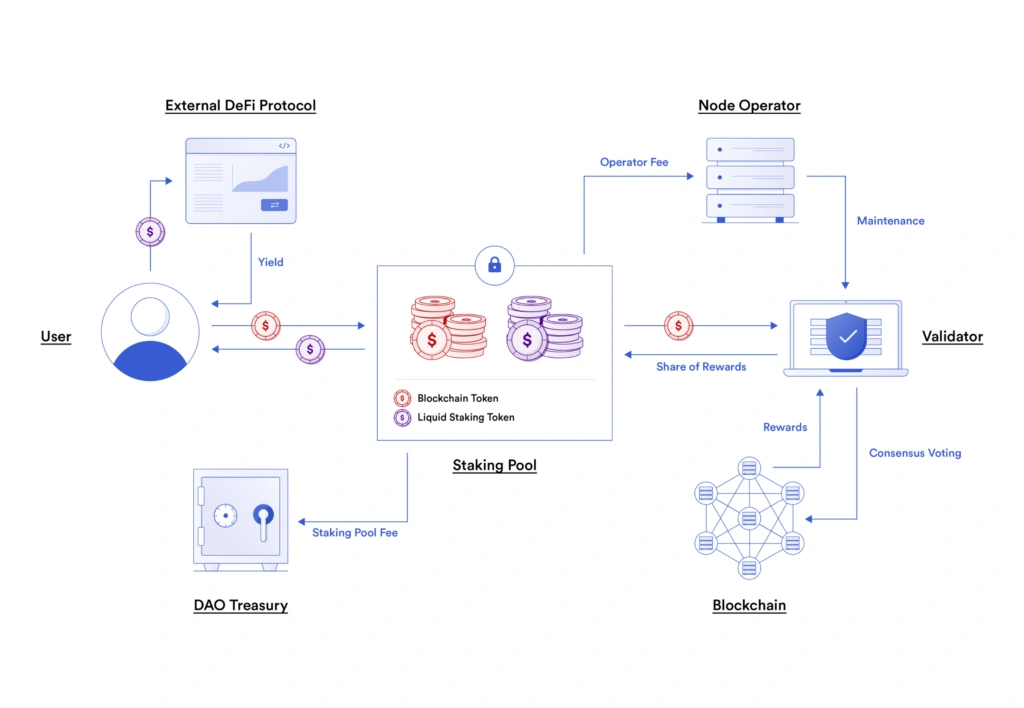

Liquid staking is a staking solution that allows users to stake tokens while also accessing liquidity, similar to traditional staking on a Proof-of-Stake (PoS) blockchain.

Liquid staking works similarly to traditional PoS protocols. Users deposit their funds into an escrow account run by a smart contract to participate. The platform then issues tokenized versions of the staked funds, which hold an equivalent value.

When you stake funds, you still earn rewards. However, with liquid staking, you can now use those tokens for other purposes. These tokens are called liquid staking tokens (LSTs). You can transfer LSTs from the platform, store them elsewhere, trade them, or spend them without affecting your initial deposit. To access your original holding, you must exchange the tokenized versions of the same value.

Below is a liquid staking protocol chart showing how LSTs can be integrated into external DeFi projects.

Benefits of Liquid Staking

Liquid staking offers significant advantages over traditional staking methods, especially in the context of the SEI ecosystem. Let’s explore some of the key benefits users can expect when using Kryptonite’s liquid staking solution:

-

Liquidity: Unlike traditional staking, assets are not locking up here. With liquid staking, you receive derivative tokens representing your staked assets, which you can trade or use elsewhere in the DeFi ecosystem.

-

Accessibility: Staking is now more accessible through liquid staking, which provides instant access and increased flexibility.

-

Network Security and Decentralization: Liquid staking has the potential to improve the security and decentralization of the blockchain network by allowing more people to stake their assets.

-

Increased Utility: Liquid staking derivative tokens can be used in various DeFi applications, such as loan collateral, yield farming, and liquidity provision on decentralized exchanges (DEXs), making staked assets more useful.

The Takeaway

Decentralized finance is growing, and protocols like Kryptonite are changing established paradigms. Through the clever integration of staking, stablecoin minting, and utility functionalities within the Sei ecosystem, Kryptonite pioneers a new level of secure and stable DeFi infrastructure.

Stake with Everstake | Follow us on X | Connect with us on Discord