Ethereum has grown into the world’s largest Proof-of-Stake (PoS) network, with over 1 million validators securing almost 36 million ETH. This architecture keeps Ethereum decentralized and resilient and has built-in safety mechanisms. One of the least understood yet most important of these is the validator exit queue—the protocol’s way of slowing down mass exits so the network doesn’t destabilize.

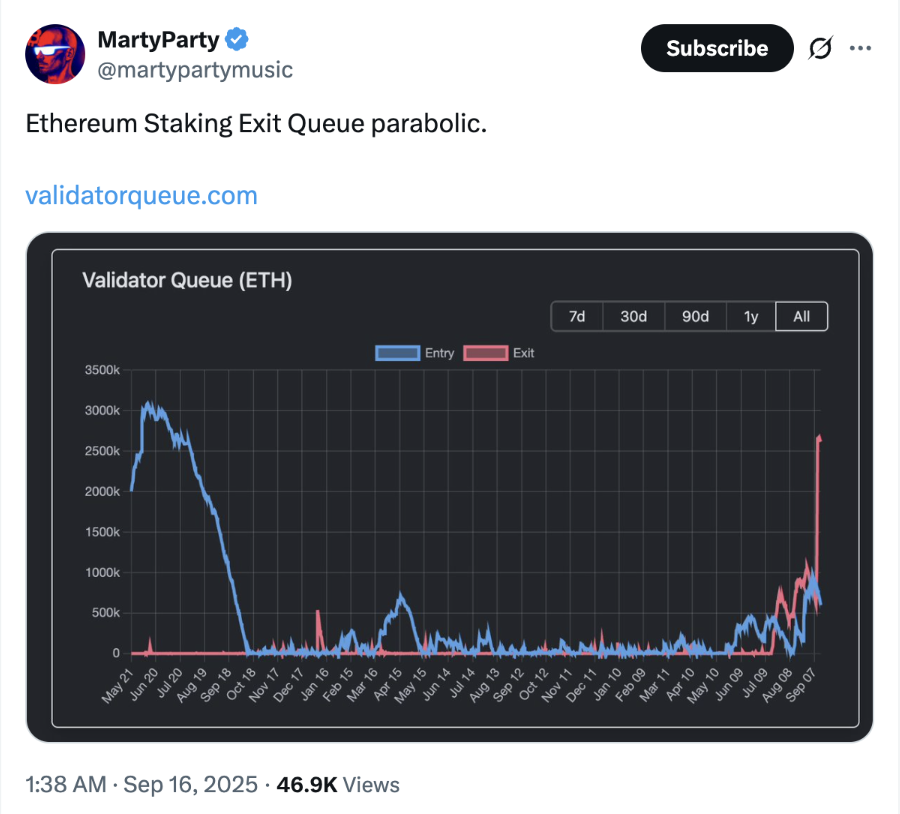

Most of the time, the exit queue is invisible to users because inflows and outflows of validators roughly balance. But when a large operator decides to withdraw en masse, the queue can suddenly swell, stretching unstake times from days into weeks. That’s exactly what happened recently, when exits piled up to record levels, putting around 1.6 million ETH, about $7.2 billion, in line to leave staking.

For regular stakers, this raises pressing questions: Why is this happening? Does it signal risk for Ethereum? And how can my staking provider make the experience less painful?

We decided to wait a bit to assess the situation with the mass exit of validators more objectively. During this time, the Everstake Ethereum team gathered different opinions from the community about what was happening and why.

Why do exits queue at all?

Ethereum deliberately slows mass movements to protect finality and validator set stability.

- Churn limit governs pace. The protocol allows only a limited number of activations and exits per epoch. That limit scales with total active validators, which keeps the system predictable during stress.

- Exit and withdrawal are separate. After a validator requests a voluntary exit, it waits in the exit queue. Once processed, there is a mandatory delay before the balance becomes withdrawable. Only then does the withdrawal sweep pay out to the execution layer address.

- Partial vs full. Partial withdrawals (excess over the effective balance) are swept continuously. Full withdrawals depend on the exit queue. In a surge, the full-exit path becomes the bottleneck.

In short, when many validators leave together, the line gets long very quickly, exactly as designed.

Market reactions: panic, perspective, and reality

By mid-September, the exit queue swelled to a record 2.5 million ETH, about $12 billion, with average wait times of 43-45 days—the most enormous validator exit wave in history. The numbers alone triggered plenty of hot takes.

The panic

Macro analyst MartyPary called it: “Ethereum staking exit queue goes parabolic.”

Crypto blogger Lark Davis warned: “Heavy sell pressure incoming.”

The perspective

A swollen exit queue doesn’t mean everyone is selling. It can reflect migrations, profit-taking, or repositioning into new products.

The stabilizers

Institutions are still net buyers. According to Strategic ETH Reserves, strategic reserves and ETFs grew from 4.7M ETH in July to 11.7M ETH today. Most of these assets are staked or plan to be staked, which adds stability and may stimulate a staking queue in the coming weeks. Funds like Bitmine Immersion Tech, SharpLink Gaming, and The Ether Machine keep adding weight to the staking side.

The bigger picture

Interest in a potential ETH staking ETF is rising. Some investors free liquidity now to re-enter later. While the SEC’s formal deadline is April 2026, analyst Axel Bitblaze expects a green light as early as October 2025. Last week alone, Ethereum investment products saw $646M in inflows.

The reminder

As Vitalik Buterin put it: “An army cannot stay together if any fraction of its members can leave instantly.” Exit queues are not flaws. They are Ethereum’s safety valve — frustrating for users, but critical for stability.

The user experience problem

For an individual staker, the protocol’s safety features translate into uncertainty: “How long will my unstake take?” During peak queues, quoting exact timing becomes guesswork, which is a poor user experience even though the chain behaves correctly.

Everstake’s answer: the interchange mechanism

We built a pool-level process that respects protocol rules yet smooths user timing.

How it works

- When users request to unstake, we do not immediately exit validators on-chain.

- We first match exits with new entries inside the pool. Think of it as internal netting: deposits coming in naturally cover part of the requested withdrawals.

- Only if internal balancing cannot satisfy demand do we trigger real on-chain exits to replenish the pool.

Why it matters during spikes

- During heavy queues, even modest organic inflows help reduce the share of requests that must touch the exit queue.

- Users often complete their unstake materially faster than raw queue estimates.

- Network safety remains intact. We never bypass Ethereum’s rules. We simply minimize how often we need to invoke them for each individual request.

Honest boundary conditions

If net outflows persist for an extended period, on-chain exits become unavoidable and timing converges to the protocol queue. Interchange is not magic. It is disciplined inventory management that protects user experience when flows are mixed.

What to watch while the queue evolves

- Queue size and trend. Rising, flat, or falling tells you more than snapshots.

- Provider migrations. Policy or fee changes at large operators can trigger new clusters.

- Institutional flows. ETF creations or treasury mandates can quickly flip net flow signs.

- Communication quality. Prefer operators who publish clear exit logic and capacity plans instead of vague assurances.

Quick clarity on common questions

- Does a long queue mean Ethereum is in trouble?

No. The queue is the safety valve. It prevents abrupt validator set swings and preserves finality.

- Can the protocol “speed it up”?

The churn limit is a fixed parameter. Earlier it scaled with validator count, but changes today can only happen through the Ethereum improvement process, not ad-hoc decisions.

- Is interchange custodial or risky?

No change to custody model. Interchange is an operational policy: match inflows and outflows first, exit on-chain only for the remainder. Funds move on-chain when needed, under normal rules.

Bottom line

Large exit waves will happen again. They are a feature of a mature, heavily used network that optimizes for safety. The difference in user experience comes from your operator. Everstake planned for these cycles with an interchange mechanism that turns chaotic queues into orderly processing without cutting corners.

If you are rebalancing size or migrating positions and want to minimize queue exposure, talk to us. We will coordinate timing, explain the trade-offs in plain terms, and execute under the same principle we apply everywhere: security first, operational clarity always.

Stake with Everstake | Follow us on X | Connect with us on Discord

Everstake is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services, or take custody of, or otherwise hold or manage, customer assets. Everstake does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency, or associated funds. Everstake’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.