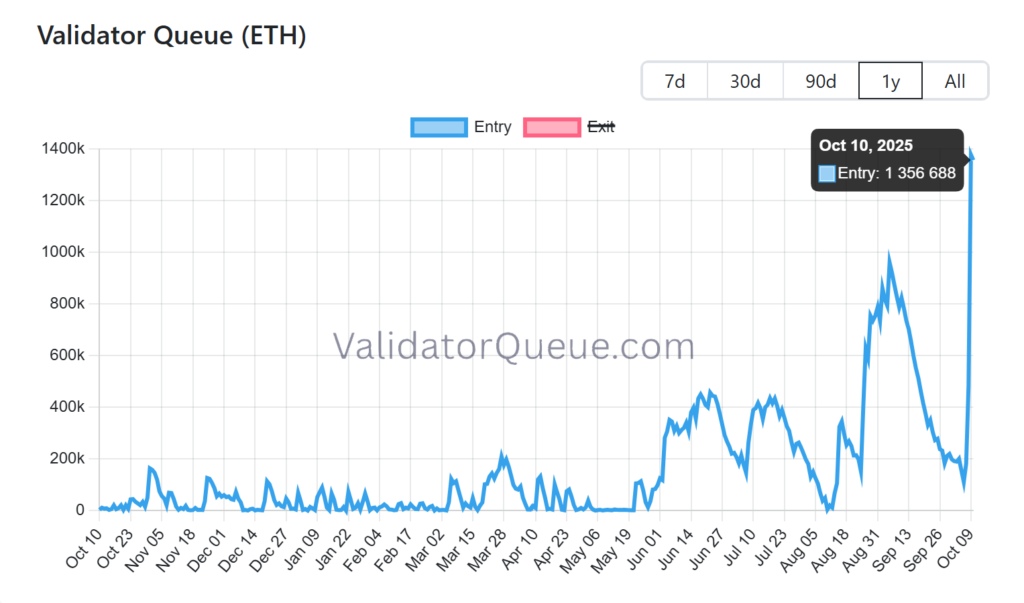

On October 10, 2025, the Ethereum validator entry queue surged to 1,356,688 ETH, worth roughly $5.5 billion at the time of writing. This follows the record-high exit queue earlier this year, marking a new phase in validator dynamics and network participation.

It represents one of the largest inflows of staking deposits since the Beacon Chain launched, indicating a powerful wave of validator activity and renewed network confidence.

The graph above shows a sharp vertical climb, a near-parabolic rise compared to the relatively moderate fluctuations earlier in 2025. For months, the entry queue had remained below 300,000 ETH. Then, within just a few days in early October, it spiked more than fourfold, highlighting an unprecedented surge in demand to become an Ethereum validator.

This sudden growth reflects several converging factors: large institutional staking activity, a broadly optimistic market outlook at the start of Q4, and anticipation of the upcoming Fusaka upgrade, scheduled for December 2025.

Together, they’ve created the perfect conditions for Ethereum’s validator set to expand faster than at any point this year.

What Is the Ethereum Entry Queue?

To understand what’s happening, let’s take a step back and look at how the entry queue works. Every participant who wants to become a validator on Ethereum must first stake 32 ETH. When many participants try to join at once, they can’t all be activated immediately. Instead, they enter a waiting line — the entry queue.

This system exists to protect Ethereum’s stability. The network limits how many validators can join or exit per epoch through a mechanism called the churn limit. It prevents sudden expansions or contractions in the validator set that could otherwise impact consensus performance and network latency.

When demand is low, new validators can be activated almost instantly. But when demand spikes like now, the waiting time can extend dramatically.

As of mid-October 2025, new validators are facing an average delay of around 21-24 days before activation.

In simpler terms: The entry queue acts as a traffic light for new validators, ensuring Ethereum’s growth remains steady, secure, and predictable even in times of massive interest.

Why the Queue Skyrocketed

The recent surge was triggered primarily by Grayscale, which staked 1,161,600 ETH (over $5.2 billion) within just three days. Such a massive institutional deposit instantly expanded the validator entry queue, pushing wait times to nearly a month as the network gradually activates new validators under its churn limit.

At the same time, “Uptober” brought a wave of optimism across the crypto market. Rising prices and renewed investor confidence encouraged both individuals and institutions to stake their ETH, reflecting a broader belief in Ethereum’s long-term strength.

Finally, anticipation of the Fusaka upgrade, planned for December 2025, is adding momentum. The update promises performance and efficiency improvements for validators, prompting many to position their ETH early to benefit from future enhancements once Fusaka goes live.

What This Means for Ethereum

This surge signals strong long-term confidence in Ethereum’s staking model. A growing entry queue means more participants are committing to secure the network and receive validator rewards; it’s a healthy indicator for overall ecosystem stability.

However, it also highlights the growing institutional presence in staking. While large deposits, such as Grayscale’s, strengthen trust and capital inflows, they can temporarily reduce accessibility for smaller validators due to longer activation times.

From a network perspective, the steady influx of validators supports decentralization and resilience. Yet, the pace of this expansion underscores the importance of future upgrades, such as Fusaka, which aim to optimize validator management and sustain performance as Ethereum continues to scale.

How to Track the Queue

For anyone planning to stake ETH or simply follow the network’s dynamics, the easiest way to monitor real-time validator activity is through Ethereum Validator Queue.

The dashboard shows the current entry and exit queues, average wait times, and total validator count, helping users understand when new validators are likely to be activated.

Final Thoughts

The record-high entry queue reflects a convergence of factors — institutional staking, improving market sentiment, and anticipation of Ethereum’s next major upgrade.

While short-term wait times may be inconvenient for newcomers, the broader picture is clear: Ethereum’s validator ecosystem is stronger and more active than ever, setting the stage for continued growth heading into 2026.

Stake with Everstake | Follow us on X | Connect with us on Discord

***

Everstake, Inc. or any of its affiliates is a software platform that provides infrastructure tools and resources for users but does not offer investment advice or investment opportunities, manage funds, facilitate collective investment schemes, provide financial services or take custody of, or otherwise hold or manage, customer assets. Everstake, Inc. or any of its affiliates does not conduct any independent diligence on or substantive review of any blockchain asset, digital currency, cryptocurrency or associated funds. Everstake, Inc. or any of its affiliates’s provision of technology services allowing a user to stake digital assets is not an endorsement or a recommendation of any digital assets by it. Users are fully and solely responsible for evaluating whether to stake digital assets.